A legally sound agreement is essential when lending money, whether it’s between individuals or a financial institution and a consumer. Utilizing a well-crafted Consumer Loan Agreement Template can protect both the lender and the borrower by clearly outlining the terms and conditions of the loan. It’s a vital step in ensuring transparency and preventing potential disputes.

This comprehensive guide explores the essential components of a consumer loan agreement and offers insights into creating a template that accurately reflects the specifics of the lending arrangement. Understanding the legal requirements and best practices associated with these agreements is paramount for anyone involved in consumer lending. From defining the principal amount and interest rate to specifying repayment schedules and default clauses, every detail matters.

We’ll delve into the various sections that should be included in your template, highlighting the importance of clarity and precision in each. Furthermore, we’ll provide practical tips and advice to help you customize the template to suit your unique lending scenario, ensuring that you create a document that is legally compliant and effectively protects your interests.

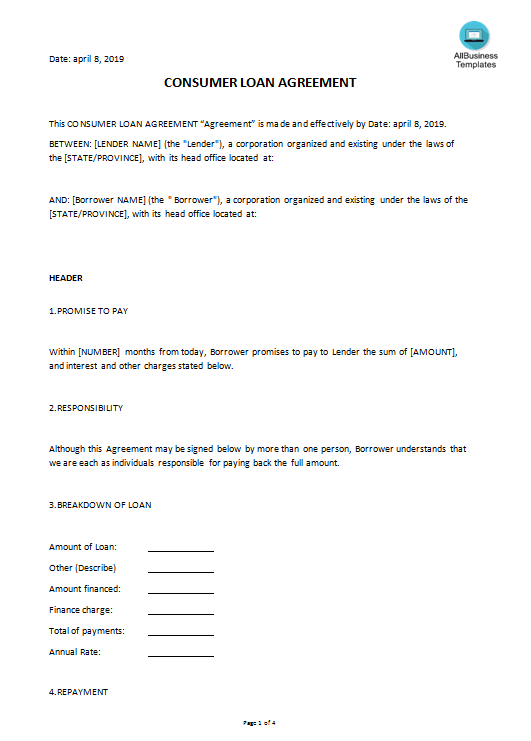

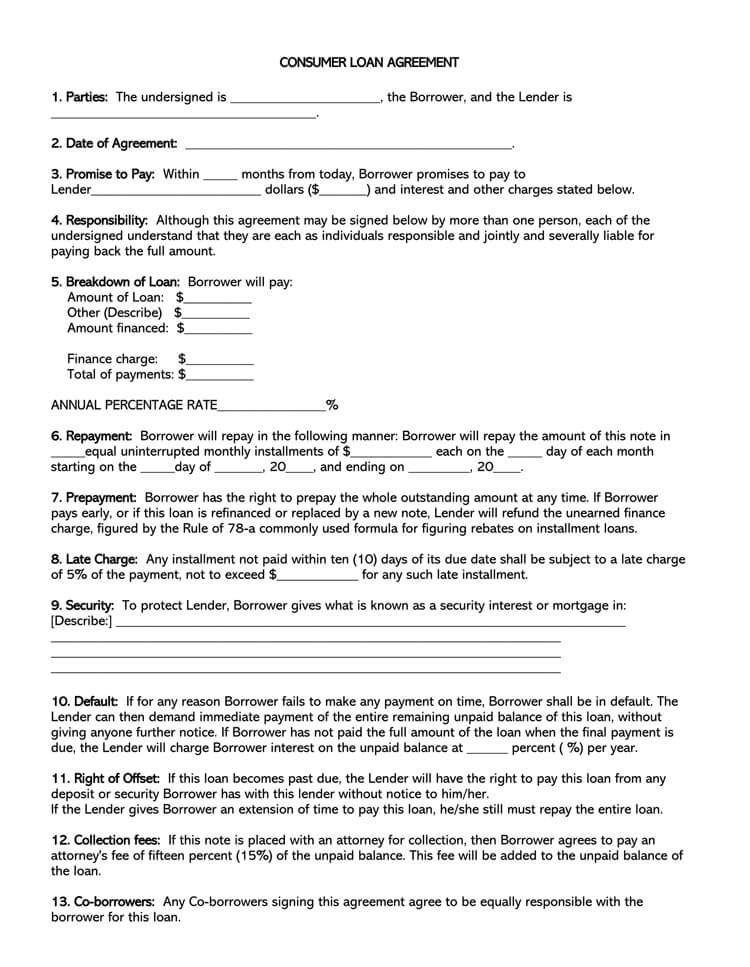

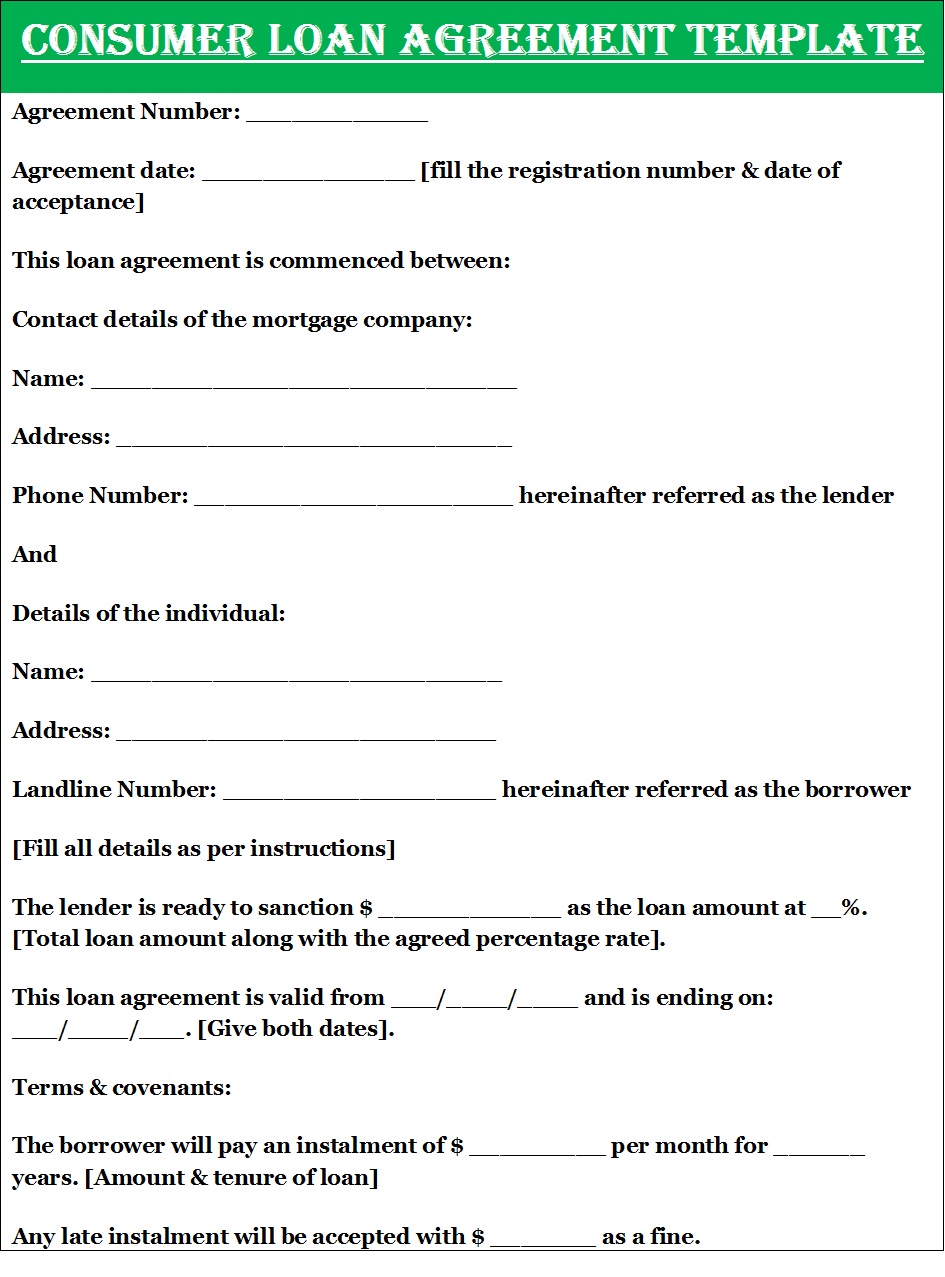

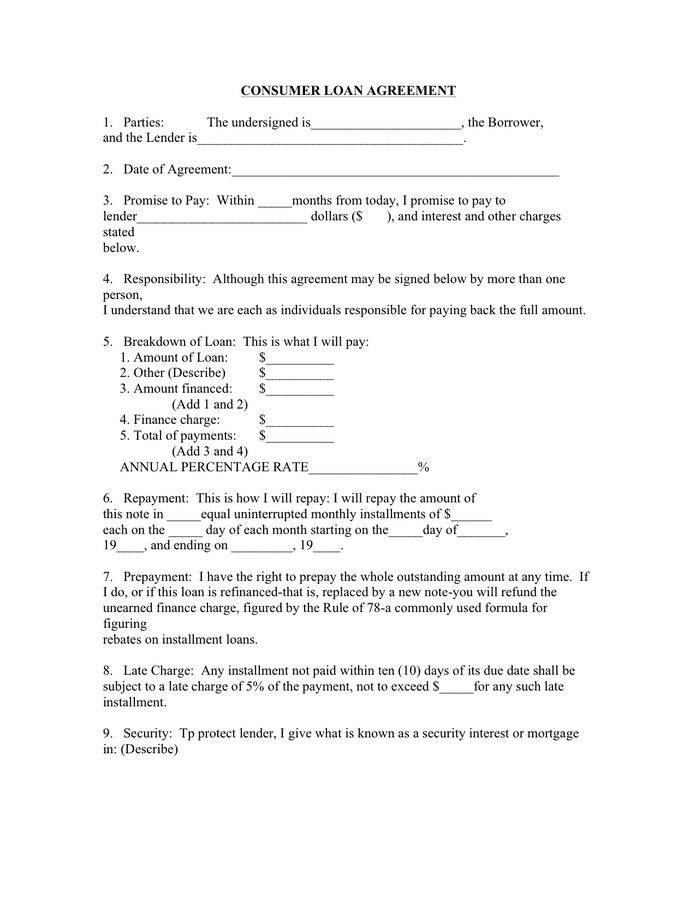

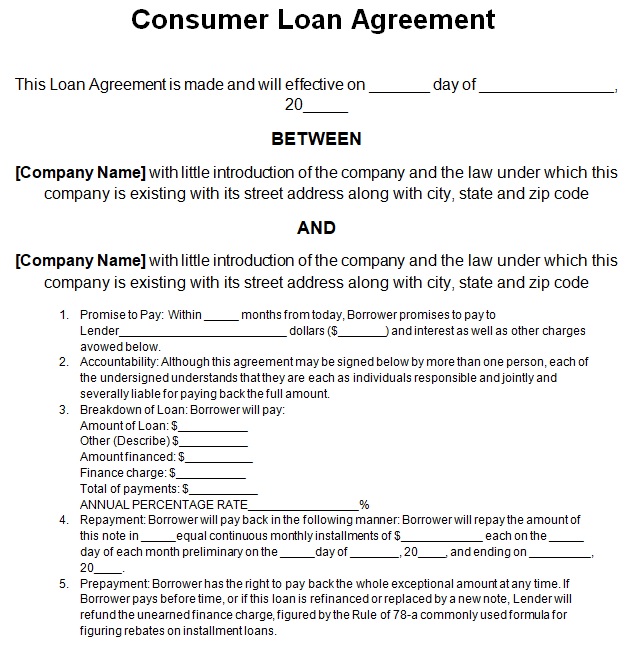

A robust consumer loan agreement contains several critical elements that define the terms of the loan and protect the interests of both parties. These components work together to provide a clear and legally binding framework for the lending arrangement.

The principal amount, representing the sum of money borrowed, must be clearly stated. This is the foundation of the loan. Equally important is the interest rate, which is the percentage charged on the principal amount and represents the lender’s profit. The agreement should specify whether the interest rate is fixed or variable and how it is calculated. Be sure to comply with any applicable state or federal regulations regarding interest rate caps.

The repayment schedule details how the borrower will repay the loan. This section specifies the frequency of payments (e.g., monthly, bi-weekly), the amount of each payment, and the due date. An amortization schedule can be included to illustrate the breakdown of each payment between principal and interest over the life of the loan. Clarity in the repayment schedule minimizes the risk of confusion and late payments.

The agreement should clearly outline the penalties for late payments. This may include late fees and an increase in the interest rate. The definition of default is also crucial. Default typically occurs when the borrower fails to make payments as agreed or violates other terms of the agreement. The consequences of default, such as acceleration of the loan (requiring immediate repayment of the entire balance) and legal action, must be explicitly stated.

If the loan is secured by collateral, such as a car or a house, the agreement must clearly identify the collateral and specify the lender’s rights in the event of default. This includes the right to repossess or foreclose on the collateral. The process for selling the collateral and applying the proceeds to the outstanding debt should also be outlined.

Several other clauses are essential for a comprehensive consumer loan agreement:

Creating a tailored Consumer Loan Agreement Template requires careful consideration of the specific details of your lending arrangement. While generic templates are available, customizing them to your specific needs is essential for legal compliance and clarity.

Begin by finding a reputable Consumer Loan Agreement Template online or consulting with legal counsel. Ensure the template complies with the laws of your jurisdiction. Several websites offer free or low-cost templates, but always review them carefully to ensure they are comprehensive and accurate.

Adapt the template to reflect the specific terms of your loan. This includes:

Use clear and concise language throughout the agreement. Avoid jargon or legal terms that the borrower may not understand. Every term and condition should be unambiguous to prevent misunderstandings and disputes. Consider having a lawyer review the template to ensure it is legally sound and easy to understand.

Consider including clauses that protect the borrower’s rights, such as a right to prepay the loan without penalty or a grace period for late payments. This can foster a more positive relationship between the lender and the borrower. Always comply with consumer protection laws, such as the Truth in Lending Act (TILA) in the United States, which requires lenders to disclose certain information to borrowers, including the annual percentage rate (APR).

Laws and regulations governing consumer loans can change over time. Regularly review and update your Consumer Loan Agreement Template to ensure it remains compliant. This is particularly important if you are lending money frequently.

Consumer loan agreements are subject to various state and federal laws designed to protect borrowers. Lenders must be aware of these legal requirements and ensure their agreements comply with them.

In the United States, the Truth in Lending Act (TILA) requires lenders to disclose certain information to borrowers, including the annual percentage rate (APR), the total amount financed, and the repayment schedule. TILA applies to many types of consumer loans, including personal loans, auto loans, and mortgages. Failure to comply with TILA can result in significant penalties.

Most states have usury laws that limit the maximum interest rate that can be charged on loans. These laws vary from state to state, so lenders must be aware of the usury laws in the state where the borrower resides. Charging an interest rate that exceeds the usury limit can result in civil and criminal penalties.

The Fair Debt Collection Practices Act (FDCPA) regulates the conduct of debt collectors. While the FDCPA primarily applies to third-party debt collectors, lenders who collect their own debts must still comply with certain provisions, such as prohibitions on harassing or abusive collection tactics.

Various other consumer protection laws may apply to consumer loan agreements, depending on the specific type of loan and the jurisdiction. These laws may address issues such as predatory lending, unfair business practices, and discrimination. Lenders should consult with legal counsel to ensure they are complying with all applicable consumer protection laws.

To illustrate the key components of a Consumer Loan Agreement Template, here are some examples of clauses that you might include:

“The Borrower agrees to pay interest on the unpaid principal balance at a fixed annual interest rate of [Percentage]%. Interest shall accrue from the date of this Agreement.”

“The Borrower shall repay the Principal Amount, together with accrued interest, in [Number] monthly installments of [Dollar Amount] each, commencing on [Date] and continuing on the same day of each month thereafter until fully paid.”

“If any payment is not received within [Number] days of the due date, the Borrower shall pay a late fee of [Dollar Amount] or [Percentage]% of the overdue payment, whichever is greater.”

“The Borrower shall be deemed to be in default under this Agreement if any of the following events occur: (a) failure to make any payment when due; (b) breach of any other material term of this Agreement; (c) insolvency or bankruptcy of the Borrower.”

“Upon the occurrence of an event of default, the Lender may, at its option, declare the entire unpaid principal balance, together with accrued interest, immediately due and payable.”

“This Agreement shall be governed by and construed in accordance with the laws of the State of [State Name].”

While you can create a Consumer Loan Agreement Template yourself, it’s crucial to have it reviewed by an attorney. An attorney can ensure that the agreement complies with all applicable laws and regulations, is clear and unambiguous, and adequately protects your interests. Legal review can help you avoid potential disputes and legal challenges down the road.

An attorney can identify potential legal issues that you may have overlooked, such as non-compliance with TILA or state usury laws. They can also advise you on how to structure the agreement to minimize your risk of liability.

An attorney can review the language of the agreement to ensure it is clear, concise, and unambiguous. They can also assess whether the agreement is likely to be enforceable in court.

An attorney can advise you on how to structure the agreement to protect your interests in the event of a default or other dispute. They can also help you negotiate the terms of the agreement with the borrower.

Using a comprehensive and well-drafted Consumer Loan Agreement Template is essential for protecting both lenders and borrowers in any lending transaction. By understanding the key components of such an agreement, customizing it to your specific needs, and ensuring it complies with all applicable laws, you can minimize the risk of disputes and ensure a smooth and transparent lending process. Remember to seek legal advice to ensure your template is sound and effective.