The concept of a share buyback – when a company repurchases its own shares – is increasingly common in today’s market. It’s a strategic move that can signal confidence in the company’s future prospects, often benefiting shareholders. Understanding how these agreements work and how to structure a template is crucial for both companies considering a buyback and investors evaluating potential investments. This article provides a comprehensive overview of share buyback agreements, covering key aspects, considerations, and best practices. Share Buyback Agreement Template – a vital tool for navigating this complex financial landscape. This guide will delve into the fundamentals, outlining the various types, legal considerations, and practical steps involved in creating and utilizing a robust buyback agreement. We’ll explore the benefits, risks, and potential pitfalls, aiming to equip you with the knowledge to make informed decisions.

Share buybacks, also known as stock repurchases, represent a company’s way of returning capital to shareholders. Instead of distributing profits to the owners, the company uses its cash reserves to buy back its own shares in the open market. This can be a powerful tool for boosting shareholder value, signaling confidence in the company’s future, and potentially increasing the stock price. The primary goal of a share buyback is to reduce the number of outstanding shares, thereby increasing earnings per share (EPS) and potentially boosting the stock price. Companies often use buybacks to:

There are several different types of share buyback agreements, each with its own nuances and implications. Here’s a breakdown of the most common:

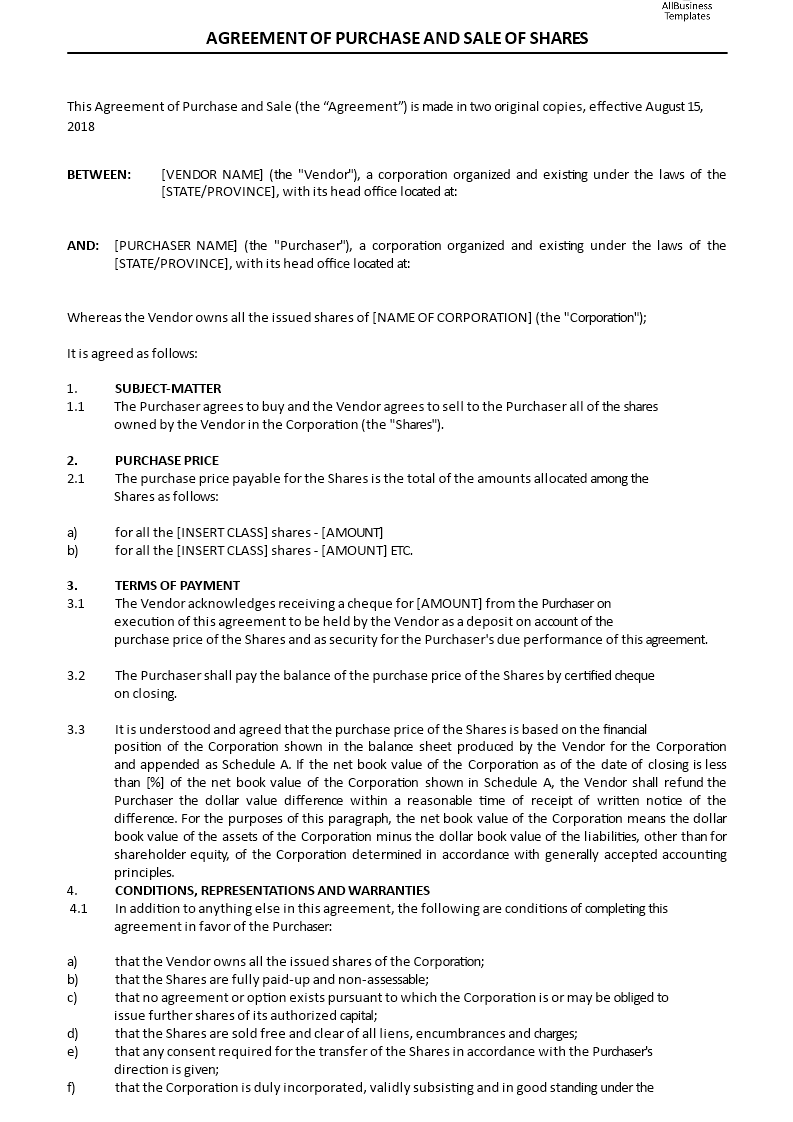

A well-structured share buyback agreement should clearly outline the following key elements:

Creating a robust and legally sound share buyback agreement requires careful consideration and attention to detail. Here’s a step-by-step approach:

Share buybacks offer several potential benefits for both the company and its shareholders:

While share buybacks can be beneficial, it’s important to be aware of the potential risks:

Given the complexities of share buyback agreements, it’s crucial to engage experienced legal counsel to ensure that the agreement is properly drafted and compliant with all applicable laws and regulations. A lawyer specializing in corporate finance and securities law can provide invaluable guidance throughout the process.

Share buyback agreements are a powerful tool for companies seeking to return capital to shareholders and improve their financial performance. However, they are not without risks. A well-structured agreement, coupled with careful consideration of the company’s specific circumstances, is essential for maximizing the benefits and minimizing the potential drawbacks. Understanding the different types of buyback agreements, the key components, and the associated risks is vital for both companies considering these strategies and investors evaluating potential investments. Share Buyback Agreement Template – a tool that requires careful planning and expert guidance. Continued monitoring and adjustments to the agreement may be necessary to ensure its continued effectiveness and compliance.