Are you struggling to keep track of your spending? Do you find yourself constantly wondering where your money is going? A daily expense report can be a powerful tool for gaining control of your finances and achieving your financial goals. This comprehensive guide will walk you through creating a robust daily expense report template, helping you understand your spending habits and make informed decisions about your budget. Daily Expense Report Template is more than just a spreadsheet; it’s a proactive step towards financial wellness. It’s a simple, yet effective way to visualize where your money is going, identify areas for potential savings, and ultimately, improve your financial situation. Let’s dive in!

Creating a daily expense report isn’t about meticulously logging every single penny. It’s about establishing a consistent habit of awareness. It’s about recognizing where your money is going, rather than just how much. This awareness is the foundation for effective budgeting and financial planning. Without a clear understanding of your spending patterns, it’s difficult to determine where you can cut back, save more, or invest wisely. A well-maintained daily expense report provides a valuable snapshot of your spending, allowing you to identify trends, pinpoint areas of overspending, and adjust your spending habits accordingly. It’s a proactive approach to managing your money, rather than a reactive one. The benefits extend beyond simple budgeting; it fosters a greater sense of financial control and reduces stress related to money matters.

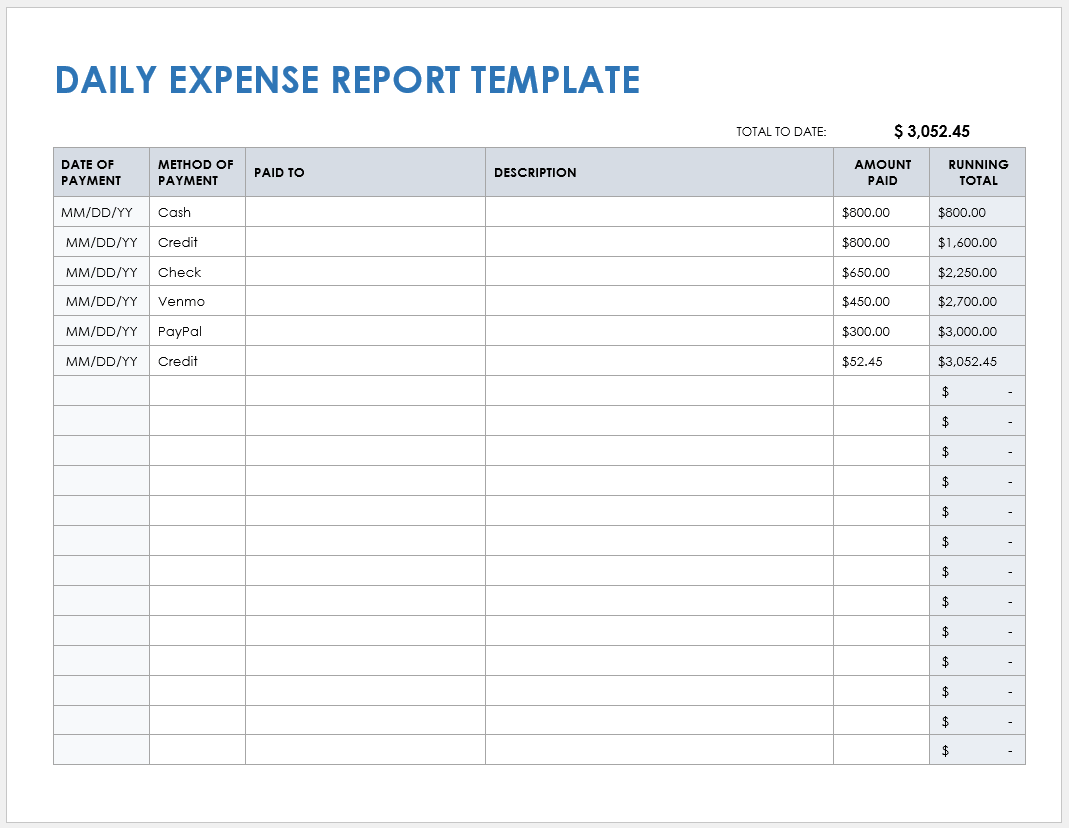

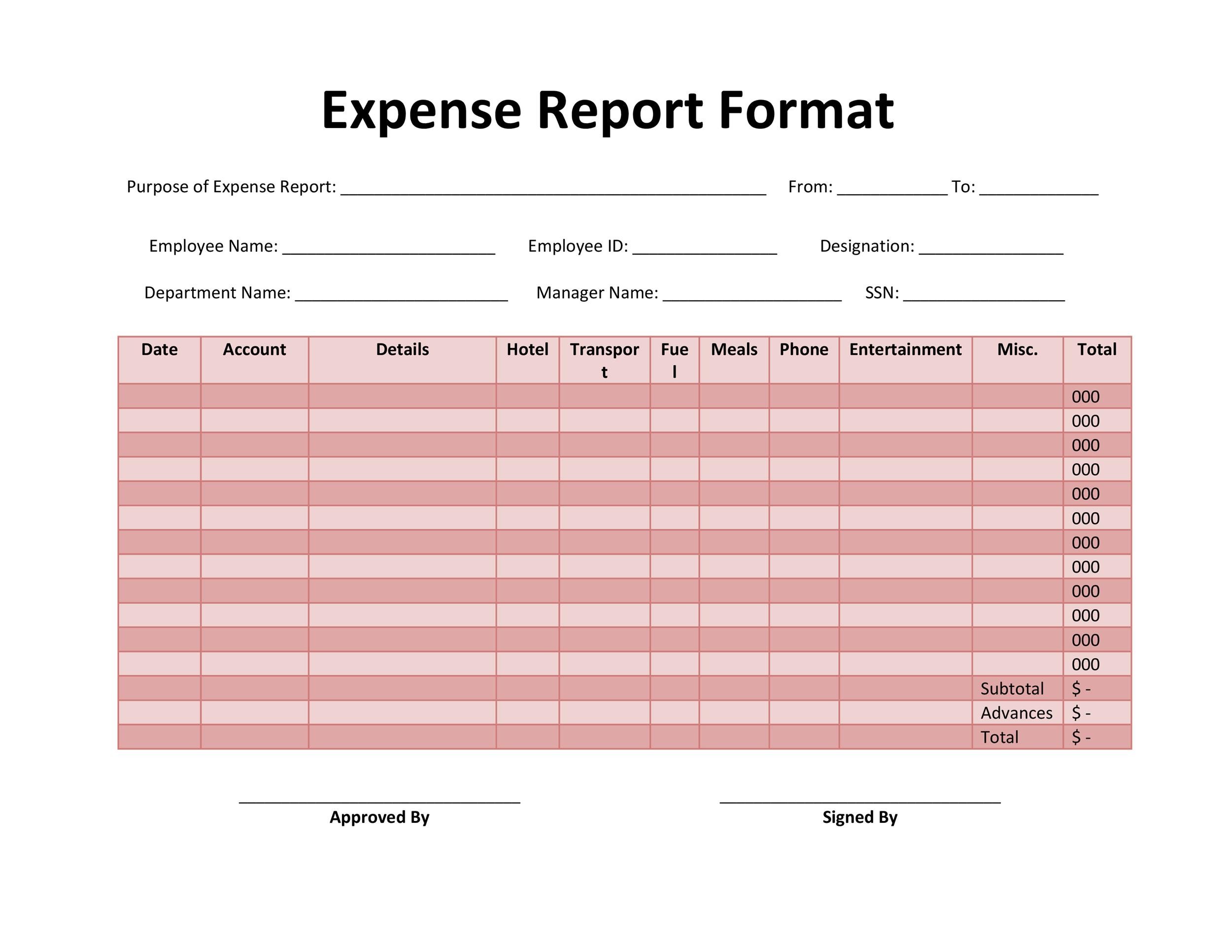

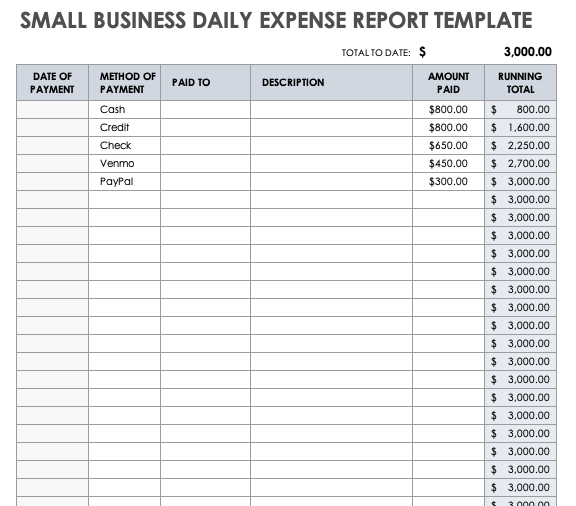

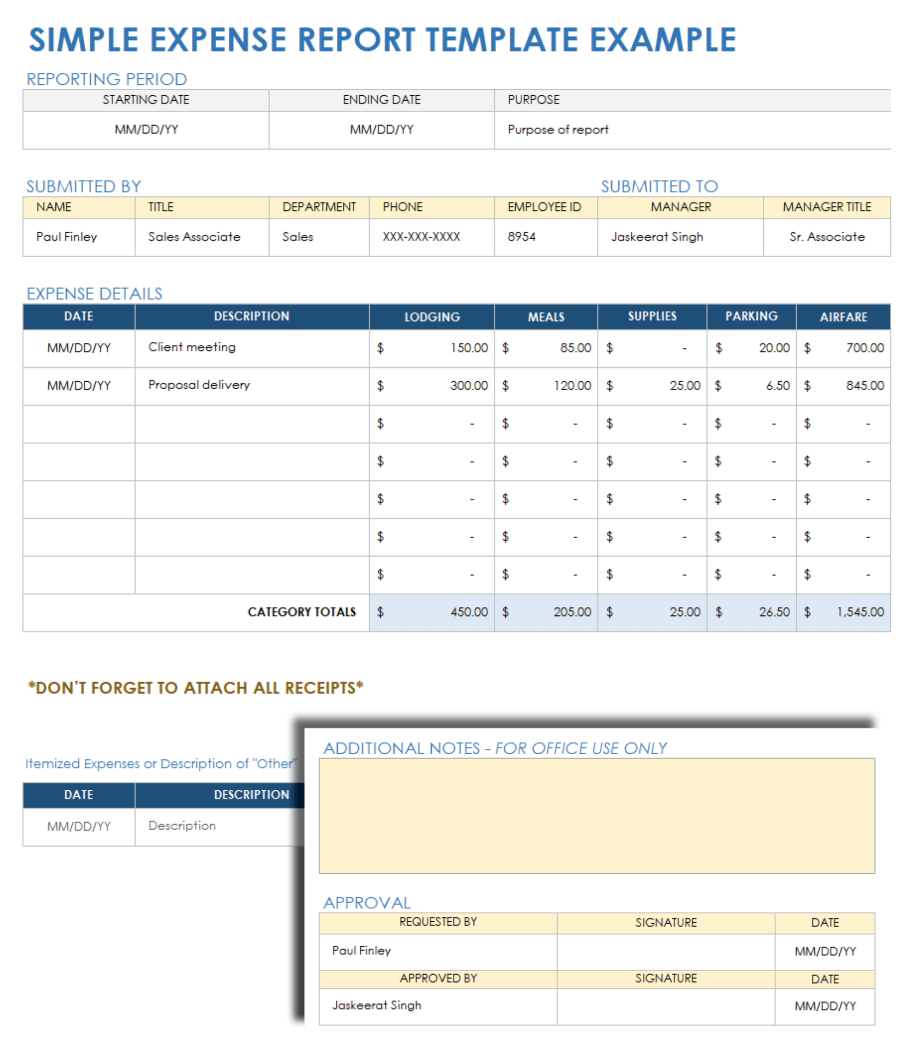

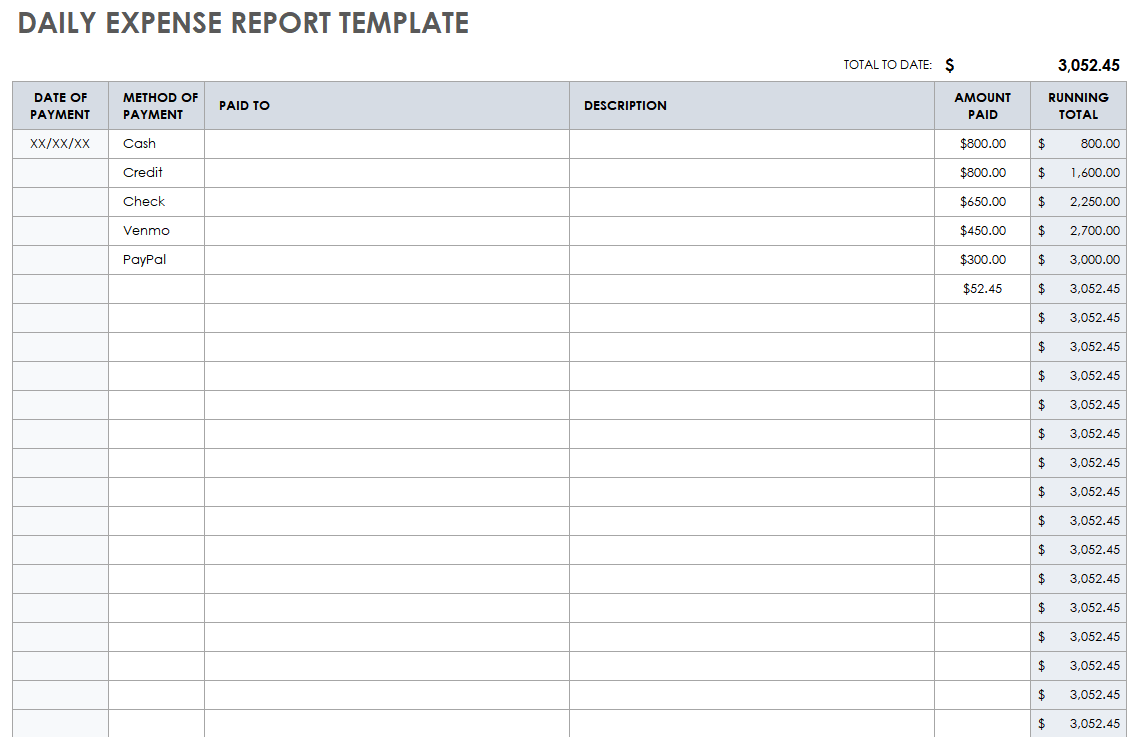

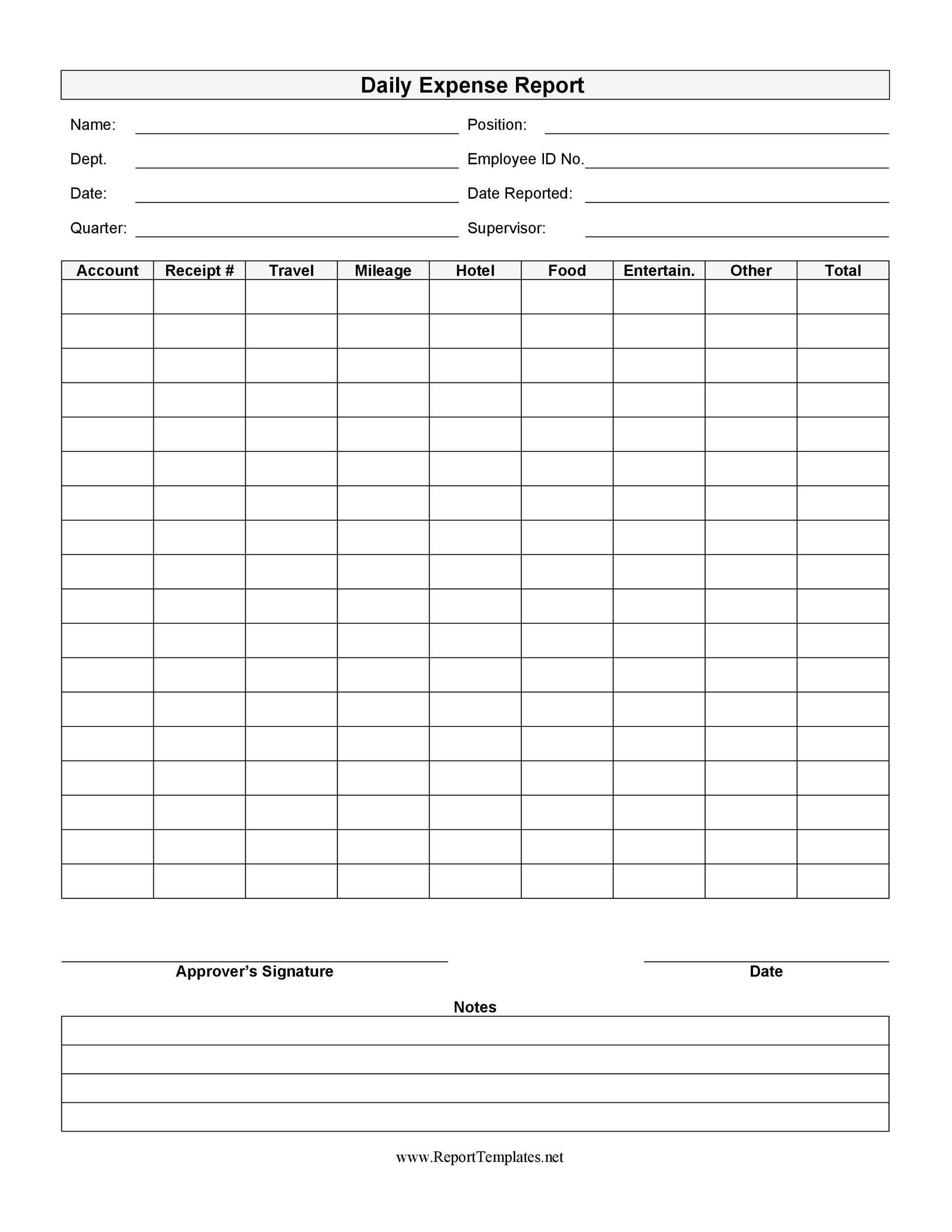

There are numerous ways to structure your daily expense report. The key is to find a system that works for you. Here’s a suggested template, adaptable to your individual needs:

You can use a simple spreadsheet (Google Sheets, Excel) or a dedicated expense tracking app (Mint, YNAB, PocketGuard) to create your report. The important thing is to consistently record your expenses. Start small – don’t try to track everything at once. Focus on capturing your spending habits consistently.

Food and dining are often a significant area for potential savings. Tracking your food expenses allows you to identify whether you’re eating out too frequently or spending too much on groceries.

Tip: Keep a running total of your food expenses for the week to get a better sense of your spending habits.

Transportation costs can vary greatly depending on your location and commuting habits. Tracking these expenses is crucial for understanding your overall budget.

Consider: Are you using public transportation regularly? Are you driving a fuel-efficient vehicle? Are you taking advantage of ride-sharing services?

Entertainment expenses can quickly add up. Tracking these helps you identify areas where you can cut back without sacrificing enjoyment.

![]()

Budgeting Tips: Look for free or low-cost entertainment options. Consider cooking at home more often instead of eating out.

Utilities – electricity, gas, water, and internet – can be a substantial expense. Tracking these helps you identify areas where you can conserve energy and reduce your bills.

![]()

Strategies for Savings: Conserve energy by turning off lights and electronics when not in use. Shop around for the best internet rates.

Shopping and personal care expenses can be surprisingly large. Tracking these helps you identify areas where you can reduce impulse purchases and save money on essential items.

Be mindful of impulse buys: Before making a purchase, ask yourself if you really need it.

Don’t forget about recurring expenses like rent, mortgage, insurance, and subscriptions. Tracking these helps you understand your overall financial obligations.

Creating a daily expense report is more than just a record-keeping exercise; it’s a process of self-discovery. Regularly reviewing your report will reveal patterns in your spending habits. By identifying areas where you’re overspending, you can make informed decisions about your budget and prioritize your financial goals. Daily Expense Report Template provides a framework for this analysis. Look for trends – are you consistently spending more on dining out than you intended? Are you consistently overspending on entertainment? Understanding these patterns is the first step towards taking control of your finances.

Developing and consistently using a daily expense report is a cornerstone of effective personal finance management. It’s a simple yet powerful tool that empowers you to understand your spending, identify areas for improvement, and ultimately, achieve your financial goals. By diligently tracking your expenses, you’ll gain valuable insights into your financial habits and make informed decisions about your money. Remember, consistent tracking is key to long-term success. Don’t be afraid to adjust your template as your needs and circumstances change. The goal is to create a system that works for you. Start today and reap the rewards of greater financial control.

Ultimately, a well-maintained daily expense report is a valuable tool for anyone seeking to improve their financial well-being. It’s a proactive approach to managing your money, fostering awareness, and empowering you to make informed decisions. By consistently tracking your spending, you’ll gain a clearer picture of your financial situation and be better equipped to achieve your financial goals. The process itself is rewarding, providing a sense of accomplishment and control over your finances. Investing time in creating and maintaining a daily expense report is an investment in your future financial security.