When a customer returns a product, or you’ve made an error on an invoice, a simple apology isn’t enough. You need a formal way to document the adjustment, and that’s where a credit note comes in. It’s a crucial document for maintaining accurate financial records and good customer relationships. Finding the right tool to create these efficiently is key, and many businesses turn to a Credit Note Template Doc to streamline the process. This article will delve into everything you need to know about credit notes, from their purpose and legal requirements to where to find and how to use a suitable template.

Credit notes aren’t just about fixing mistakes; they’re about building trust. They demonstrate to your customers that you value their business and are willing to rectify any issues promptly and professionally. Ignoring errors or making the correction process difficult can lead to lost customers and a damaged reputation. A well-issued credit note provides a clear record of the adjustment, preventing disputes and ensuring transparency.

Understanding the difference between a credit note and an invoice is also vital. An invoice requests payment, while a credit note reduces the amount owed. Think of it as a negative invoice. Both documents share similar elements, but their purpose and impact on your accounting are fundamentally different. Properly managing both is essential for healthy cash flow and accurate financial reporting.

Finally, choosing the right format for your credit notes is important. While you can create them from scratch, using a pre-designed template saves time and ensures you include all the necessary information. This is where a downloadable document, like a Credit Note Template Doc, becomes incredibly valuable.

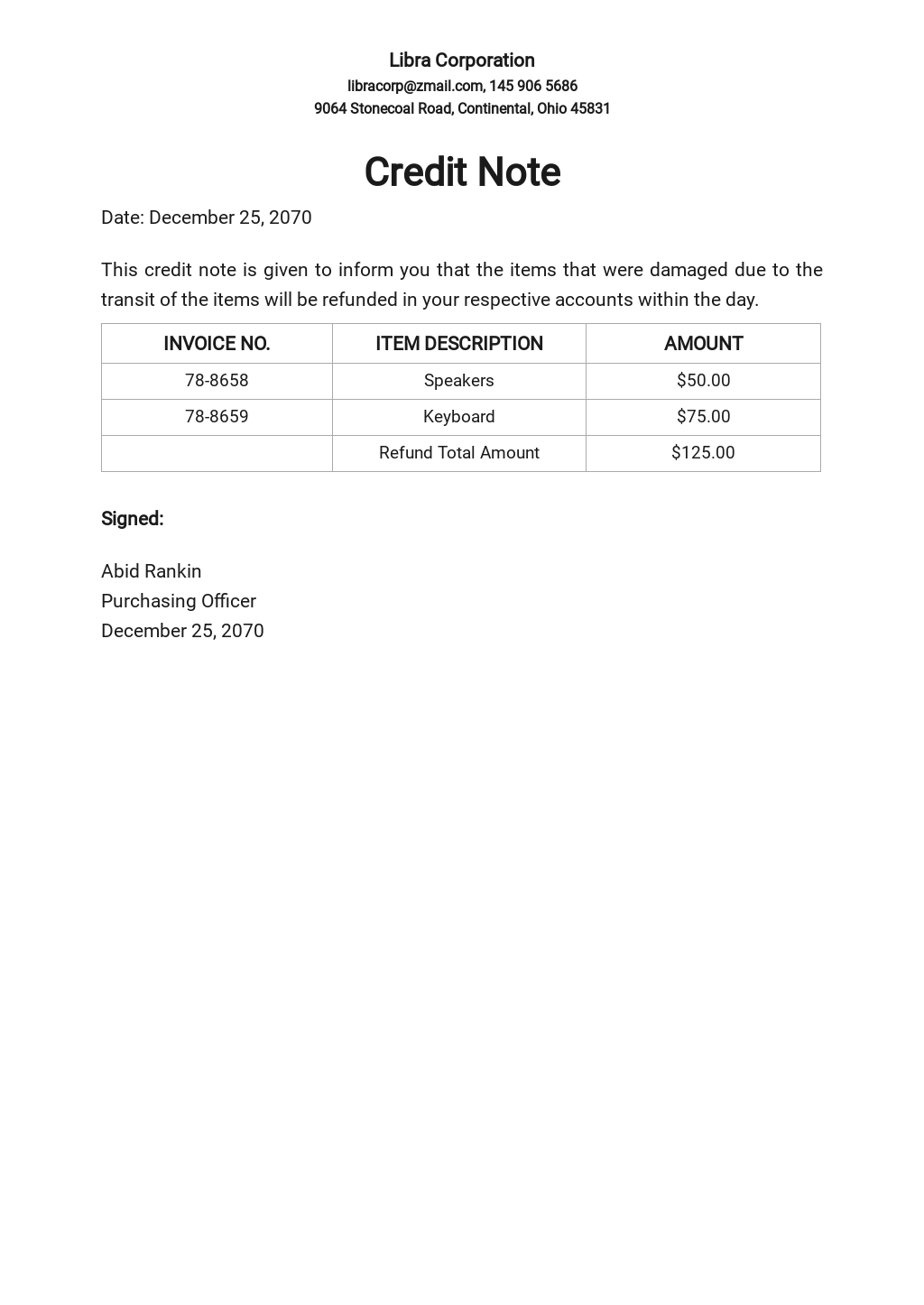

A credit note, sometimes called a credit memo, is a document issued by a seller to a buyer, reducing the amount the buyer owes. It’s essentially a refund offered after an invoice has already been issued. Several situations might necessitate issuing a credit note. These include:

Creating credit notes from scratch each time can be time-consuming and prone to errors. A Credit Note Template Doc offers several advantages:

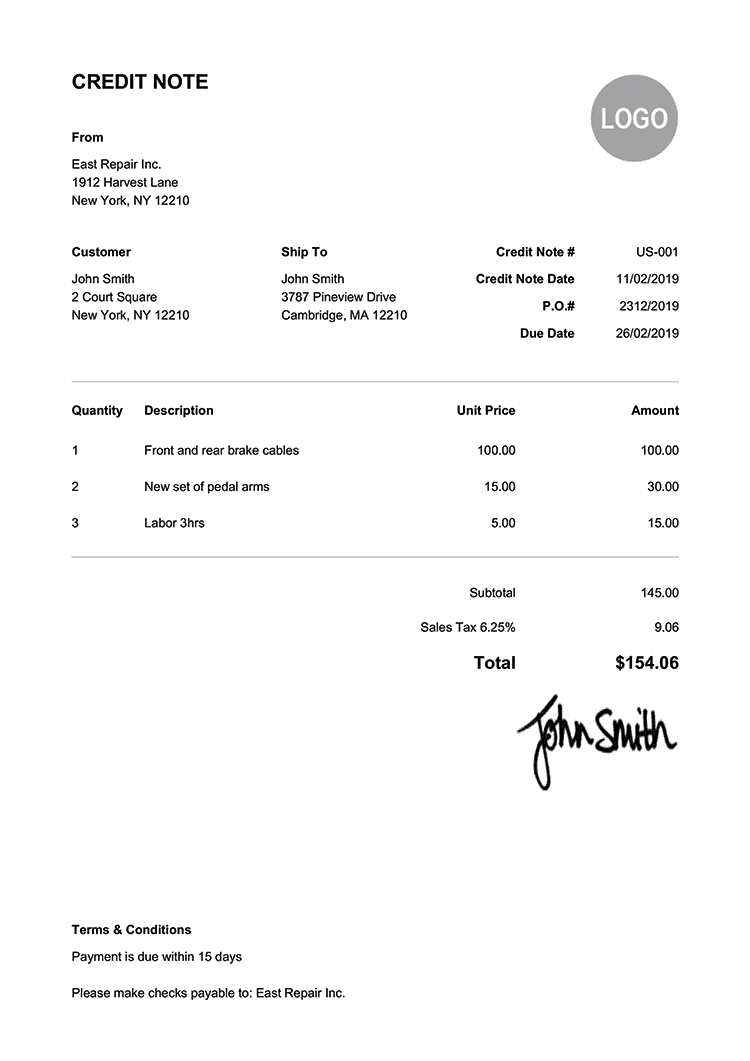

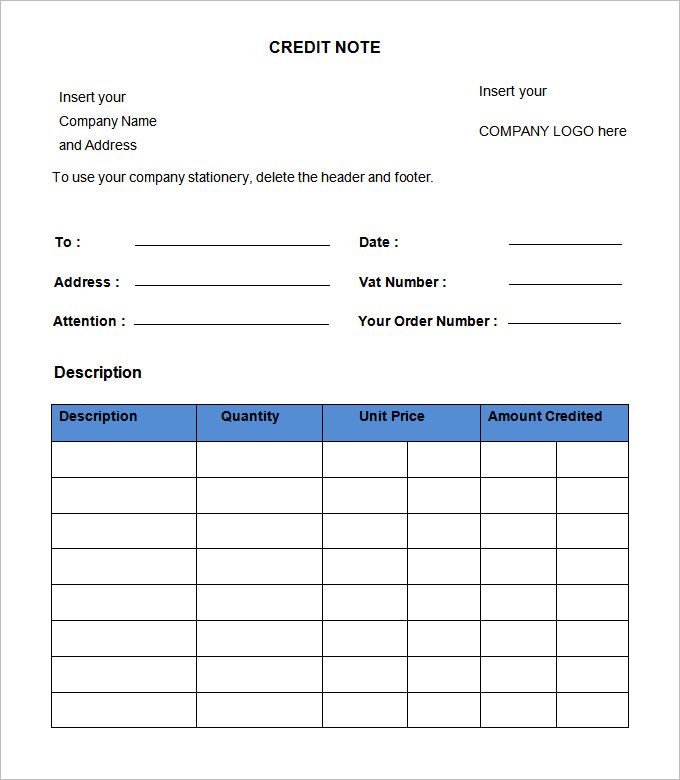

Regardless of whether you use a template or create a credit note from scratch, certain elements are essential:

Numerous resources offer free and paid Credit Note Template Doc options. Here are a few places to look:

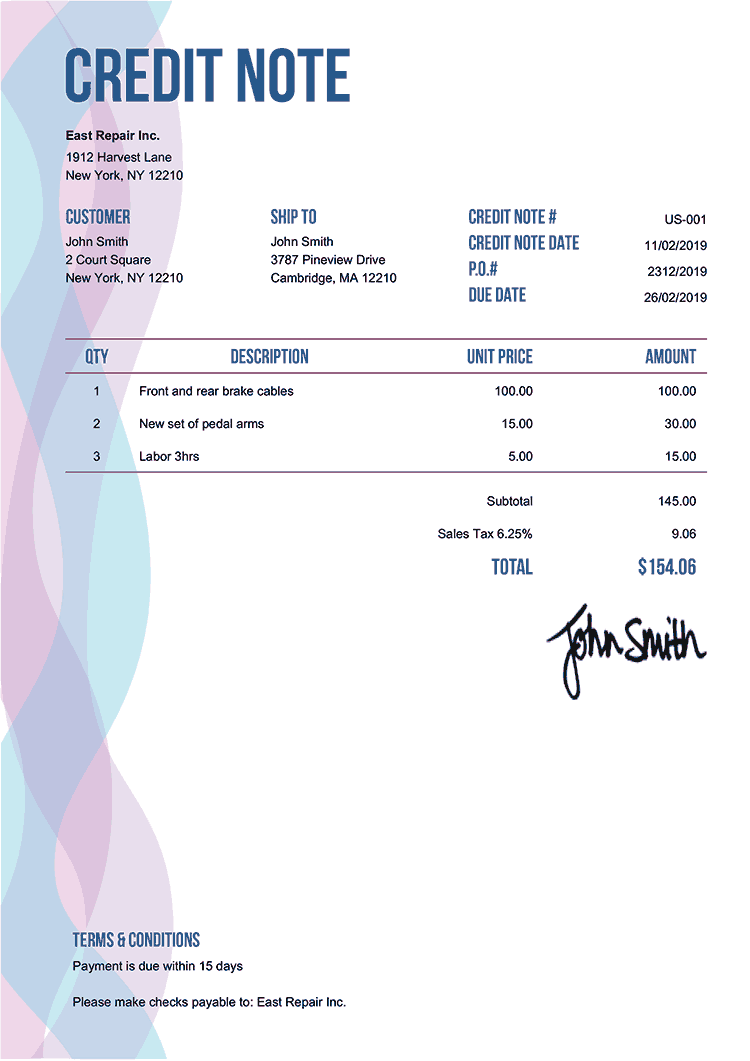

When choosing a template, consider your specific needs. Do you need a simple template or one with more advanced features? Do you prefer a Word document, an Excel spreadsheet, or a PDF form? Ensure the template is easily customizable and includes all the essential elements mentioned above.

Once you’ve downloaded a template, take the time to customize it to reflect your brand and specific requirements. This includes:

While credit notes are generally straightforward, there are some legal considerations to keep in mind:

Following these best practices can help ensure a smooth and professional credit note process:

A Credit Note Template Doc is an invaluable tool for any business that deals with returns, errors, or adjustments to invoices. By understanding the purpose of credit notes, the essential elements they should contain, and the legal considerations involved, you can streamline your accounting processes, maintain accurate financial records, and build strong customer relationships. Choosing the right template and customizing it to your specific needs will save you time and ensure a professional presentation. Remember, a well-issued credit note isn’t just about correcting a mistake; it’s about demonstrating your commitment to customer satisfaction and building trust.