Creating a robust and legally sound commercial loan agreement is a critical step for any business seeking funding. It’s a complex document that protects both the lender and the borrower, outlining the terms and conditions of the loan. A well-drafted agreement minimizes risks and fosters a clear understanding of expectations. This guide provides a comprehensive overview of the key elements and considerations involved in constructing a commercial loan agreement template. Understanding these elements is paramount to ensuring a successful loan transaction. The core of a successful loan agreement lies in its clarity, precision, and adherence to legal requirements. It’s not simply a formality; it’s a vital tool for managing risk and establishing a solid foundation for the business relationship. This article will delve into the essential components of a commercial loan agreement template, offering practical guidance and best practices.

Before diving into the specifics, it’s crucial to grasp why a commercial loan agreement is so important. A poorly drafted agreement can lead to disputes, delays, and even legal battles. It protects the lender’s investment by clearly defining the loan’s terms, repayment schedule, collateral, and default provisions. For the borrower, a strong agreement provides certainty and safeguards their financial interests. It’s a contract, and like any contract, it needs to be carefully reviewed and executed with the assistance of legal counsel. Ignoring these considerations can have significant consequences, potentially jeopardizing the entire loan process. The agreement serves as a roadmap for the relationship, establishing expectations and outlining responsibilities. It’s a foundational document that impacts the long-term viability of the business.

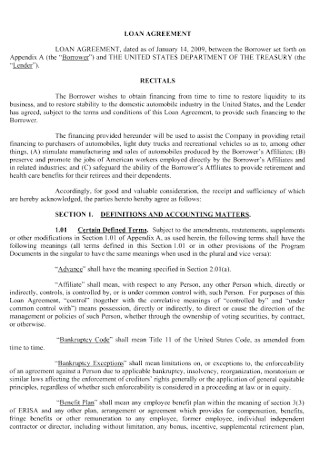

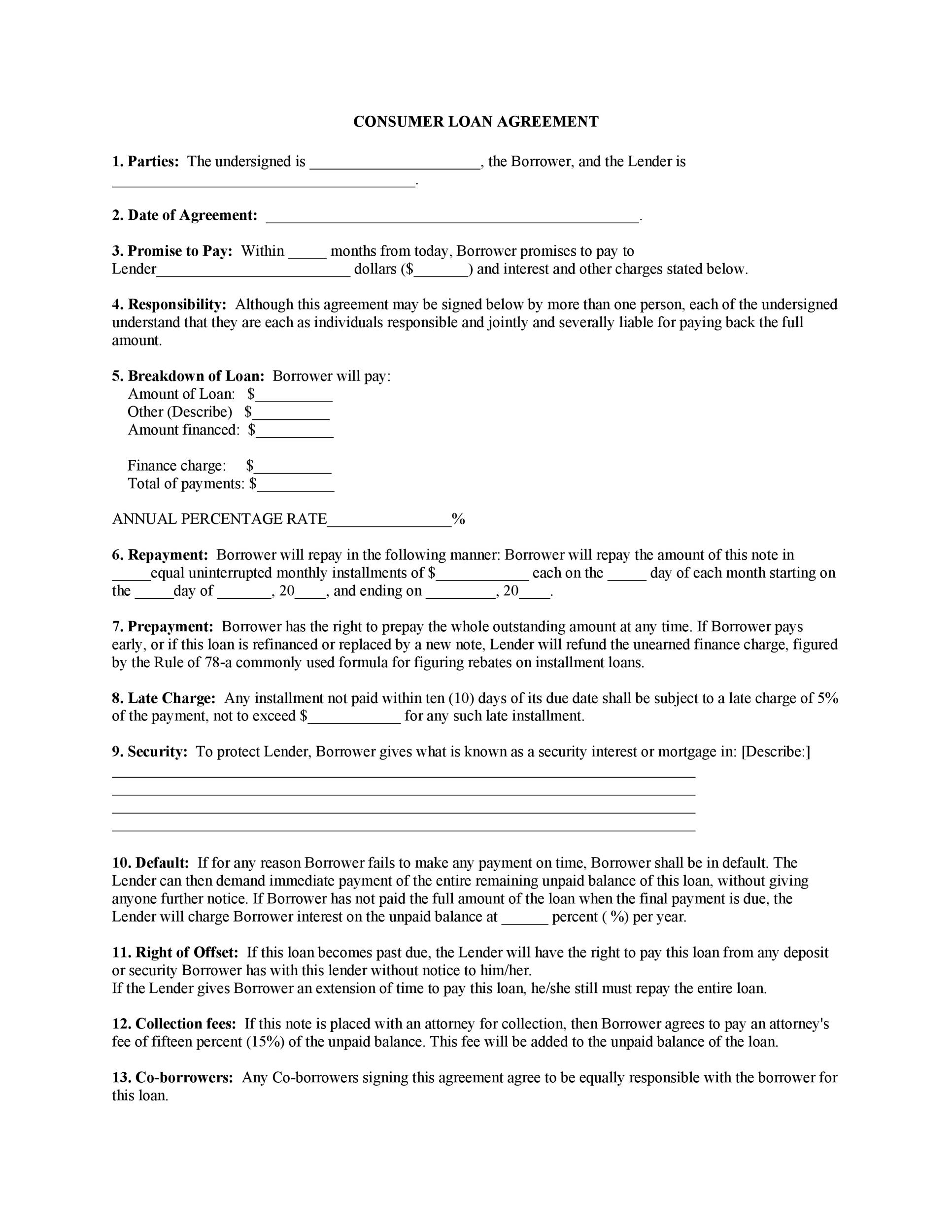

A comprehensive commercial loan agreement typically includes several key sections. Let’s examine some of the most important ones:

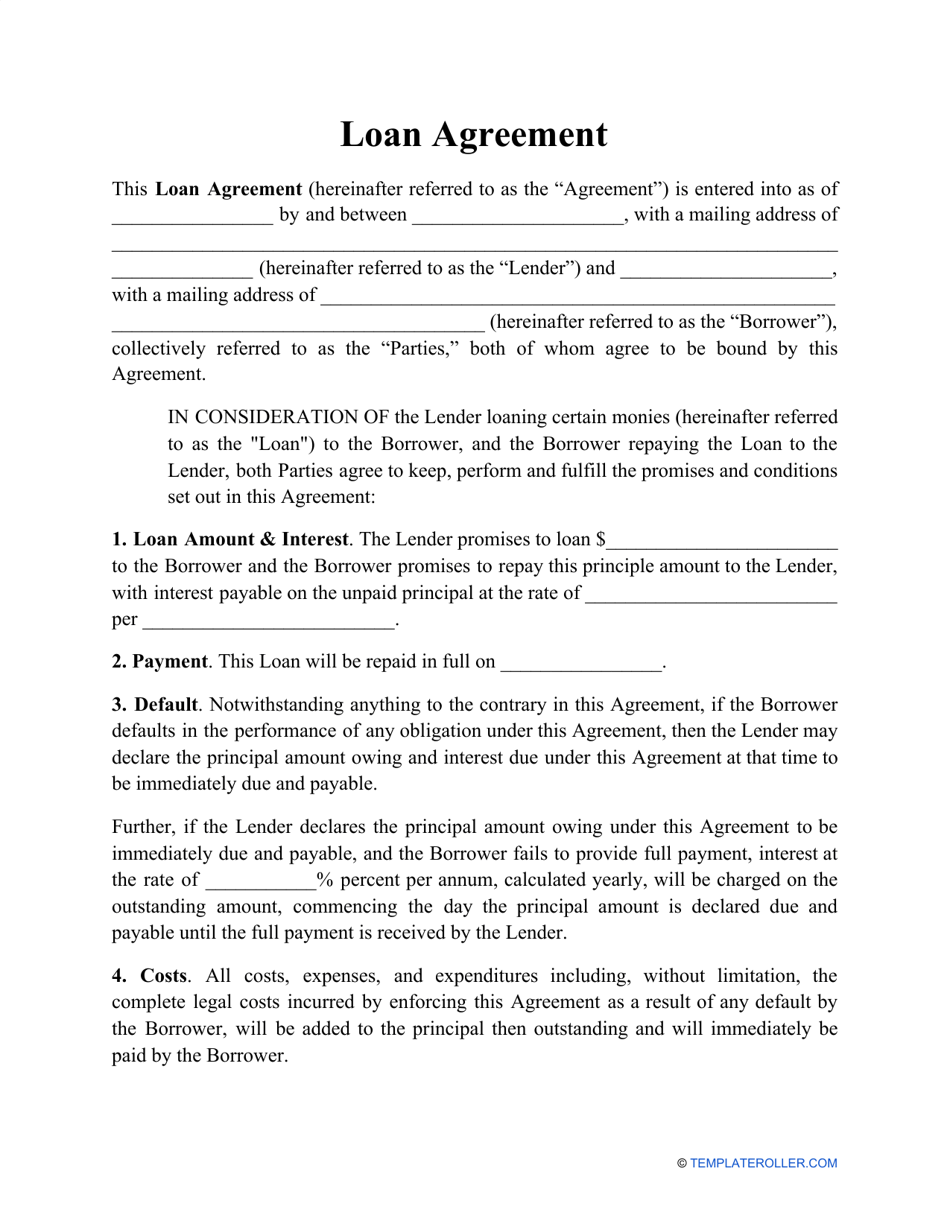

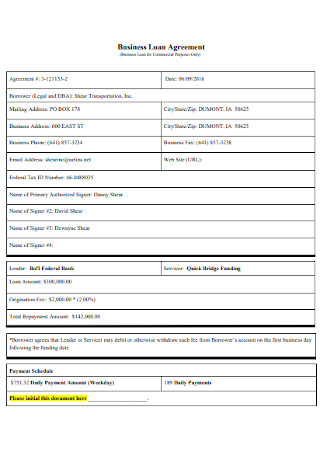

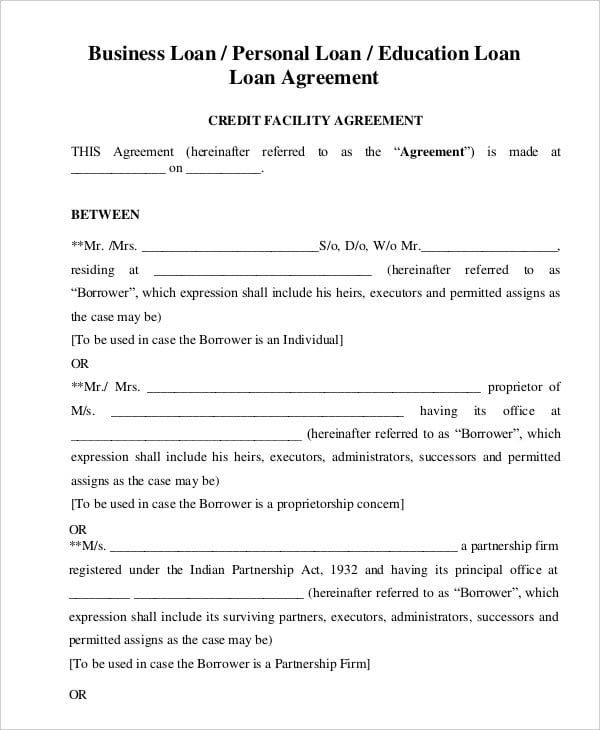

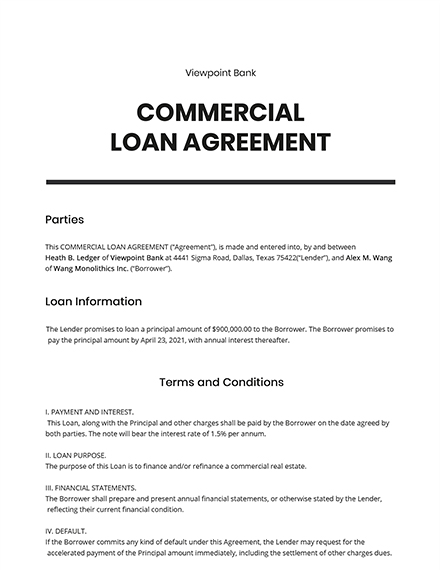

This section clearly identifies the parties involved in the loan agreement. It’s vital to accurately list the lender and the borrower, including their full legal names and addresses. It’s also important to specify the roles and responsibilities of each party, such as the borrower’s management and the lender’s investment strategy. A clear delineation of each party’s rights and obligations is essential for avoiding misunderstandings. For example, the lender should explicitly state their intention to provide capital and the borrower’s intention to use the funds for a specific purpose.

This section details the exact amount of the loan being requested and the specific purpose for which the funds will be used. It’s crucial to define the loan’s terms, including the repayment schedule (e.g., monthly installments, balloon payments), the interest rate (fixed or variable), and any associated fees. The purpose of the loan should be clearly articulated and aligned with the borrower’s business plan. Providing a detailed business plan demonstrating the loan’s viability is highly recommended. The lender needs to understand the intended use of the funds to assess risk and determine appropriate terms.

If the loan is secured by collateral (e.g., equipment, real estate), this section outlines the collateral’s description, value, and the lender’s right to seize and sell the collateral if the borrower defaults. The agreement should specify the process for valuing the collateral and the lender’s procedures for securing the collateral. Proper documentation, such as appraisals and title searches, are typically required to establish the collateral’s value. A clear understanding of the collateral’s worth is critical for both parties.

This section outlines the repayment schedule, including the frequency of payments, the due date for each installment, and any potential penalties for late payments. The agreement should specify the method of repayment (e.g., direct deposit, check) and the lender’s procedures for collecting payments. It’s important to consider potential delays or disruptions in the borrower’s cash flow when determining the repayment schedule. A flexible repayment schedule can be beneficial, but it must be clearly defined and agreed upon by both parties.

This section addresses what happens if the borrower fails to meet their repayment obligations. It outlines the lender’s rights to pursue legal remedies, such as foreclosure, repossession, or acceleration of the loan. The agreement should specify the process for notifying the borrower of a default and the lender’s remedies. It’s vital to clearly define the lender’s right to seek legal action to recover the loan amount. Understanding the remedies available to the lender is crucial for protecting their investment.

Covenants are specific requirements imposed on the borrower to ensure the loan’s proper use and repayment. These can include maintaining financial statements, providing regular reports, and restricting certain business activities. Covenants can provide the lender with greater assurance that the borrower is managing the funds responsibly. The specific covenants will vary depending on the type of loan and the lender’s risk tolerance. Carefully consider the impact of any covenants on the borrower’s operations.

This section specifies the jurisdiction whose laws will govern the agreement and the method for resolving disputes. It may also include a clause specifying the method for resolving disputes, such as mediation or arbitration. Choosing a clear and predictable dispute resolution process can help minimize the risk of costly and time-consuming litigation. A well-defined dispute resolution mechanism can streamline the process and protect all parties involved.

It’s essential to consult with an experienced attorney when drafting or reviewing a commercial loan agreement. A lawyer can ensure that the agreement complies with all applicable laws and regulations, protects your interests, and minimizes the risk of future disputes. They can also advise you on the specific terms and conditions that are appropriate for your business and the loan’s purpose. The cost of legal counsel is a worthwhile investment to safeguard your financial interests.

A well-crafted commercial loan agreement is a cornerstone of any successful business financing relationship. It’s a complex document that requires careful attention to detail and legal expertise. By understanding the key sections and considerations outlined in this guide, businesses can create a robust agreement that protects their interests and fosters a stable and mutually beneficial partnership. Remember that the agreement is a starting point – ongoing communication and collaboration between the lender and borrower are crucial for ensuring its effectiveness. Regularly reviewing and updating the agreement as the business evolves is also recommended. Ultimately, a solid commercial loan agreement is an investment in the long-term success of your business.