Navigating the world of expenses, reimbursements, and financial record-keeping can often feel like a complex journey, especially when dealing with the myriad of small, transactional costs that accumulate over time. Among these, taxi fares are a common occurrence for many, from business professionals on the go to individuals needing quick transportation. While most taxi services provide a receipt, these can often get lost, damaged, or simply not be detailed enough for specific accounting needs. This is where a Blank Taxi Receipt Template becomes an indispensable tool, offering a standardized and reliable way to document these vital transportation expenses.

The utility of a pre-formatted taxi receipt template extends far beyond merely replacing a lost slip. It empowers users with control over their financial documentation, ensuring that every necessary detail is captured accurately and consistently. Whether you’re a freelancer meticulously tracking business mileage, a corporate employee seeking seamless expense reimbursement, or a small business owner aiming for precise financial oversight, the ability to generate a professional and complete taxi receipt on demand is invaluable. It streamlines the often-tedious process of expense reporting, minimizing errors and delays.

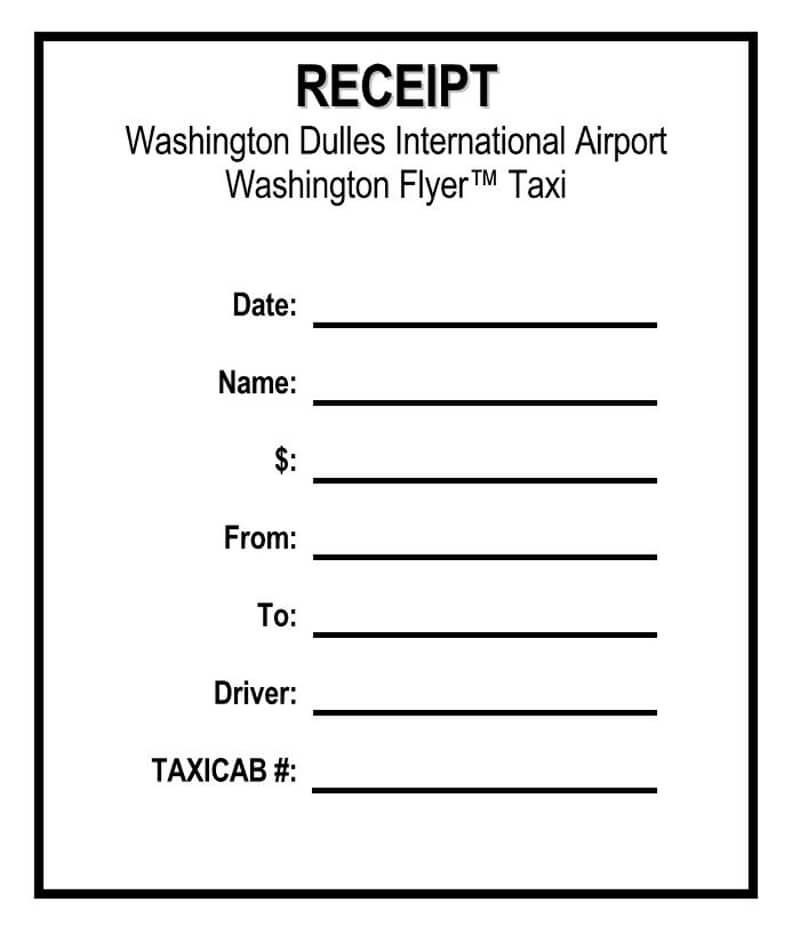

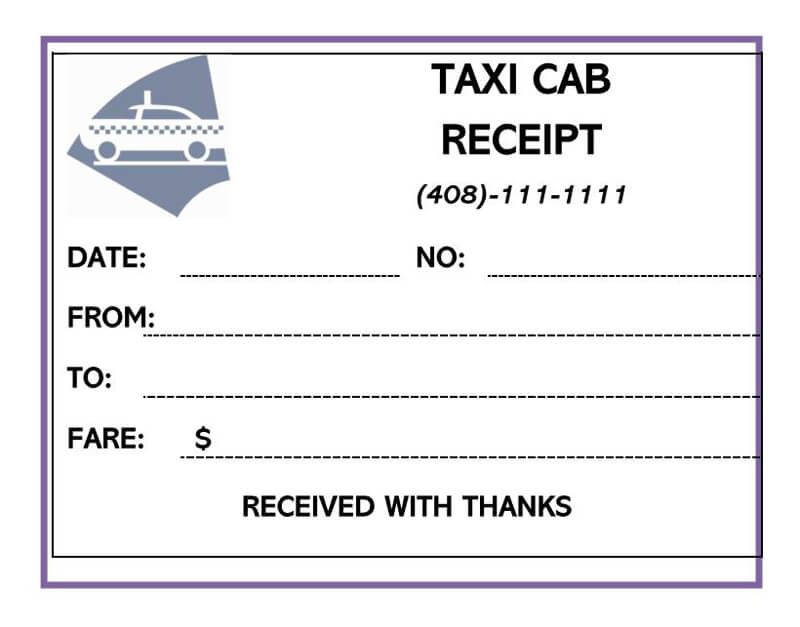

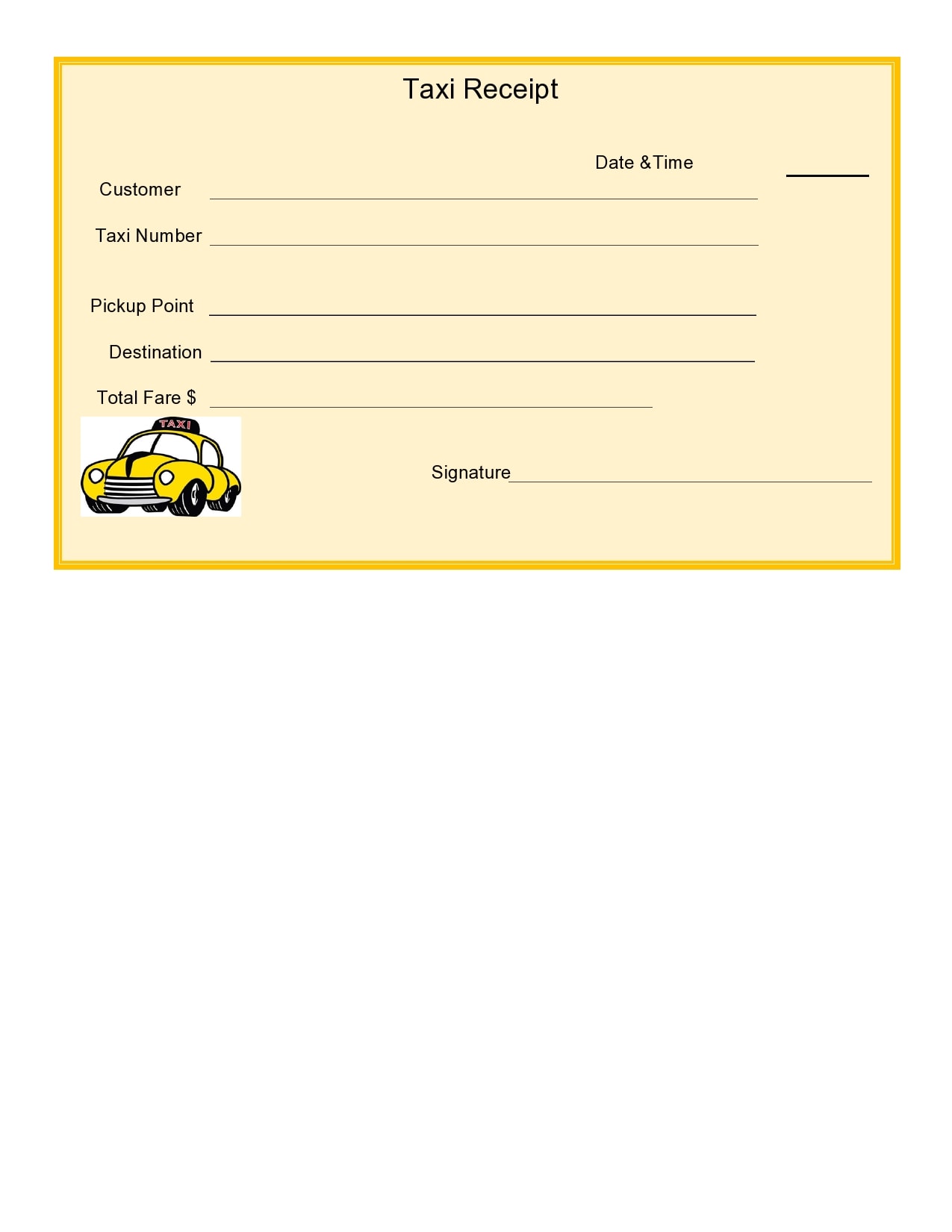

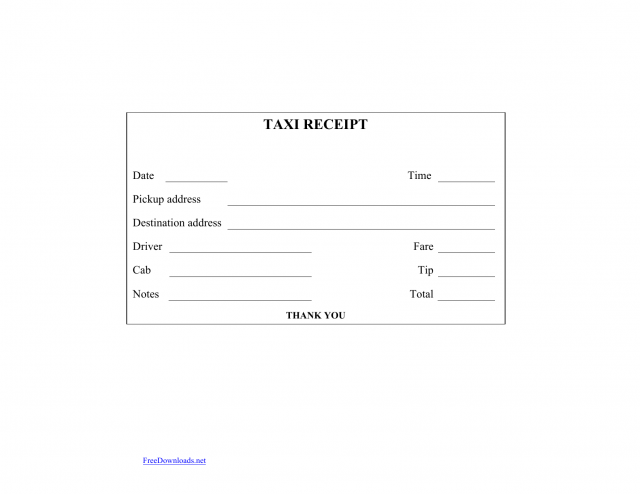

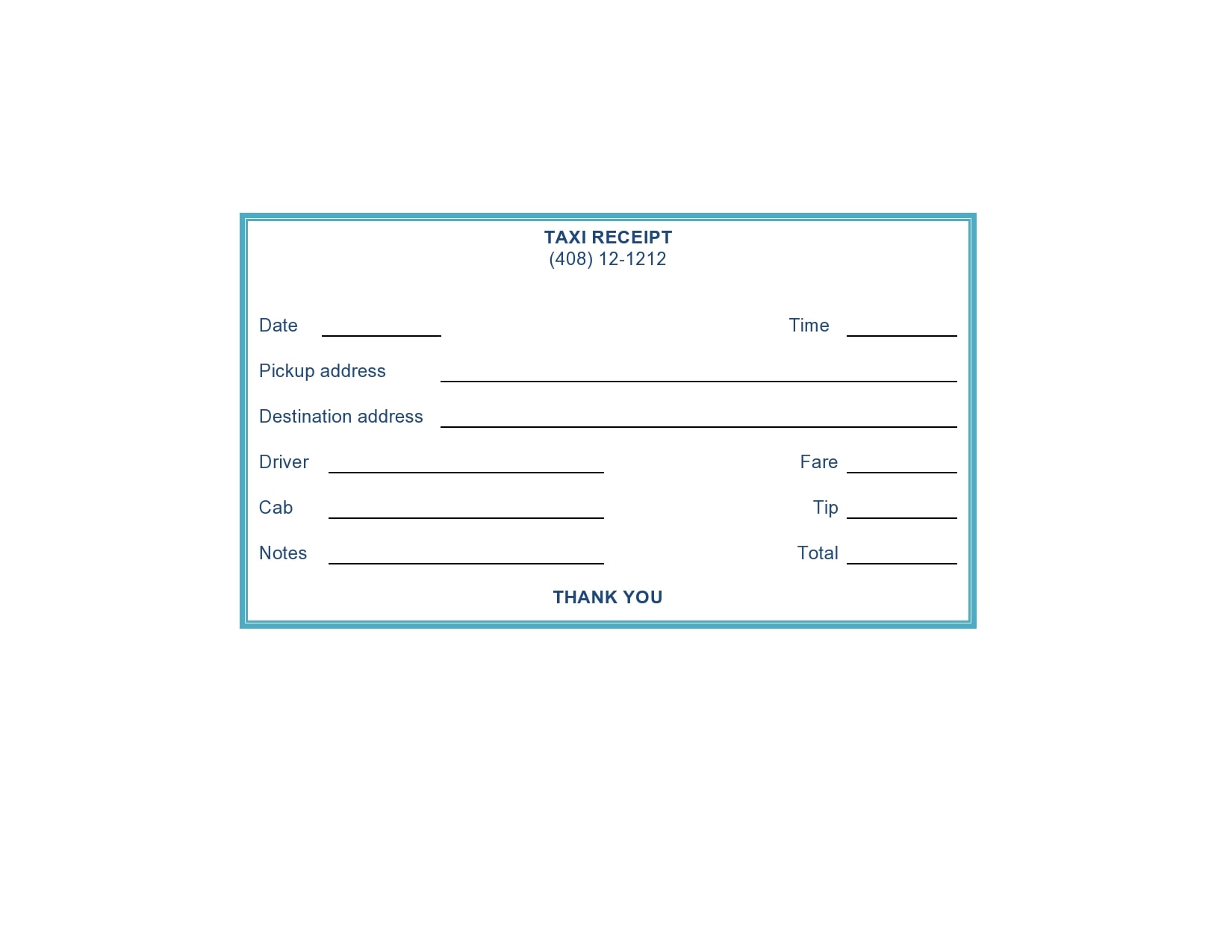

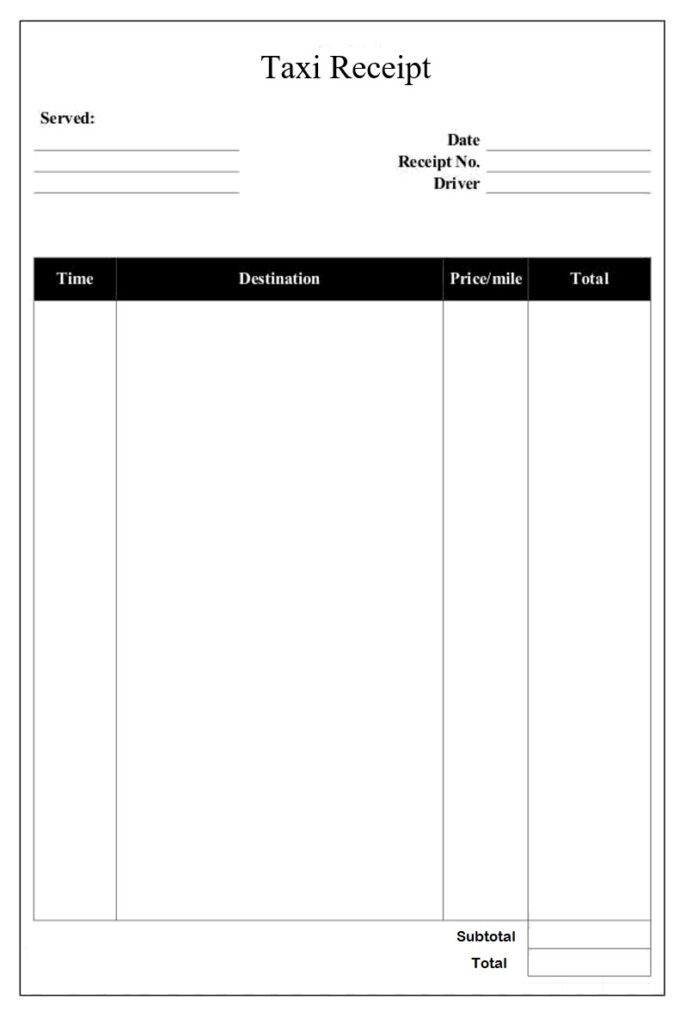

These templates are designed with clarity and functionality in mind, typically including fields for essential information such as the date, time, fare amount, driver details, and passenger information. Their adaptable nature means they can be customized to fit specific organizational requirements or personal preferences, providing a flexible solution for a diverse range of users. The shift towards digital record-keeping further enhances their utility, allowing for easy storage, retrieval, and integration with modern accounting software.

Ultimately, embracing the use of a blank taxi receipt template is a proactive step towards superior financial organization. It transforms a potential point of frustration—missing or inadequate receipts—into an opportunity for structured, compliant, and efficient expense management. This article will delve into what these templates entail, who stands to benefit most, how to use them effectively, and the critical considerations for their legal and tax implications.

A blank taxi receipt template is a pre-designed document, either digital or printable, that provides a standardized format for recording details of a taxi transaction. It serves as a placeholder for information typically found on an official taxi receipt issued by a driver or taxi company. The primary purpose of such a template is to allow users to generate a professional-looking and comprehensive receipt when an original is unavailable, lost, or insufficient for their accounting or reimbursement needs.

These templates are structured to capture all pertinent data required for financial reconciliation. They act as a critical piece of documentation for individuals and businesses alike, ensuring that every expense, no matter how small, is properly accounted for. The beauty of a template lies in its consistency; once adopted, it ensures that all taxi-related expenses are documented in a uniform manner, simplifying the process of auditing and reporting.

While specific designs may vary, a robust blank taxi receipt template typically includes several core fields to ensure completeness and validity. These essential elements contribute to the receipt’s credibility and usefulness for financial purposes:

The choice between a digital and physical blank taxi receipt template often depends on individual preference and the nature of expense management. Digital templates (e.g., in Word, Excel, PDF, or integrated software) offer immense flexibility. They can be easily edited, saved, duplicated, and shared electronically, supporting paperless workflows and reducing physical clutter. They are also readily accessible from various devices, making on-the-go generation simple. Physical templates, typically printed forms, are useful for those who prefer tangible records or when immediate on-site completion is necessary without access to digital tools. Many users opt for a hybrid approach, using digital templates to print out physical copies as needed.

The utility of a Blank Taxi Receipt Template spans a wide array of users, each finding unique advantages in its application. From individual travelers to large corporations, the ability to generate a standardized receipt proves invaluable for different aspects of financial management and accountability.

For business travelers, accurate expense reporting is paramount for reimbursement. Lost or illegible taxi receipts can lead to significant delays or even denial of claims. A template provides a reliable backup, allowing them to recreate lost documentation quickly and professionally, ensuring timely reimbursement for their out-of-pocket expenses. It simplifies the often-cumbersome process of compiling expense reports at the end of a trip.

Freelancers, independent contractors, and other self-employed individuals need meticulous records for tax purposes. Taxi fares often qualify as legitimate business expenses, deductible against income. A blank taxi receipt template helps these professionals accurately track and categorize transportation costs, which is crucial for maximizing tax deductions and minimizing tax liabilities. It offers a structured way to maintain an audit trail, proving the legitimacy of each expense.

Small businesses, especially those without sophisticated expense management systems, can greatly benefit from standardized receipt templates. They can use them to issue receipts to clients or employees, or for internal expense tracking. This ensures consistency in financial documentation, aids in budget monitoring, and simplifies the process of preparing for tax season or financial audits. It also projects a professional image when providing receipts for services rendered.

Beyond business applications, individuals can use these templates for personal financial management. Tracking significant personal expenses, such as medical transport or travel costs, can be vital for budgeting or insurance claims. A blank taxi receipt template provides a formal method for recording these expenditures, aiding in a clearer understanding of personal cash flow and serving as backup documentation for various personal needs.

Accountants and bookkeepers often deal with incomplete or missing documentation from their clients. A blank taxi receipt template can be a lifeline in such situations, allowing them to help clients reconstruct expense records with greater accuracy. While not a substitute for original receipts, a well-filled template, corroborated by other evidence (like bank statements or travel itineraries), can significantly improve the quality of financial records during tax preparation or audits.

Using a Blank Taxi Receipt Template effectively involves more than just filling in the blanks; it requires attention to detail, consistency, and a clear understanding of its purpose within your financial ecosystem. Proper usage ensures that the generated receipts are credible and useful for their intended function, whether it’s for reimbursement, tax deduction, or personal record-keeping.

Finding or creating a reliable Blank Taxi Receipt Template is a straightforward process, thanks to the abundance of online resources and the flexibility of common office software. The method you choose will often depend on your technical comfort, the specific features you need, and whether you prefer a ready-made solution or a custom-designed one.

The internet is a treasure trove of free and paid templates designed for various purposes, including taxi receipts.

When downloading from online sources, always ensure the website is reputable to avoid malware or templates that are poorly designed or lack essential fields. Look for templates that clearly outline all the necessary components of a valid receipt.

For those who prefer a personalized touch or have specific branding requirements, creating a custom template using common office software is an excellent option.

When designing your own, remember to include all the essential elements mentioned earlier. Prioritize clarity, ease of use, and a professional appearance. Custom templates allow you to incorporate your business’s branding, contact information, and specific legal disclaimers if needed, making them perfectly tailored to your unique requirements.

While a Blank Taxi Receipt Template is a powerful tool for expense management, it’s crucial to understand its legal and tax implications. These templates are intended to document expenses, but they must be used responsibly and accurately to avoid issues with audits, reimbursements, or tax deductions. The key lies in ensuring the information provided is truthful and justifiable.

The primary concern when using a self-generated receipt is its validity in the eyes of an auditor, an employer, or tax authorities. Here are critical points for ensuring compliance:

Avoiding common pitfalls is essential for safeguarding the integrity of your financial records when utilizing a blank taxi receipt template:

By adhering to these guidelines, users can maximize the utility of a blank taxi receipt template while minimizing potential legal or financial complications. It serves as a valuable record, but its strength lies in the accuracy and integrity of the information it contains.

While a basic Blank Taxi Receipt Template fulfills the primary need for expense documentation, there are several advanced strategies and integrations that can elevate its utility, streamlining your financial processes even further. These tips leverage technology and best practices to make your receipt management more efficient and robust.

Modern accounting and expense management software are designed to handle financial data seamlessly. Integrating your generated taxi receipts into these systems can save significant time and reduce manual entry errors.

Optical Character Recognition (OCR) technology can transform your blank taxi receipt templates from static documents into searchable and data-extractable assets.

The rise of smartphones has brought forth a new generation of tools that can enhance your receipt management, even for self-generated taxi receipts.

By embracing these advanced tips, your use of a blank taxi receipt template moves beyond simple record-keeping to become an integral part of a sophisticated and efficient financial management system. This not only saves time but also significantly improves the accuracy and accessibility of your expense data, contributing to better financial health and audit readiness.

The need for precise and comprehensive financial documentation is a constant in both personal and professional spheres. While modern transportation often provides digital solutions, the classic taxi ride can still leave gaps in record-keeping, whether due to lost slips, illegible print, or insufficient detail. This is precisely where the Blank Taxi Receipt Template emerges as an invaluable asset, transforming potential administrative headaches into opportunities for structured and efficient expense management.

Throughout this article, we’ve explored the multifaceted benefits of employing such templates. They serve as a reliable fallback for lost original receipts, a standardized tool for consistent record-keeping, and a crucial aid for ensuring compliance with tax regulations and company policies. From business travelers seeking seamless reimbursements to freelancers optimizing tax deductions, and from small businesses maintaining meticulous records to individuals budgeting personal finances, the utility of a well-designed template is undeniable.

We’ve delved into the essential components that make a receipt credible, provided practical steps for effective usage, and outlined where to find or design templates that suit specific needs. Critically, we emphasized the paramount importance of accuracy and truthfulness in filling out these templates, reinforcing that supporting evidence significantly strengthens their validity in the eyes of auditors and financial authorities. Finally, advanced tips on integration with accounting software, leveraging OCR, and utilizing mobile apps highlight how these templates can be part of a sophisticated, modern expense management system.

In an increasingly digital world, the Blank Taxi Receipt Template remains a testament to the enduring value of clear, organized, and verifiable financial documentation. By embracing its use thoughtfully and responsibly, individuals and businesses can achieve greater control over their expenses, simplify their financial processes, and navigate the complexities of accounting with confidence and clarity.