Effectively managing cash flow is the lifeblood of any successful business, yet it remains one of the most significant challenges entrepreneurs and managers face. A critical component of this is tracking the money owed to you by your customers. Without a systematic way to monitor these incoming funds, a company can quickly find itself with a healthy-looking profit and loss statement but an empty bank account. This is where a well-structured Accounts Receivable Report Template becomes an indispensable tool, providing a clear, at-a-glance overview of your financial health and helping you proactively manage customer payments.

The reality of business-to-business transactions can be sobering. A recent study by Atradius revealed a startling statistic: in 2023, a staggering 56% of B2B invoices in the United States were paid late. These delays aren’t just minor inconveniences; they can create a domino effect that cripples a company’s ability to pay its own bills, invest in growth, and meet payroll. Accounts receivable (A/R) represents the money that customers owe you for goods or services they have received but not yet paid for. It is a current asset on your balance sheet, but until that cash is in your bank account, it’s just a number on a page.

Failing to manage this crucial asset is a high-stakes game. According to a landmark study by U.S. Bank, an overwhelming 82% of small business failures are directly attributable to poor cash flow management. This highlights a critical truth: it’s not a lack of sales that sinks most businesses, but a lack of liquidity. By implementing a robust system for tracking and analyzing accounts receivable, you can transform this potential liability into a predictable and reliable source of cash, ensuring your company has the fuel it needs to operate and thrive. This guide will walk you through everything you need to know about creating and using an A/R report to secure your company’s financial future.

At its core, an accounts receivable report is a financial document that lists all the money customers owe to your business. It serves as a detailed ledger of outstanding invoices, providing a snapshot of the short-term assets you are waiting to collect. The primary purpose of this report is to help you track who owes you money, how much they owe, and for how long the payment has been outstanding.

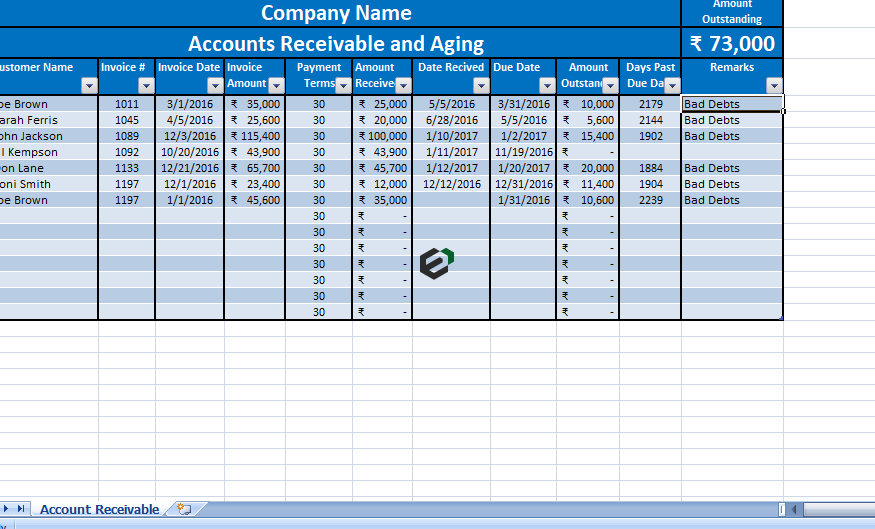

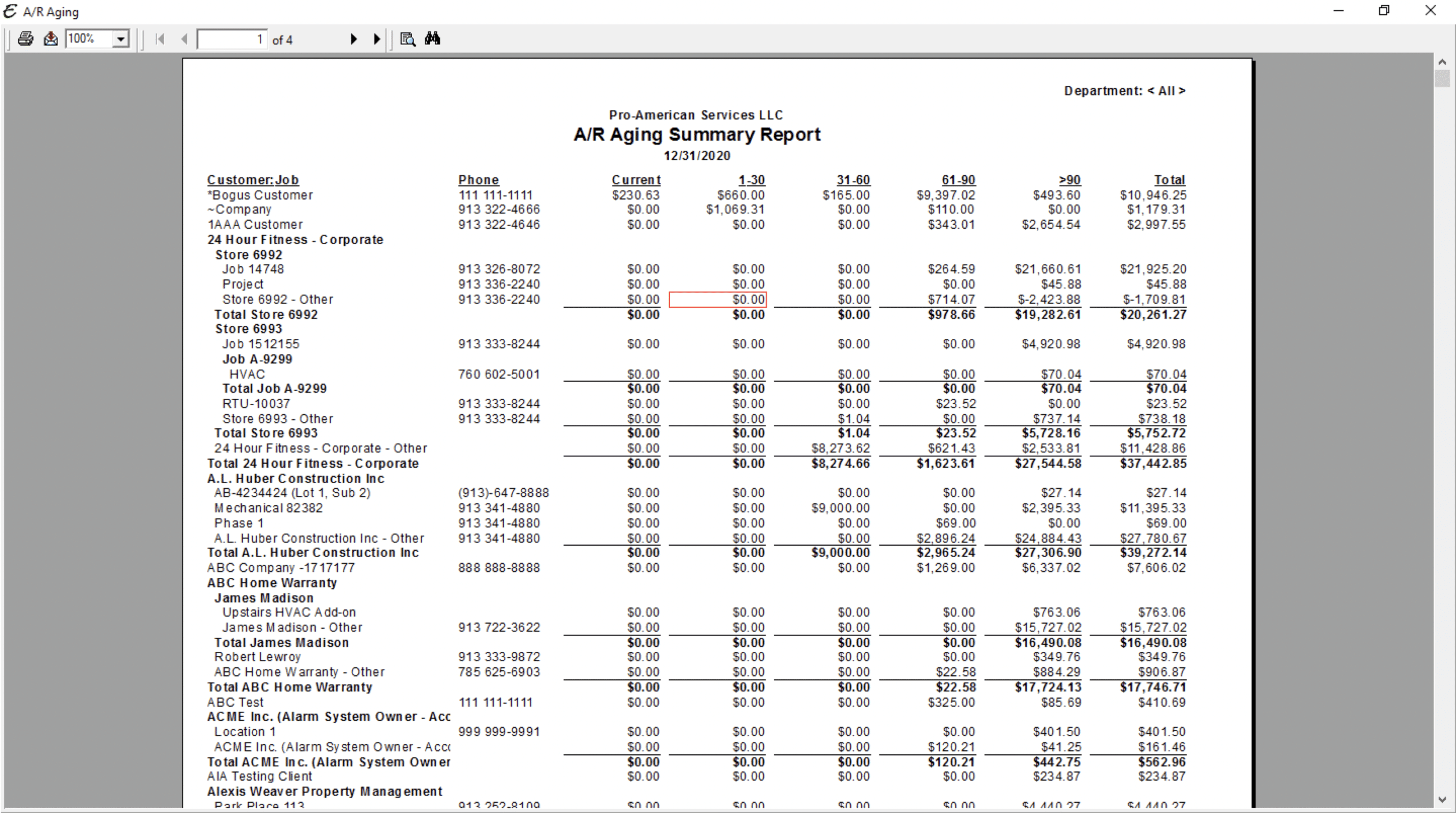

The most common and effective type of A/R report is the accounts receivable aging report. This report categorizes outstanding invoices into different “buckets” based on their age, or the number of days they are past their due date. This “aging” process is what makes the report so powerful. It provides a clear and immediate visual representation of the health of your receivables. As renowned CPA and financial consultant Dr. Elena Vance states, “An accounts receivable aging report is the single most critical tool for managing a company’s cash flow. It’s not just a report; it’s a roadmap to financial health.”

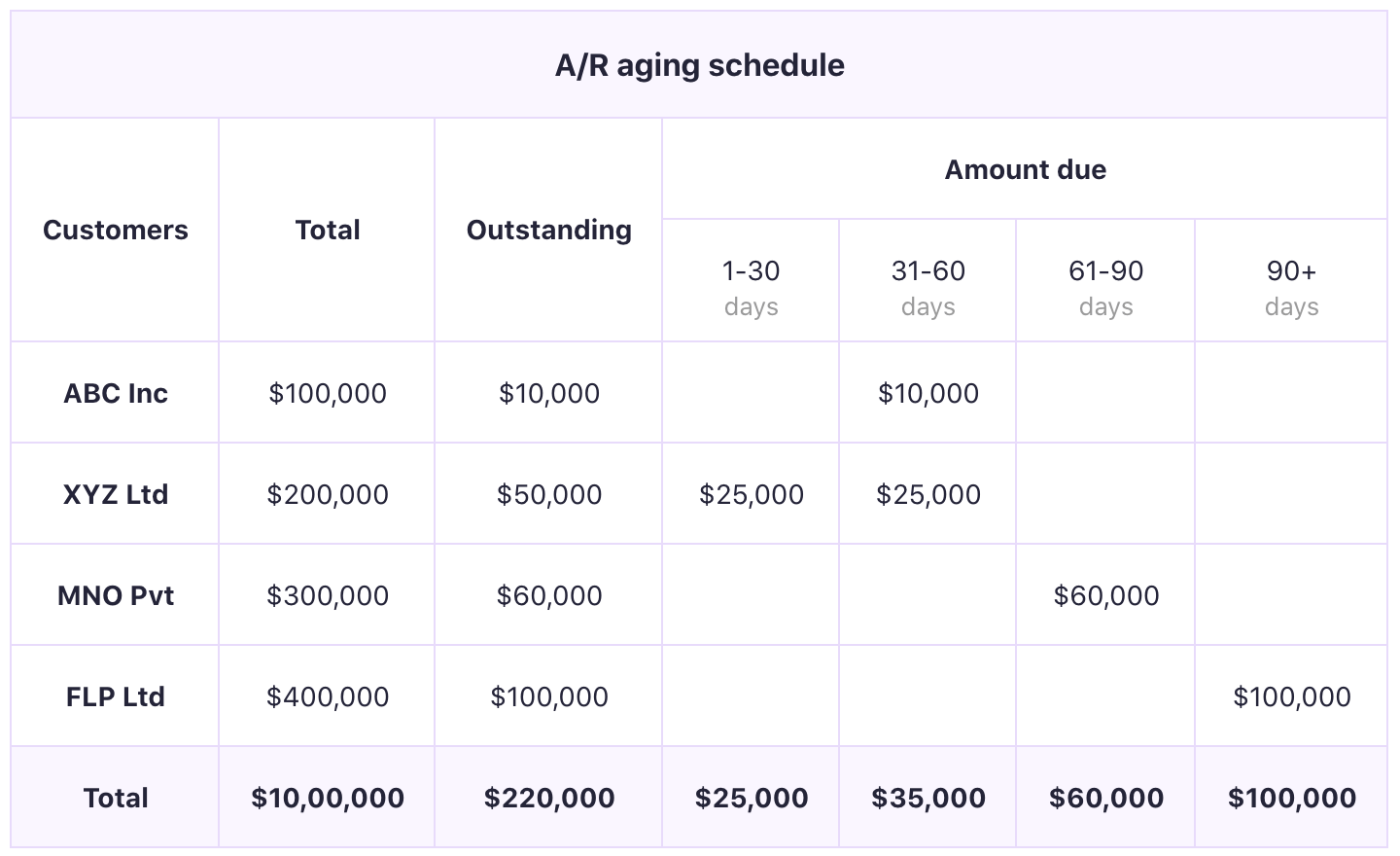

A typical A/R aging report organizes invoices into columns, such as:

* Current: Invoices that are not yet due (typically within 0-30 days of the invoice date).

* 1-30 Days Past Due: Invoices that are 1 to 30 days late.

* 31-60 Days Past Due: Invoices that are 31 to 60 days late.

* 61-90 Days Past Due: Invoices that are 61 to 90 days late.

* 91+ Days Past Due: Invoices that are more than 90 days late.

By looking at this report, you can instantly identify which customers are paying on time and, more importantly, which ones are falling behind. The further an invoice moves to the right across these columns, the higher the risk of non-payment, signaling an urgent need for collection efforts.

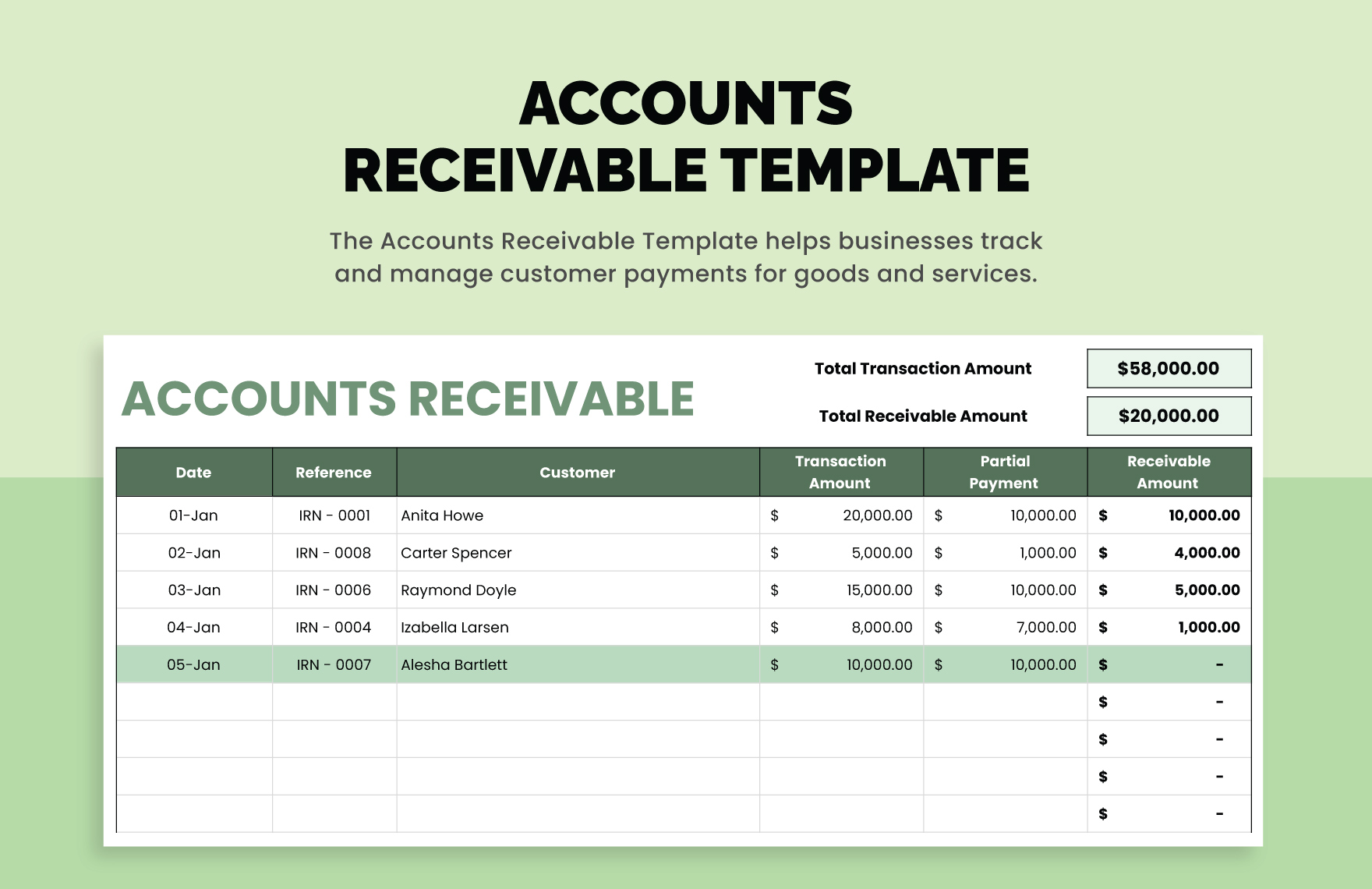

Using a standardized template for your A/R reporting isn’t just about good bookkeeping; it’s a strategic business practice that delivers tangible benefits. It provides structure and consistency, turning a complex set of data into actionable intelligence that can directly impact your bottom line.

The primary benefit of a consistent A/R report is improved cash flow visibility. The report allows you to forecast incoming cash with much greater accuracy. By understanding payment patterns and the status of outstanding invoices, you can better predict when money will arrive, enabling you to plan for expenses, investments, and payroll with confidence. This proactive approach is a direct defense against the cash flow issues that, as the U.S. Bank study found, are fatal to so many businesses.

An aging report immediately flags problem accounts. When you see a customer’s invoices consistently slipping into the 31-60 or 61-90 day columns, you know there’s an issue that needs to be addressed. This allows you to prioritize your collection efforts, focusing your time and resources on the oldest and largest outstanding balances first. Without this clear overview, problematic invoices can easily get lost in the shuffle until it’s too late to collect.

The data from your A/R reports is a goldmine for strategic decision-making. Are certain customers chronically late payers? Perhaps it’s time to revise their credit terms or move them to a cash-on-delivery (COD) basis. Is your overall collection time increasing? This could indicate a need to tighten your credit policies or implement a more aggressive collections strategy. This information helps you make informed choices that protect your company’s financial health.

Creating a report from scratch every week or month is time-consuming and prone to errors. An accounts receivable report template ensures that the process is fast, repeatable, and consistent. Everyone on your finance or management team will be looking at the same format, making communication and analysis seamless. This efficiency pays off; data shows that companies using a standardized A/R reporting template see an average reduction in their Days Sales Outstanding (DSO) by a remarkable 15-20% within the first six months.

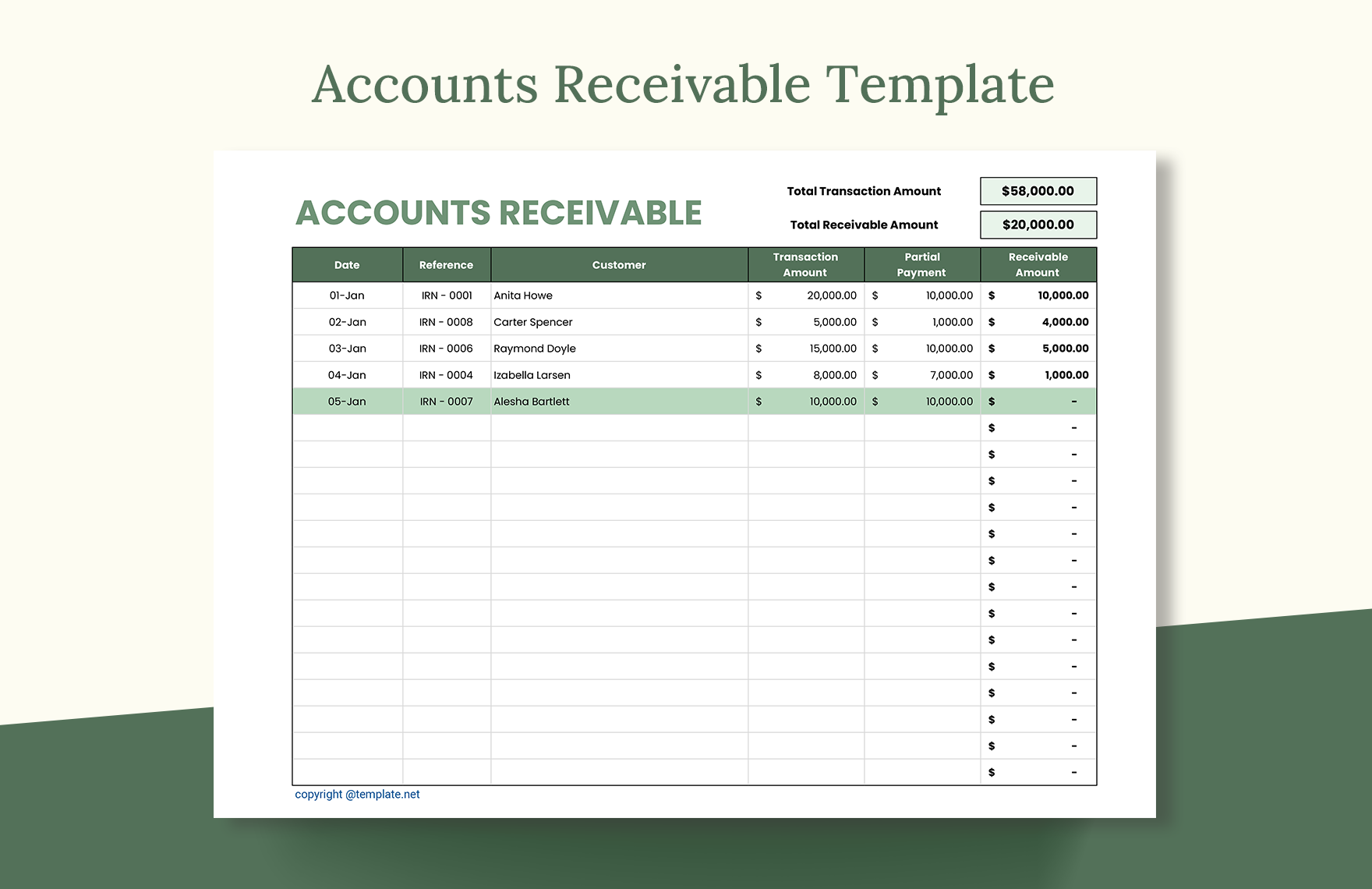

To be truly effective, your A/R report template must contain several key pieces of information. A well-designed template is clear, comprehensive, and easy to understand at a glance.

This section identifies who owes you money. At a minimum, each entry should include:

* Customer Name: The legal name of the business or individual.

* Customer ID (Optional): A unique identifier from your accounting or CRM system.

* Contact Information: A name, phone number, or email for the primary accounts payable contact.

This is the core data for each outstanding payment. For every invoice, you should track:

* Invoice Number: The unique reference number for the specific invoice.

* Invoice Date: The date the invoice was issued.

* Due Date: The date the payment is expected.

* Original Invoice Amount: The total value of the invoice when it was created.

* Outstanding Balance: The amount that remains unpaid. This is crucial for tracking partial payments.

This is the heart of the aging report. It consists of several columns that categorize the outstanding balance based on how many days it is past due. The standard buckets are:

* Current (0-30 Days): For invoices within their payment terms.

* 31-60 Days: For invoices that are moderately late.

* 61-90 Days: For invoices that are significantly late and require attention.

* 91+ Days: For invoices that are critically overdue and pose a high risk of becoming bad debt.

Your template should automatically calculate totals at the bottom of the report. This provides a high-level summary and includes:

* Total A/R Balance: The sum of all outstanding balances.

* Total for Each Aging Bucket: The sum of all balances within each aging category (e.g., total amount 31-60 days past due).

* Percentage of Total A/R: This shows what portion of your total receivables falls into each aging bucket, which is excellent for spotting trends over time.

Putting your template into practice involves a clear, repeatable process. Following these steps will ensure you get the maximum value from your reporting.

You have several options for creating your template.

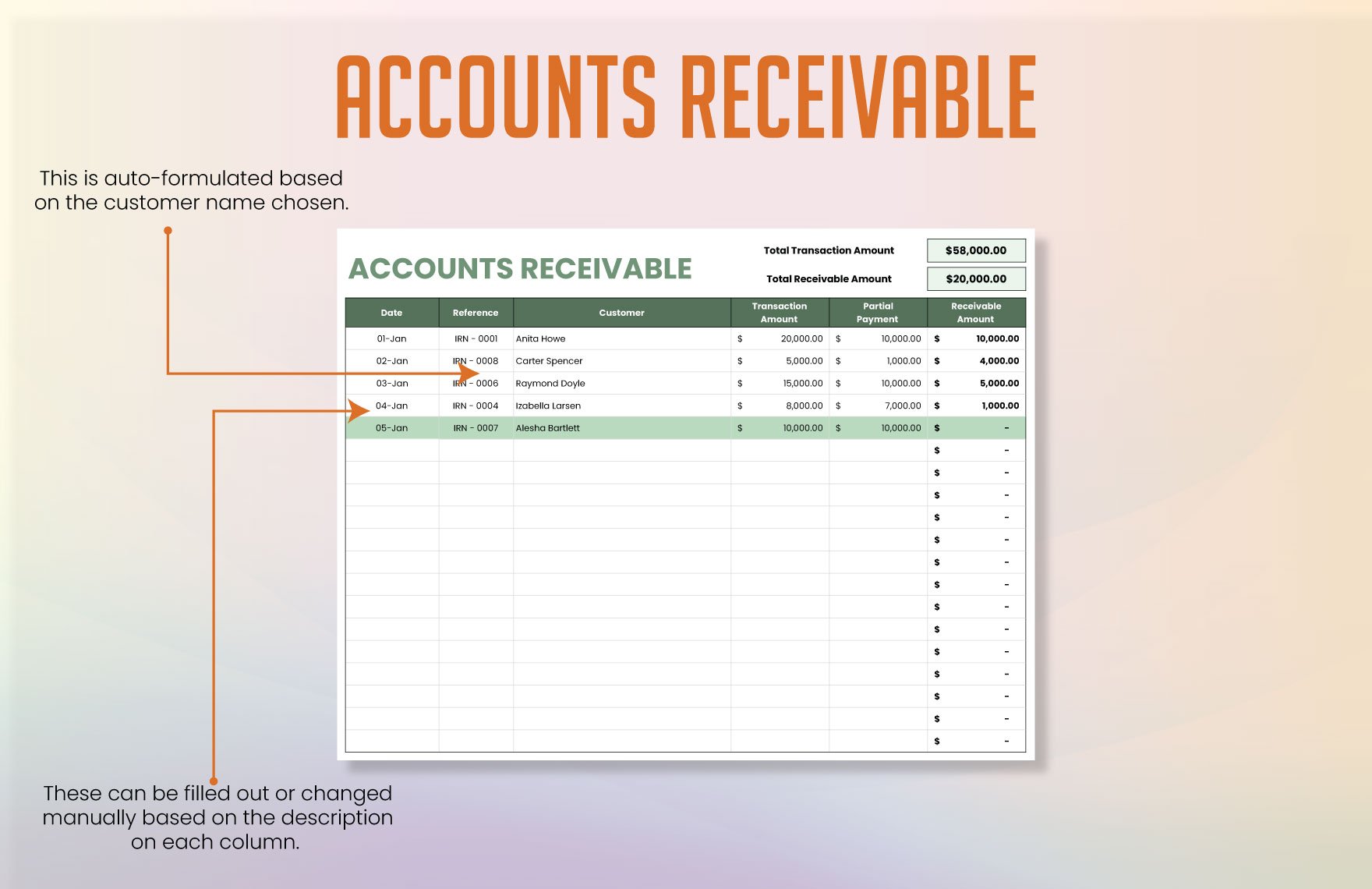

* Spreadsheets (Excel/Google Sheets): These are highly flexible and customizable. You can build a template from scratch that perfectly fits your needs, using formulas to automate calculations for aging and totals. This is an excellent starting point for small to medium-sized businesses.

* Accounting Software (QuickBooks, Xero, NetSuite): Most modern accounting platforms can automatically generate A/R aging reports. While they may be less customizable than a spreadsheet, they offer the huge advantage of pulling real-time data directly from your invoicing and payment records, eliminating manual data entry. A custom spreadsheet template can still be valuable for deeper, more tailored analysis alongside your software’s standard reports.

Gather all your outstanding invoices and enter the required information into your template: customer name, invoice number, date, due date, and amount. Accuracy is paramount. A single error in an invoice date or amount can throw off your entire report. If you’re using a spreadsheet, you may be able to export a list of open invoices from your accounting system to streamline this process.

Once the data is in, it’s time for analysis. Look for red flags:

* Large balances in older buckets: A significant amount of money in the 61-90 or 91+ day columns requires immediate action.

* Chronically late customers: Identify customers who consistently appear in the past-due columns.

* Disputed invoices: Note any invoices that a customer has questioned, as these may require special attention to resolve.

Based on this analysis, develop a prioritized collections strategy. For example, you might decide that all invoices over $1,000 in the 61-90 day bucket receive a personal phone call this week.

A report is useless if you don’t act on it. Use the insights to drive your collection activities. This includes sending reminder emails, making phone calls, and, if necessary, pausing services or future credit for non-paying clients. It’s also crucial to update the report regularly—ideally on a weekly basis. This keeps the information current and allows you to track the effectiveness of your collection efforts.

Once you have mastered the basic aging report, you can incorporate more advanced metrics to gain even deeper insight into your financial performance.

DSO measures the average number of days it takes for your company to collect payment after a sale is made. A lower DSO is better, as it means you are converting your sales into cash more quickly.

Formula: DSO = (Total Accounts Receivable / Total Credit Sales) * Number of Days in Period

Tracking your DSO month-over-month helps you see whether your collection efforts are improving. As mentioned, implementing a template is a proven way to drive this number down.

This ratio measures how efficiently you are collecting your receivables. It indicates how many times per period (e.g., a year) your company collects its average A/R balance. A higher ratio is a sign of efficiency.

Formula: A/R Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A low or declining ratio could signal issues with your credit policies or a weakness in your collections process.

For growing businesses, manually updating a spreadsheet can become cumbersome. This is where automation becomes a game-changer. Modern accounting software and specialized A/R automation platforms can handle the entire process for you.

These systems integrate directly with your invoicing platform to provide real-time A/R aging reports without any manual data entry. They can also automate the collections process by sending out customized payment reminders based on rules you define (e.g., a friendly email at 7 days past due, a more direct one at 30 days). Automation reduces human error, saves countless hours of administrative work, and ensures your collections process is consistent and relentless. While a manual accounts receivable report template is a powerful and essential starting point, viewing automation as the next logical step can help your business scale efficiently.

Mastering accounts receivable is not just an accounting function; it is a fundamental pillar of business survival and growth. In an economic climate where late payments are common, leaving cash flow to chance is a risk you cannot afford to take. The accounts receivable report template is your primary weapon in this fight, providing the clarity, structure, and insight needed to take control of your finances.

By consistently tracking who owes you money and for how long, you can transform your receivables from a source of stress into a predictable and reliable stream of cash. This powerful tool enables you to identify potential problems before they escalate, make smarter decisions about credit and collections, and ultimately fortify your company’s financial foundation. Whether you start with a simple spreadsheet or leverage the power of accounting software, implementing a disciplined A/R reporting process is one of the most impactful steps you can take to ensure your business’s long-term health and success.