Creating and managing your credit card bill can often feel like a daunting task. It’s a regular requirement, and keeping track of payments, due dates, and outstanding balances can be stressful. Fortunately, a well-structured credit card bill template provides a clear and organized way to handle these financial matters. This guide will walk you through creating a professional and effective template, ensuring you’re prepared for any bill. Credit Card Bill Template is more than just a document; it’s a tool for financial control and peace of mind. Understanding how to create and utilize a template can significantly simplify your credit card management process. Whether you’re a seasoned spender or just starting out, a template can be invaluable. Let’s dive in!

The credit card bill is a crucial document for several reasons. It’s a record of all transactions, allowing you to monitor your spending habits and identify areas where you can potentially save money. It also serves as a reminder of your obligations and helps you stay on top of your payments. A well-designed template streamlines this process, reducing the risk of missed payments and potential late fees. Furthermore, a template can be customized to fit your specific needs, making it a valuable asset for anyone managing their credit card accounts. Without a template, tracking and managing your credit card bills can become a chaotic and time-consuming endeavor. Investing in a template is an investment in your financial well-being.

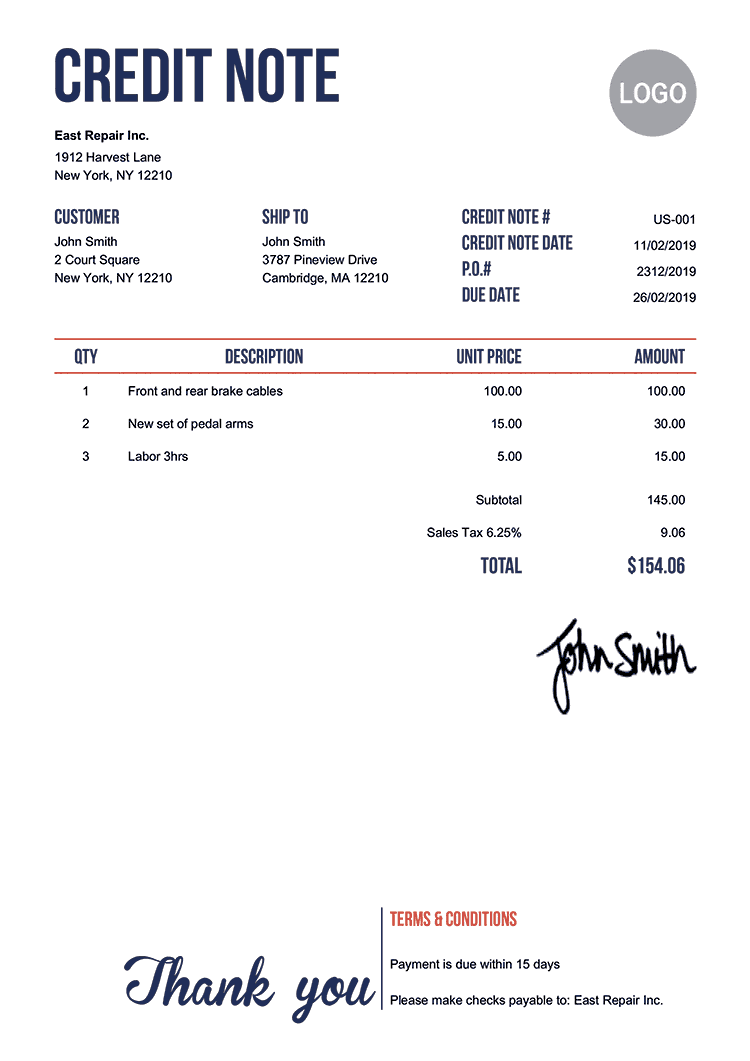

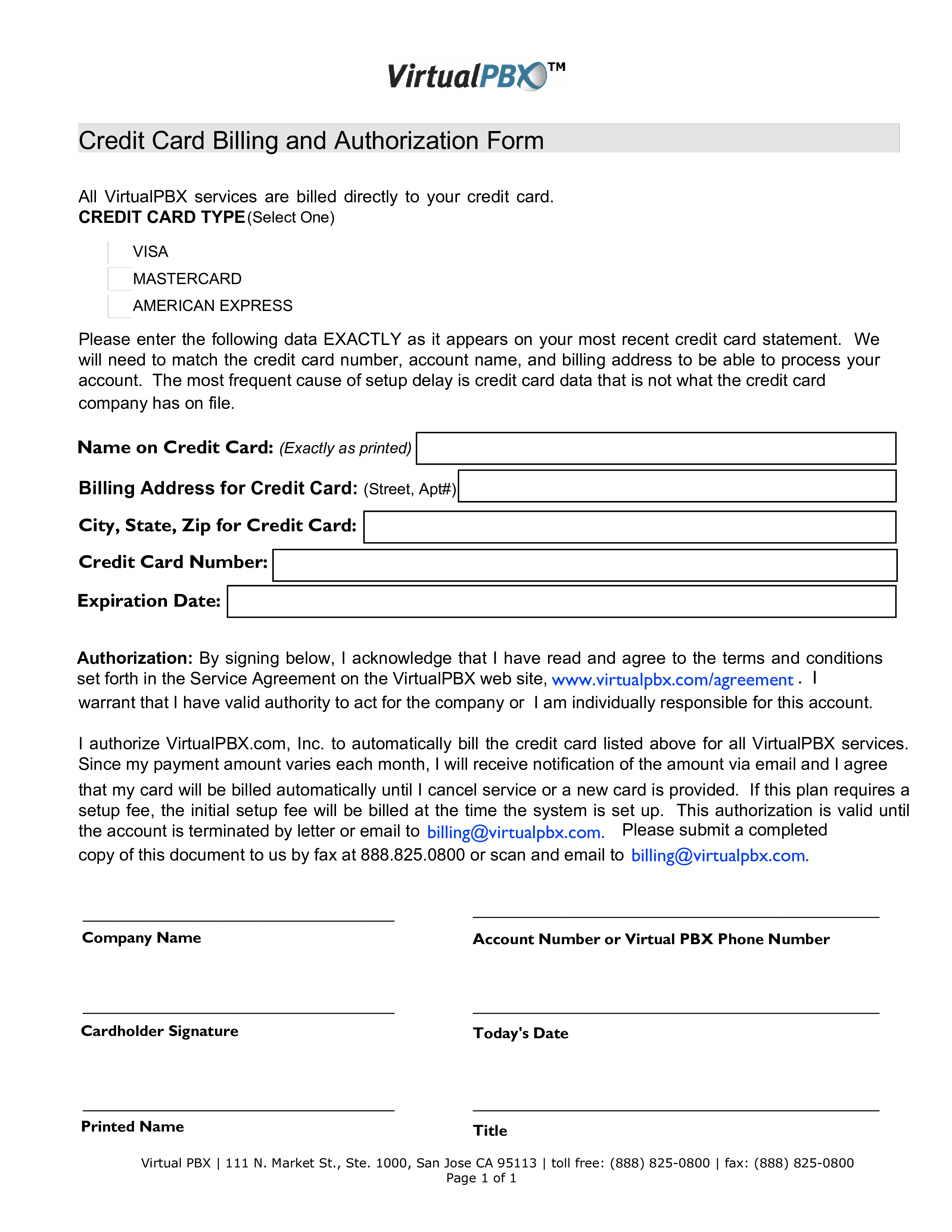

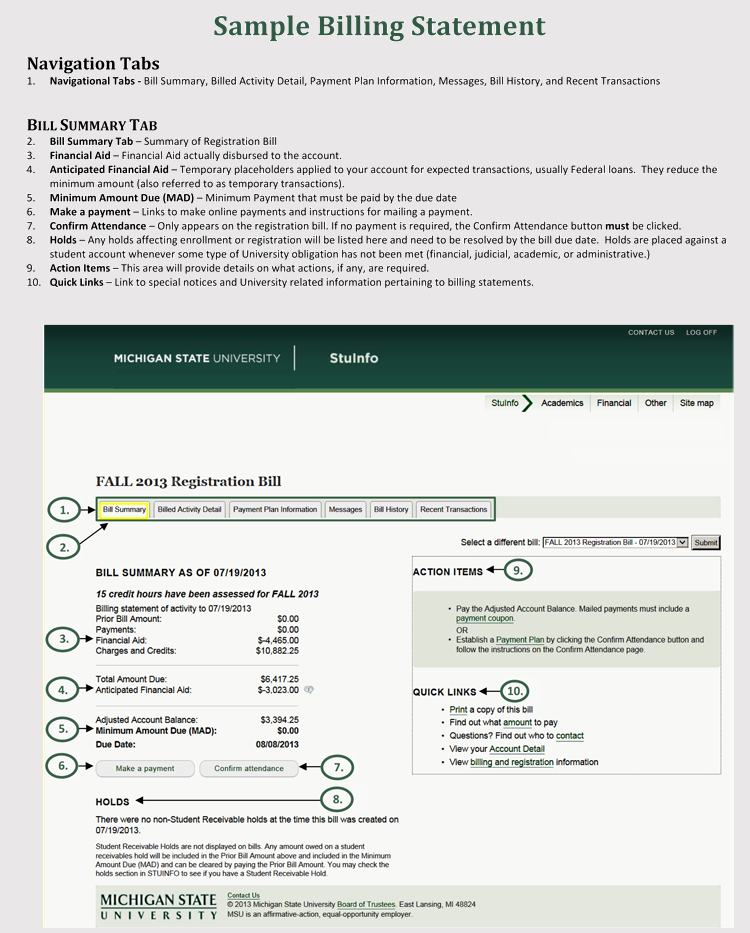

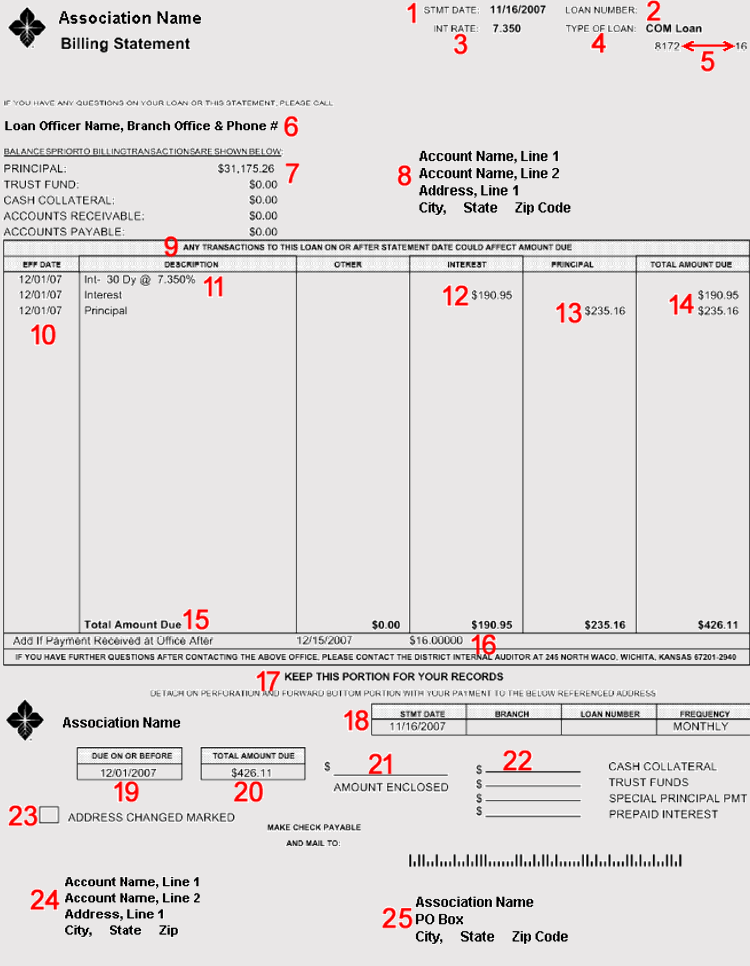

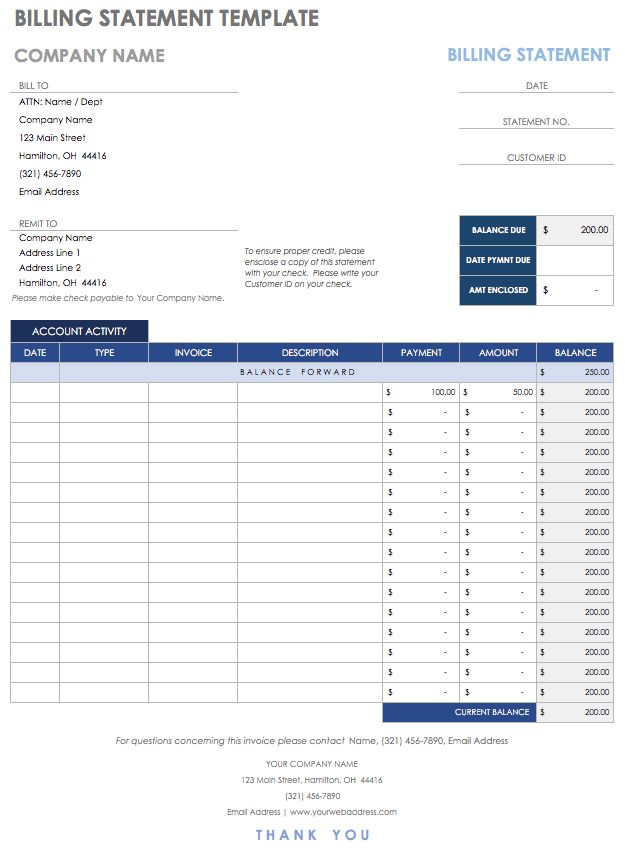

A robust credit card bill template should include several key elements to ensure clarity and accuracy. Here’s a breakdown of the essential components:

Let’s look at how to create a basic but effective credit card bill template. You can adapt this to your specific needs and software preferences.

You can create a credit card bill template in several ways:

Beyond simply creating a template, here are some additional tips for effective credit card bill management:

Technology is playing an increasingly important role in streamlining credit card bill management. Mobile apps and online platforms allow you to track your spending, set reminders for payments, and view your statements digitally. Many banks and credit card companies offer mobile apps that provide access to your bill and payment history. These tools can significantly reduce the time and effort required to manage your credit card accounts.

Many individuals struggle with understanding their credit card bills. Here are some common concerns and how to address them:

Creating and utilizing a well-structured credit card bill template is a fundamental step towards effective financial management. It provides a clear, organized, and accessible record of your transactions, empowering you to monitor your spending, avoid late fees, and maintain a healthy credit score. By investing time in creating a template, you’re investing in your financial future. Remember to consistently review and update your template to ensure it remains relevant to your individual needs and circumstances. Don’t underestimate the power of a simple, well-designed template – it can make a significant difference in your overall financial well-being. Credit Card Bill Template is a tool that, when used correctly, can be a powerful asset.