Expense reporting is a critical process for businesses of all sizes, allowing for accurate tracking of spending and improved financial control. A well-structured expense report template can significantly streamline this process, ensuring compliance with company policies and providing valuable insights for budgeting and analysis. Expense Report Template Excel 2010 is a versatile tool that can be customized to meet specific organizational needs. This article will guide you through creating and utilizing an effective expense report template in Microsoft Excel 2010, covering essential features and best practices. We’ll explore how to input data, categorize expenses, generate reports, and ensure data accuracy. Understanding the core functionalities of this template is vital for anyone responsible for managing and reporting on business expenditures. Let’s dive in!

Effective expense reporting isn’t just about collecting receipts; it’s about establishing a clear and transparent record of all business-related expenses. Poorly managed expenses can lead to inaccurate financial statements, potential audits, and difficulties in justifying budgets. A robust expense report template provides a centralized location for all expenses, making it easier to track spending, identify trends, and make informed decisions. Furthermore, it facilitates compliance with tax regulations and internal policies. The ability to generate reports quickly and accurately is a significant advantage for both individuals and organizations. The process of creating and maintaining a consistent expense report is a cornerstone of good financial management.

At the heart of an effective expense report template lies a well-defined structure. Here’s a breakdown of the key features you’ll find in most standard templates:

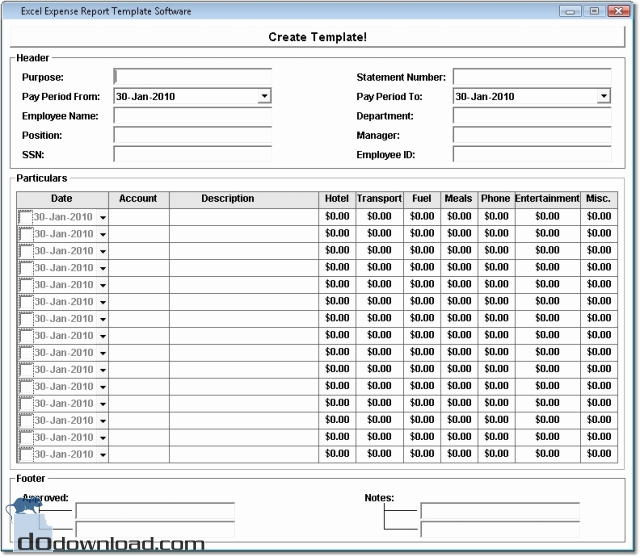

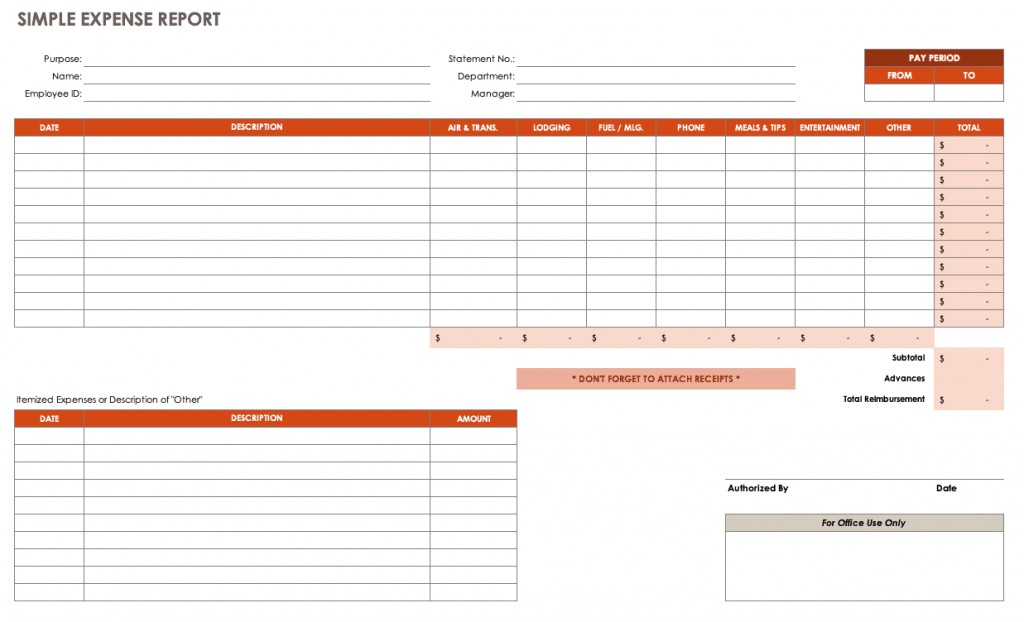

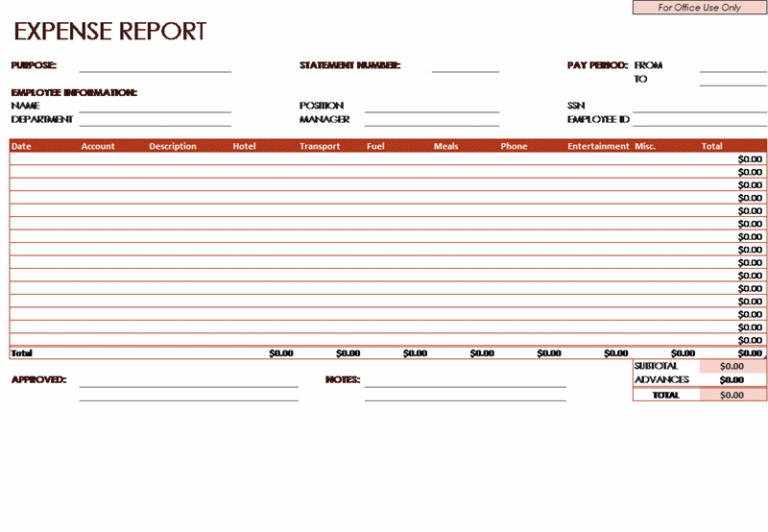

Let’s examine some of the key sections within a typical expense report template, emphasizing the use of the keyword Expense Report Template Excel 2010:

The initial entry point is the expense entry form. This is where you meticulously document each expenditure. It’s vital to be accurate and detailed here. Don’t just write “Lunch.” Instead, specify “Lunch with Client John Smith at The Italian Place – $25.00, Credit Card.” The more information you provide, the easier it will be to analyze spending patterns. Consider using dropdown menus for common categories to streamline data entry. The template should also include a field for a brief description of the expense, which can be helpful for future reference. This field is particularly useful for complex or unusual expenses.

Effective expense categorization is paramount for effective reporting. The template should offer a range of pre-defined categories, but also allow for the creation of custom categories to suit specific business needs. The use of the keyword “Expense Report Template Excel 2010” is directly relevant here. For example, a company might create a custom category called “Client Appreciation Events” to track expenses related to client gifts and celebrations. Regularly reviewing and refining your category structure is crucial for maintaining data accuracy. Consider using a spreadsheet to manage your categories and ensure consistency.

Receipts are essential for verifying expenses and supporting your claims. The template should provide a designated area for attaching receipts. Ideally, it should integrate with a cloud-based document management system (like Google Drive or OneDrive) to ensure secure storage and easy access. The template should also include a field for a brief note describing the receipt, such as the vendor name, date, and amount. This note can be invaluable for auditing purposes. The ability to scan receipts with a mobile device is a significant advantage in today’s fast-paced environment.

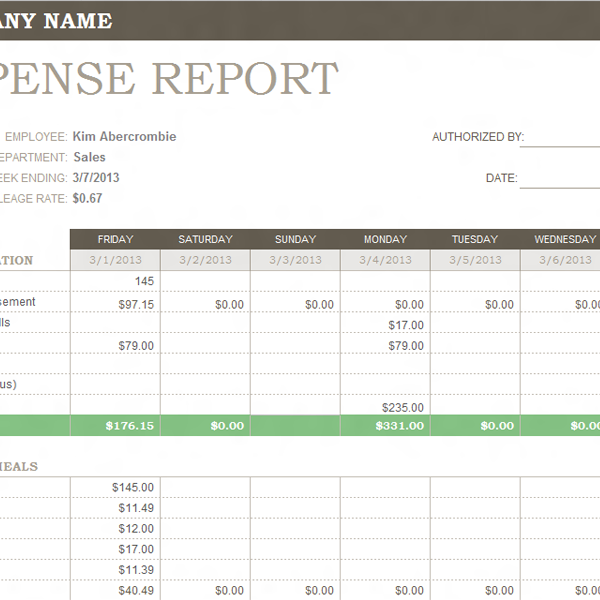

Mileage tracking is increasingly important for businesses that travel frequently. The template should allow for the input of mileage details, including the vehicle used, the destination, and the purpose of the trip. The keyword “Expense Report Template Excel 2010” is directly relevant to this section. The template should also allow for the calculation of mileage reimbursement based on standard mileage rates. Consider using a mileage tracking app to simplify the process. Ensure that all mileage entries are properly documented and verified.

Once you’ve entered your expenses, the template should offer a range of reporting options. The use of the keyword “Expense Report Template Excel 2010” is directly relevant to the reporting capabilities. You can generate summary reports to see total expenses by category, date range, or payment method. You can also create more detailed reports that drill down into specific transactions. The template should also allow you to export your data in various formats, such as CSV or PDF. Consider using Excel’s built-in charting tools to visualize your spending patterns.

Creating and utilizing a well-structured expense report template in Excel 2010 is a fundamental step towards effective financial management. By implementing the features outlined in this article, you can streamline the expense reporting process, improve accuracy, and gain valuable insights into your business spending. Remember that consistency and attention to detail are key to ensuring the success of your expense reporting program. Investing time in creating a robust template will pay dividends in the long run, contributing to improved financial control and informed decision-making. Don’t underestimate the power of a well-designed expense report – it’s a critical tool for any business striving for financial transparency and efficiency. Continuous improvement and adaptation of your template based on evolving business needs are also essential for maintaining its effectiveness.