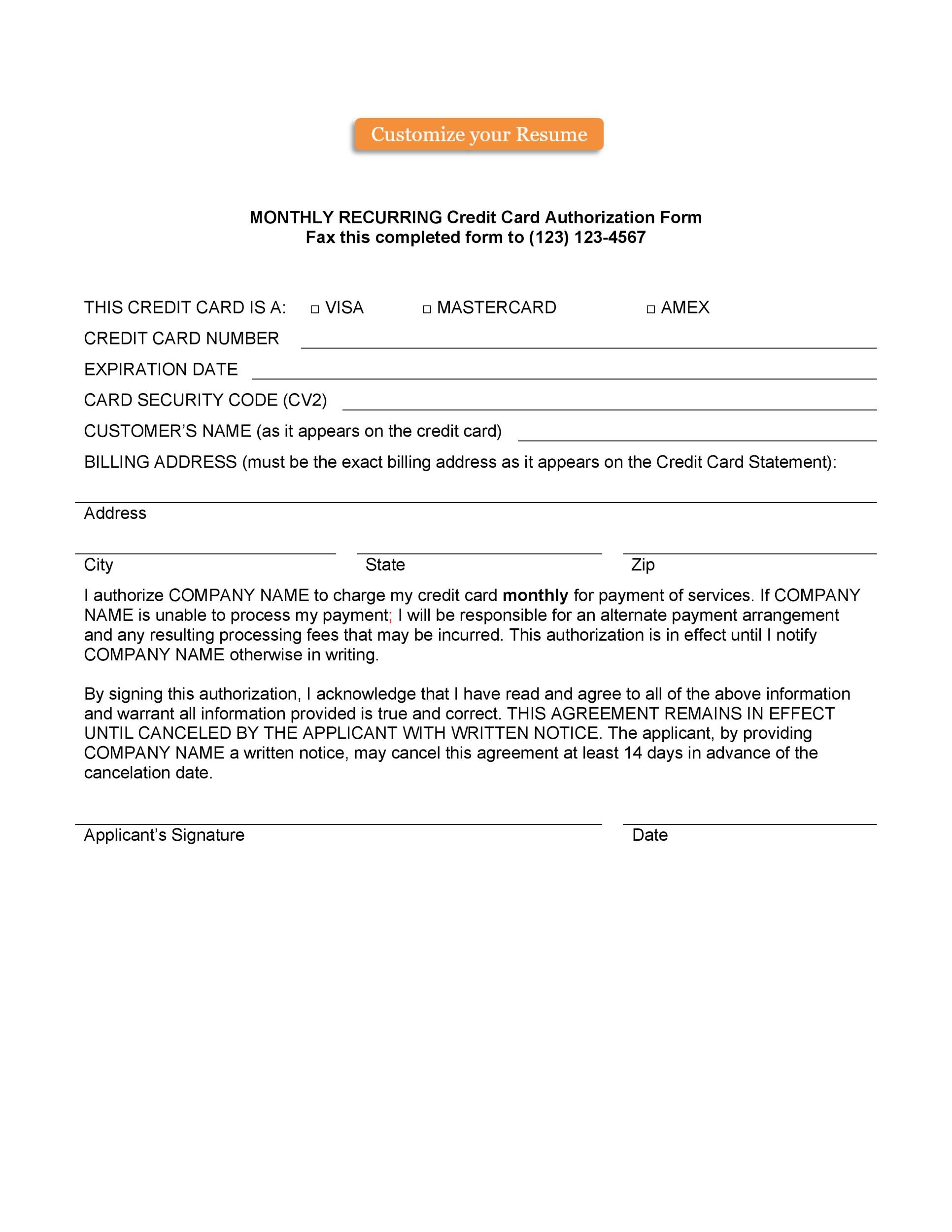

The world of business relies heavily on financial flexibility, and that’s where corporate credit card agreements come in. These agreements are crucial for managing business expenses, tracking spending, and ensuring compliance with financial regulations. A well-drafted corporate credit card agreement provides a clear framework for both businesses and their card issuers, minimizing risk and fostering strong relationships. This article will delve into the key aspects of creating and understanding corporate credit card agreements, offering a comprehensive guide for businesses of all sizes. Corporate Credit Card Agreement Template is the cornerstone of responsible credit card usage within an organization. It’s more than just a simple form; it’s a legally binding contract that protects both the business and its card provider. Navigating the complexities of these agreements requires careful consideration and professional guidance. Let’s explore the essential components and best practices.

Before diving into the specifics, it’s important to grasp the fundamental purpose of a corporate credit card agreement. It’s a legally enforceable contract outlining the terms and conditions for using a business credit card. It dictates how the card is issued, used, and repaid, ensuring accountability and protecting the business from potential misuse. A robust agreement protects the company’s financial health and facilitates efficient expense management. Without a clear agreement, businesses risk incurring unnecessary debt, damaging their credit rating, and facing legal challenges. The agreement should clearly define the cardholder’s responsibilities, the issuing bank’s rights, and the consequences of non-compliance. It’s a vital tool for maintaining a healthy and profitable business.

A comprehensive corporate credit card agreement typically includes several key components. These include:

Effective communication is paramount when drafting a corporate credit card agreement. Using clear, concise, and unambiguous language is crucial to avoid misunderstandings and potential disputes. Jargon and overly complex sentences can create confusion and increase the risk of legal challenges. It’s always advisable to consult with legal counsel to ensure the agreement is properly drafted and reflects the specific needs of the business. Furthermore, consider using plain language – avoid technical terms that the average business owner may not understand. A well-written agreement demonstrates professionalism and builds trust with the card issuer.

A strong corporate credit card agreement isn’t just about protecting the business; it’s about mitigating risk. Here are some key strategies for minimizing potential liabilities:

Creating and managing corporate credit card agreements can present several challenges. Here are some common issues businesses face:

To ensure the effectiveness of your corporate credit card agreement, consider these best practices:

A well-crafted corporate credit card agreement is an indispensable tool for businesses seeking to manage their finances effectively and minimize risk. It’s a legally binding contract that protects both the business and its card provider. By understanding the key components, implementing best practices, and seeking professional guidance, businesses can ensure they have a robust agreement in place that supports their financial goals. The Corporate Credit Card Agreement Template is a starting point, but it’s crucial to tailor the agreement to the specific needs and circumstances of each business. Ultimately, a thoughtfully designed agreement fosters trust, promotes responsible credit card usage, and contributes to long-term financial success. Investing in a solid agreement is an investment in the future of your business.