The world of finance can be complex, and securing funding often requires careful planning. One of the most common and crucial tools for businesses and individuals seeking capital is the Line Of Credit Loan Agreement Template. This document outlines the terms and conditions of a loan, providing a framework for lenders and borrowers to establish a clear and legally sound agreement. Understanding the nuances of a Line Of Credit Loan Agreement Template is paramount for ensuring a successful and transparent transaction. This article will delve into the key components, best practices, and considerations involved in creating and reviewing such a document.

A Line Of Credit Loan Agreement Template serves as a foundational document, establishing the core principles of a credit relationship. It defines the borrower’s rights and obligations, the lender’s responsibilities, and the repayment schedule. It’s not simply a set of words; it’s a legally binding contract that protects both parties. Without a well-drafted template, the risk of disputes and legal complications can significantly increase. For businesses, a Line Of Credit Agreement Template facilitates access to funds when needed, while for individuals, it provides a secure pathway to manage financial emergencies or pursue opportunities. It’s a vital tool for responsible lending and prudent borrowing.

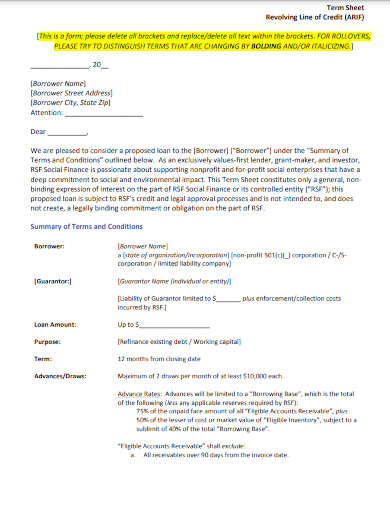

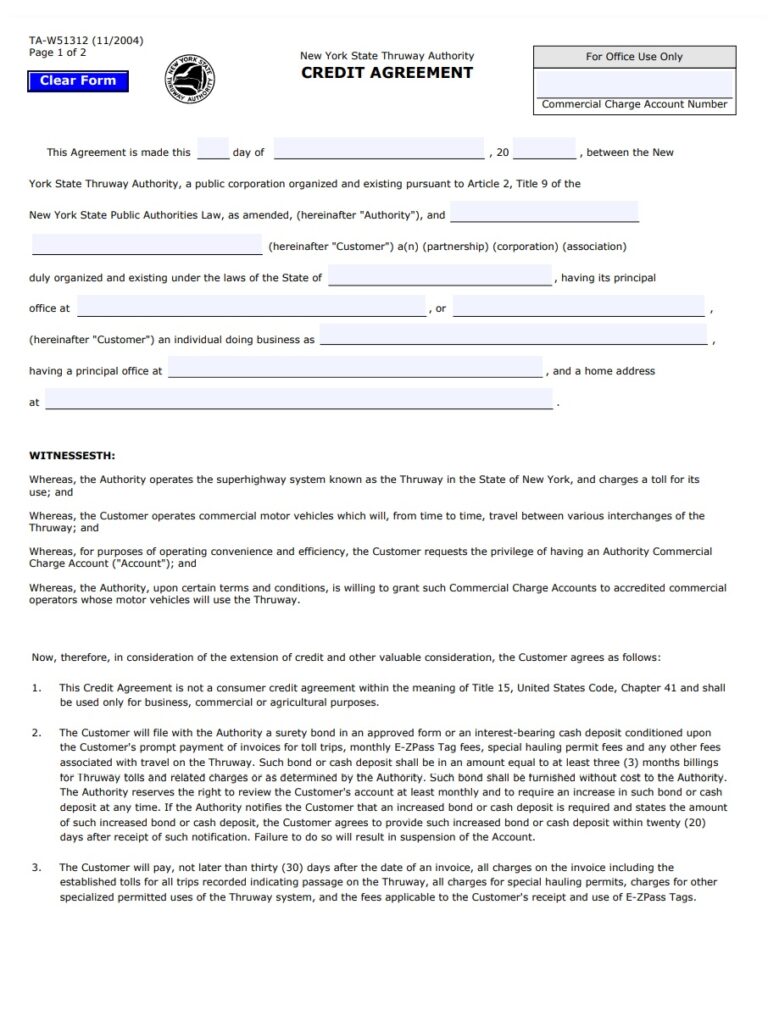

A comprehensive Line Of Credit Loan Agreement Template typically includes several key sections. These sections are designed to protect all parties involved and clearly define the scope of the loan. Let’s examine some of the most important elements:

Creating a robust Line Of Credit Loan Agreement Template requires careful consideration and attention to detail. Here’s a breakdown of the process:

While a well-drafted template is the foundation, technology can streamline the creation and management of these agreements. Legal document automation platforms can help to populate the template with specific data, reducing errors and saving time. These platforms often offer features like clause management, version control, and electronic signature capabilities. However, it’s crucial to remember that technology is a tool, not a replacement for a skilled legal professional.

Implementing a well-structured Line Of Credit Loan Agreement Template offers numerous benefits for both borrowers and lenders. For borrowers, it provides access to capital when needed, while for lenders, it reduces risk and increases the likelihood of a successful loan transaction. The template promotes transparency, minimizes disputes, and establishes a clear framework for managing credit relationships. Ultimately, a properly drafted agreement strengthens the entire financial ecosystem.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

The Line Of Credit Loan Agreement Template is a cornerstone of modern finance. It’s a critical document that governs the relationship between lenders and borrowers, protecting both parties and facilitating access to capital. By understanding the key components, best practices, and considerations involved in creating and reviewing these agreements, businesses and individuals can significantly increase their chances of a successful and secure financial transaction. Remember, seeking expert legal counsel is always recommended to ensure the agreement meets your specific needs and complies with all applicable laws. Continued monitoring and review of the agreement are also vital to address any changes in market conditions or business needs.