Creating a legally sound and comprehensive promissory note is a crucial step in securing funding and establishing financial obligations. A simple promissory note provides a clear framework for lending money, outlining the terms of repayment and the rights and responsibilities of both parties. This template offers a solid starting point for drafting such documents, ensuring clarity and minimizing potential disputes. Understanding the key elements of a promissory note is vital for anyone seeking to lend or borrow money. This guide will walk you through the essential components and considerations involved in creating a reliable and enforceable simple interest promissory note. The core of a successful promissory note lies in its precision and adherence to legal requirements. It’s important to consult with legal counsel to ensure the note complies with all applicable state and federal laws. This template is intended as a starting point and should be reviewed and adapted by a qualified professional.

At its heart, a promissory note is a legally binding agreement where one party (the borrower or debtor) promises to repay a specified sum of money to another party (the lender or creditor) on a predetermined schedule. The note clearly defines the principal amount, interest rate (if applicable), repayment schedule, and consequences of non-payment. A simple promissory note is typically the most straightforward type, focusing on the core elements of a loan agreement. It’s a fundamental document for businesses, individuals, and organizations seeking to borrow funds. The template provided here aims to simplify the process, offering a structured framework for creating a reliable and legally sound promissory note. The importance of accurate and complete information is paramount; any errors or omissions can lead to legal complications.

Let’s break down the essential components of a simple promissory note. Each section plays a vital role in establishing the terms of the loan.

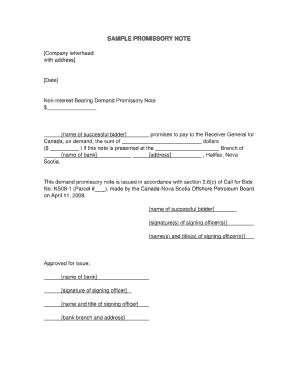

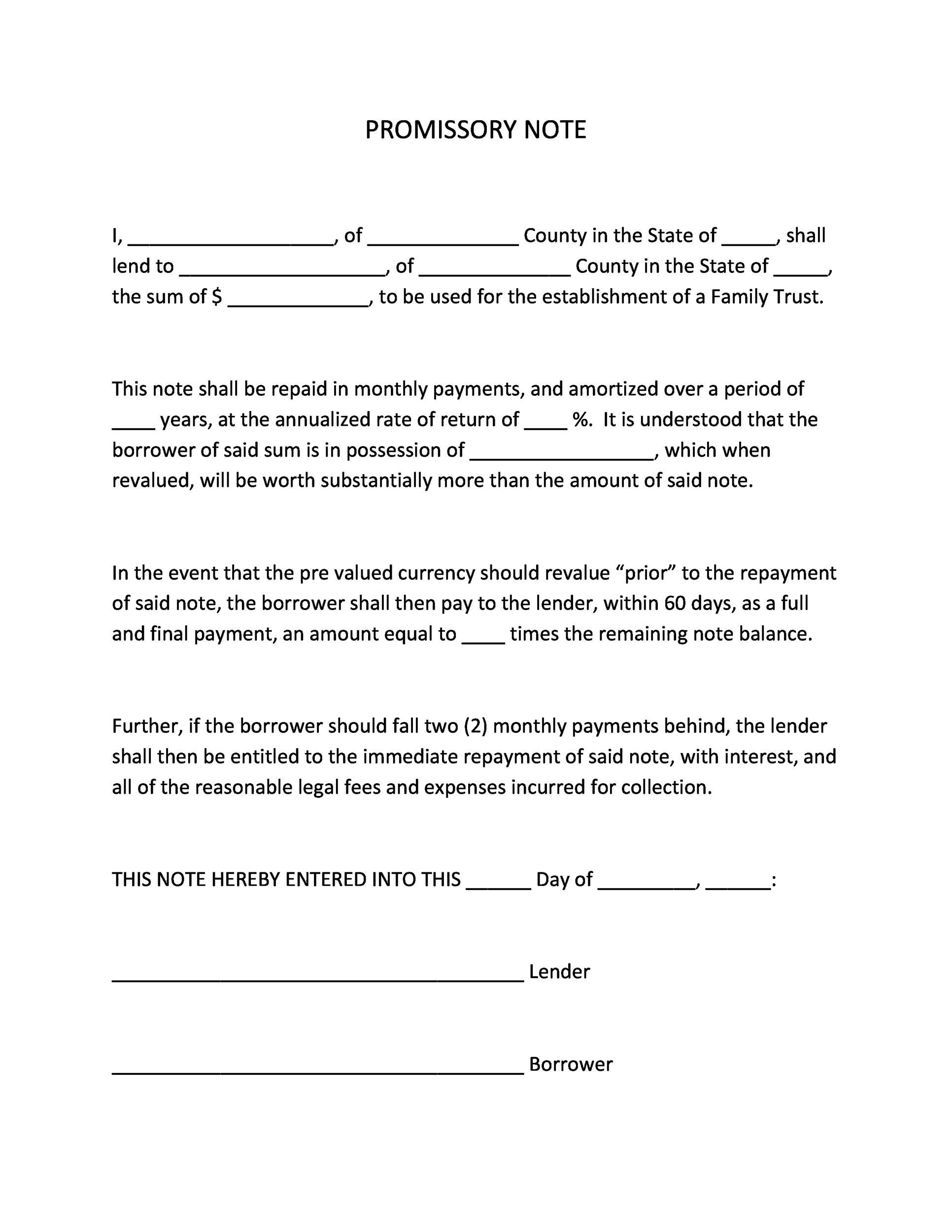

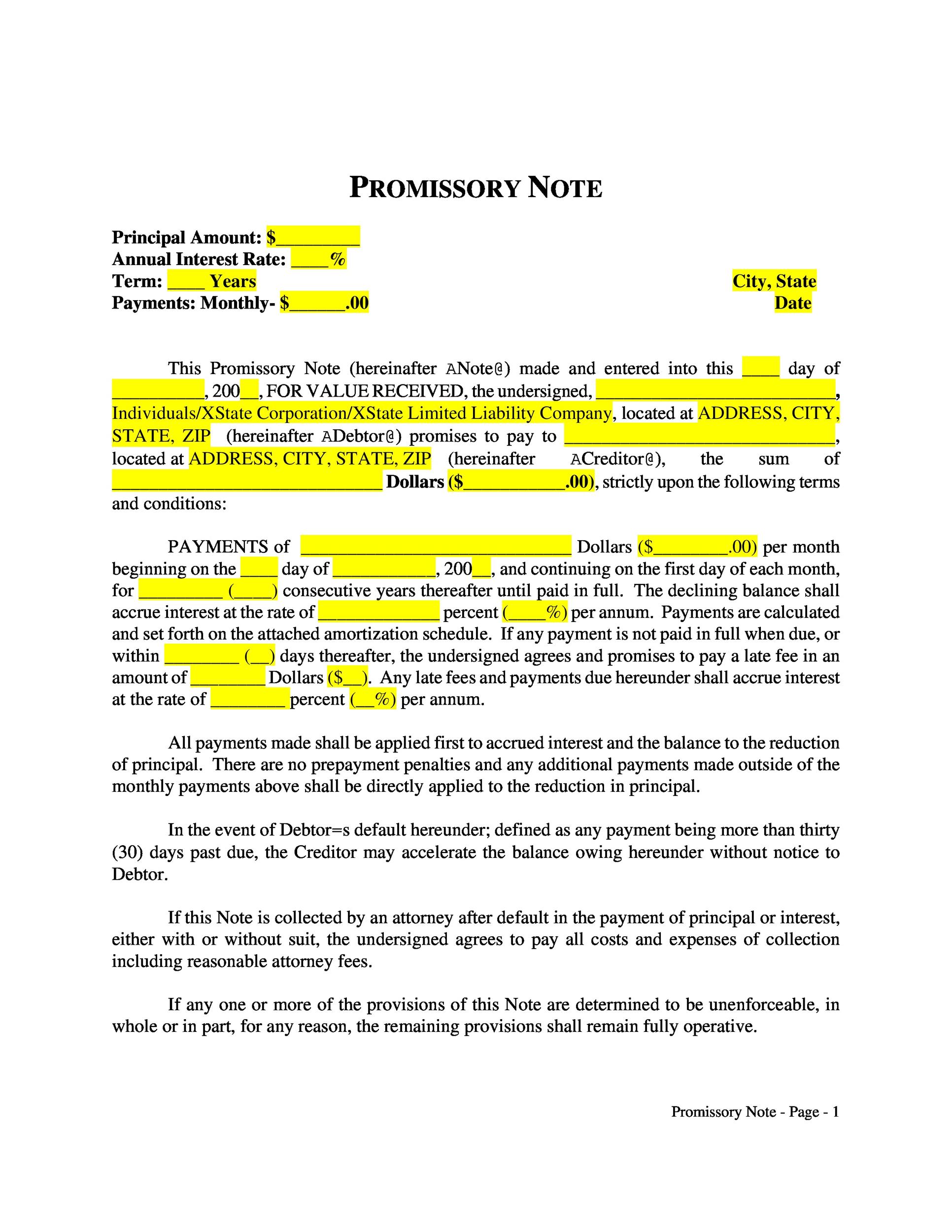

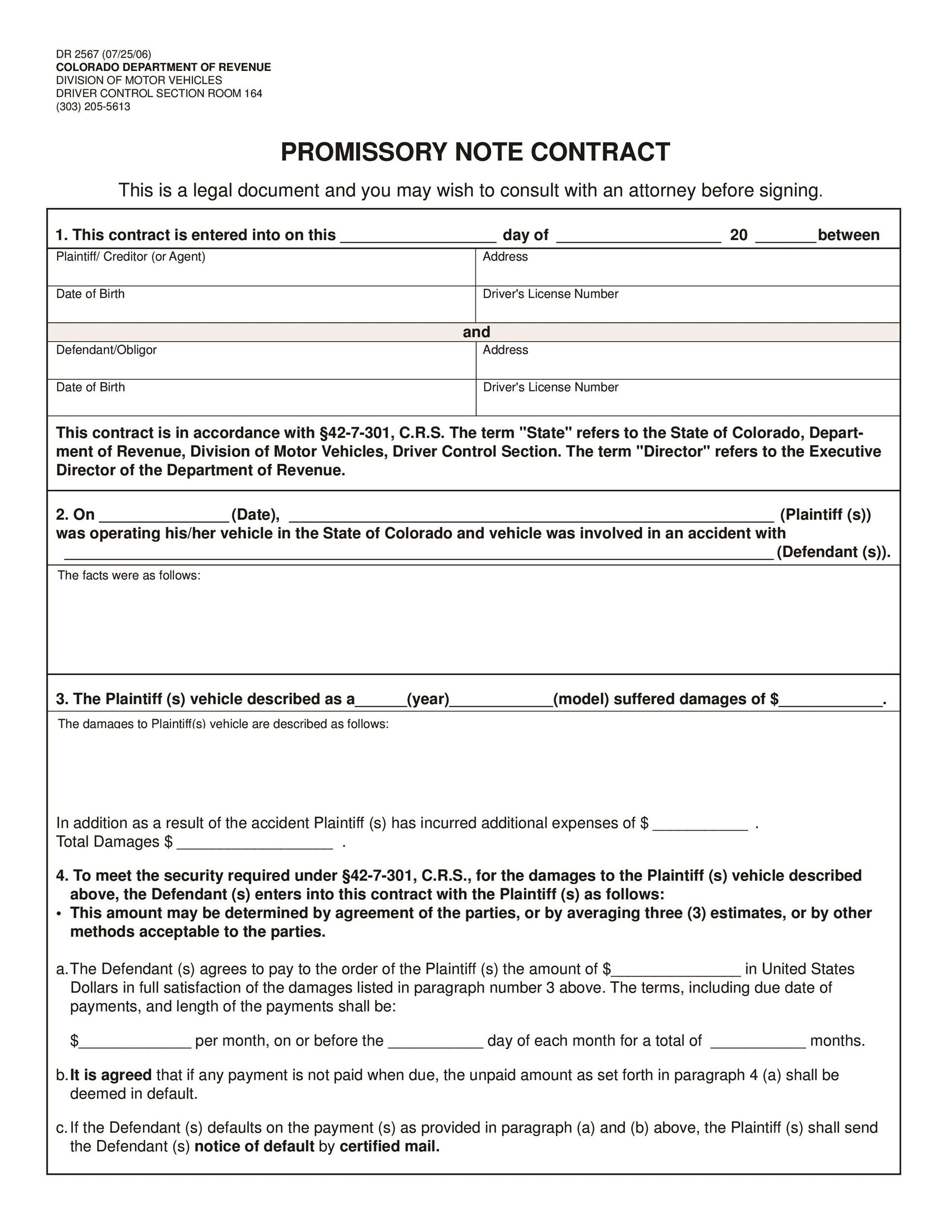

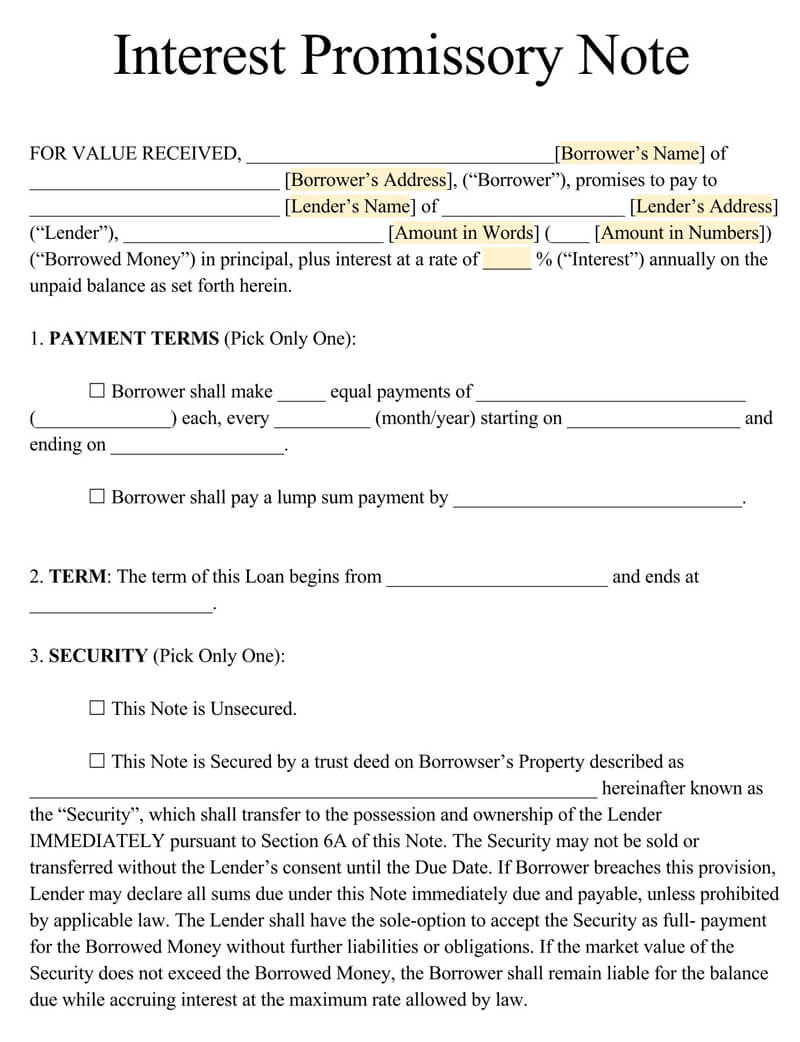

The first section of the note clearly identifies the parties involved. This typically includes the borrower (the individual or entity requesting the loan) and the lender (the individual or entity providing the loan). It’s crucial to accurately represent the full legal names and addresses of both parties. A clear statement of the relationship between the parties – is it a formal loan agreement, a business loan, or something else? This section establishes the legal basis for the agreement. For example, a formal loan agreement between a business and an investor would require a more detailed section outlining the business’s legal structure and the investor’s rights.

The note specifies the exact amount of money being borrowed. This is the principal amount of the loan. It’s important to clearly state the currency used (e.g., USD, EUR). The note should also detail the original amount of the loan, which is the initial sum borrowed. This is a fundamental element for calculating interest payments and determining the repayment schedule. It’s good practice to include a line for the original amount borrowed, providing a clear reference point.

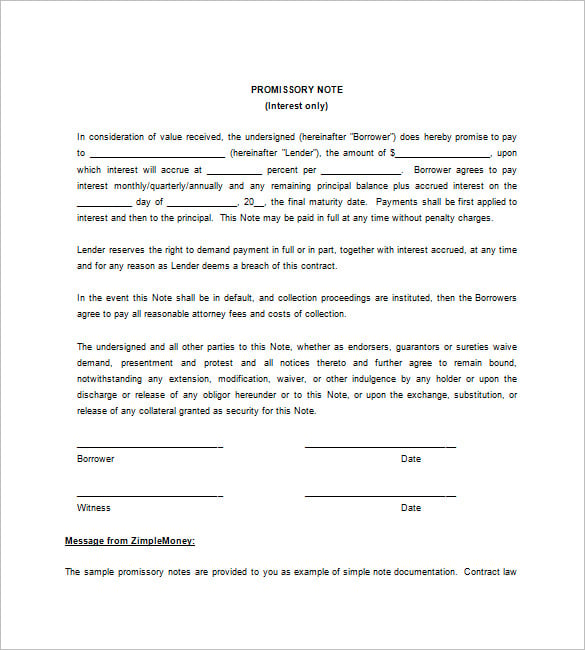

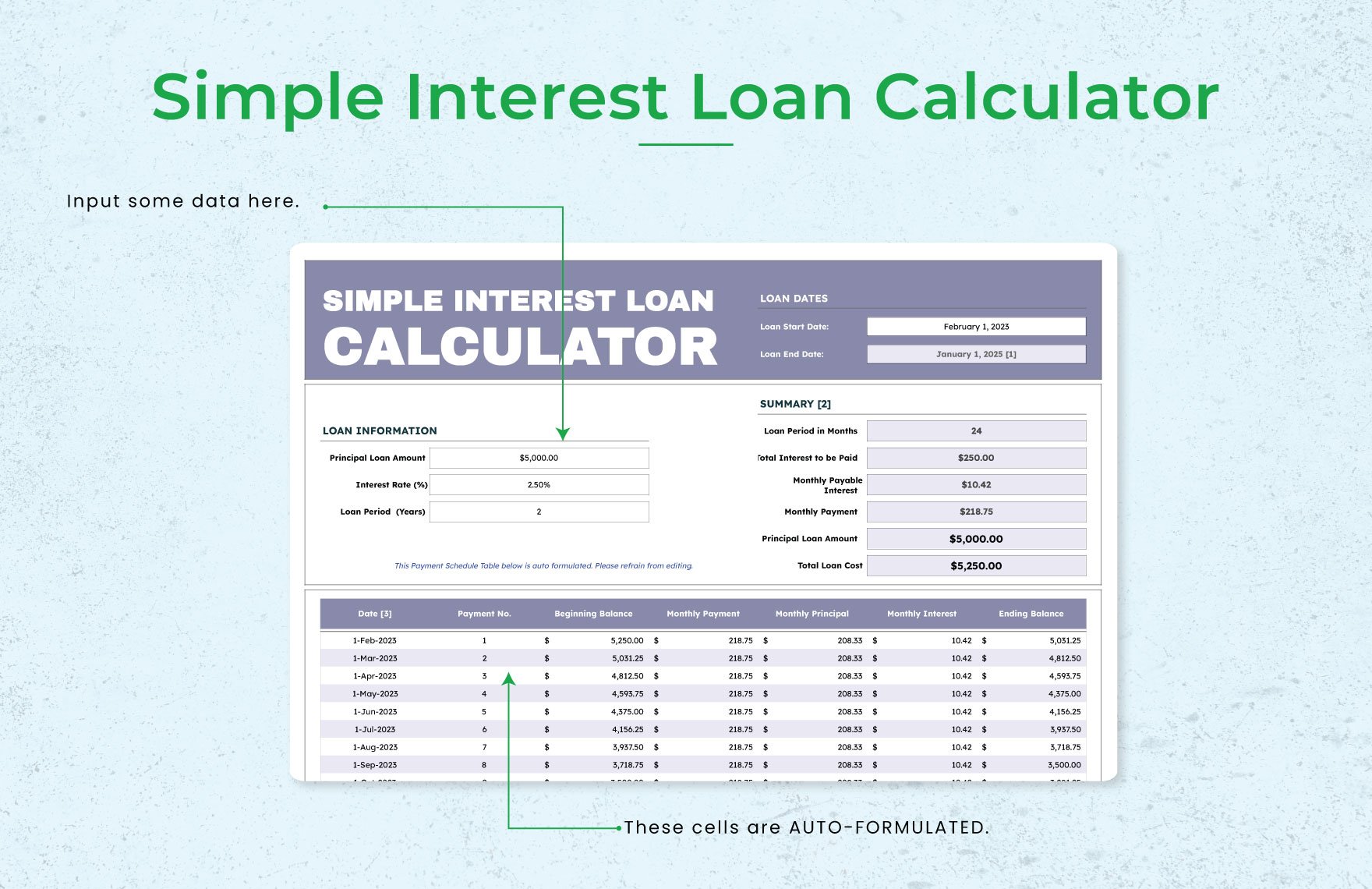

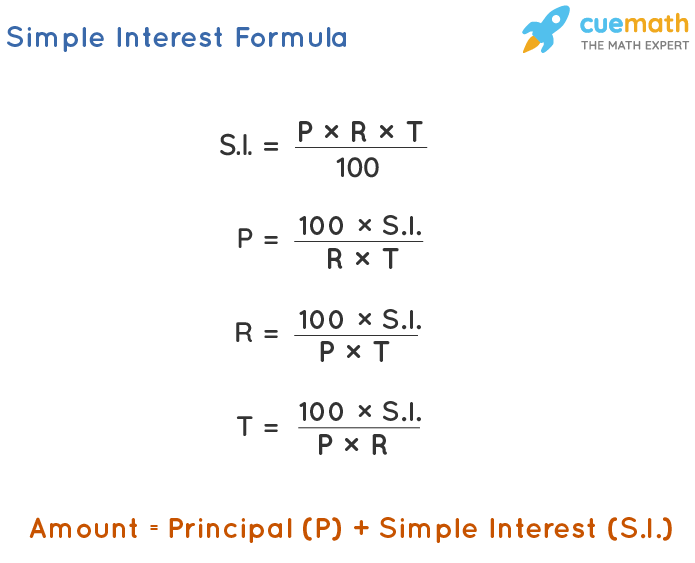

This section outlines the interest rate, if any, that will be charged on the loan. The interest rate can be expressed as a percentage or a fixed amount. The note should specify the payment schedule, detailing how often the borrower will make payments (e.g., monthly, quarterly) and the amount of each payment. A clear schedule is essential for ensuring timely repayment. Consider including a clause specifying the method of payment (e.g., direct deposit, check). The payment schedule should be realistic and reflect the borrower’s ability to repay.

The note defines the length of time the borrower is obligated to repay the loan. This is typically expressed as a period of time, such as 1 year, 3 years, or 5 years. The term should be clearly stated and consistent with the borrower’s ability to repay. A longer repayment term may be appropriate for larger loans, but it also increases the risk for the lender. It’s important to consider the borrower’s financial situation and the overall economic climate when determining the appropriate term.

This section addresses what happens if the borrower fails to make payments as agreed. It outlines the consequences of default, which could include legal action, including lawsuits and potential seizure of assets. The note should specify the legal remedies available to the lender, such as seeking a judgment and enforcing the debt. It’s crucial to clearly state the lender’s rights and responsibilities in the event of default. A well-defined clause regarding remedies protects the lender’s interests while providing recourse for non-payment.

Here’s a simplified example of a promissory note incorporating several key elements:

Loan Amount: $10,000.00

Interest Rate: 6% per annum (payable monthly)

Payment Schedule: Monthly payments of $250.00 due on the 1st of each month.

Repayment Term: 3 years

Default: If the borrower fails to make payments as agreed, Acme Investments may seek a judgment against the borrower and pursue legal remedies, including filing a lawsuit to recover the outstanding principal and interest.

Governing Law: This note shall be governed by and construed in accordance with the laws of the State of Delaware.

It is absolutely essential that anyone considering creating a simple promissory note consult with an attorney to ensure it complies with all applicable laws and regulations. This is particularly important if the loan amount is significant or if the borrower or lender has any complex financial circumstances. A lawyer can help to refine the terms of the note, identify potential risks, and ensure that the document is legally sound. Furthermore, a lawyer can advise on the best way to structure the note to protect the lender’s interests while providing a reasonable level of protection for the borrower.

Creating a simple promissory note is a vital step in establishing a sound financial relationship. By carefully considering the key components outlined in this guide, and by seeking professional legal advice, you can ensure that your note is legally sound, protects your interests, and facilitates a successful loan transaction. Remember that clarity, precision, and adherence to legal requirements are paramount. The simple interest promissory note template provides a solid foundation, but it’s a starting point that requires careful customization and professional review to meet your specific needs. Ultimately, a well-drafted promissory note is a powerful tool for managing financial obligations and fostering trust between borrowers and lenders.