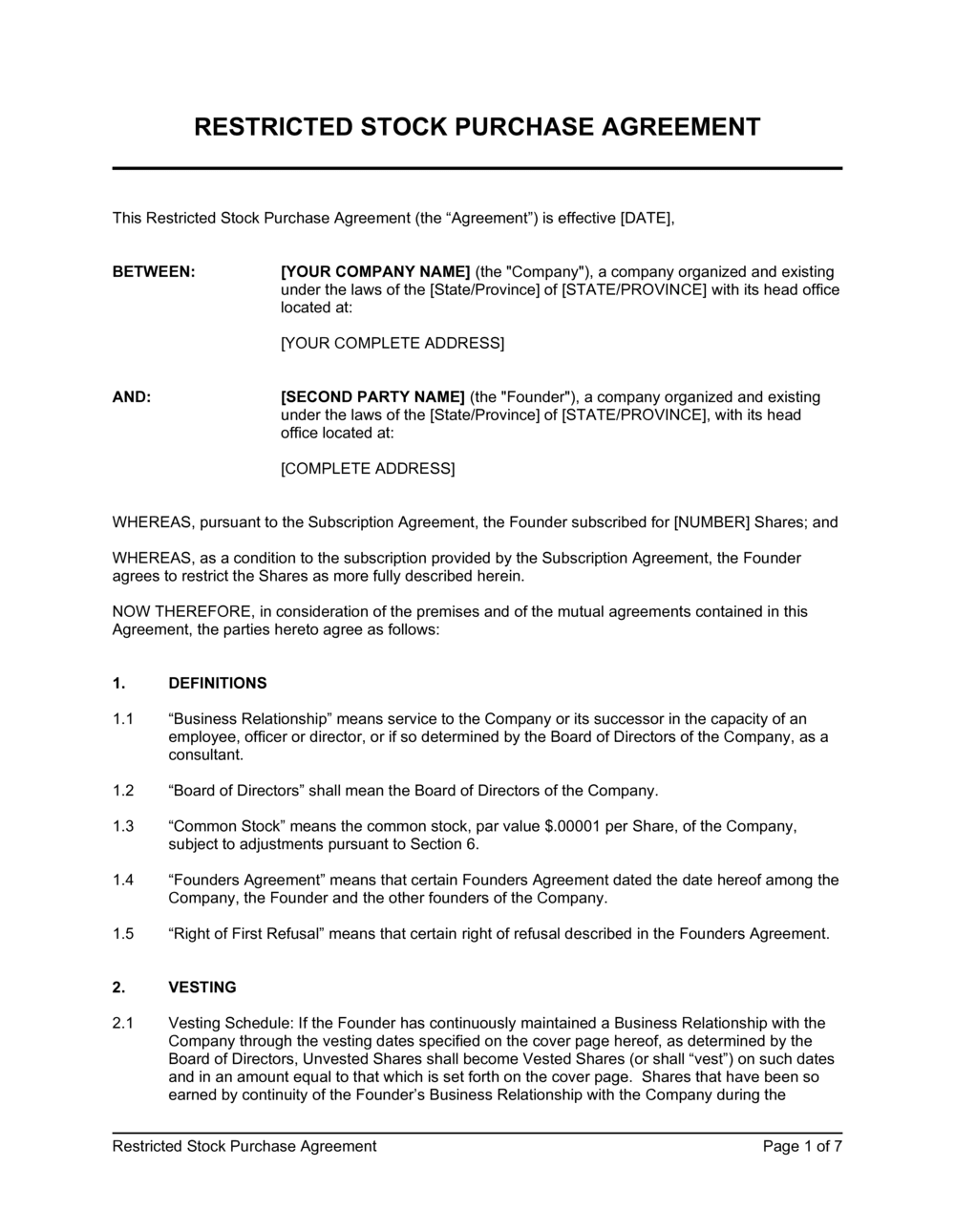

The Restricted Stock Purchase Agreement (RSPA) is a complex legal document that allows a company to purchase its own shares of stock. It’s a powerful tool for incentivizing employees and aligning their interests with the company’s success. Understanding the nuances of an RSPA is crucial for both employers and employees. This guide provides a comprehensive overview of the key elements and considerations involved in drafting and reviewing an RSPA. At the heart of this agreement lies the Restricted Stock Purchase Agreement Template, a foundational document that dictates the terms of the purchase. This template serves as a starting point, and careful customization is essential to ensure the agreement meets the specific needs of the company and its employees. A well-crafted RSPA can significantly impact employee motivation, retention, and overall company performance. It’s more than just a transfer of stock; it’s a strategic tool for fostering a productive and engaged workforce. This article will delve into the core components of an RSPA, offering practical guidance and best practices.

The primary goal of an RSPA is to provide employees with the opportunity to purchase their own shares of the company, often in exchange for a predetermined value. This offers several benefits beyond simply transferring stock. It’s a way to align employee interests with the company’s long-term goals, encouraging them to contribute to the company’s growth and success. Furthermore, it can be a valuable tool for retaining top talent, particularly when compared to other compensation options. The RSPA allows employees to benefit from the company’s future growth, fostering a sense of ownership and commitment. It’s a recognition of their contributions and a tangible reward for their hard work. Without a clearly defined RSPA, employees may feel disconnected from the company’s strategic direction, leading to decreased motivation and potentially higher turnover. The template provides a structured framework for achieving these objectives.

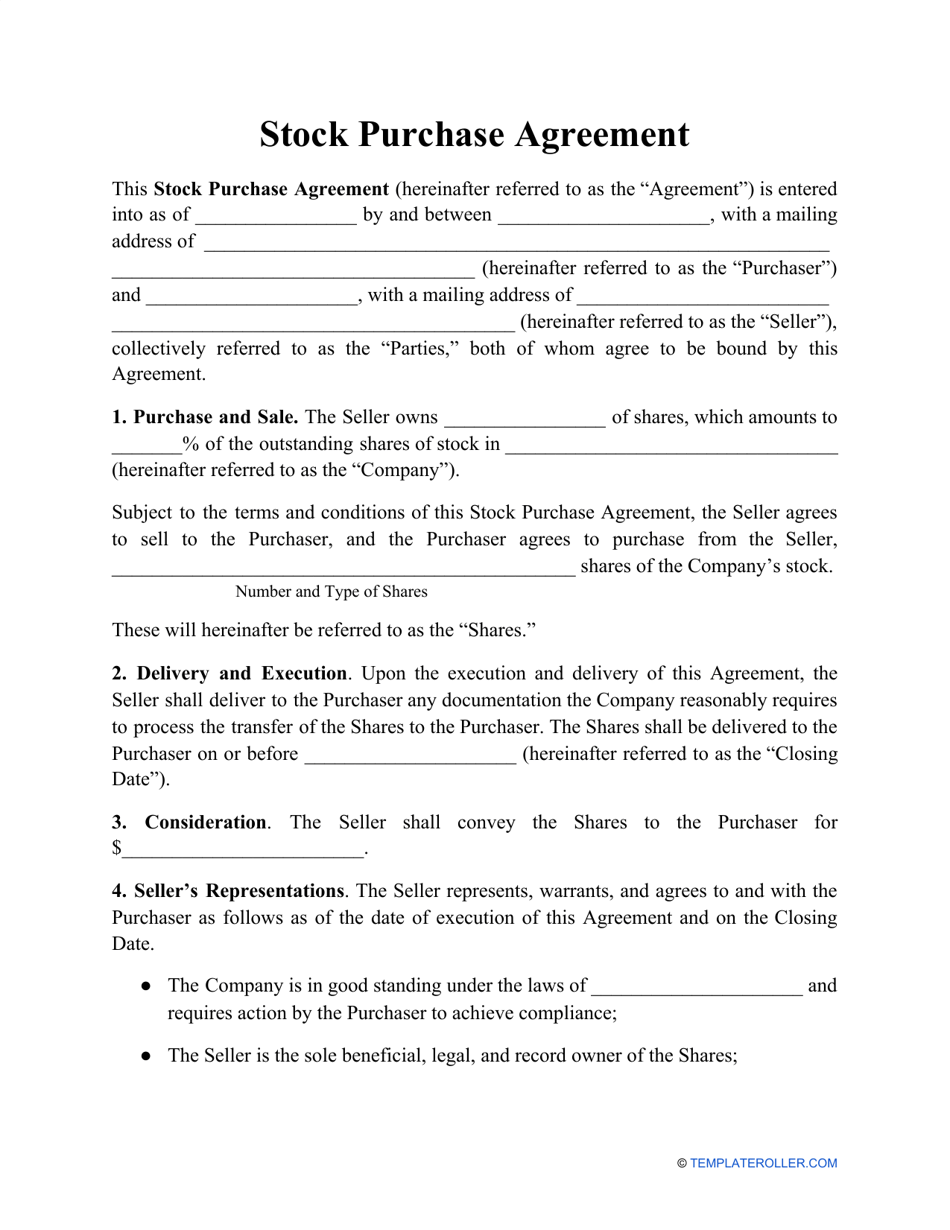

A robust RSPA typically includes several key components. Let’s examine some of the most important elements:

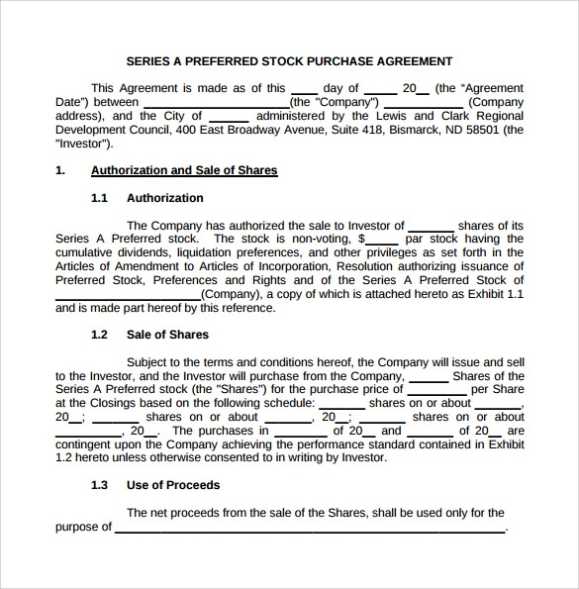

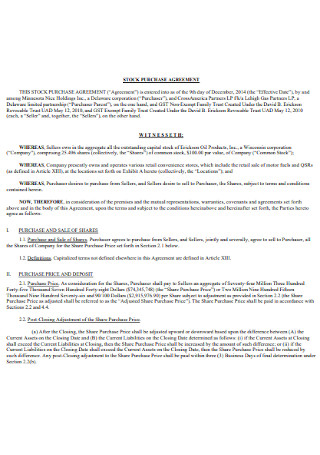

The first and arguably most critical element is the purchase price. This is the amount the company will pay for the employee’s shares. The valuation method used will significantly impact the final price. Common methods include:

It’s crucial to clearly define the valuation method and the basis for determining the purchase price. Any ambiguity here can lead to disputes down the line.

The Restricted Stock Period (RSP) defines the timeframe during which the employee must maintain ownership of the shares. This period typically ranges from 3 to 12 months, but can vary depending on the company’s policies and the employee’s role. During the RSP, the employee is typically required to continue working for the company. During this time, the shares are subject to certain restrictions.

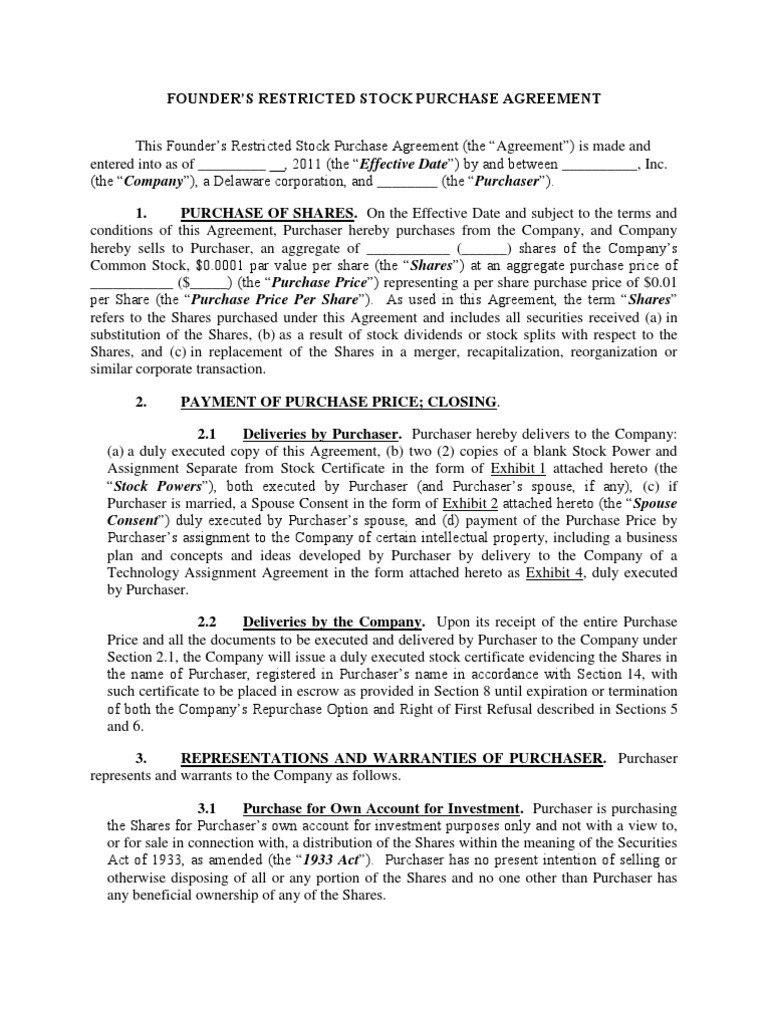

An RSG is a common component of an RSPA. It’s a grant of shares that the employee must hold for a specified period. The RSG specifies the number of shares granted, the vesting schedule (how and when the shares vest), and any conditions that must be met before the shares vest. The vesting schedule is particularly important, as it determines when the employee actually gains ownership of the shares.

The vesting schedule dictates when the employee gains ownership of the shares. Common vesting schedules include:

While RSGs are prevalent, stock options are another common form of incentive. Stock options grant the employee the right to purchase shares at a predetermined price within a specific timeframe. The RSPA will typically specify the terms of both RSGs and stock options.

What happens to the shares if the employee leaves the company? The RSPA should clearly outline the process for terminating the RSPA, including the conditions for termination and the distribution of the shares. This is a critical area to address to avoid potential disputes.

The benefits of an RSPA extend beyond simply transferring stock. They contribute to a more engaged and motivated workforce.

Creating a successful RSPA requires careful planning and attention to detail. Here are some best practices:

The Restricted Stock Purchase Agreement Template is a vital tool for companies seeking to incentivize employees and align their interests with the company’s long-term success. A well-drafted RSPA can significantly impact employee motivation, retention, and overall company performance. By understanding the key components of an RSPA and following best practices, companies can create agreements that are both legally sound and strategically beneficial. The ongoing evolution of employment law necessitates a proactive approach to RSPA drafting and administration. As technology and business practices continue to change, so too must the framework for managing employee incentives. Ultimately, a thoughtfully designed RSPA is an investment in the company’s future.