A convertible note term sheet template is an invaluable tool for startups seeking early-stage funding. It provides a standardized framework for outlining the key terms and conditions of a convertible note, a type of debt that converts into equity at a later date, typically during a qualified financing round. Understanding and effectively utilizing this template can save significant time and legal expenses, while ensuring both the startup and the investors are aligned on the fundamental aspects of the investment.

For startups, convertible notes offer a streamlined and often faster route to securing initial capital compared to traditional equity financing. They delay the complexities of valuation and equity allocation until a later, more mature stage of the company’s development. Investors, on the other hand, are attracted to convertible notes due to the potential for higher returns through interest accrual and a conversion discount on the future equity price. This alignment of interests makes the convertible note term sheet template a crucial document in early-stage fundraising.

The purpose of this article is to provide a comprehensive overview of convertible note term sheet templates, their key components, and best practices for their use. We will delve into the specific terms that are typically included in these templates, explaining their significance and potential implications for both the startup and the investors. This guide aims to empower entrepreneurs and investors alike to navigate the world of convertible notes with greater confidence and clarity.

Therefore, thoroughly understanding the nuances of a convertible note term sheet template is paramount to a successful funding round. It not only dictates the immediate terms of the investment but also lays the groundwork for the startup’s future capitalization and equity structure.

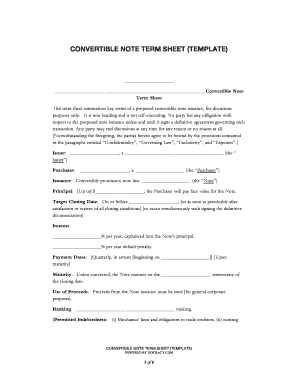

A term sheet, in general, is a non-binding agreement outlining the proposed terms and conditions of an investment. In the context of a convertible note, it specifically describes the terms under which a loan will be made to a startup with the understanding that the loan will convert into equity at a later point. The convertible note term sheet template serves as a starting point for negotiations between the startup and the investors, eventually leading to legally binding definitive agreements. While the term sheet itself is typically non-binding (except for certain clauses like confidentiality and exclusivity), it sets the stage for the entire transaction.

While both convertible notes and SAFEs (Simple Agreements for Future Equity) are popular instruments for early-stage funding, they differ in several key aspects. A convertible note is a form of debt, meaning it accrues interest and has a maturity date. A SAFE, on the other hand, is not debt; it is an agreement to issue equity to the investor upon the occurrence of certain events. This distinction affects how the investment is treated on the company’s balance sheet and has implications for tax and legal considerations. SAFEs also typically avoid the complexities associated with interest rates and maturity dates, making them simpler and faster to execute. Choosing between a convertible note and a SAFE depends on the specific needs and circumstances of the startup and its investors.

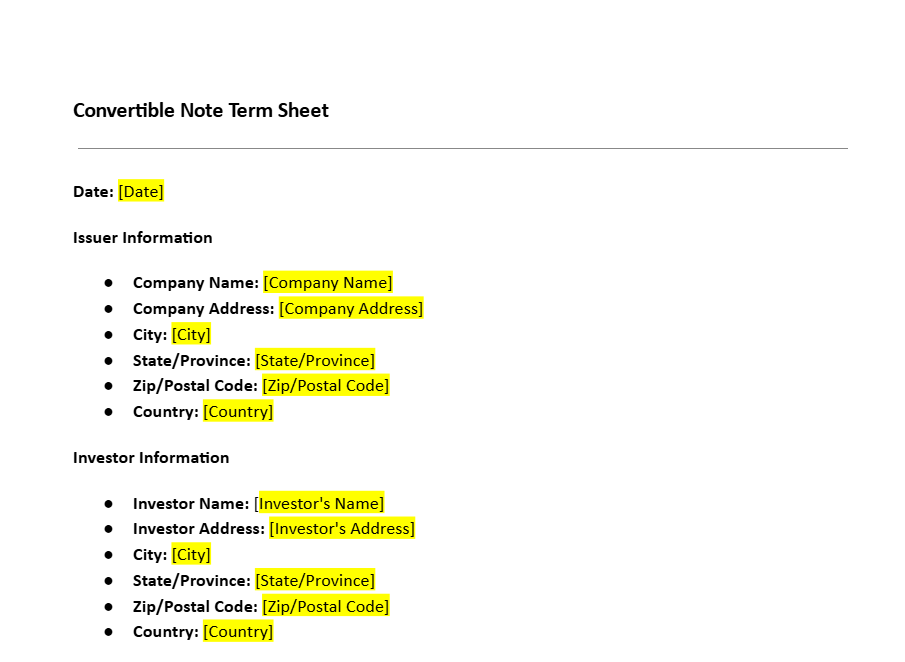

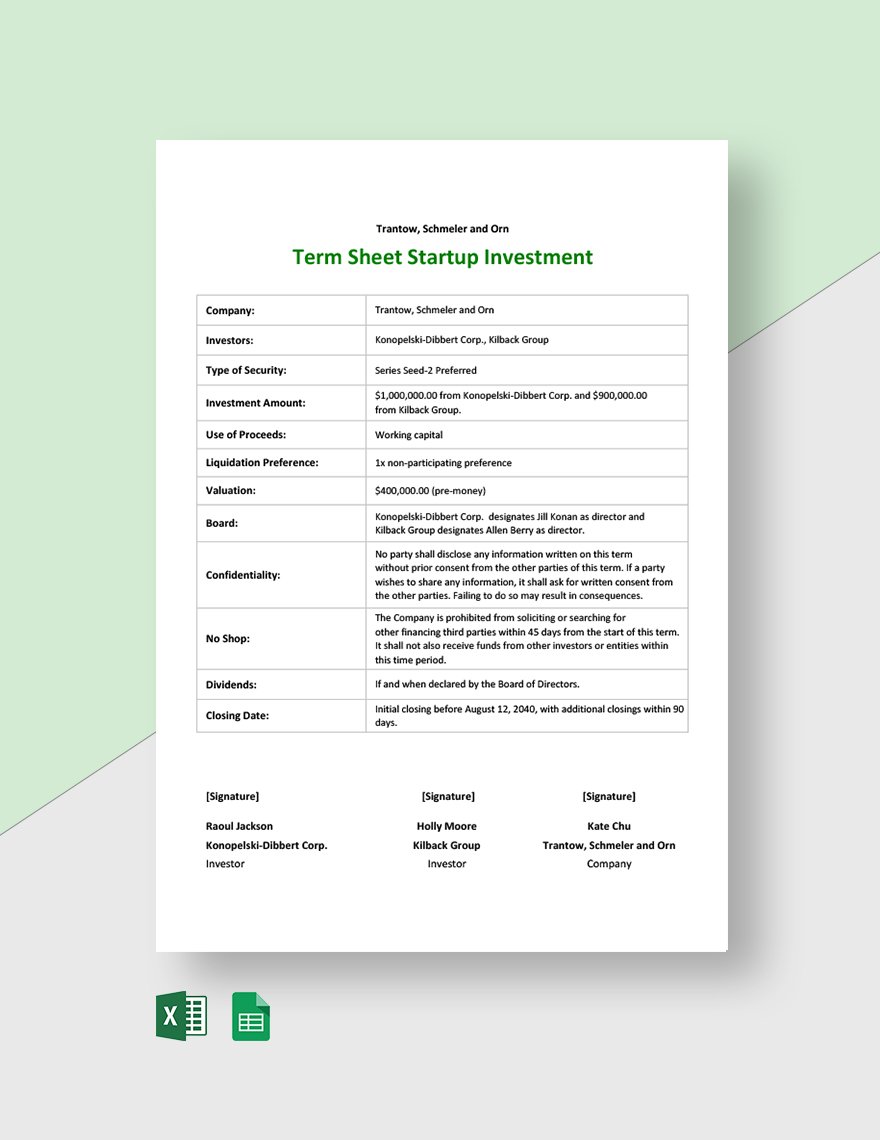

A convertible note term sheet template typically includes several key components, each of which plays a crucial role in defining the terms of the investment. Understanding these components is essential for both startups and investors to ensure a fair and mutually beneficial agreement.

This is the amount of money the investor is lending to the startup. It’s a straightforward term, but it’s the foundation upon which all other calculations (interest, conversion, etc.) are based.

The interest rate specifies the percentage of the principal amount that will accrue as interest over the life of the note. Interest is typically paid either in cash at maturity or added to the principal amount for conversion into equity. The interest rate compensates the investor for the risk and the time value of money.

The maturity date is the date on which the principal and any accrued interest become due and payable if the note has not already converted into equity. This date provides a deadline for conversion and incentivizes both the startup to raise a qualified financing round and the investor to participate in that round. A longer maturity date gives the startup more time to secure funding, but it also increases the risk for the investor.

This section defines the events that trigger the conversion of the note into equity. The most common trigger is a “qualified financing,” typically defined as a Series A funding round of a certain minimum size (e.g., $3 million). Other potential triggers include a change of control (e.g., acquisition) or an initial public offering (IPO).

The conversion discount allows the investor to convert their debt into equity at a lower price per share than other investors in the qualified financing. This discount compensates the early investor for taking on the greater risk of investing in the startup at an early stage. Typical discounts range from 10% to 30%.

A valuation cap sets a maximum valuation at which the note will convert into equity. This protects the investor from excessive dilution in the event that the company’s valuation increases significantly between the time the note is issued and the qualified financing. The combination of a conversion discount and a valuation cap provides investors with downside protection and upside potential.

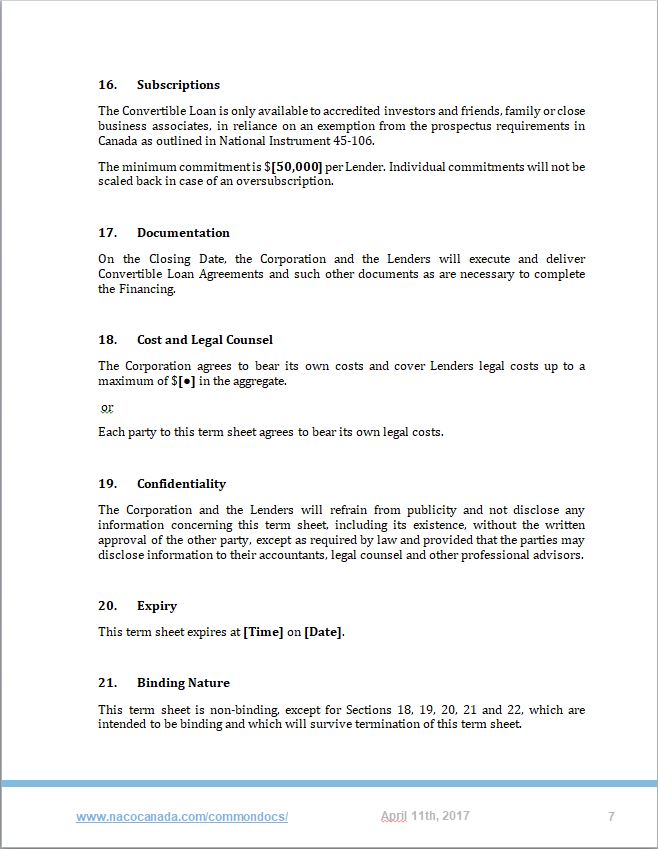

The MFN clause grants the investor the right to receive the same terms as any other investor in a subsequent convertible note offering. This ensures that the initial investor is not disadvantaged if the company later offers more favorable terms to new investors.

This term defines the order in which investors will be paid out in the event of a liquidation or sale of the company. Typically, convertible note holders will have a preference over common stockholders but may rank behind preferred stockholders in the qualified financing round.

Successfully utilizing a convertible note term sheet template requires more than just filling in the blanks. It demands a clear understanding of the implications of each term and the ability to negotiate effectively to achieve a fair and mutually beneficial agreement.

While a convertible note term sheet template provides a solid foundation, it’s crucial to remember that it’s just a starting point. Each startup is unique, and the terms of the convertible note should be tailored to reflect its specific circumstances, stage of development, and fundraising goals. Resist the temptation to simply use the template “as is” without careful consideration and customization.

Negotiating and drafting convertible note agreements can be complex, involving legal and financial considerations that are best handled by experienced professionals. Consulting with an attorney who specializes in startup financing is highly recommended. Legal counsel can help you understand the implications of each term, negotiate effectively with investors, and ensure that the final agreement is legally sound and protects your interests.

Successful negotiation involves understanding the perspectives and motivations of the other party. Investors are seeking to maximize their return while minimizing their risk. Understanding their concerns and priorities can help you craft a proposal that is more likely to be accepted. Be prepared to justify your position and offer reasonable compromises.

Several terms in a convertible note term sheet template are particularly important to negotiate carefully. These include the interest rate, maturity date, conversion discount, and valuation cap.

Interest Rate: A higher interest rate benefits the investor, while a lower rate benefits the startup. The appropriate rate depends on the risk profile of the company and prevailing market conditions.

Maturity Date: A shorter maturity date puts pressure on the startup to raise funding, while a longer date provides more flexibility.

Conversion Discount: A larger discount benefits the investor, while a smaller discount benefits the startup. The discount should reflect the early-stage risk taken by the investor.

Valuation Cap: A lower valuation cap benefits the investor, while a higher cap benefits the startup. The cap should reflect the potential future value of the company.

Both startups and investors should conduct thorough due diligence before entering into a convertible note agreement. Startups should carefully vet potential investors to ensure that they are reputable and aligned with the company’s vision. Investors should conduct due diligence on the startup to assess its business plan, financial projections, and management team.

Using a convertible note term sheet template can be beneficial, but avoiding common pitfalls is crucial. These mistakes can lead to unfavorable terms, legal disputes, or even derail the funding process altogether.

One of the biggest mistakes is failing to have the term sheet and final agreement reviewed by legal counsel. While templates offer a starting point, they can’t account for the specific circumstances of each deal or the nuances of relevant laws. Legal counsel can identify potential risks, ensure the terms are fair, and protect your interests.

Another common error is proposing or accepting terms that are far outside of market standards. This can signal a lack of understanding or a disregard for the other party’s perspective. Researching comparable deals and consulting with advisors can help you establish realistic expectations.

While valuation is important, it shouldn’t be the only focus. Terms like the conversion discount, interest rate, and maturity date can significantly impact the overall economics of the deal. Neglecting these details can lead to an unfavorable outcome, even with a seemingly attractive valuation.

It’s crucial to understand how the convertible notes will convert into equity under various scenarios, such as a qualified financing, a change of control, or a failure to raise additional funding. Failing to plan for these possibilities can lead to unintended consequences and disputes.

Convertible notes impact a company’s cap table, and it’s vital to understand the dilution effect on existing shareholders. Improperly managing the cap table can lead to future conflicts and complicate future fundraising efforts.

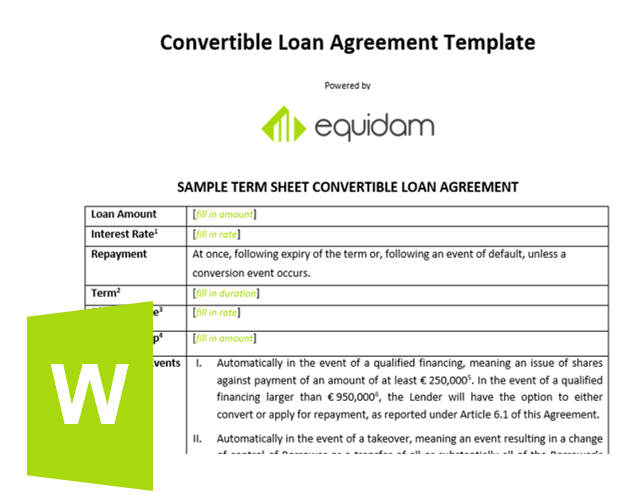

Several online resources offer convertible note term sheet templates and related information. These resources can be valuable for both startups and investors seeking to understand the key terms and conditions of convertible note financing.

Law Firms: Many law firms that specialize in startup financing offer free convertible note term sheet templates on their websites. These templates are typically drafted by experienced attorneys and reflect current legal standards.

Venture Capital Firms: Some venture capital firms also provide convertible note term sheet templates as a resource for entrepreneurs. These templates may reflect the firm’s preferred investment terms.

Online Legal Services: Online legal service providers offer customizable convertible note term sheet templates and access to legal advice.

A convertible note term sheet template is an essential tool for startups seeking early-stage funding. It provides a structured framework for negotiating the key terms of a convertible note, which can be a faster and more efficient way to raise capital than traditional equity financing. By understanding the essential components of a convertible note term sheet template, seeking legal counsel, and negotiating effectively, startups and investors can reach mutually beneficial agreements that support the company’s growth and success. Remember to customize the template to your specific circumstances, avoid common mistakes, and leverage available resources to ensure a smooth and successful fundraising process.