Crafting a comprehensive budget is essential for the financial health and long-term success of any small business. A well-structured budget allows you to track income and expenses, forecast future performance, and make informed decisions. Fortunately, you don’t always need expensive software to get started. A free small business budget template Excel can be a powerful and accessible tool to help you manage your finances effectively. This article will explore the benefits of using an Excel budget template, where to find them, how to customize them, and offer best practices for small business budgeting.

Effective budgeting isn’t just about knowing where your money is going; it’s about actively shaping your financial future. Many small business owners are intimidated by the prospect of budgeting, assuming it requires advanced accounting skills. However, with the right resources and a clear understanding of your business’s finances, you can create a budget that works for you.

Using a free small business budget template Excel can significantly simplify the budgeting process. These templates are pre-formatted spreadsheets designed to help you organize your financial data and calculate key metrics. They offer a convenient starting point, eliminating the need to build a budget from scratch. This can save you considerable time and effort, allowing you to focus on other aspects of your business.

This guide will walk you through everything you need to know to successfully implement a budgeting process using a free small business budget template Excel. We’ll cover how to choose the right template, customize it for your specific needs, and utilize it effectively to manage your small business finances.

Using an Excel budget template provides numerous advantages, especially for small businesses operating with limited resources. One of the most significant benefits is cost-effectiveness. Instead of investing in expensive budgeting software, you can leverage a free small business budget template Excel, making it a financially smart choice.

Excel is a widely used software, and many individuals already possess a basic understanding of its functionalities. This familiarity reduces the learning curve associated with new budgeting tools and enables you to get started almost immediately. The accessibility of Excel also means that you can access and update your budget from virtually any computer, making it convenient for on-the-go adjustments.

While many budgeting software options offer limited customization, Excel provides a high degree of flexibility. You can tailor your free small business budget template Excel to match the unique needs of your business, adding specific categories, formulas, and calculations relevant to your industry and operations. This ability to customize ensures that your budget accurately reflects your financial situation.

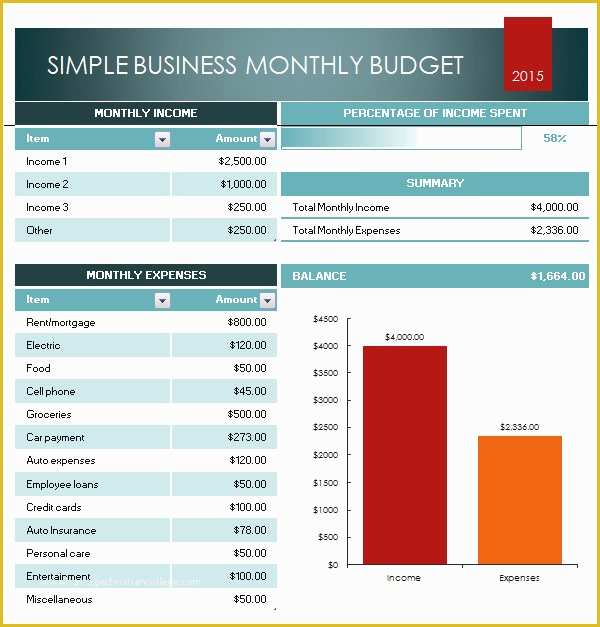

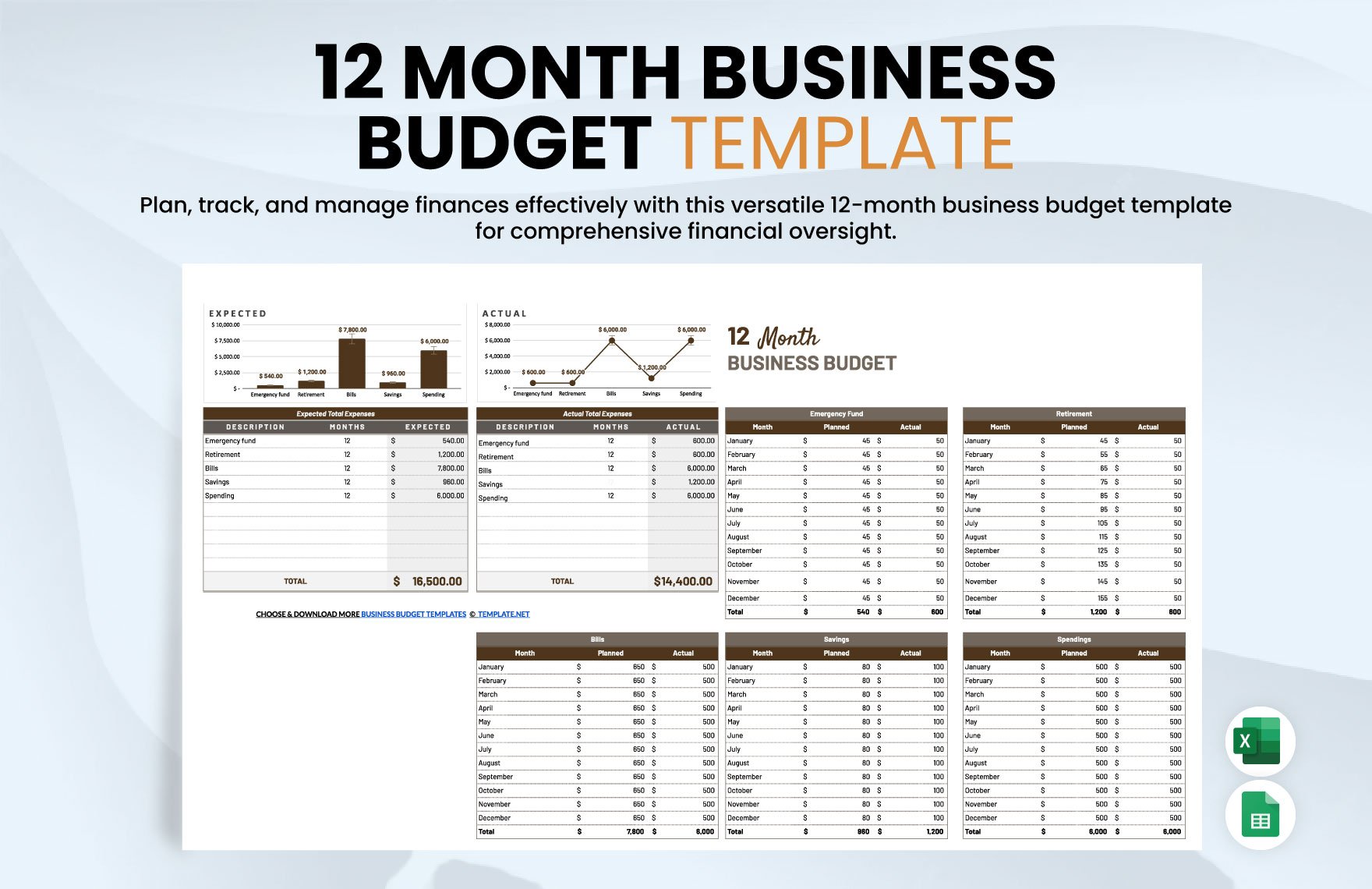

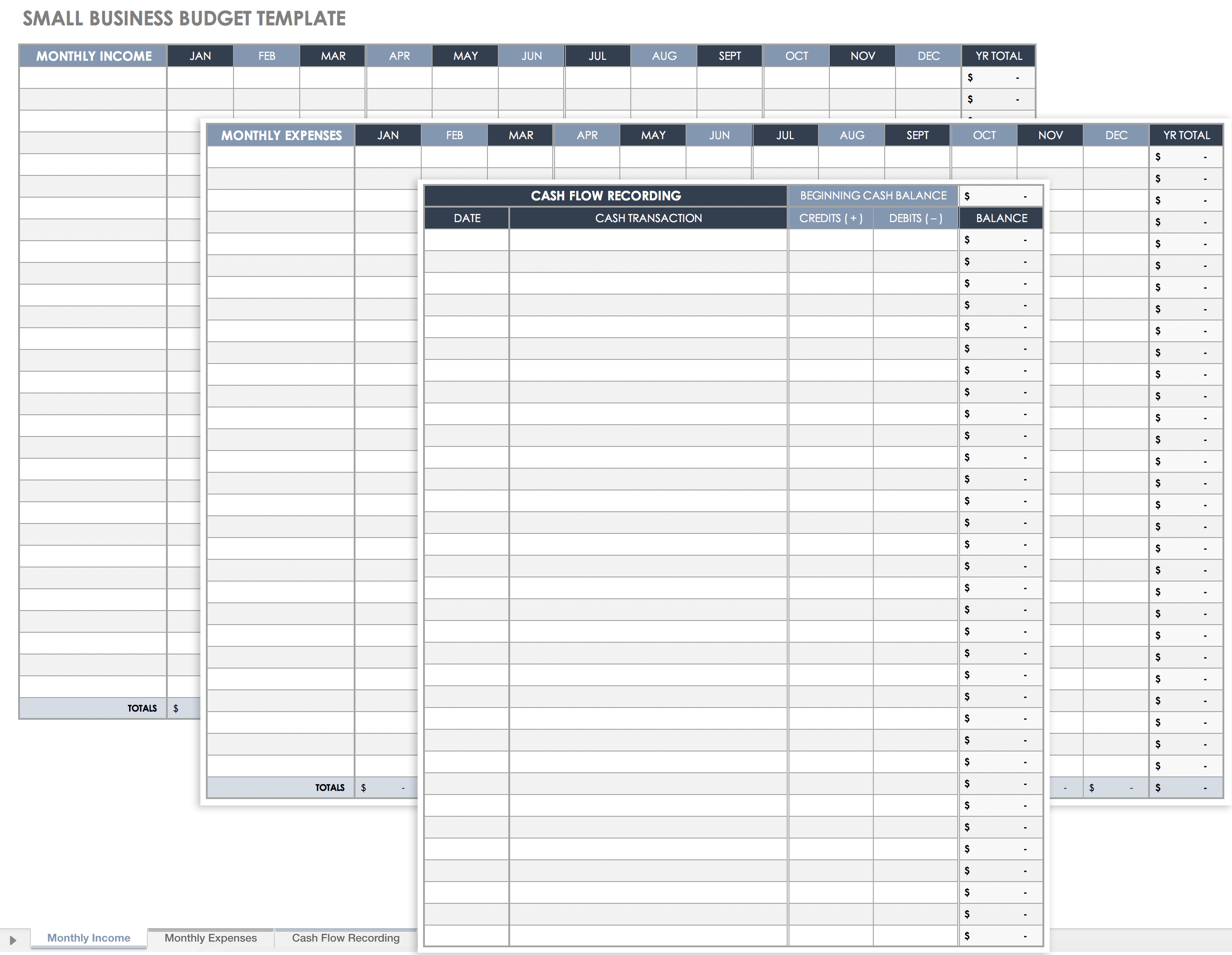

Excel offers a range of data analysis tools that can enhance your budgeting efforts. You can use charts and graphs to visualize your financial data, identify trends, and track your progress against your budget. The reporting capabilities of Excel allow you to generate insightful reports that can inform decision-making and help you identify areas for improvement.

Compared to complex accounting software, Excel is relatively easy to use, especially with a pre-designed template. The straightforward interface and intuitive features make it simple to enter data, perform calculations, and generate reports. This ease of use translates to faster implementation and reduced time spent on budgeting tasks, freeing you up to focus on other critical aspects of your business.

The internet offers a wealth of free small business budget template Excel options, but not all templates are created equal. Choosing the right template is crucial for ensuring that your budget is effective and meets your specific needs. Here are some key considerations to keep in mind when searching for a template:

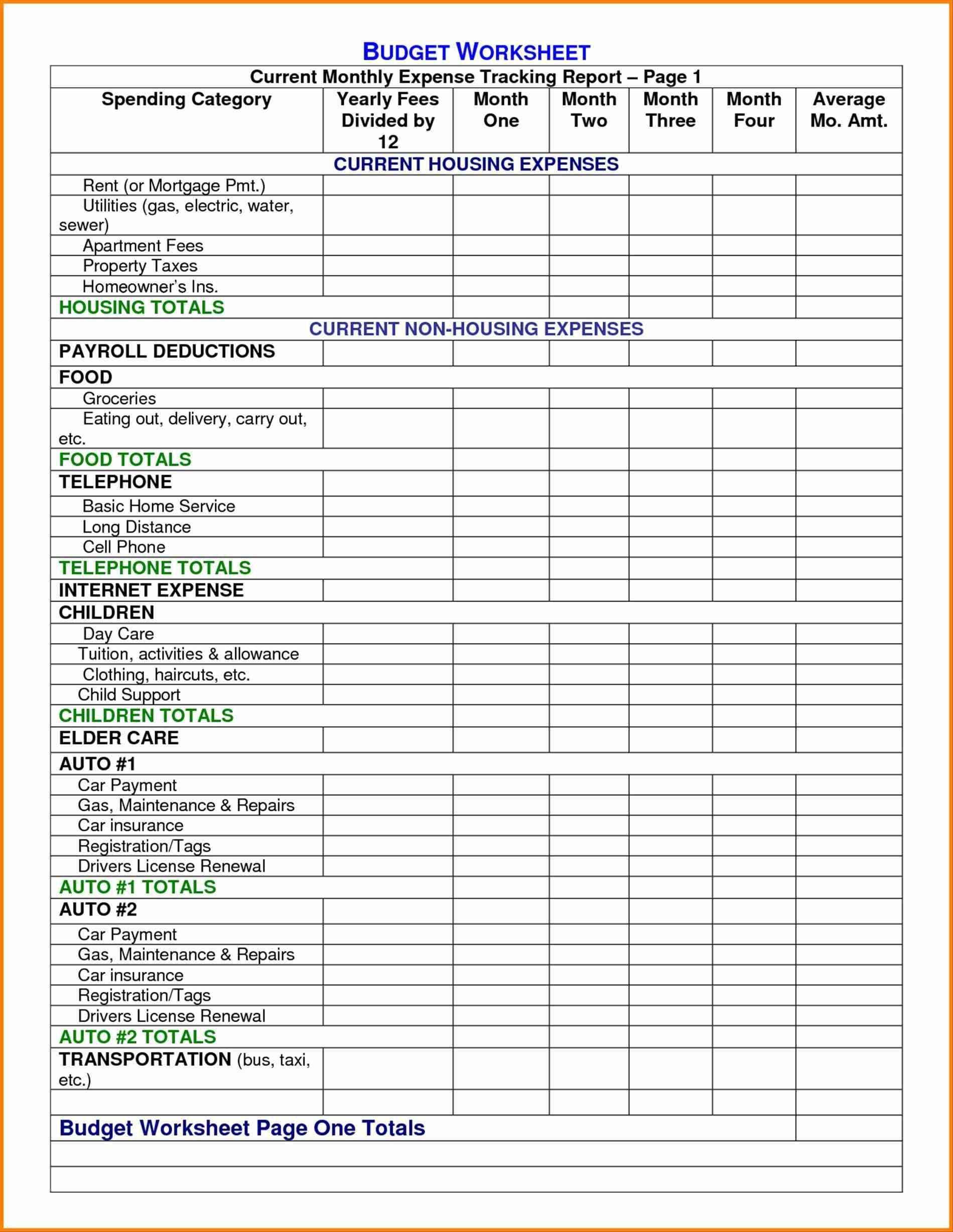

Before you start browsing for templates, take the time to define your specific budgeting needs. Consider the type of business you operate, the complexity of your financial transactions, and the level of detail you require in your budget. For example, a retail business with inventory management will need a different template than a service-based business.

Look for templates from reputable sources such as Microsoft, SCORE, or financial institutions. These sources typically offer well-designed, accurate, and reliable templates. Avoid downloading templates from unknown or suspicious websites, as they may contain errors or even malware.

Evaluate the features offered by different templates. Look for templates that include the following:

If possible, read reviews and ratings from other users who have used the template. This can provide valuable insights into the template’s usability, accuracy, and effectiveness.

Once you’ve selected a free small business budget template Excel, it’s essential to customize it to fit the unique needs of your business. Customization ensures that your budget accurately reflects your financial situation and provides valuable insights.

Most templates offer a basic set of income and expense categories, but you may need to add more specific categories relevant to your business. For example, if you operate an e-commerce business, you might add categories for website hosting, online advertising, and shipping costs. Tailoring your budget to your unique expense structure will help you gain better control over your spending.

Review the formulas and calculations in the template to ensure they are accurate and appropriate for your business. You may need to adjust formulas to account for specific taxes, depreciation methods, or other financial factors. For instance, if you use a specific method for calculating the cost of goods sold (COGS), you’ll want to incorporate that into the budget template.

Consider incorporating key performance indicators (KPIs) into your budget. KPIs are metrics that measure the performance of your business, such as sales revenue, customer acquisition cost, and profit margin. Tracking KPIs alongside your budget can provide valuable insights into your business’s overall performance and help you identify areas for improvement.

Enhance the visual appeal and usefulness of your budget by adding charts and graphs. Excel offers a variety of chart types, such as bar charts, pie charts, and line graphs, that can help you visualize your financial data and identify trends. Visualizations can make your budget more engaging and easier to understand.

Using a free small business budget template Excel effectively requires more than just downloading and filling in the numbers. Here are some best practices to help you create and maintain a successful budget:

Your budget should be a living document that is updated regularly to reflect your business’s current financial situation. Aim to update your budget at least monthly, or even more frequently if your business experiences significant fluctuations in income or expenses. Regular updates ensure that your budget remains accurate and relevant.

Consistently track your actual income and expenses against your budgeted figures. This variance analysis will help you identify areas where you’re over or under budget and understand the reasons for those discrepancies. Variance analysis allows you to make timely adjustments to your spending and improve your budgeting accuracy.

Involve key stakeholders, such as managers and employees, in the budgeting process. This ensures that everyone is aware of the budget and understands their role in achieving the financial goals. Involving stakeholders can also foster a sense of ownership and accountability.

When forecasting future income and expenses, be realistic and conservative. Avoid overly optimistic projections, as they can lead to disappointment and financial difficulties. It’s better to underestimate your income and overestimate your expenses to create a buffer for unexpected events.

Regularly review and revise your budget to ensure it remains aligned with your business goals and market conditions. Your budget should be a flexible tool that adapts to changing circumstances. Review your budget at least quarterly and make adjustments as needed.

While a basic free small business budget template Excel is a great starting point, exploring Excel’s advanced features can further enhance your budgeting capabilities.

Pivot tables are a powerful tool for summarizing and analyzing large amounts of data. You can use pivot tables to create custom reports, analyze trends, and identify patterns in your financial data. Pivot tables allow you to quickly drill down into specific areas of your budget and gain deeper insights.

Macros are automated sequences of commands that can streamline repetitive tasks. You can create macros to automate tasks such as data entry, report generation, and variance analysis. Macros can save you time and effort, making your budgeting process more efficient.

Excel can be integrated with other software, such as accounting software and CRM systems. This integration allows you to import data directly into your budget, eliminating the need for manual data entry. Integration can also improve the accuracy and consistency of your data.

Several reliable sources offer free small business budget template Excel downloads. Here are a few recommendations:

A free small business budget template Excel is an invaluable tool for small business owners looking to manage their finances effectively. By leveraging the accessibility, customization options, and data analysis capabilities of Excel, you can create a budget that accurately reflects your financial situation and supports your business goals. Remember to choose the right template, customize it to your specific needs, and follow best practices for budgeting to maximize its effectiveness. Regular monitoring, analysis, and adjustments are key to ensuring your budget remains a valuable tool for informed decision-making and sustainable growth.