The process of securing a commercial mortgage can be complex, involving numerous parties and intricate agreements. Ensuring a smooth and transparent transaction requires a well-defined fee structure. A crucial element of this process is the Commercial Mortgage Broker Fee Agreement Template, a document that outlines the compensation arrangement between the broker and the borrower. This article will delve into the key components of a robust fee agreement, providing a comprehensive guide to understanding and utilizing this vital tool. Understanding the nuances of these agreements is paramount for both brokers and lenders, fostering trust and minimizing potential disputes. A clear and legally sound fee agreement protects both parties, establishing expectations and ensuring fair compensation for the services provided. This template offers a starting point, and it’s highly recommended to consult with legal counsel to tailor the agreement to your specific circumstances and jurisdiction.

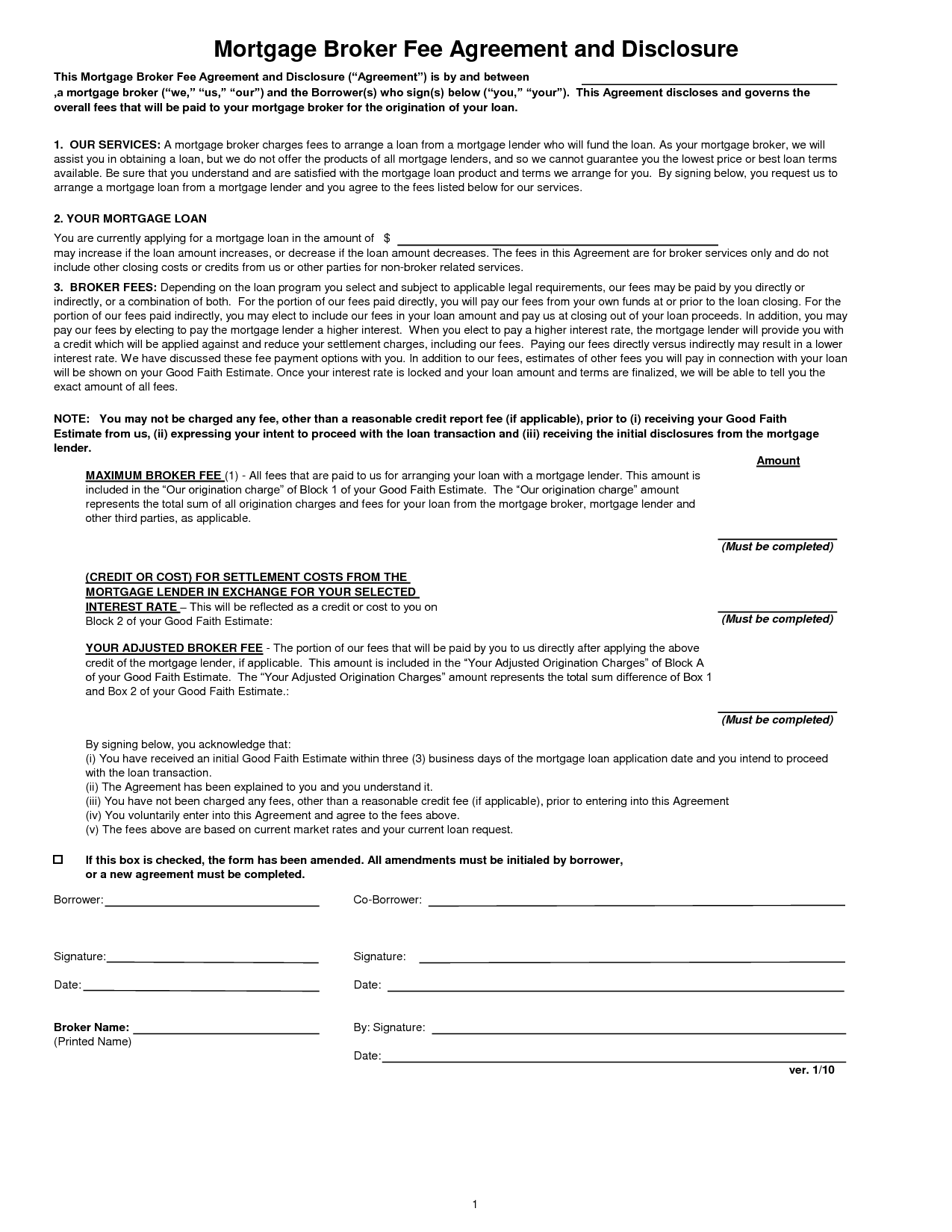

Commercial mortgage broker fees are a significant part of the overall transaction cost. They represent a portion of the lender’s profit margin and are often a key factor in determining the borrower’s loan terms. A poorly drafted fee agreement can lead to misunderstandings and dissatisfaction, potentially jeopardizing the entire transaction. Conversely, a clearly defined and mutually agreeable fee structure can build trust and encourage a collaborative relationship between the broker and the borrower. The agreement should address various aspects, including the fee structure itself, the scope of services provided, and the payment schedule. Ignoring these considerations can result in costly legal battles and damaged reputations. Therefore, investing time and effort into creating a comprehensive and legally sound fee agreement is a smart business decision.

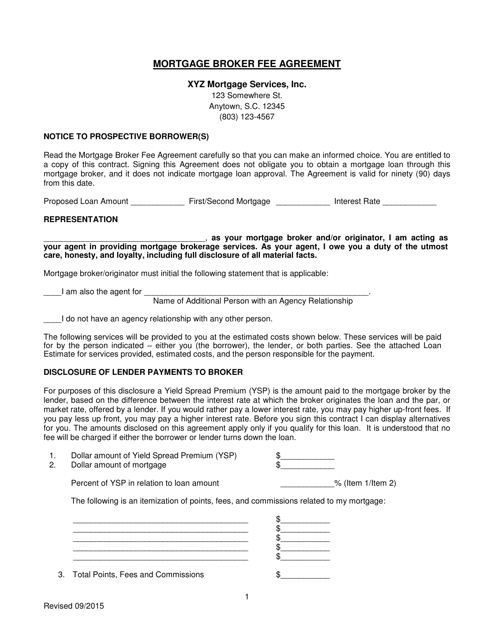

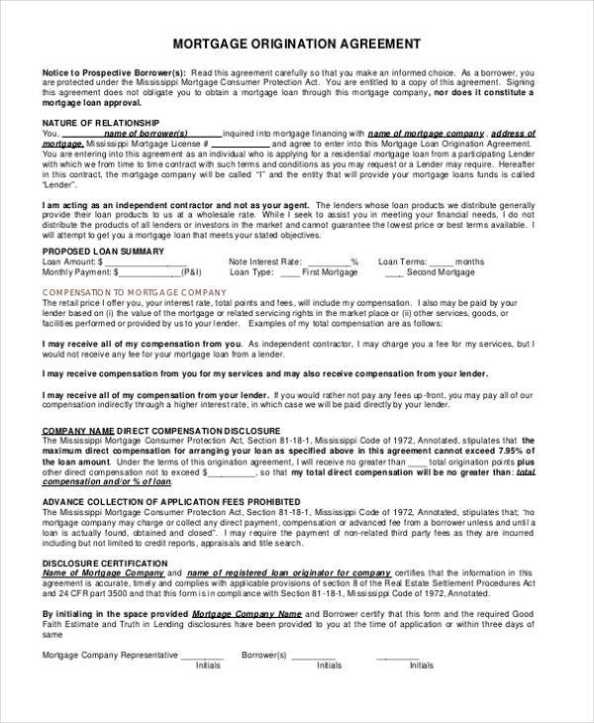

A comprehensive Commercial Mortgage Broker Fee Agreement Template typically includes the following key elements:

The Commercial Mortgage Broker Fee Agreement Template is not simply a document for the borrower; it’s a crucial tool for the broker. A well-crafted agreement demonstrates professionalism, builds trust, and protects the broker’s interests. The broker’s role is to provide expert guidance and assistance, but ultimately, the borrower bears the responsibility for selecting a qualified and reputable broker. The agreement should clearly define the broker’s responsibilities and limitations. It’s vital that the broker is transparent about their fees and services, and that they are willing to work collaboratively with the borrower to achieve a successful outcome.

The choice of fee structure can significantly impact the overall cost of a commercial mortgage. Here’s a breakdown of considerations for different fee structures:

Regardless of the fee structure chosen, thorough due diligence is essential. The broker should conduct comprehensive due diligence on the property, the borrower, and the financing options. This includes reviewing financial statements, conducting title searches, and assessing market conditions. Identifying and mitigating potential risks is crucial for protecting both the broker and the borrower. A robust risk assessment process can help prevent costly surprises down the line. The agreement should address potential contingencies and provide a mechanism for addressing unforeseen circumstances.

It is absolutely essential that both the broker and the borrower have the agreement reviewed by legal counsel before signing. A lawyer can ensure that the agreement is legally sound, protects the interests of both parties, and complies with all applicable laws and regulations. This is particularly important in complex transactions or when dealing with significant amounts of money. The lawyer can also advise on the best way to structure the agreement to minimize potential disputes.

A successful commercial mortgage transaction relies not only on a well-defined agreement but also on ongoing communication and a strong relationship between the broker and the borrower. Regular updates, proactive problem-solving, and a commitment to transparency are crucial for maintaining a positive relationship. Open communication can prevent misunderstandings and foster trust. The broker should be readily available to answer questions and address concerns.

The Commercial Mortgage Broker Fee Agreement Template is a critical document for any commercial mortgage transaction. By carefully considering the key components outlined in this article, brokers and lenders can create agreements that are fair, transparent, and legally sound. Investing time and effort into drafting a comprehensive agreement is an investment in the long-term success of the transaction. Remember that a clear and well-executed agreement fosters trust, minimizes risk, and ultimately leads to a more successful outcome for all involved. Continuous monitoring and adaptation of the agreement as the transaction progresses are also vital for maintaining its effectiveness. Ultimately, a proactive and collaborative approach is key to navigating the complexities of commercial mortgage financing.