Dealing with high credit card debt can feel incredibly overwhelming. The constant pressure to pay off balances and the fear of further interest charges can be debilitating. Fortunately, a well-structured payment plan can provide a clear path towards financial freedom. This article will explore various options for creating and implementing a credit card payment plan, equipping you with the knowledge to take control of your finances and achieve your goals. Credit Card Payment Plan Template is a crucial tool for navigating this challenging situation. Understanding the different strategies and choosing the right approach is key to long-term success. We’ll cover everything from simple budgeting techniques to more complex strategies involving debt consolidation and negotiation. Let’s dive in.

Before we talk about solutions, it’s important to acknowledge why you’re struggling with credit card debt. Often, it’s not simply a matter of not paying on time. It frequently stems from a combination of factors: impulsive spending, lack of budgeting skills, and a general inability to prioritize financial goals. Many people fall into the trap of revolving debt, constantly adding to their balances without a clear plan. Recognizing the underlying causes is the first step towards developing a sustainable solution. Ignoring the problem will only lead to increased interest costs and further financial strain. It’s vital to be honest with yourself about your spending habits and the impact they’re having on your finances.

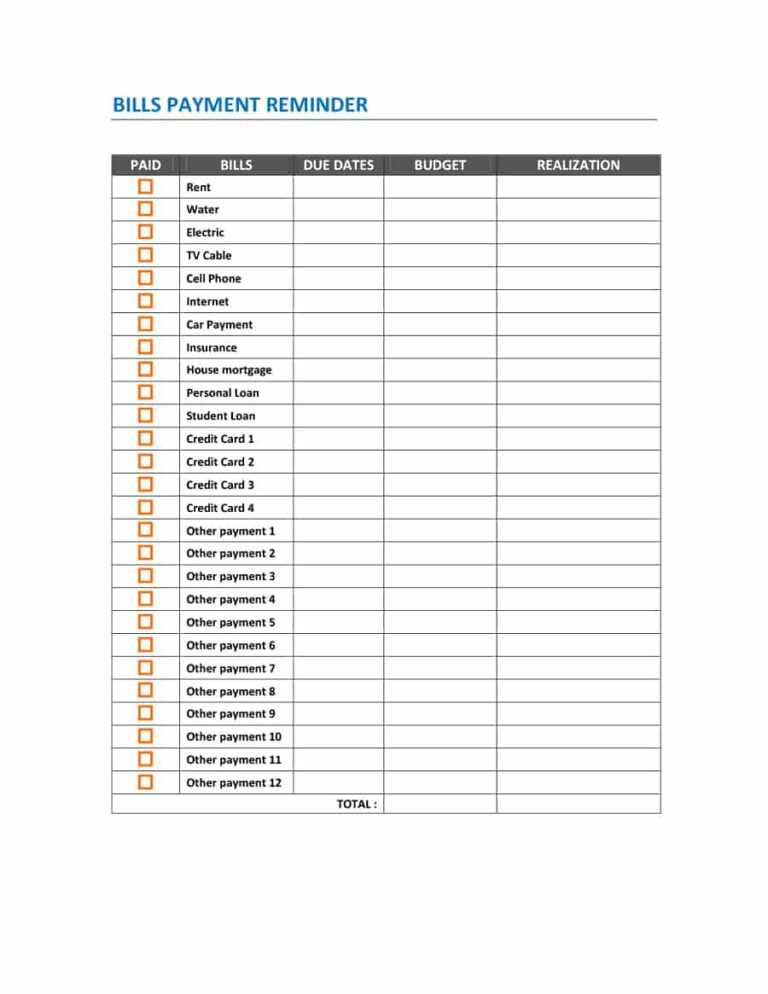

A robust budget is the foundation of any successful debt repayment strategy. It’s not just about tracking income and expenses; it’s about understanding where your money is going and identifying areas where you can cut back. You need to know exactly how much you’re earning and how much you’re spending. There are numerous budgeting apps and tools available, ranging from simple spreadsheets to more sophisticated software. The key is to find a method that works for you and to consistently track your spending. Categorizing your expenses – housing, transportation, food, entertainment – allows you to identify areas where you can realistically reduce spending. Consider the 50/30/20 rule as a starting point: 50% of your income should go towards needs (housing, food, utilities), 30% towards wants (entertainment, dining out), and 20% towards savings and debt repayment.

Once you have a budget, you can start exploring different strategies for tackling your credit card debt. Here are a few popular options:

The Debt Snowball method focuses on eliminating debt by tackling the smallest balance first. This method is psychologically rewarding because you see quick wins, which can be highly motivating. You list your debts from smallest to largest, regardless of interest rate. Then, you make minimum payments on all debts except the smallest, which you aggressively pay off. Once the smallest debt is eliminated, you move on to the next smallest, and so on. The momentum of eliminating debts can be incredibly powerful.

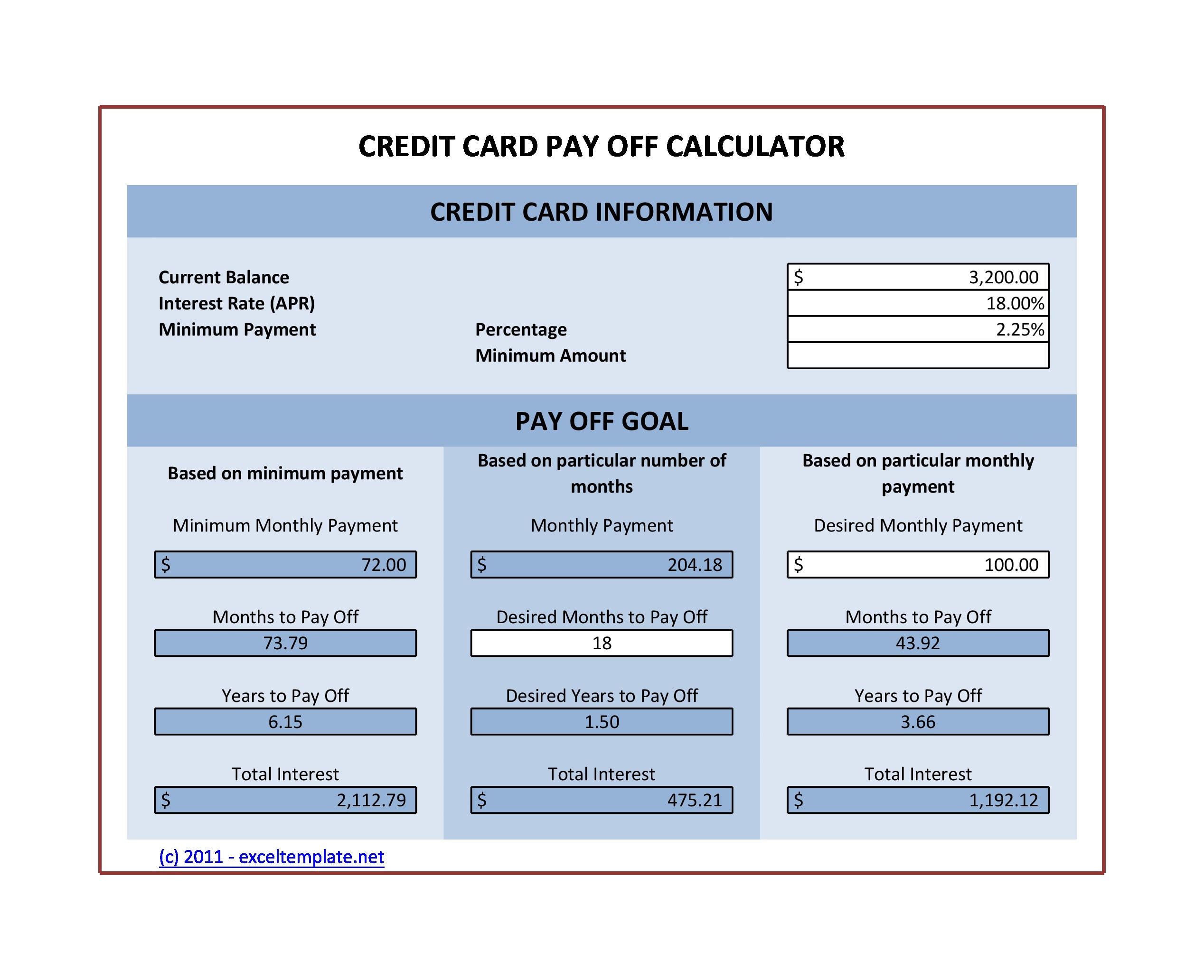

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first. This strategy saves you the most money in the long run by minimizing the overall interest you pay. You list your debts from highest to lowest interest rate, and you make minimum payments on all other debts. Once the highest-interest debt is paid off, you move on to the next highest, and so on. This method is mathematically efficient, but it can be more mentally challenging initially.

Consider a balance transfer to a credit card with a 0% introductory APR. This can be a fantastic way to save money on interest charges, allowing you to pay down your balances faster. However, be aware of balance transfer fees (typically 3-5% of the transferred amount) and make sure you can pay off the balance before the introductory period ends. Carefully review the terms and conditions of the new card before transferring any funds.

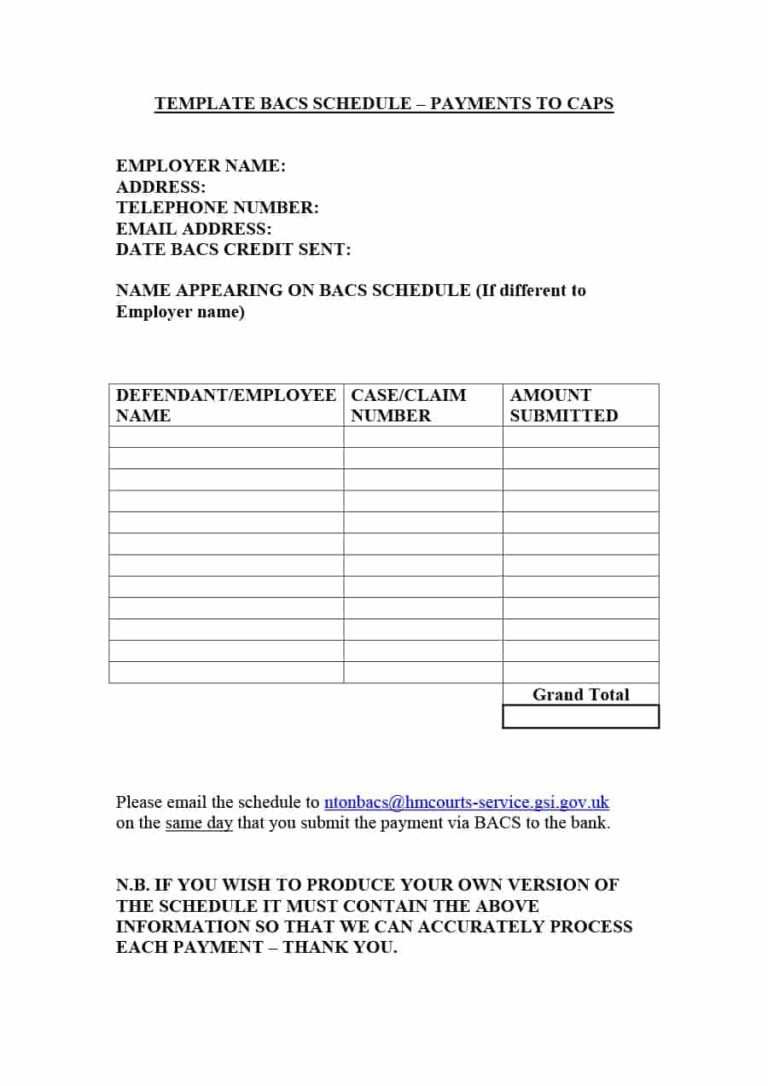

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially lower your overall interest costs. You’ll need to qualify for a new loan with a lower interest rate, and you’ll need to be disciplined about making payments on the new loan. Shop around for the best rates and terms before consolidating your debt.

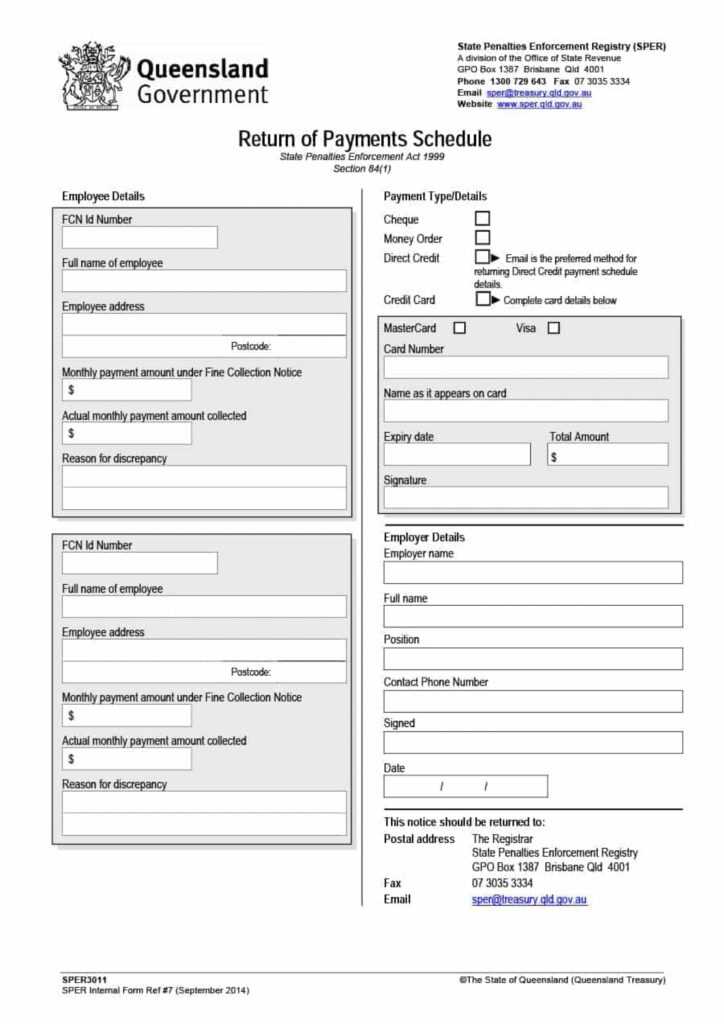

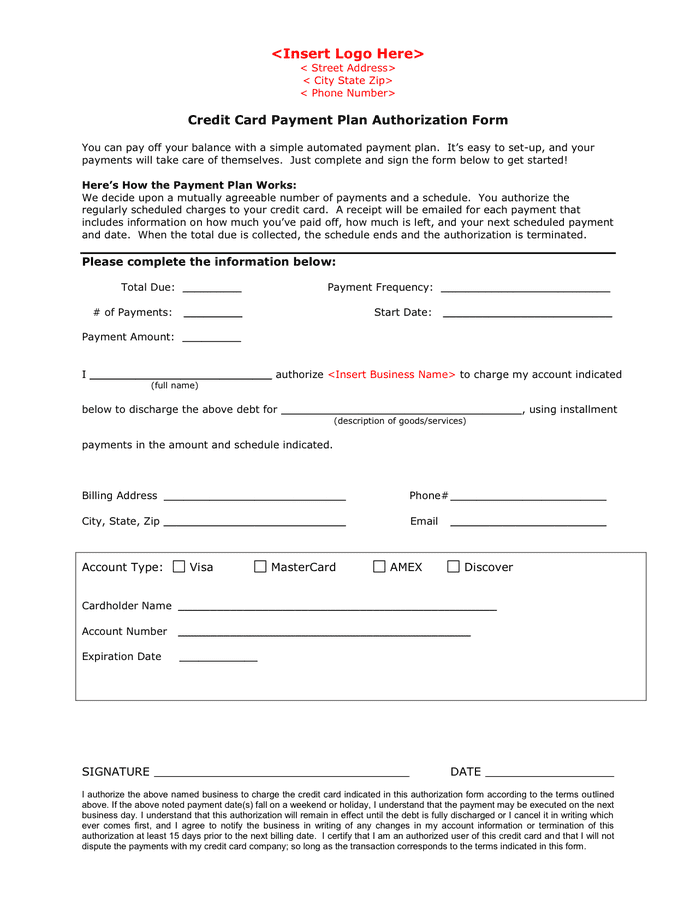

Don’t be afraid to contact your credit card companies and negotiate a lower interest rate or a payment plan. Explain your situation and demonstrate your commitment to repayment. Many companies are willing to work with borrowers who are struggling to make payments. Be polite and professional, and clearly outline your repayment plan.

Once you’ve established a basic payment plan, you can explore more advanced strategies to accelerate your debt repayment:

A DMP is a formal agreement with a credit counseling agency that can help you create a customized repayment plan. These agencies work with you to negotiate with your creditors and potentially lower your interest rates. However, be aware that a DMP can negatively impact your credit score if not managed carefully.

Debt settlement involves negotiating with your creditors to pay a lump sum that is less than the full amount owed. This can significantly reduce your debt, but it can also damage your credit score and may have tax implications. It’s crucial to understand the risks involved before pursuing debt settlement.

Refinancing your debt can be beneficial if you can secure a lower interest rate than your current credit card payments. This can save you money over the long term, but it’s important to compare offers from multiple lenders.

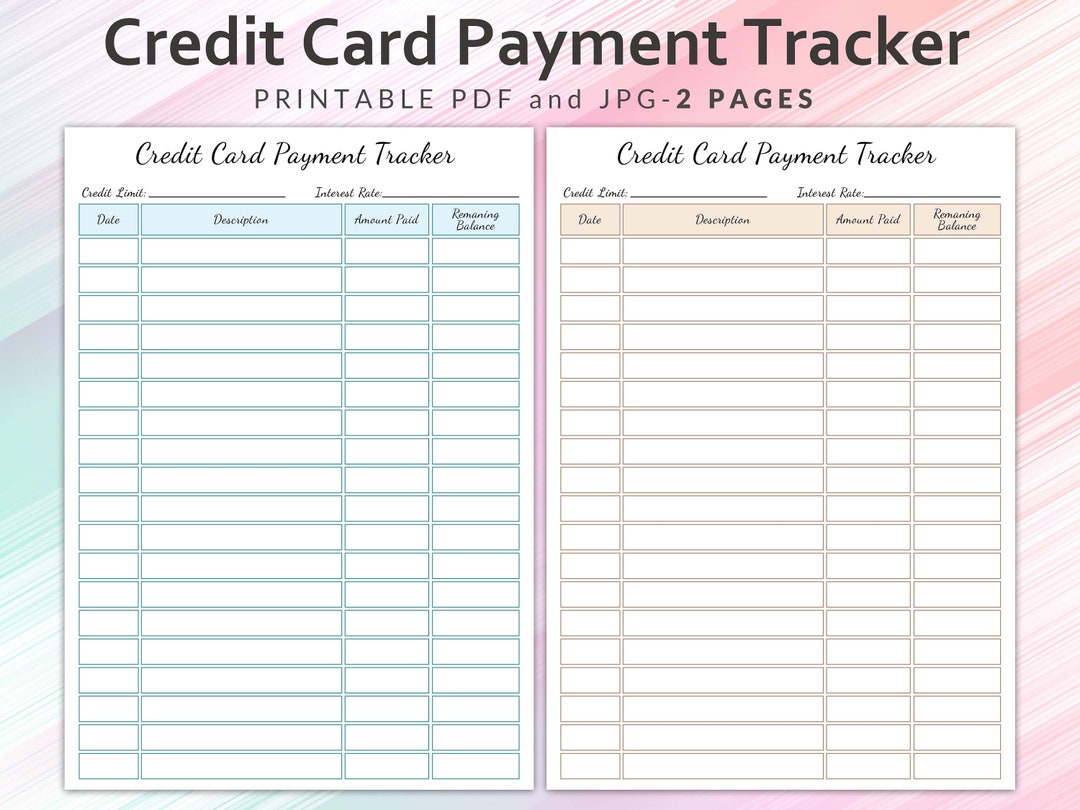

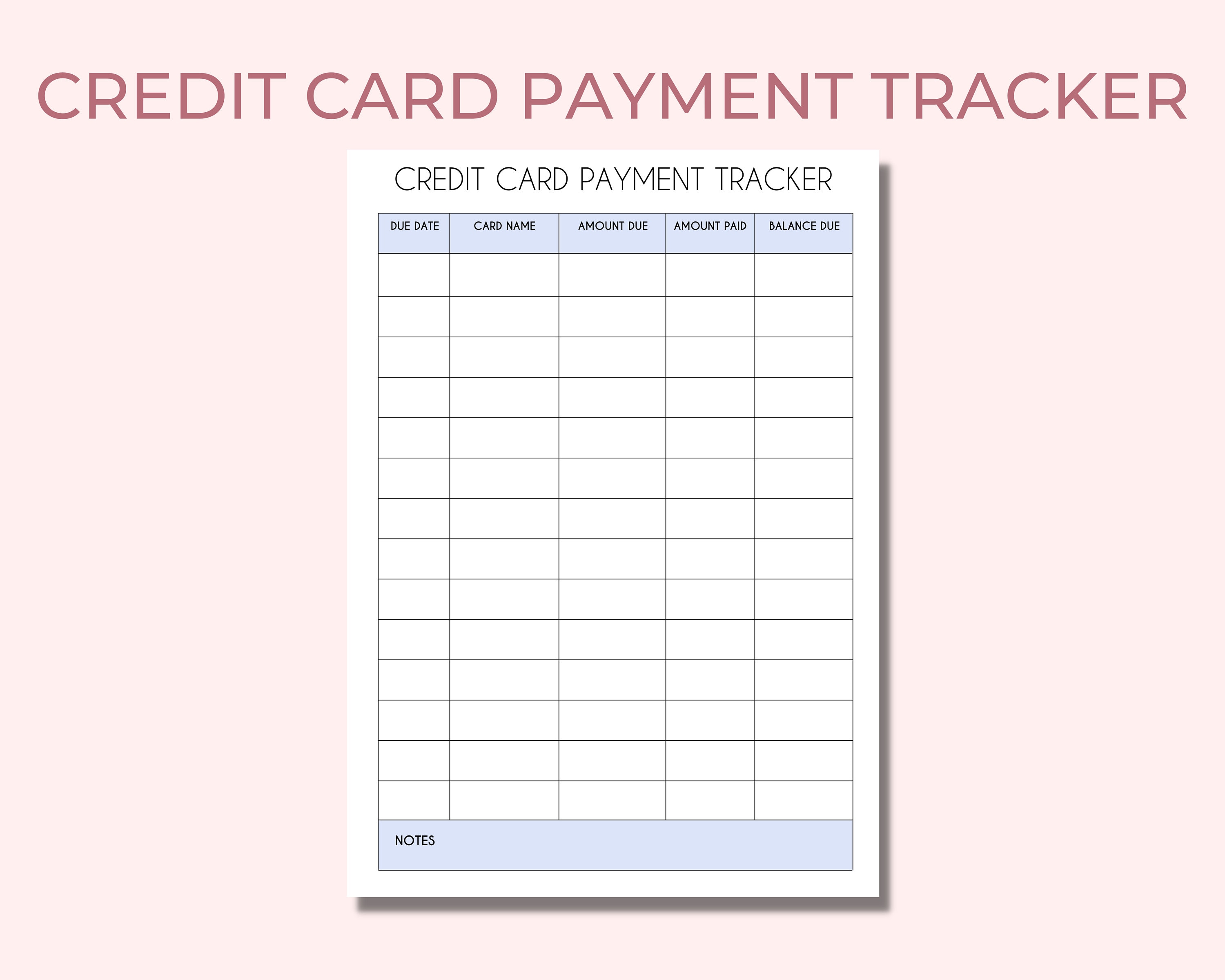

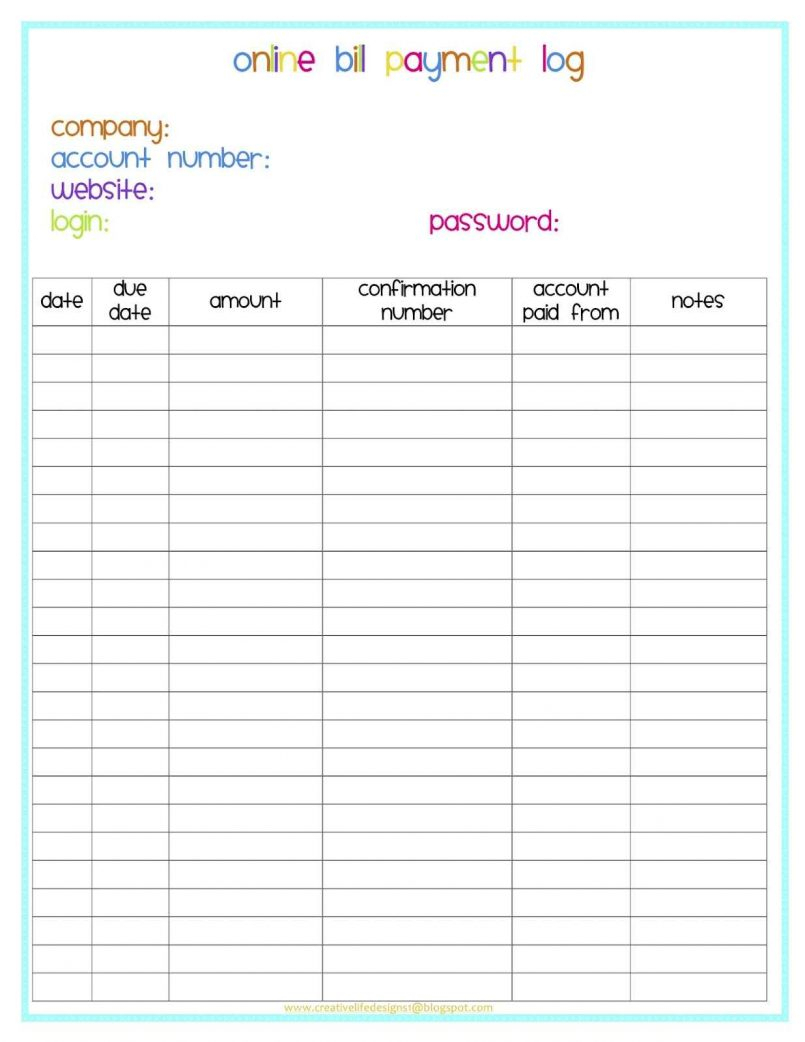

Monitoring your progress is essential for staying motivated and on track. Use a spreadsheet, budgeting app, or debt tracking tool to track your balances, interest charges, and payment amounts. Celebrate your milestones along the way – even small victories deserve recognition. Regularly review your budget and payment plan to ensure it’s still aligned with your goals. Don’t get discouraged by setbacks; simply adjust your plan as needed. Consistency is key to achieving long-term financial success.

Credit card debt can be a significant challenge, but it’s not insurmountable. By understanding the root causes of your debt, implementing a strategic payment plan, and utilizing various advanced strategies, you can regain control of your finances and move towards a brighter financial future. Remember, Credit Card Payment Plan Template is a valuable tool, but it’s only effective when combined with discipline, commitment, and a realistic understanding of your financial situation. Taking proactive steps now will pay dividends in the long run. Focus on building a sustainable financial foundation, and you’ll be well on your way to achieving your goals. Don’t hesitate to seek professional financial advice if you need assistance navigating complex debt situations.