Crafting a clear and comprehensive agreement is crucial when establishing a Financial Payment Plan Agreement Template. This document serves as a roadmap for repayment, ensuring both the creditor and debtor are on the same page regarding the terms of the payment schedule. A well-defined agreement minimizes the risk of misunderstandings and potential legal disputes, fostering a more positive and productive repayment process.

A properly constructed financial payment plan benefits both parties involved. The creditor gains assurance that the debt will be repaid according to a structured plan, while the debtor gains the opportunity to manage their finances and avoid further negative consequences like late fees, collection actions, or damage to their credit score. This structured approach helps the debtor budget responsibly and regain financial stability.

When creating a Financial Payment Plan Agreement Template, it is vital to consider factors such as the total debt amount, the debtor’s ability to repay, and a reasonable timeframe for repayment. Including clear and unambiguous language is paramount. The agreement should specify the payment amount, frequency, due dates, and accepted payment methods. Additionally, clauses addressing late payment penalties or consequences of default should be clearly articulated.

A robust agreement also includes provisions for potential modifications to the payment plan. Life circumstances can change, impacting the debtor’s ability to adhere to the original schedule. Including a clause that outlines the process for renegotiation, or modification, allows for flexibility and can prevent the agreement from failing entirely. This proactive approach can often lead to a more successful outcome for both parties.

Creating a comprehensive Financial Payment Plan Agreement Template involves including several key elements that clearly define the obligations and expectations of both the creditor and the debtor. These components contribute to the agreement’s enforceability and reduce the potential for future disputes.

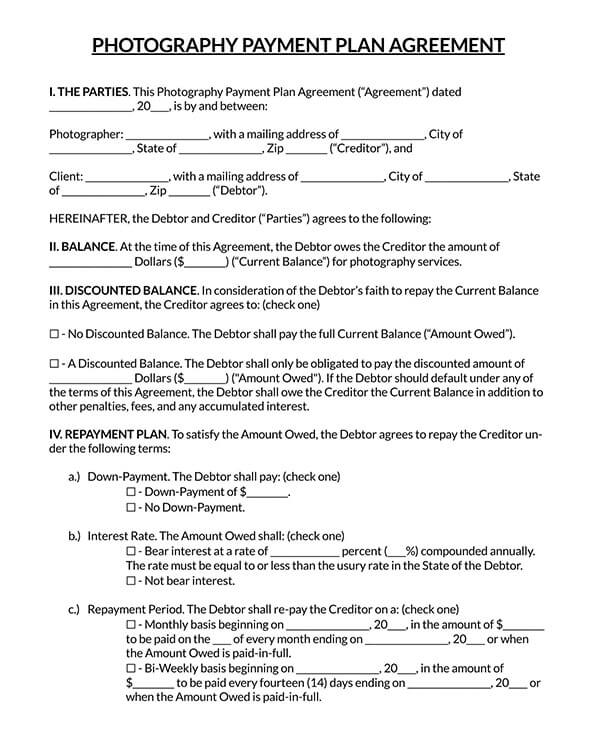

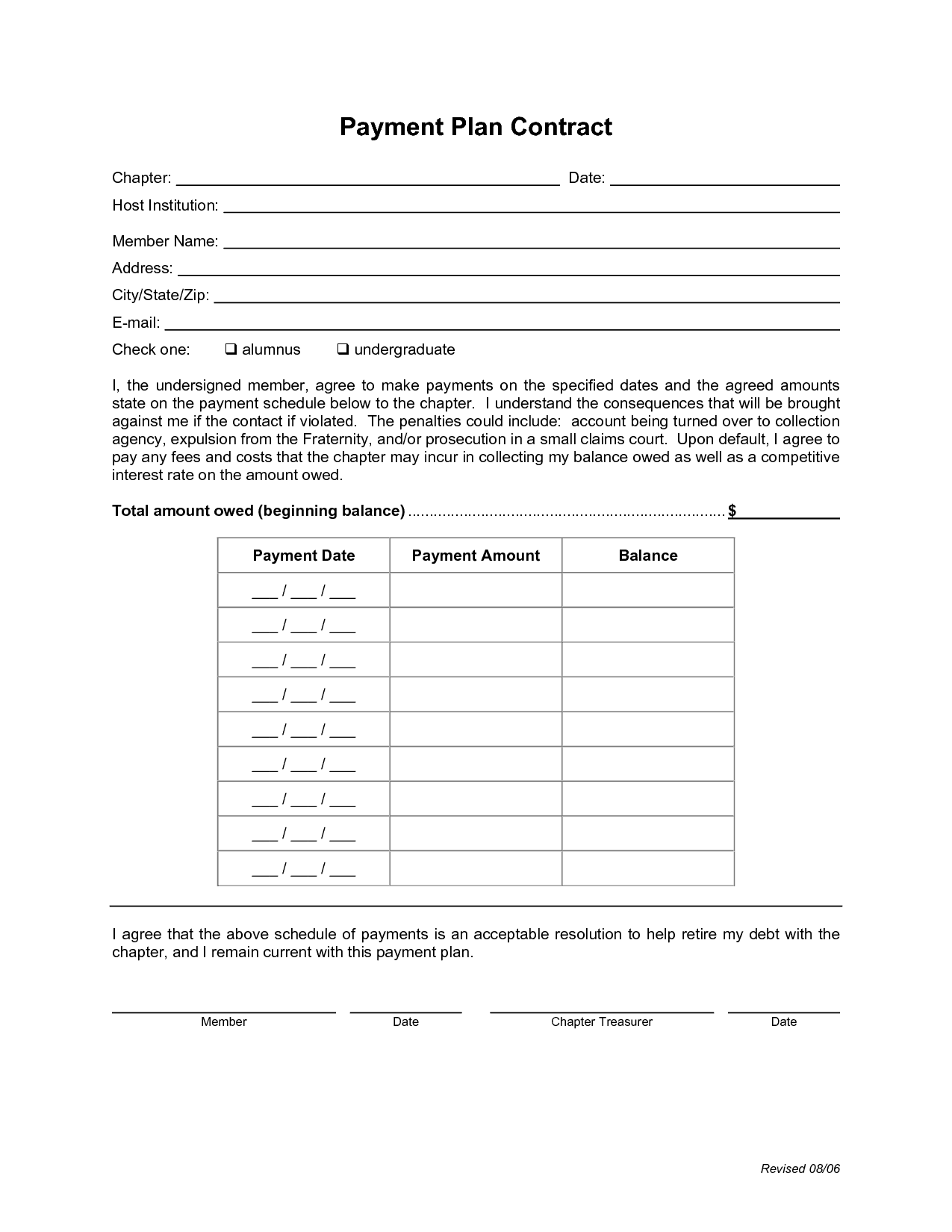

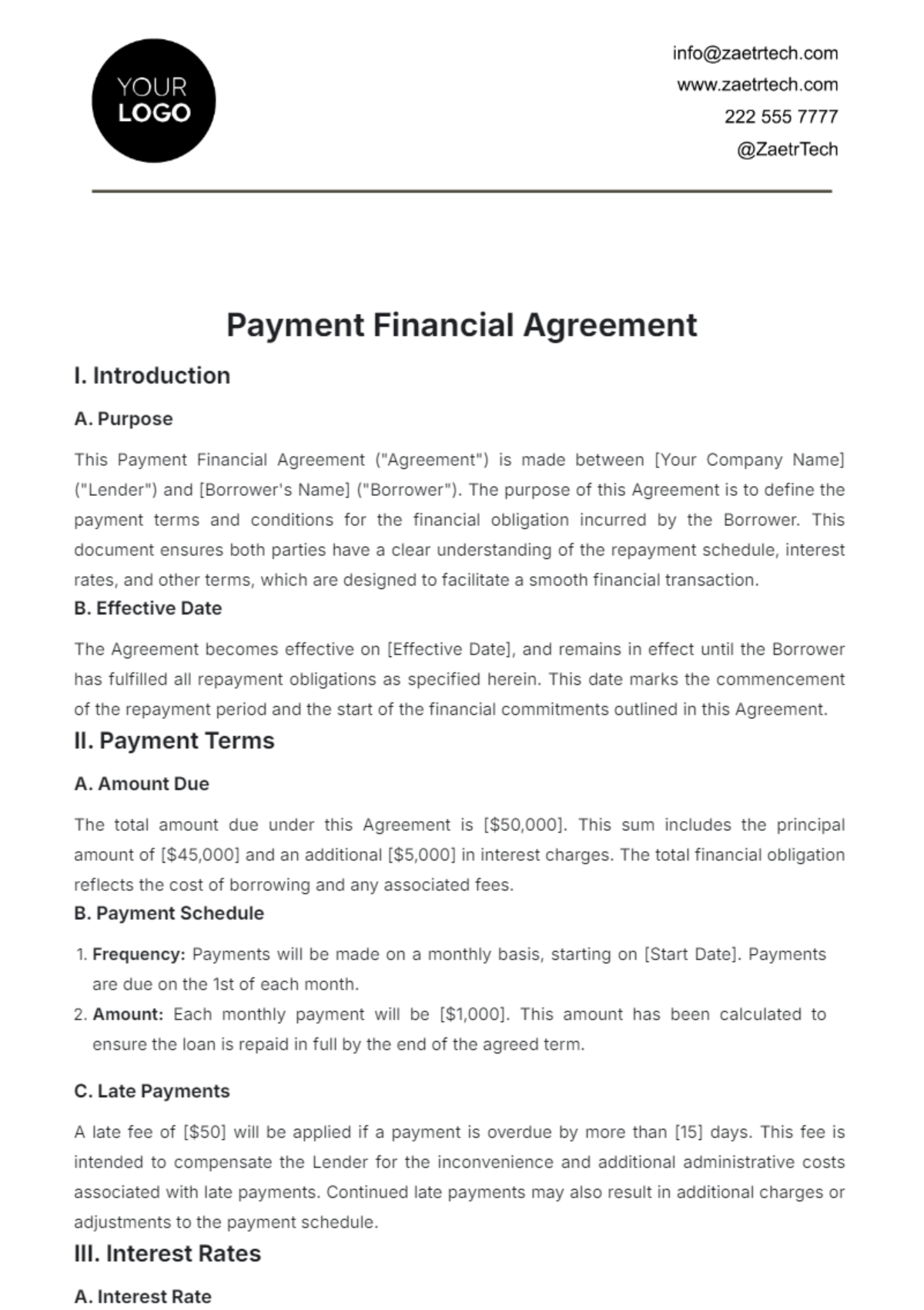

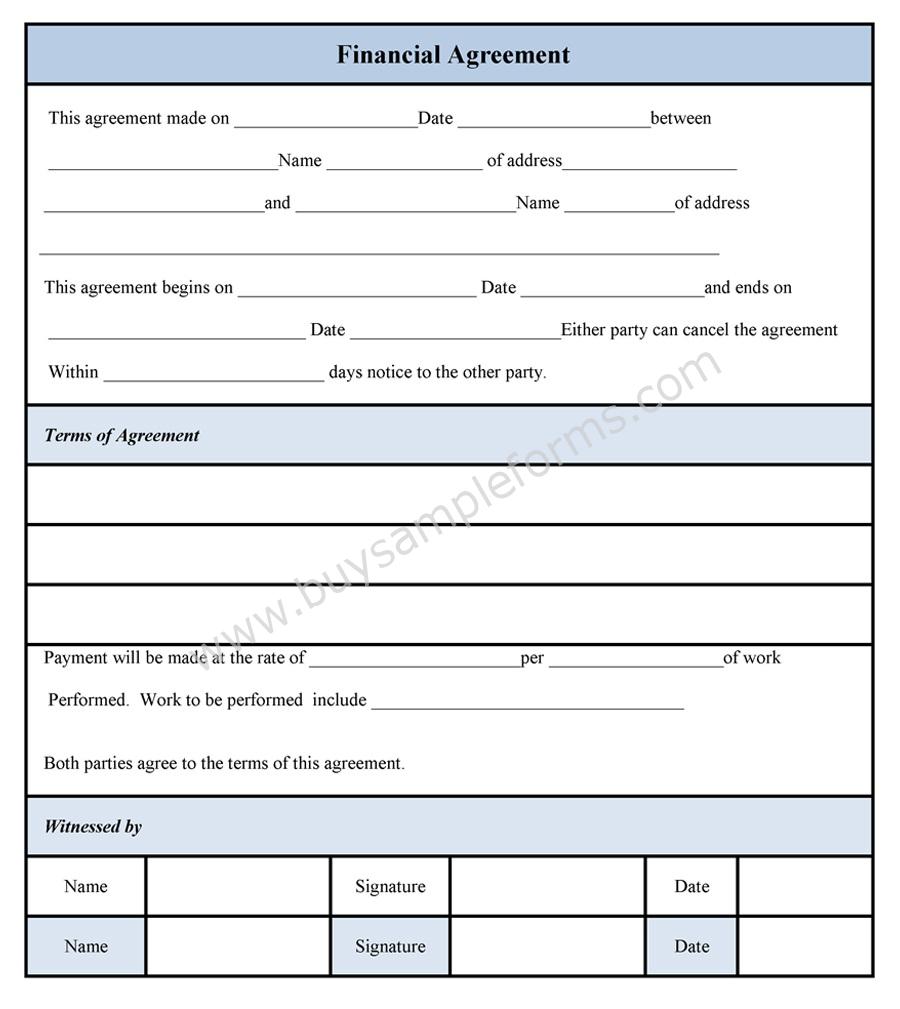

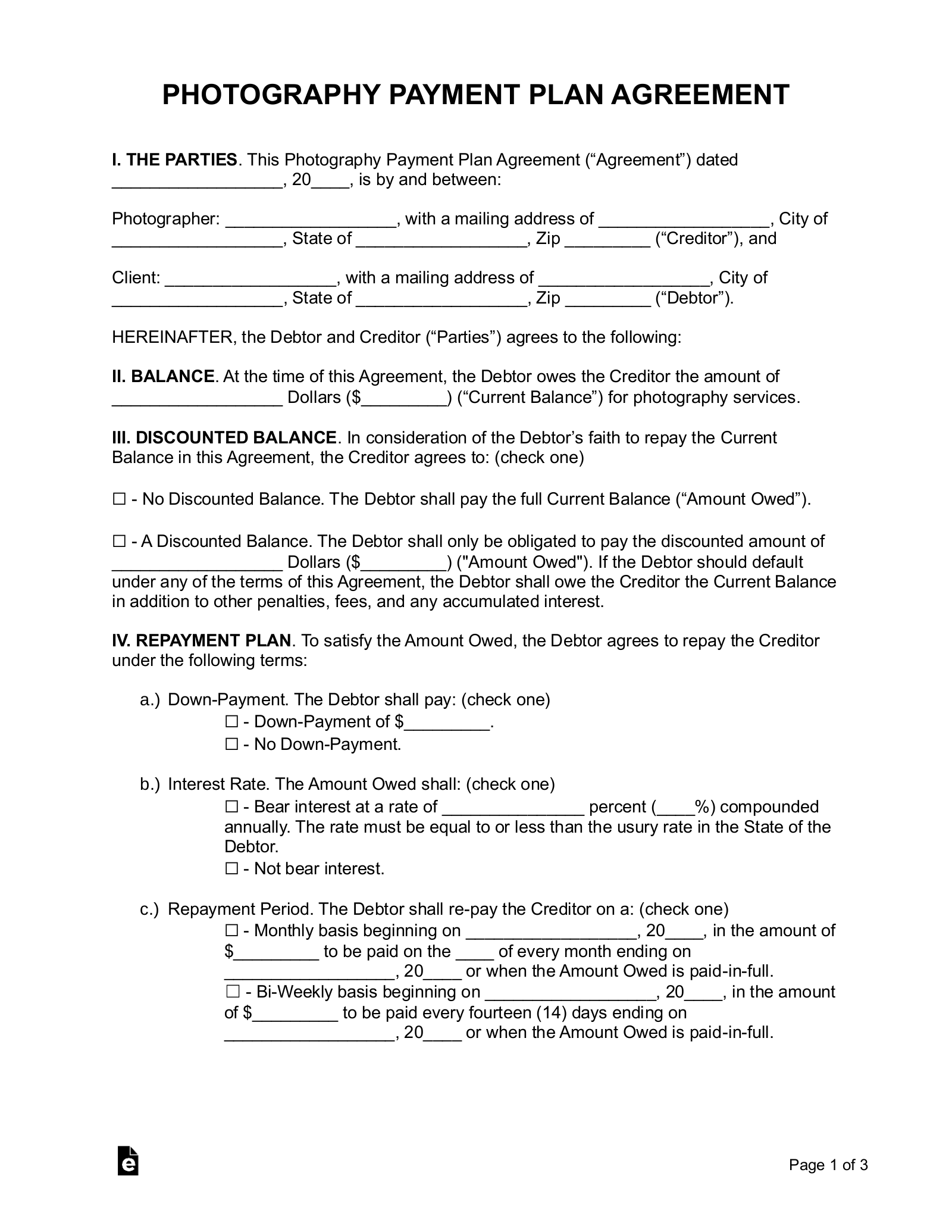

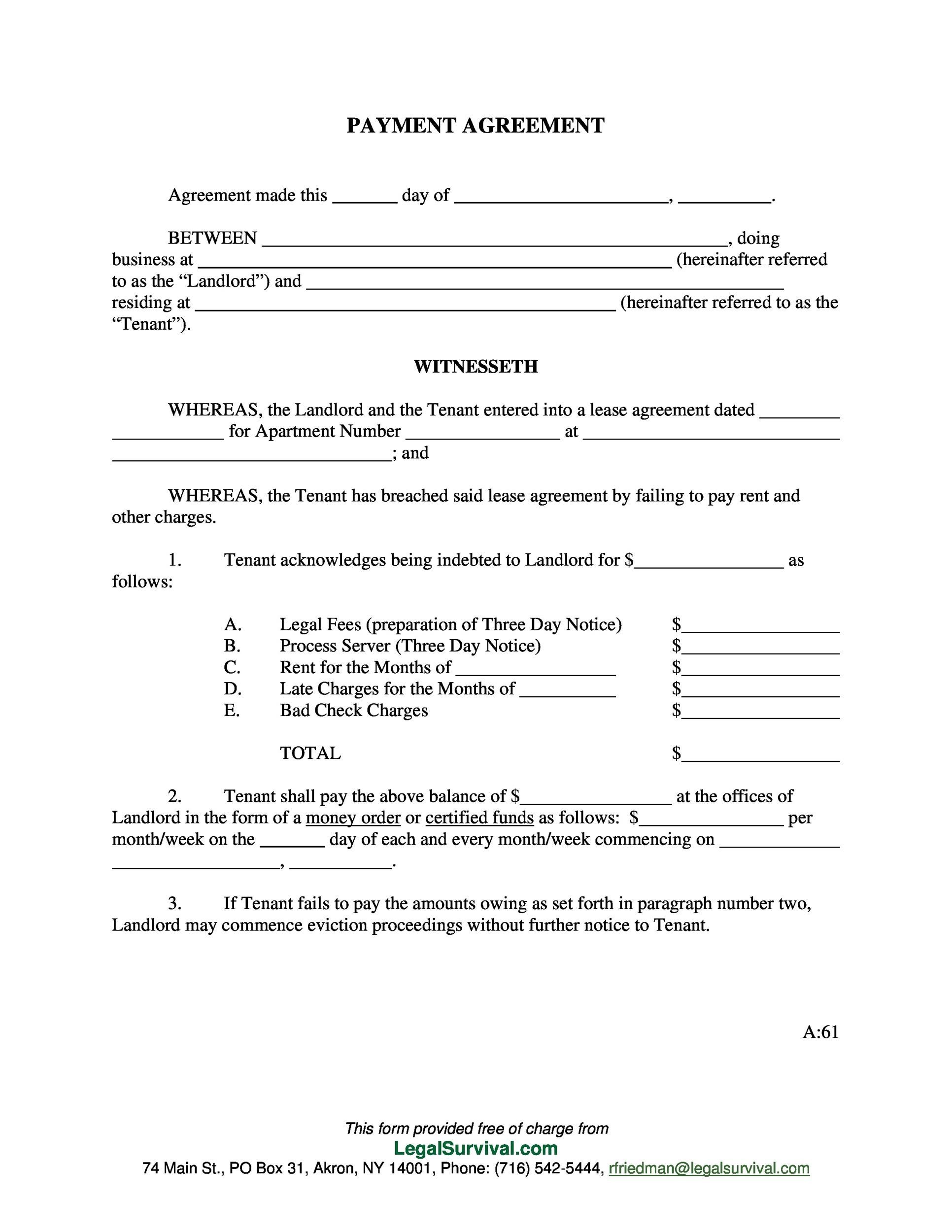

The agreement must clearly identify both the creditor (the party owed the money) and the debtor (the party owing the money). This section should include their full legal names and addresses. If either party is a business entity, include the full business name, address, and legal structure (e.g., LLC, Inc.).

This section precisely states the total amount of the original debt owed by the debtor to the creditor. This figure serves as the basis for the payment plan and should be verifiable with supporting documentation, such as invoices or loan agreements.

This is the core of the Financial Payment Plan Agreement Template. It meticulously outlines the payment schedule, including:

This section clarifies whether any interest will accrue on the outstanding debt. If so, it should specify the interest rate and how it is calculated. Also, it defines any fees associated with late payments or other breaches of the agreement. State laws often regulate interest rates and fees, so ensure compliance.

This crucial section outlines the consequences of default – the debtor’s failure to adhere to the payment plan. It should specify what constitutes a default (e.g., missing a payment, failing to cure a missed payment within a specific timeframe). It also details the creditor’s remedies in the event of a default, which may include:

A modification clause addresses the possibility of changes to the payment plan due to unforeseen circumstances. It outlines the process for requesting and approving modifications, typically requiring written agreement from both parties. This clause can prevent the agreement from collapsing entirely if the debtor experiences financial hardship.

This section specifies the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is important in case of legal disputes.

The agreement must be signed and dated by both the creditor and the debtor, demonstrating their mutual agreement to the terms. It’s advisable to have the signatures notarized for added legal protection.

Employing a pre-designed Financial Payment Plan Agreement Template offers several advantages, simplifying the process and mitigating potential risks for both parties involved.

Using a template significantly reduces the time and cost associated with drafting a payment agreement from scratch. Instead of hiring an attorney or spending hours creating a document, a template provides a ready-made framework that can be customized to fit specific circumstances.

Templates are typically designed to include all essential provisions, reducing the likelihood of omitting critical clauses. This helps prevent misunderstandings and potential legal disputes.

A well-structured template promotes clarity and consistency in the agreement. It uses standard legal language and provides a clear format, making it easier for both parties to understand their rights and obligations.

A properly executed Financial Payment Plan Agreement Template offers legal protection to both the creditor and the debtor. It provides a written record of the agreed-upon terms, which can be used as evidence in case of a dispute.

The agreement serves as a framework for ongoing communication between the creditor and the debtor. It clarifies the payment schedule, consequences of default, and procedures for modification, promoting transparency and reducing the potential for conflict.

While using a Financial Payment Plan Agreement Template simplifies the process, it’s crucial to avoid common mistakes that can undermine the agreement’s effectiveness and enforceability.

Using vague or ambiguous language can lead to misunderstandings and disputes. All terms and conditions should be clearly and precisely defined. Avoid jargon or overly complex language that may be misinterpreted.

Failing to include all essential information, such as the original debt amount, payment schedule details, and consequences of default, can render the agreement incomplete and unenforceable.

State laws regulate aspects of payment agreements, such as interest rates, fees, and collection practices. Ignoring these laws can result in the agreement being deemed invalid or unenforceable. Consult with legal counsel to ensure compliance with applicable state laws.

The agreement must be properly signed and dated by both parties. It’s also advisable to have the signatures notarized for added legal protection.

Both the creditor and the debtor should retain a copy of the signed agreement for their records. This provides a reference point for future communication and helps prevent disputes.

Circumstances can change, impacting a debtor’s ability to adhere to the original payment plan. A well-drafted Financial Payment Plan Agreement Template will include a modification clause outlining the process for requesting and approving changes to the payment schedule.

The debtor should submit a written request to the creditor, explaining the reasons for the requested modification. The request should include supporting documentation, such as financial statements or medical records, to demonstrate the need for a change.

The creditor will review the debtor’s request and supporting documentation. The creditor may request additional information or clarification before making a decision.

If the creditor is willing to consider a modification, both parties will negotiate the new terms of the payment plan. This may involve adjusting the payment amount, frequency, or extending the repayment period.

Any agreed-upon modifications should be documented in a written amendment to the original agreement. The amendment should clearly state the changes to the payment schedule and any other relevant terms.

Both the creditor and the debtor must sign and date the amendment, demonstrating their mutual agreement to the new terms.

Creating a financial payment plan agreement doesn’t have to be daunting. Here’s a simplified step-by-step guide to using a template:

A Financial Payment Plan Agreement Template is an invaluable tool for structuring debt repayment, providing clarity and legal protection for both creditors and debtors. By including essential components, avoiding common mistakes, and following a clear process for modification, these agreements can facilitate successful repayment and minimize the risk of disputes. Remember to always consult with legal counsel to ensure compliance with applicable laws and to tailor the agreement to your specific circumstances.