Creating a mortgage note is a significant step in the home buying process, and having a well-structured template is crucial for clarity and efficiency. A mortgage note is a legally binding agreement outlining the terms of a mortgage loan, protecting both the lender and the borrower. This guide will walk you through the essential components of a mortgage note template, ensuring a smooth and legally sound transaction. Mortgage Note Template is the cornerstone of this agreement, defining the rights and responsibilities of all parties involved. Understanding this template is vital for anyone involved in securing a mortgage. It’s more than just a document; it’s a roadmap for a successful loan.

The process of creating a mortgage note can seem daunting, but breaking it down into manageable sections makes it much easier. It’s important to remember that this is a template, and you should always consult with legal counsel to ensure it aligns with your specific circumstances and local laws. A professional review is highly recommended. Properly drafted and executed notes protect both the borrower and the lender, minimizing potential disputes down the line. Let’s delve into the key elements of a robust mortgage note.

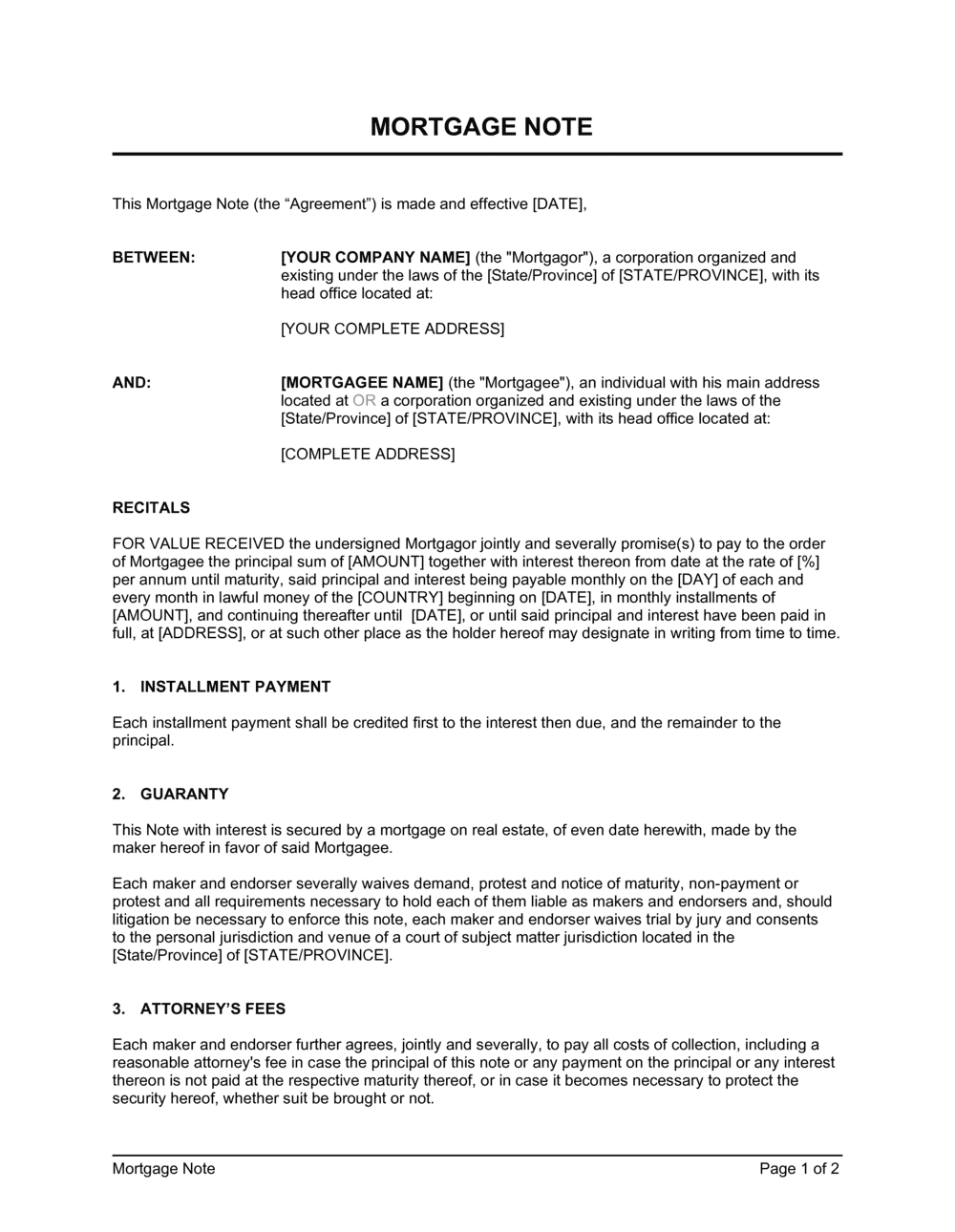

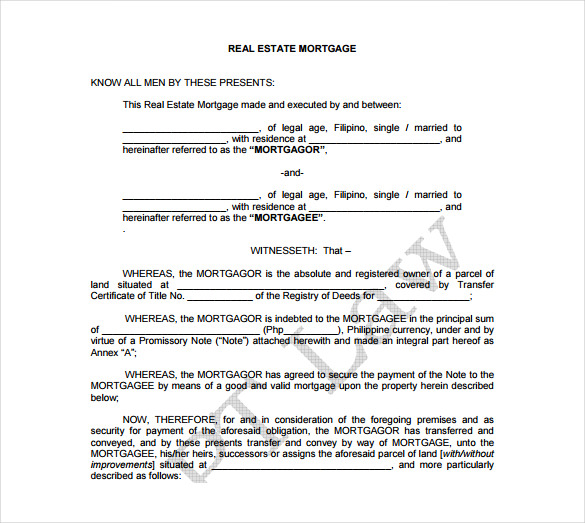

A mortgage note is a legal document that secures a mortgage loan. It’s a crucial agreement that outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral. The template typically includes several key sections, each with specific details. The most important sections are:

Let’s examine some of the most critical sections of a mortgage note template, highlighting their importance and the information they require.

This section is foundational. It’s absolutely critical to accurately represent the borrower and lender. The borrower’s legal name and address must be clearly stated, and the lender’s name and address must be precise. A signed and dated copy of the borrower’s identification documents (driver’s license, passport) is typically required. Errors in this section can lead to significant legal complications.

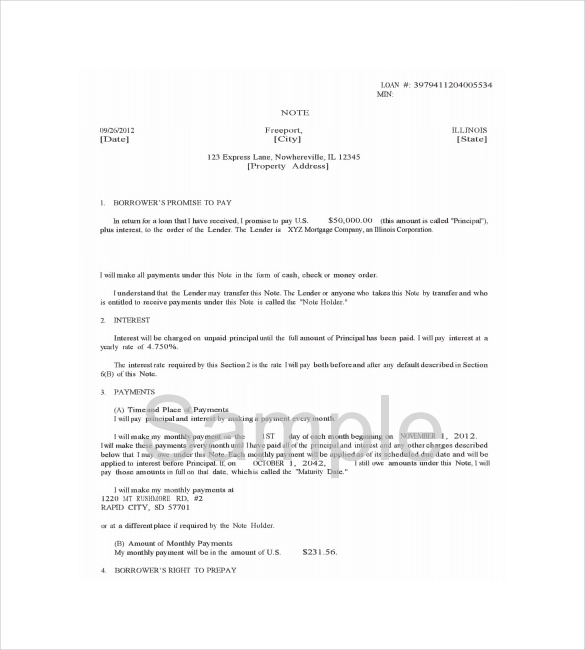

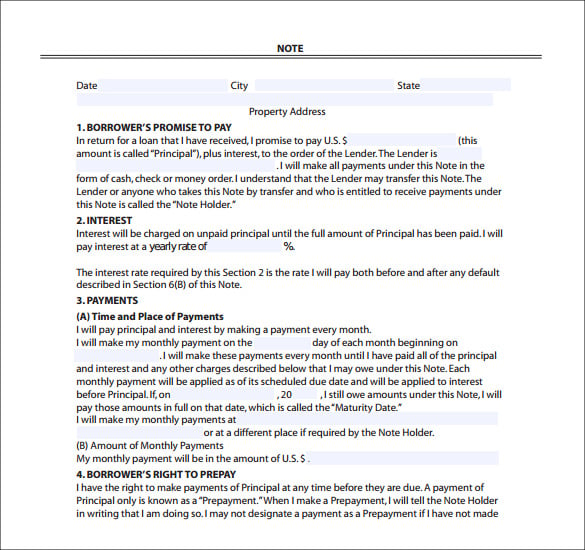

The loan amount, the purpose of the loan, and the loan term are all crucial details. The loan amount should be clearly stated, and the loan term should be specified in months or years. Understanding the loan term is essential for the borrower’s ability to make timely payments. The loan amount should be accurately reflected in the template.

A detailed description of the property is paramount. This includes the legal description (which can be found on the deed), the address, and any relevant property tax information. The property description should be precise and unambiguous to avoid disputes. The lender should verify the accuracy of the property description with the title company or assessor.

The interest rate and any associated fees must be clearly stated. The interest rate should be clearly stated, and the fees should be detailed. It’s important to understand the terms of the interest rate, including whether it’s fixed or variable. The lender should also disclose any applicable closing costs.

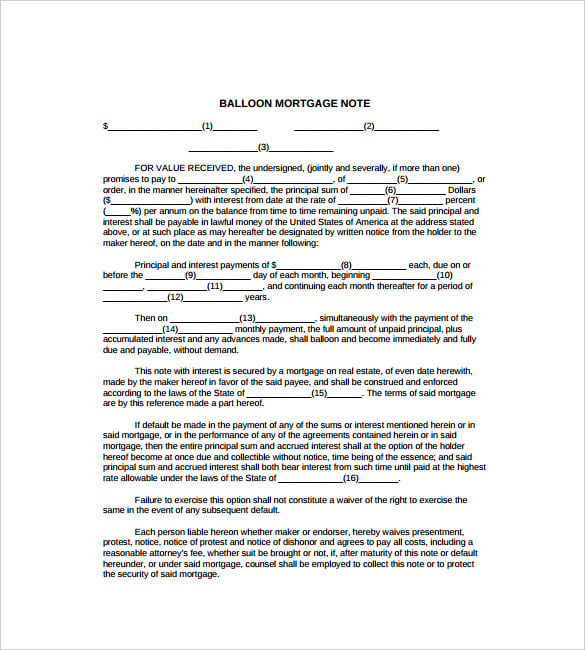

The repayment schedule is the backbone of the note. It outlines the monthly payment amount, the due date, and the total amount due each month. The schedule should be clearly presented and easy to understand. The borrower should be responsible for ensuring they can make the required payments.

This section outlines the consequences of default. It specifies the lender’s rights to foreclose on the property if the borrower fails to make payments. It also outlines the lender’s remedies, such as legal action and the potential for damages. It’s vital to clearly define the lender’s rights and responsibilities.

This section describes the collateral securing the loan. The property being financed serves as security for the loan. The lender should verify the property’s value and condition. The lender should also outline the process for the lender to seize the collateral if the borrower defaults.

Creating a robust mortgage note template is a critical step in securing a home loan. By understanding the key components and carefully reviewing the template, borrowers and lenders can ensure a smooth and legally sound transaction. Remember that this is a starting point, and it’s essential to seek professional legal advice to tailor the template to your specific needs and circumstances. Properly drafted and executed notes protect both the borrower and the lender, minimizing potential disputes and ensuring a successful loan outcome. Investing in legal counsel is a wise investment that can safeguard your financial future. A well-structured mortgage note is more than just a document; it’s a foundation for a secure and prosperous homeownership journey.