California law governs the creation and enforcement of promissory notes, a fundamental document in many business and personal transactions. Understanding these legal requirements is crucial for both individuals and businesses operating within the state. This guide provides a comprehensive overview of what you need to know about creating and utilizing a promissory note in California, including key considerations and best practices. Promissory Note California Template – a well-drafted note protects both parties involved, establishing clear expectations and responsibilities. It’s more than just a simple agreement; it’s a legally binding contract. Navigating the complexities of California promissory note law requires careful attention to detail and adherence to specific requirements. This article aims to equip you with the knowledge necessary to create a legally sound and effective promissory note.

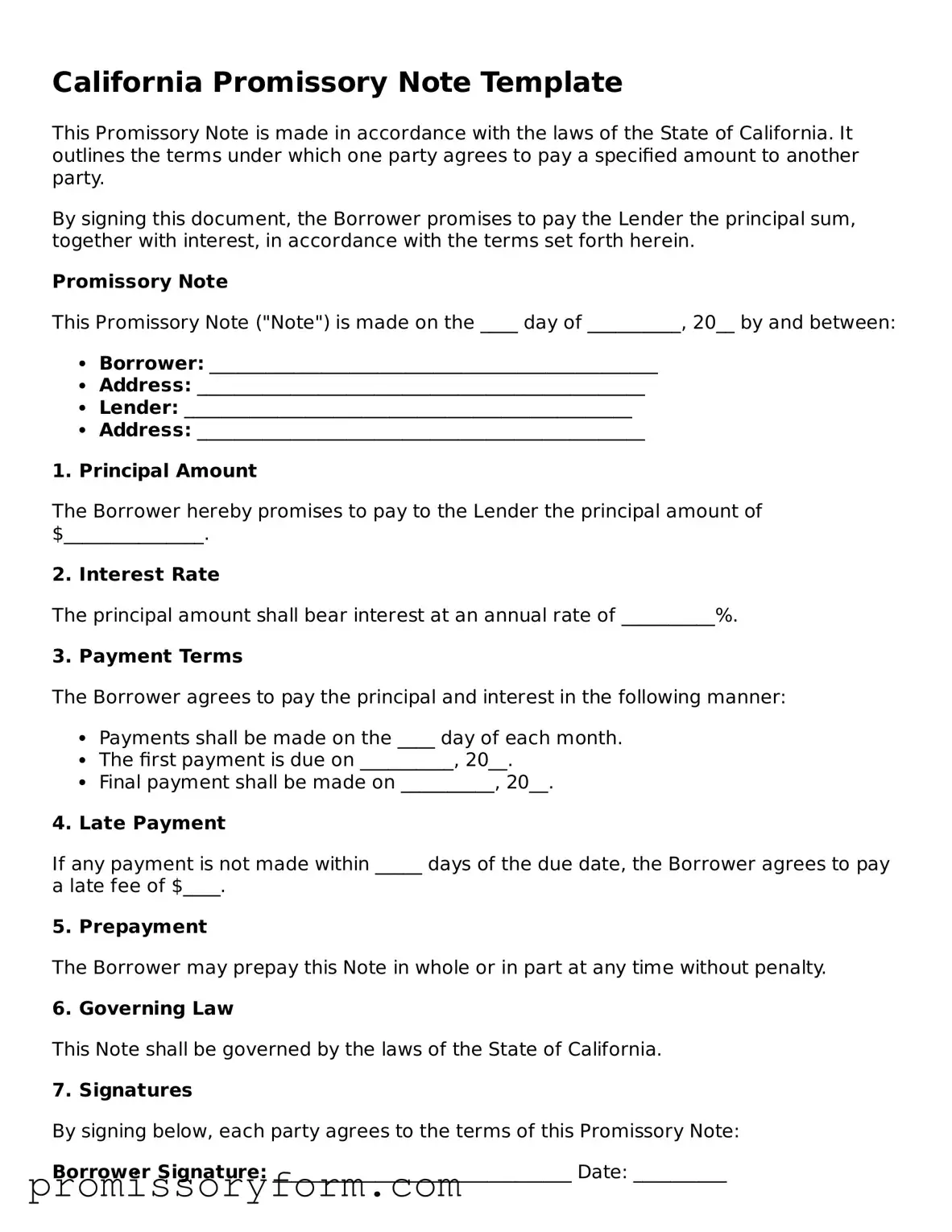

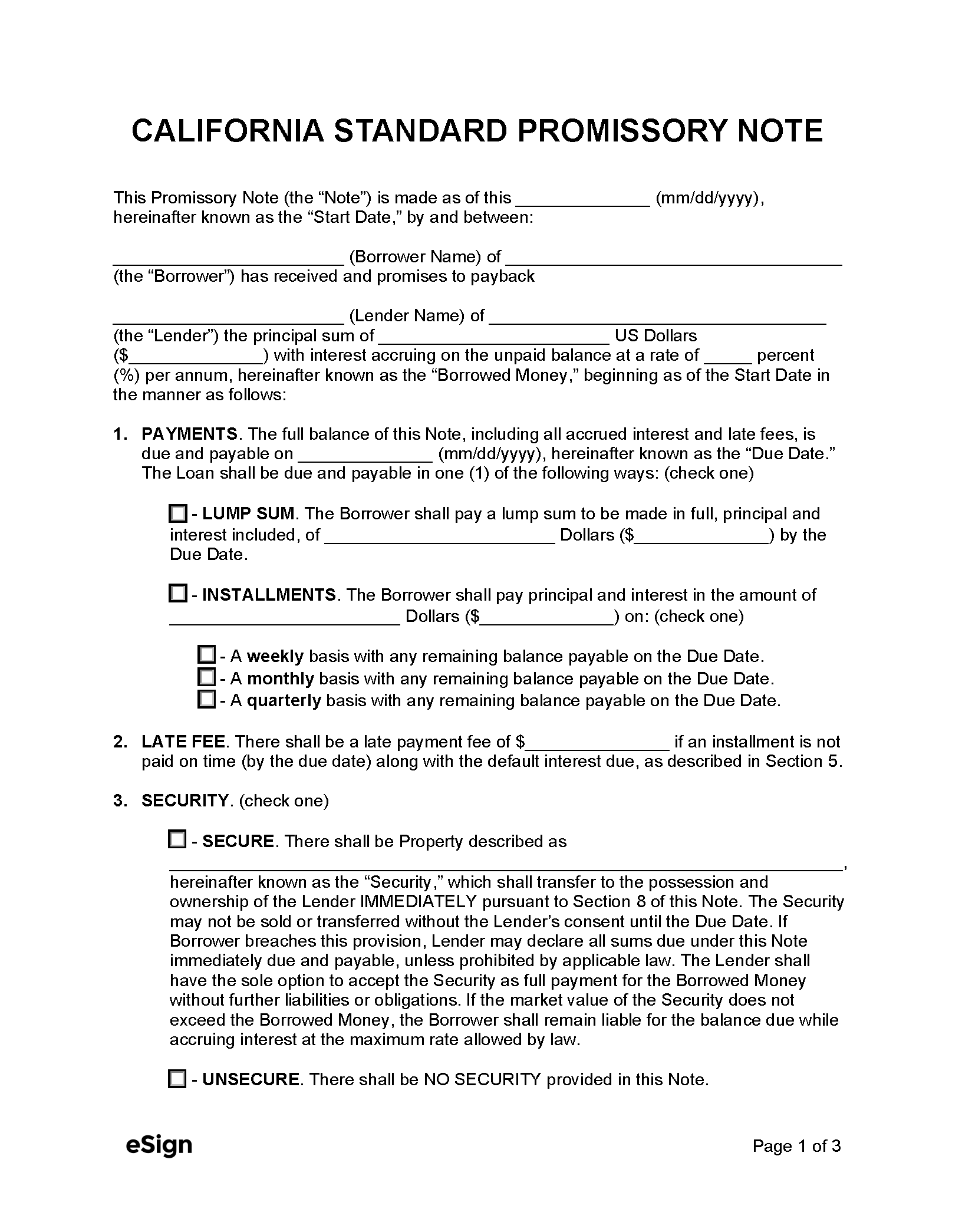

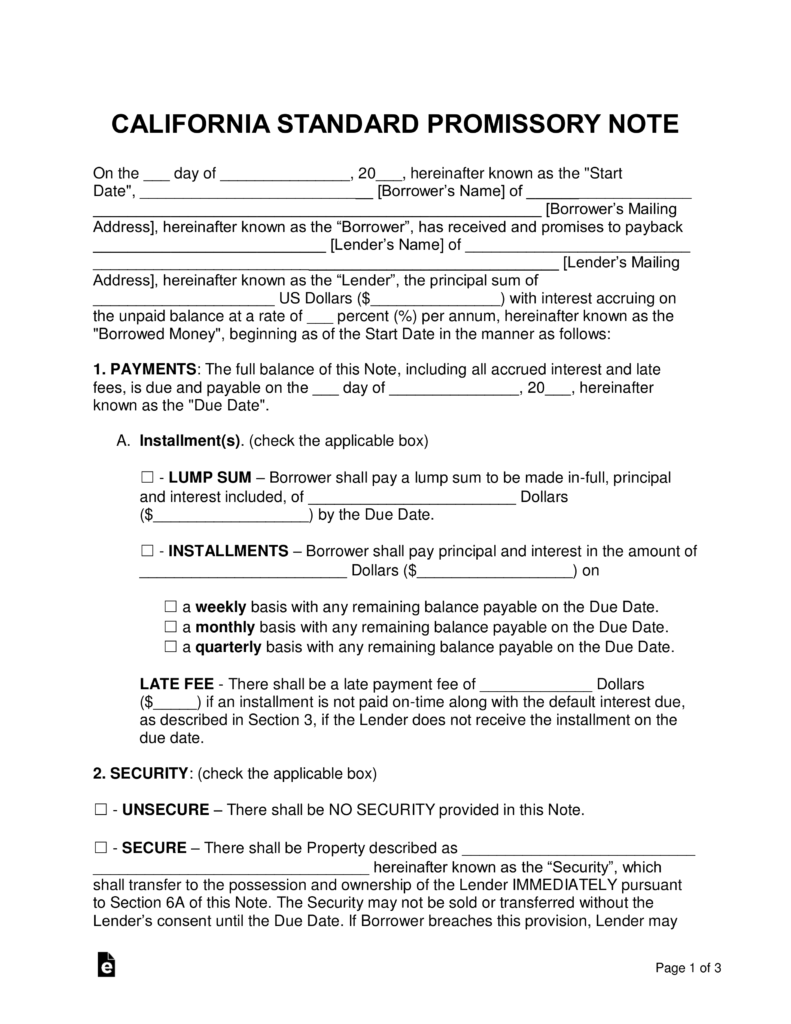

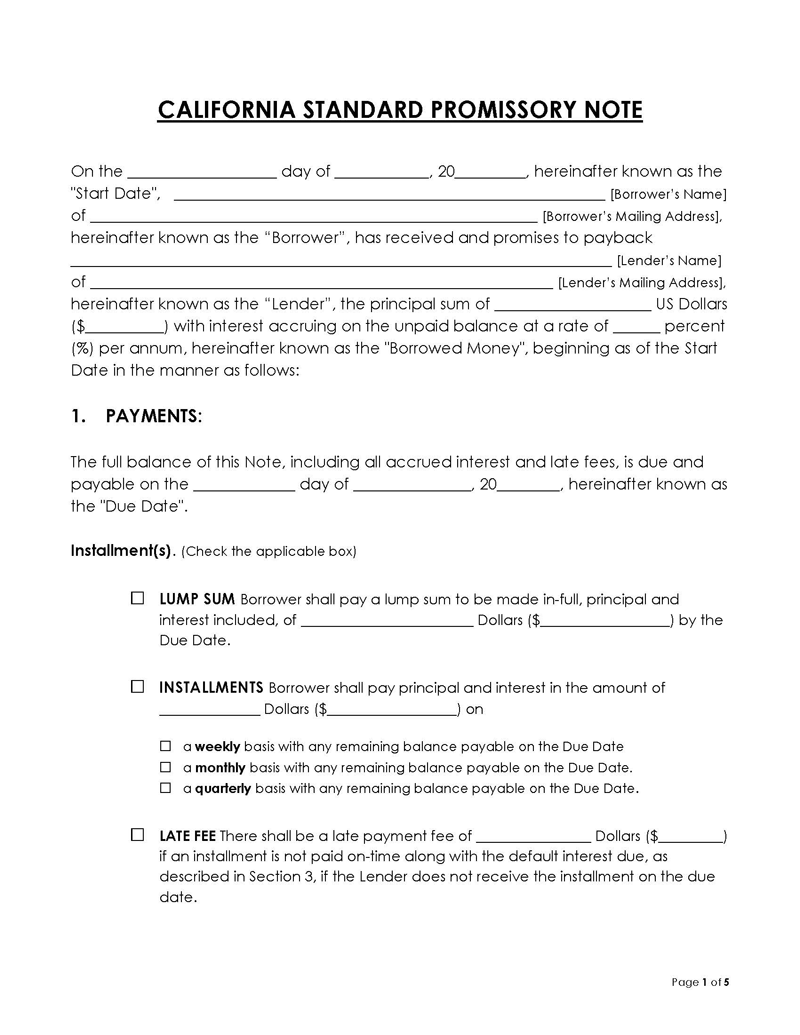

A promissory note is a written agreement where one party (the maker or promisor) promises to pay a sum of money to another party (the payee) on a specific date or on demand. It’s a cornerstone of many financial agreements, ranging from simple loans to larger investments. The core elements of a valid promissory note are:

Let’s break down the process of creating a promissory note in California. It’s essential to consult with an attorney to ensure the note complies with all applicable laws and regulations.

Determine the Purpose: Clearly define the reason for the promissory note. Is it for a loan, a gift, or something else? This will influence the terms and conditions.

Identify the Parties: Clearly state the full legal names and addresses of both the maker and payee. Ensure you have proper identification for both parties.

Specify the Amount: Precisely state the principal amount of the note. It’s wise to include a disclaimer stating that the amount is subject to change.

Establish Interest (if applicable): If the note carries interest, specify the rate of interest, the payment frequency (e.g., monthly, quarterly), and the due date for each payment. California law allows for various interest rates, so it’s crucial to understand the applicable rules.

Define Payment Terms: Detail how and when the principal and interest will be repaid. Consider specifying the method of payment (e.g., check, electronic transfer).

Include Default Provisions: This is a critical section. Clearly state what happens if the payee fails to make payments as agreed. Options include:

Governing Law: Specify the state law that will govern the promissory note. California law is generally the most relevant.

Several factors are particularly important when drafting a promissory note in California:

Statute of Limitations: California has a statute of limitations for debt collection, meaning there’s a time limit within which a creditor can initiate legal action to recover a debt. Understanding this is vital to avoid potential legal challenges.

Debt Validation: California law provides for debt validation, allowing a creditor to request documentation proving the existence of a debt. This is crucial for protecting against potential disputes.

Writing Requirement: California law requires that promissory notes be in writing to be enforceable. Oral agreements are generally not sufficient.

Tax Implications: The tax treatment of promissory notes can vary depending on the specific circumstances. Consult with a tax professional to understand the implications.

Disclosure Requirements: California requires certain disclosures to be included in a promissory note, particularly regarding the borrower’s financial situation.

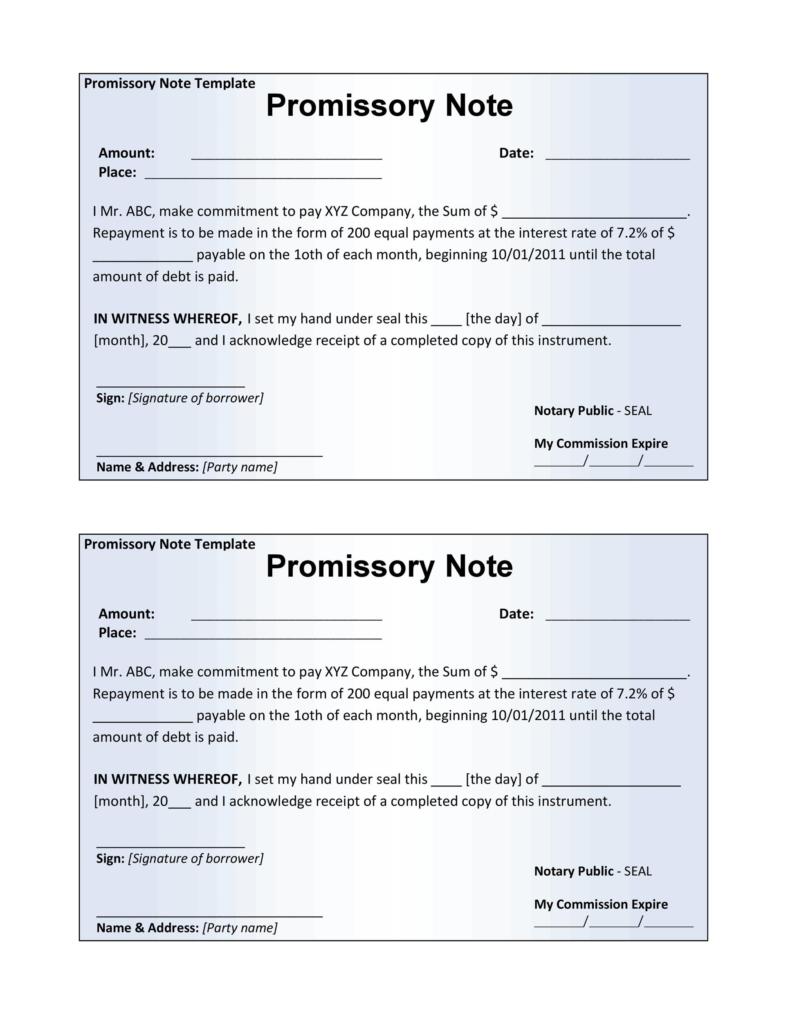

Here’s a simplified example of a promissory note, illustrating key elements. This is for illustrative purposes only and should not be used without consulting with an attorney.

This promissory note is made as of [Date] by and for [Maker’s Full Legal Name], residing at [Maker’s Address], and in favor of [Payee’s Full Legal Name], residing at [Payee’s Address].

Principal Amount: $10,000.00

Interest Rate: 6% per annum, payable monthly.

Payment Schedule: The principal and interest shall be paid monthly, commencing on [Start Date] and continuing until fully paid, or default occurs.

Default Provisions: If the Payee fails to make any payment according to the payment schedule, the Maker shall have the right to accelerate the debt, demanding immediate payment of the entire principal amount. The Maker may also pursue legal action to recover the debt, including filing a lawsuit in the Superior Court of [County Name] County, California.

Governing Law: California law shall govern this note.

[Maker’s Signature]

[Payee’s Signature]

Creating a robust and legally sound promissory note is a critical step in managing financial relationships. By understanding the key elements, considerations, and California law, you can ensure that your note is valid, enforceable, and protects your interests. Promissory Note California Template – a well-crafted note provides a foundation for clear and reliable financial transactions. Remember to always seek professional legal advice before finalizing any agreement. Consulting with an attorney specializing in California contract law is highly recommended to ensure compliance with all applicable regulations and to protect your rights.