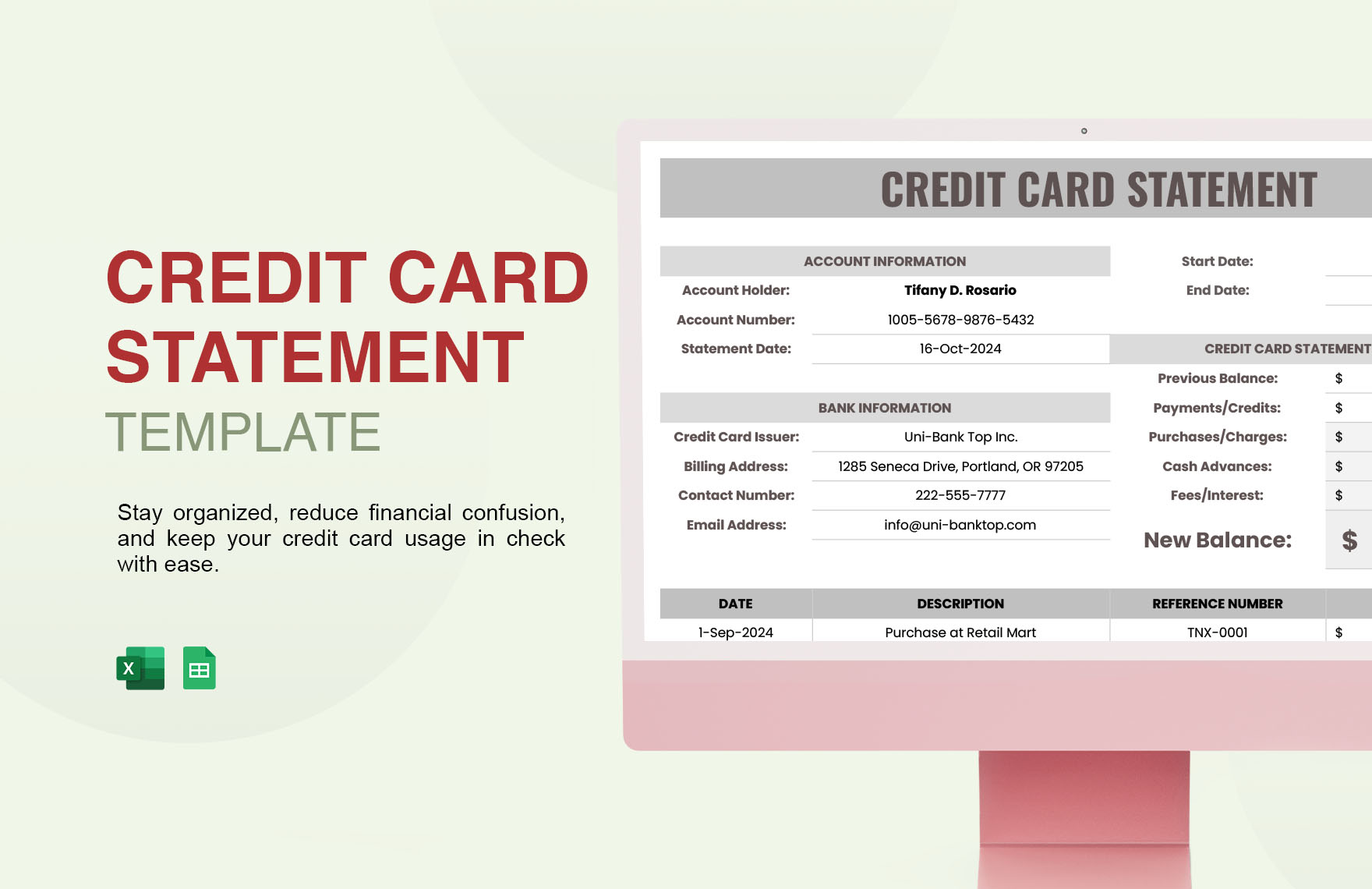

Are you struggling to manage your credit card statements? Creating a clear and organized spreadsheet can significantly simplify your financial tracking and budgeting. A Credit Card Statement Template Excel is an invaluable tool for anyone who wants to understand their spending habits, identify potential errors, and plan for future payments. This article will guide you through creating and using a template, covering everything from basic formatting to advanced features. Let’s dive in!

Managing your credit card statements can feel overwhelming, especially when they contain a wealth of information. Without a structured format, it’s easy to lose track of your spending, missed due dates, or accidentally overspend. A well-designed template provides a clear overview of your transactions, allowing you to quickly identify areas where you can improve your financial management. Furthermore, many banks and credit card companies offer templates that can be downloaded and customized to your specific needs. Using a template isn’t just about convenience; it’s about gaining control of your finances. It empowers you to proactively address potential issues and make informed decisions about your spending. The ability to easily export data into other spreadsheets or programs is a huge benefit, too. Ultimately, a Credit Card Statement Template Excel is a smart investment for anyone looking to take charge of their financial health.

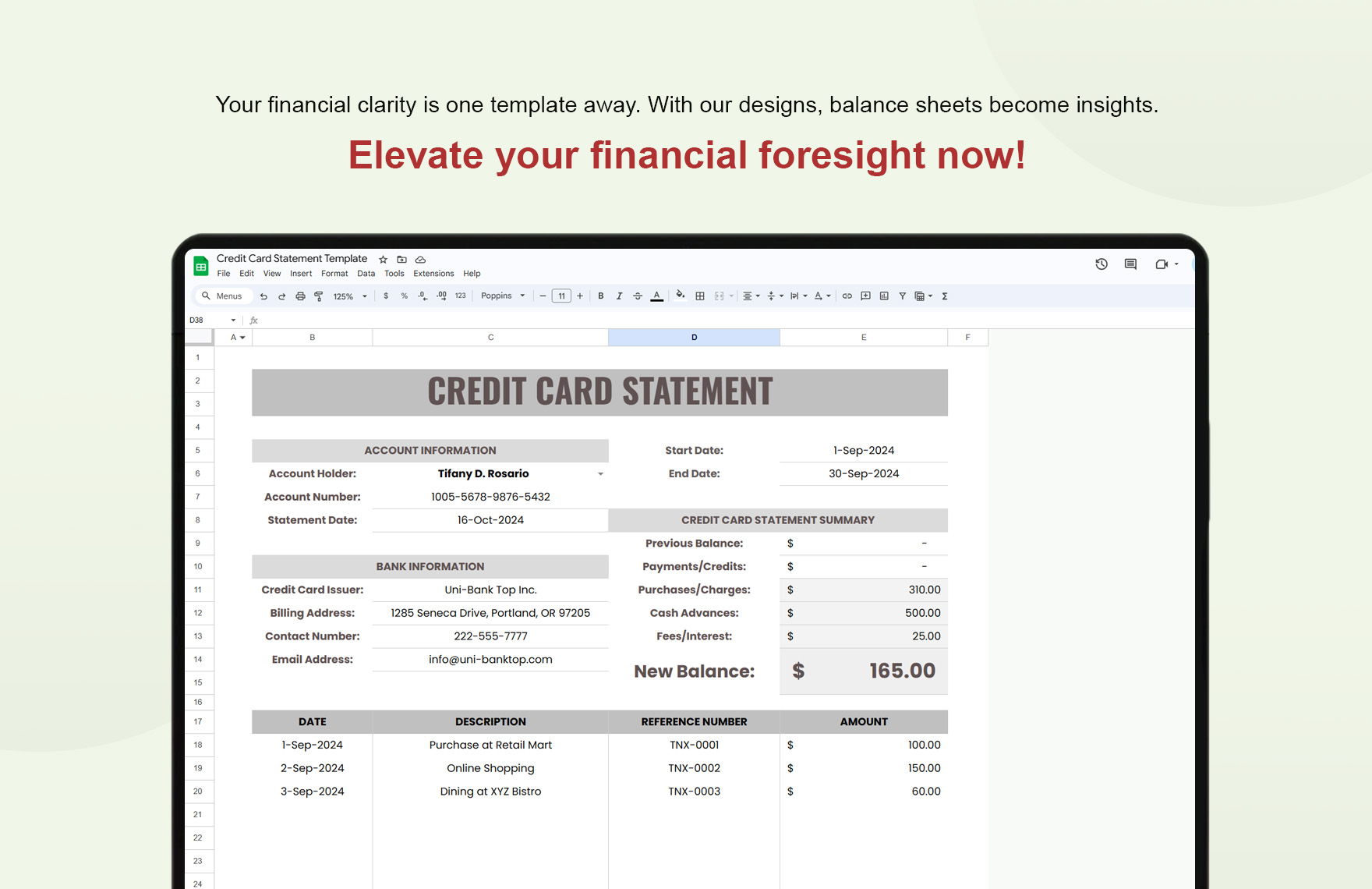

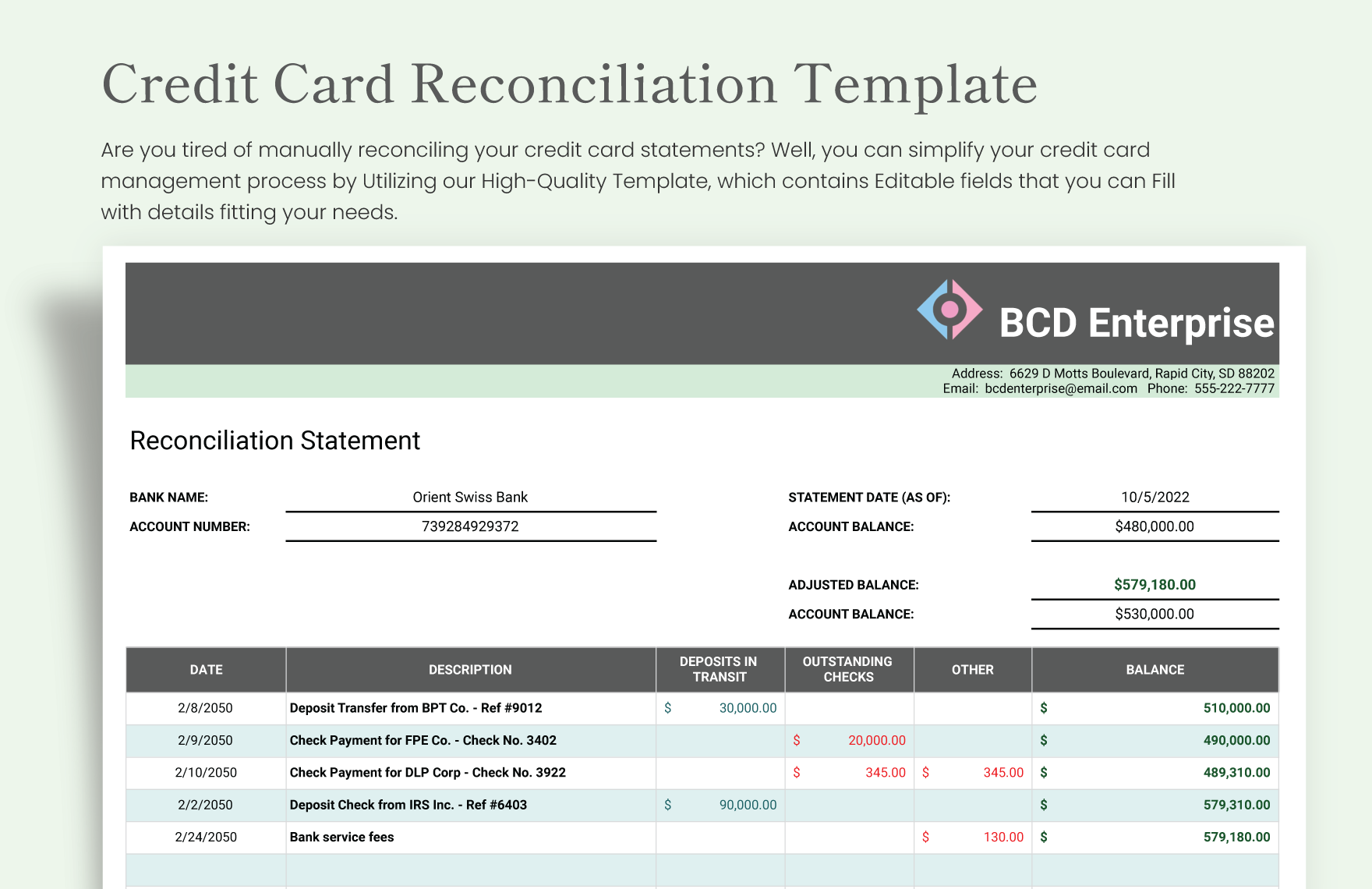

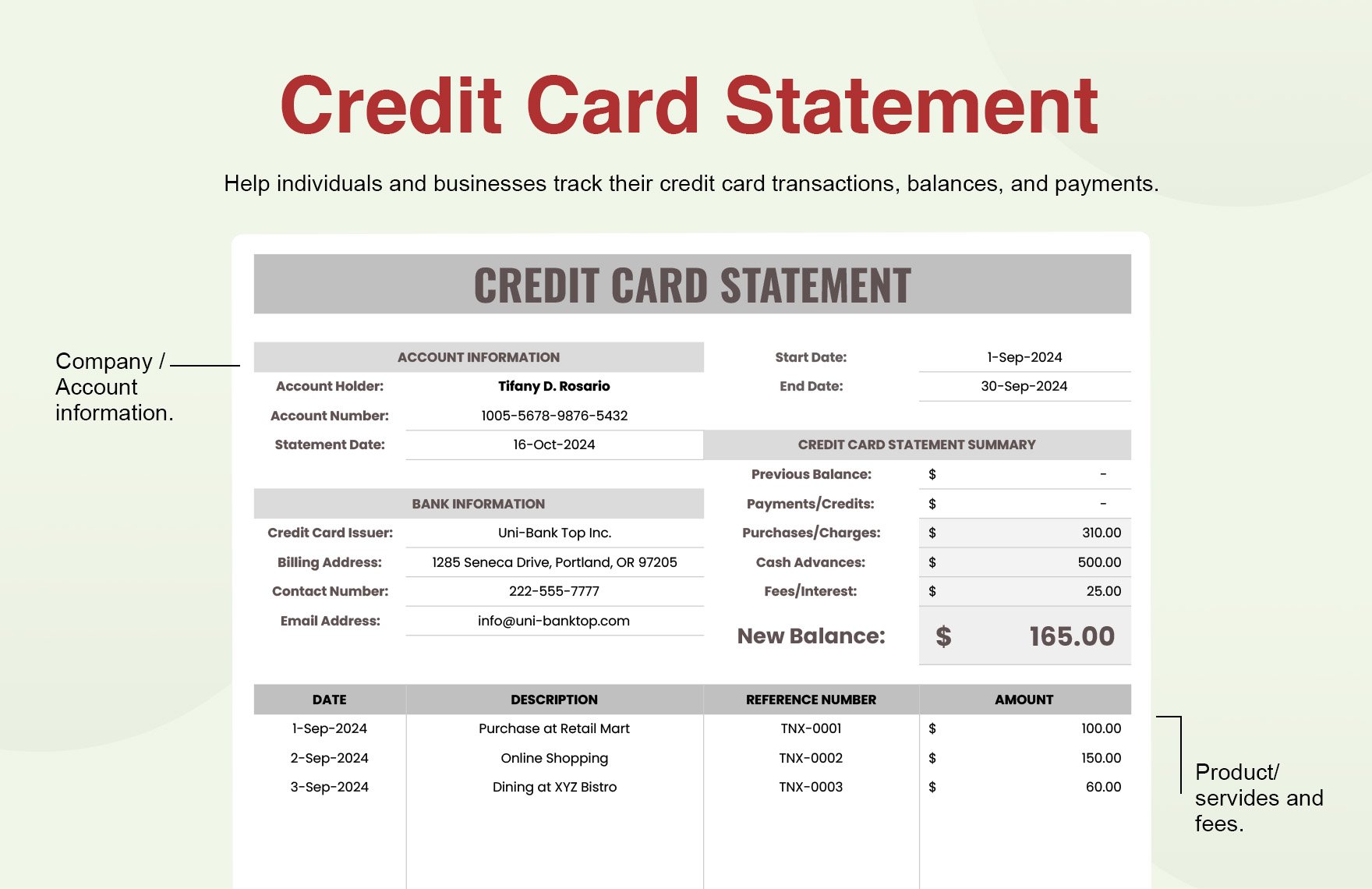

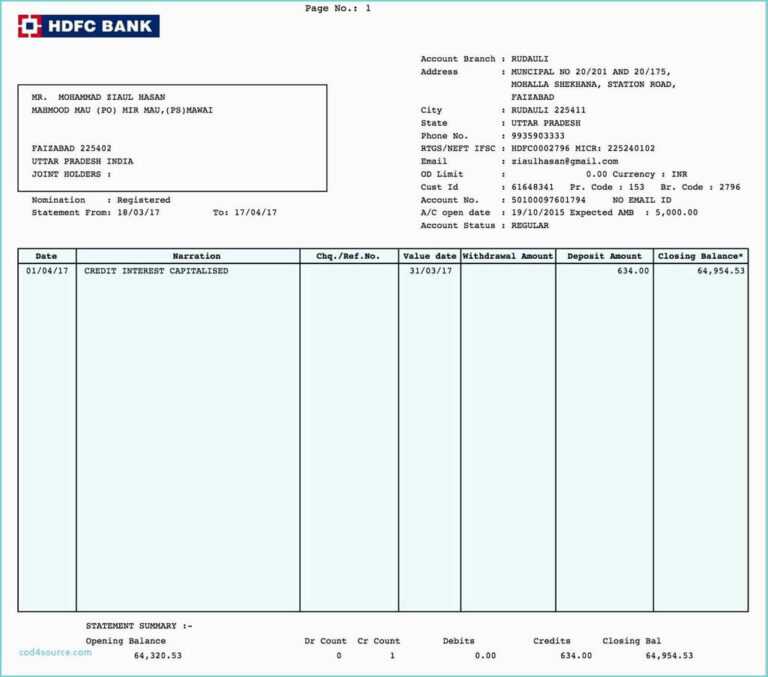

A robust Credit Card Statement Template Excel typically includes several key sections. Understanding these components is crucial for effectively utilizing the template. The most important sections include:

There are numerous free and paid templates available online. Popular options include Google Sheets, Microsoft Excel, and dedicated template websites. Here’s a basic outline of how to create your own template:

Let’s examine some of the key sections in more detail, providing practical examples:

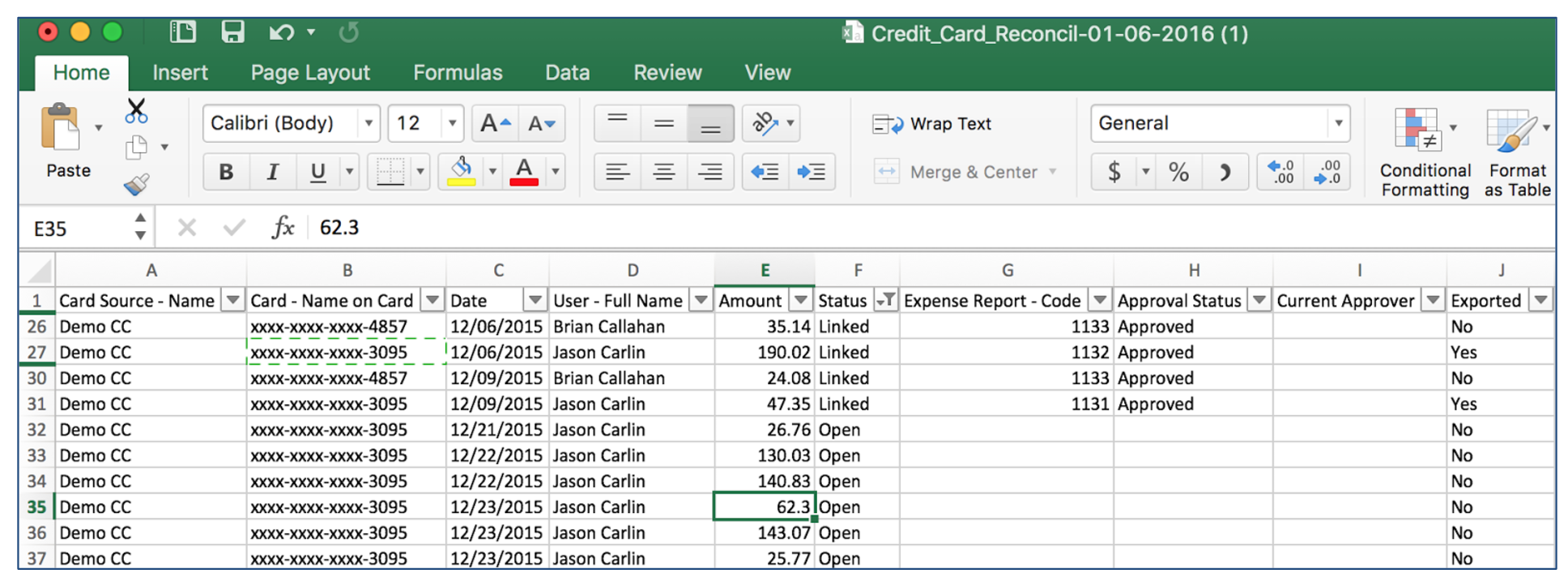

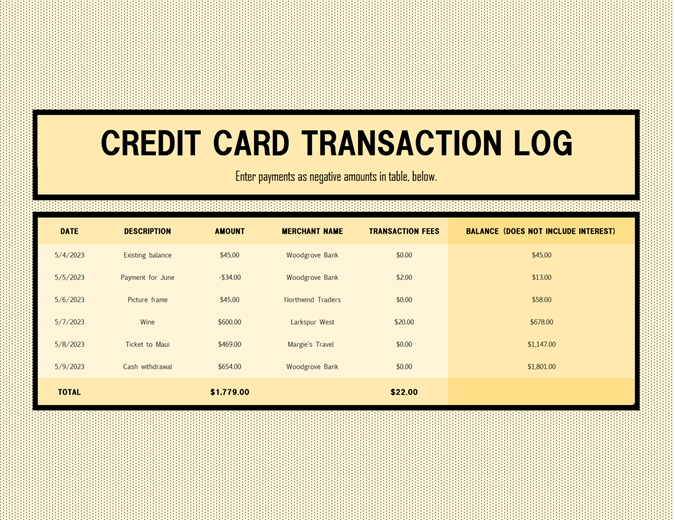

This column is fundamental. Ensure the date format is consistent (e.g., MM/DD/YYYY or DD/MM/YYYY). Using a consistent date format will make sorting and filtering much easier. For example, if you consistently record transactions on the 15th of the month, use the 15th as the date format.

Accurate merchant names are vital for identifying the source of your spending. Double-check the spelling and ensure the name is consistent across all your statements. Consider using a consistent naming convention for merchants (e.g., “Starbucks,” “Amazon,” “Walmart”).

Categorizing transactions is crucial for understanding your spending patterns. Common transaction types include:

The amount column is essential for tracking your spending. Be meticulous about entering the correct dollar amounts. Consider using a consistent currency symbol (e.g., $, €, £).

Clearly indicate the currency of each transaction. This is important for accurate reporting and budgeting. Using a consistent currency symbol (e.g., $, €, £) ensures that your data is easily comparable across different countries.

Understanding how you paid your credit card is important. Tracking your payment methods helps you identify potential fraud or unusual spending. Common payment methods include:

This column is incredibly useful for adding notes about transactions. It can be used to record details such as the reason for the purchase, any special instructions, or any other relevant information. For example, you might note a purchase of a gift card for a specific event.

Once you’ve created your Credit Card Statement Template Excel, you can use it to:

A Credit Card Statement Template Excel is a powerful tool for anyone seeking to gain control of their finances. By creating a well-structured template and utilizing it effectively, you can streamline your financial management, identify potential issues, and make informed decisions about your spending. Remember to consistently update your template with your own transactions and tailor it to your specific needs. Investing in a quality template is a worthwhile investment in your financial well-being. Don’t underestimate the benefits of a simple, yet effective, system for tracking your credit card spending. Continuous improvement and adaptation of your template are key to maximizing its value. Ultimately, a well-maintained template empowers you to proactively manage your credit card debt and achieve your financial goals.