The need to track business-related travel expenses is a universal one for many individuals and organizations. Whether you’re a freelancer, a sales representative, or simply an employee incurring travel costs, maintaining accurate records is essential for tax purposes and proper expense management. A vital tool in this process is a well-structured mileage report template. This document serves as a comprehensive record of all trips taken for business, detailing the dates, destinations, purposes, and distances traveled. Using a dedicated template ensures consistency and accuracy, making expense reporting significantly easier and less prone to errors. Choosing the right mileage report template can save time, reduce stress, and help you maximize tax deductions.

Using a pre-designed mileage report template offers several advantages over simply keeping handwritten notes or relying on memory. The structured format ensures all necessary information is captured, minimizing the risk of missing crucial details. This is particularly important for tax purposes, where documentation is paramount. A template also promotes consistency in reporting, making it easier to track expenses over time and analyze spending patterns.

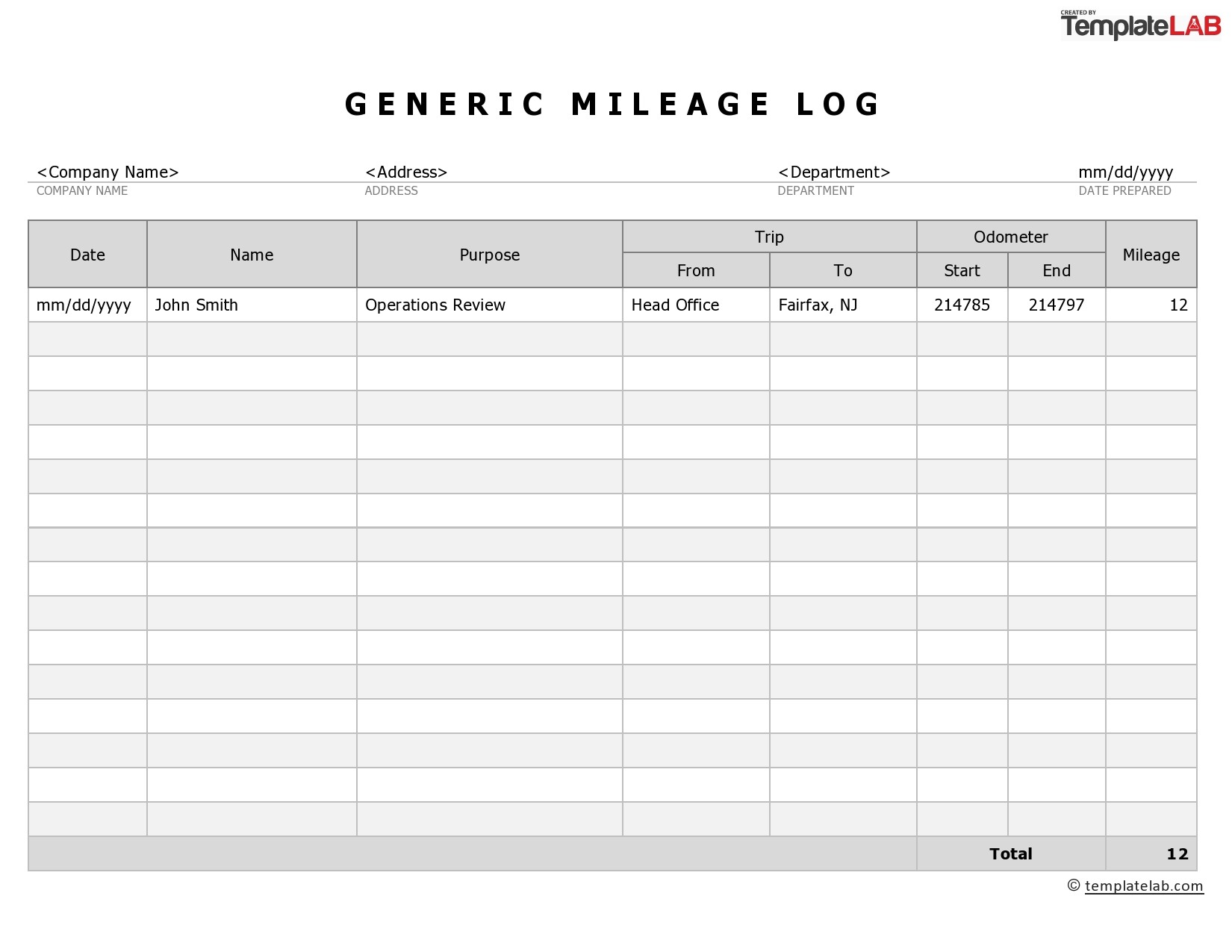

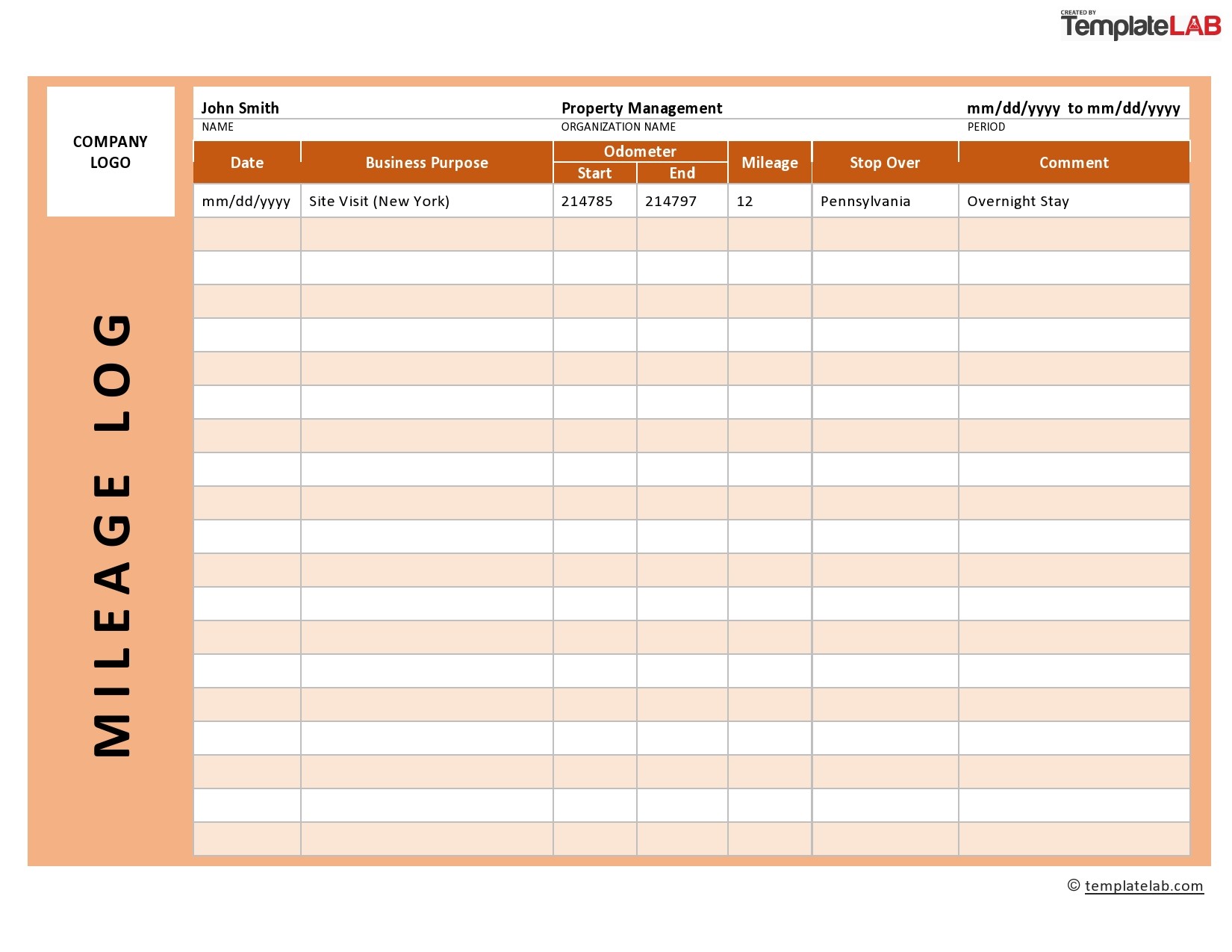

One of the primary benefits of a template is its ability to ensure accuracy. Most templates include fields for essential information like date, starting and ending locations, purpose of the trip, and total miles driven. This structured approach helps prevent omissions and reduces the likelihood of errors that could lead to denied or delayed expense reimbursements. The standardized format also simplifies data entry and analysis, saving you valuable time and effort.

For many individuals and businesses, mileage is a deductible business expense. A detailed mileage report template is indispensable for claiming these deductions. By meticulously documenting each business trip, you provide the necessary evidence to support your claim. Proper record-keeping can significantly reduce your tax liability and improve your overall financial picture. Furthermore, a well-maintained report helps you comply with IRS regulations regarding mileage expense deductions.

A comprehensive mileage report template should capture all essential details related to each business trip. Here’s a breakdown of the key information you should include:

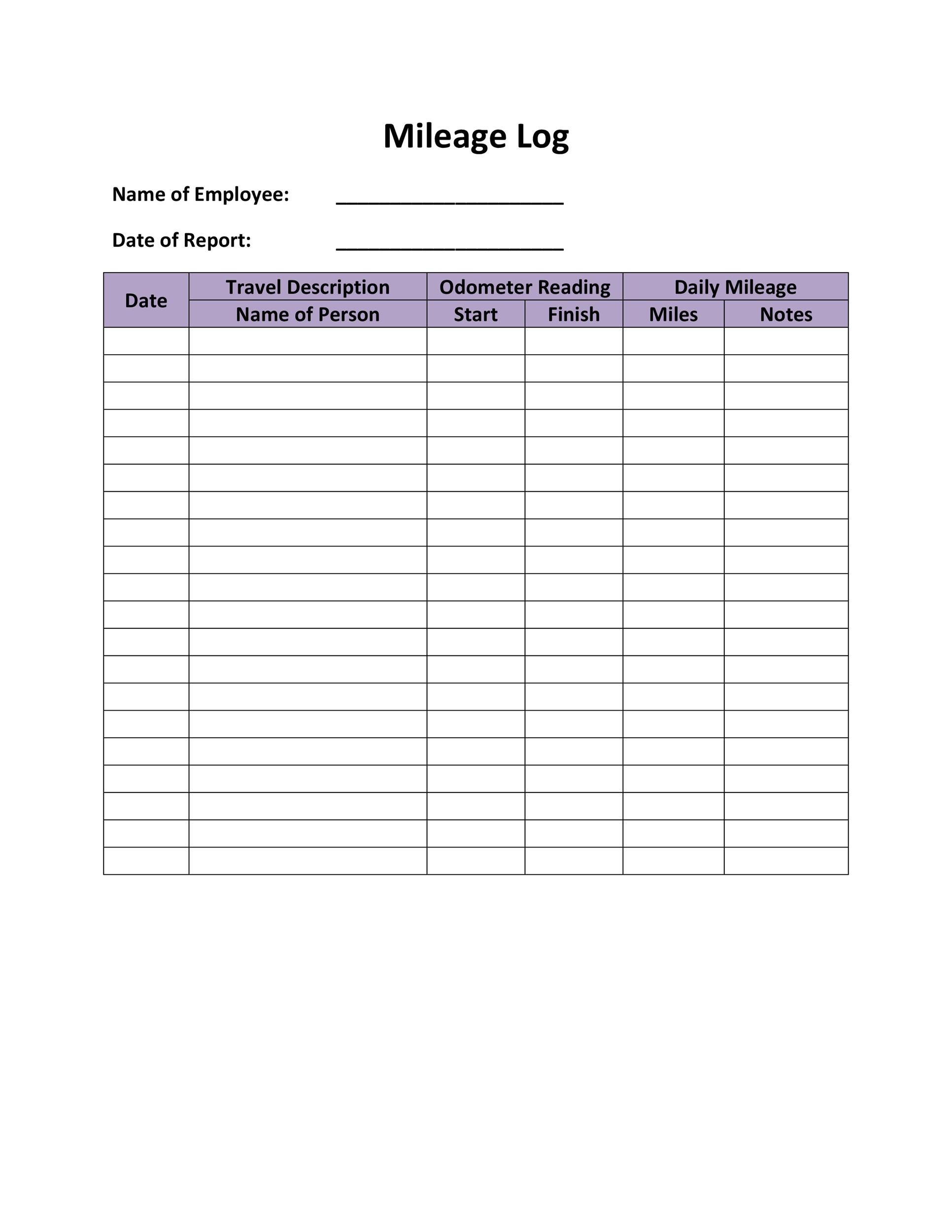

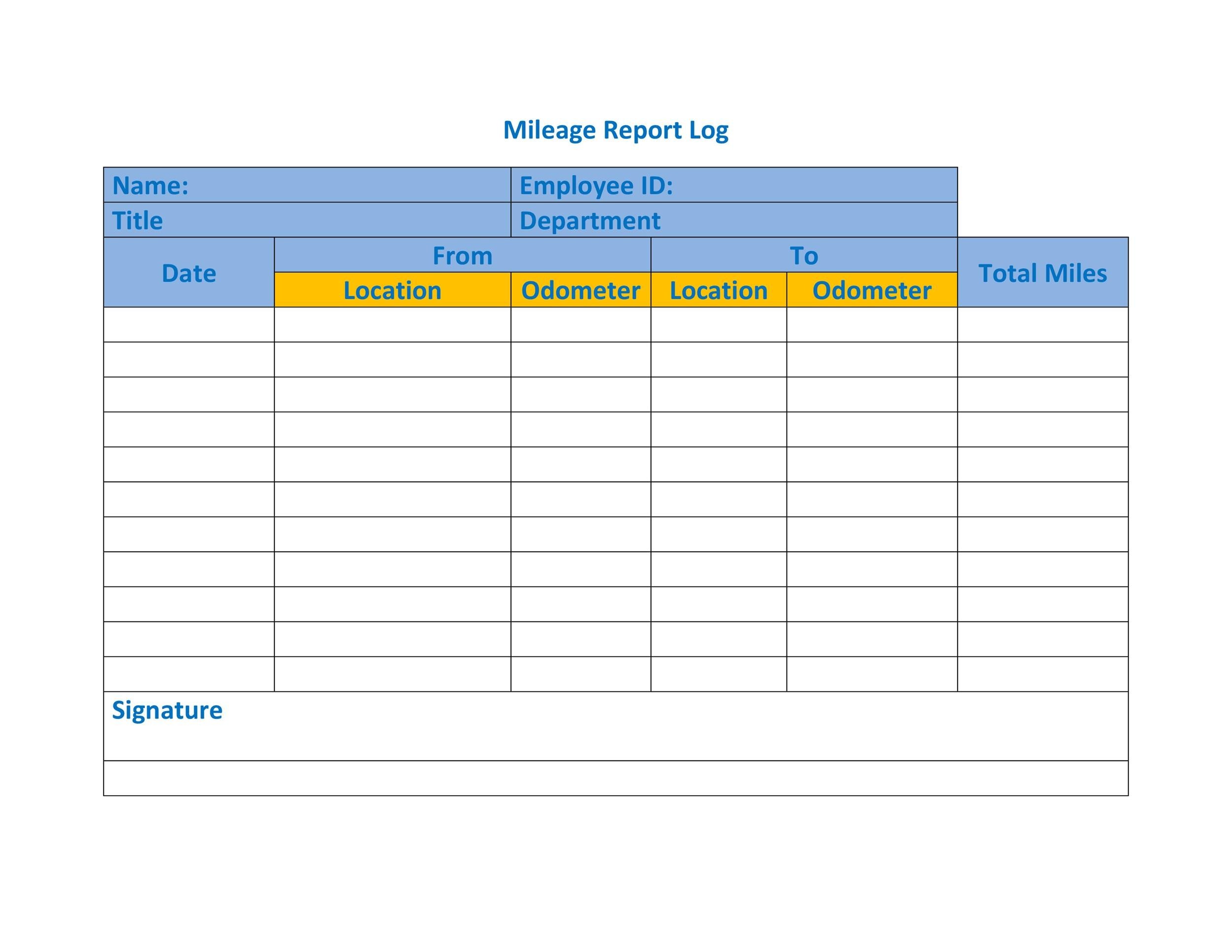

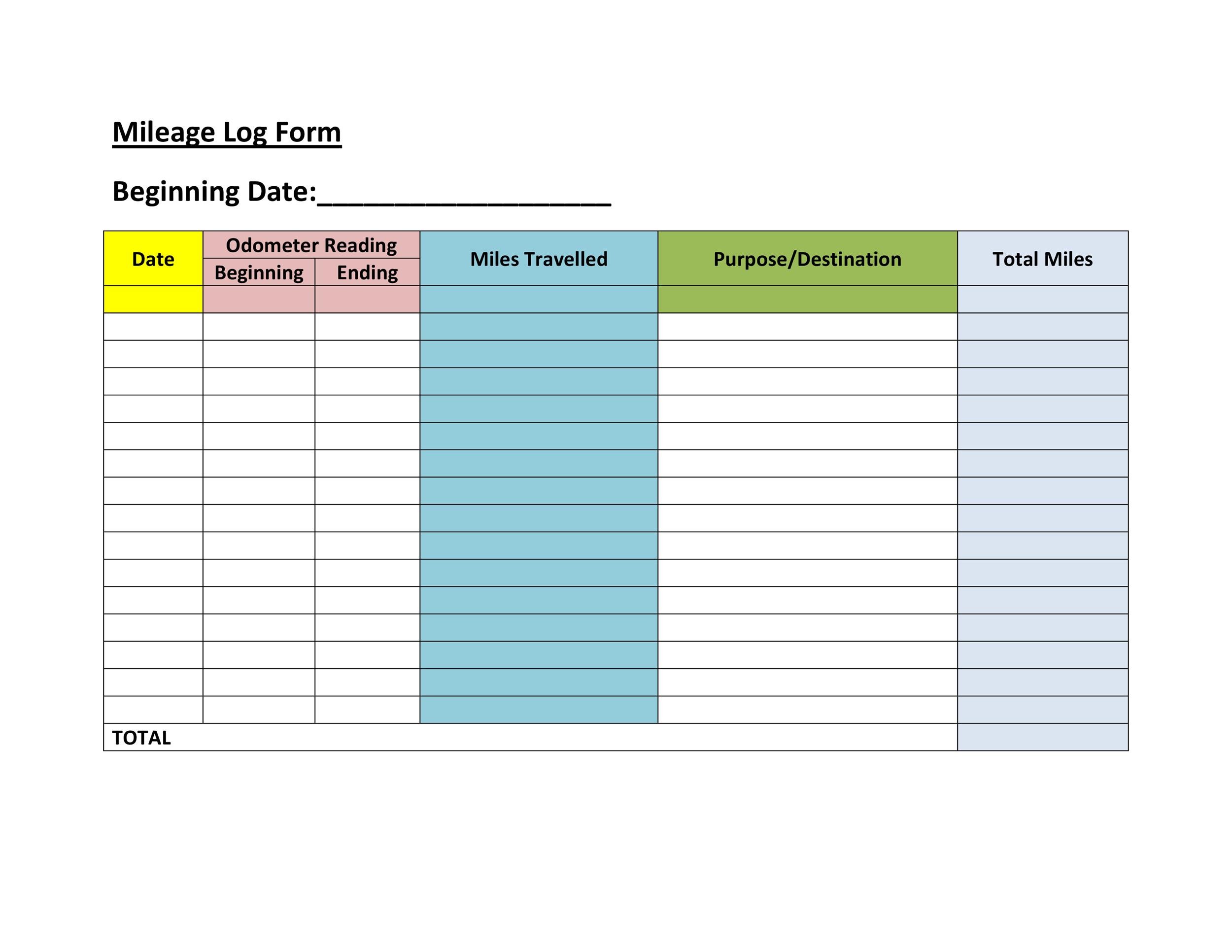

Several types of mileage report templates are available, catering to different needs and preferences.

These templates are designed to be printed and filled out manually. They are often simple and straightforward, making them a good choice for individuals who prefer a traditional approach. You can easily find free printable templates online in formats like PDF or Word. These are generally good for infrequent travelers or those who don’t need advanced features.

Spreadsheet templates offer greater flexibility and functionality. They allow you to easily calculate total mileage, track expenses, and generate reports. These templates often include formulas and charts to help you analyze your spending. This format is ideal for those who want to automate their expense tracking and gain deeper insights into their travel costs.

Numerous software programs and mobile apps are specifically designed for mileage tracking and expense reporting. These solutions often integrate with accounting software and offer advanced features such as GPS tracking, automated mileage calculations, and expense categorization. Examples include MileIQ, Everlance, and TripLog. These are best for frequent travelers and businesses that need robust expense management capabilities. These often come with subscription fees.

While pre-designed templates are convenient, you may need to customize them to meet your specific needs. Here are some tips for customizing a mileage report template:

To maximize the effectiveness of your mileage report template, follow these best practices:

Maintaining accurate records of business-related travel expenses is critical for both tax compliance and effective expense management. A well-chosen mileage report template is an invaluable tool in this process. Whether you prefer a simple printable template, a flexible spreadsheet, or a sophisticated software solution, there’s an option to suit your needs. By following best practices and customizing your template as necessary, you can streamline your expense reporting, maximize your tax deductions, and gain valuable insights into your travel spending. Investing time in setting up and using a proper mileage report template will ultimately save you time, reduce stress, and help you stay organized.