The dissolution of a partnership agreement is a significant event for any business, regardless of size or industry. It signifies the end of a mutually beneficial relationship and requires careful planning and execution to ensure a smooth transition and minimize potential disputes. A well-drafted dissolution agreement is crucial for protecting the interests of all partners and establishing clear guidelines for the distribution of assets and liabilities. This article will delve into the key aspects of dissolving a partnership agreement, providing a comprehensive overview of the process, essential clauses, and best practices. Understanding these elements is vital for any business owner or partner contemplating the termination of their partnership.

Before examining the dissolution process, it’s important to grasp the fundamental principles underpinning a partnership agreement. These agreements outline the rights, responsibilities, and obligations of each partner. They define the scope of the partnership, the roles and responsibilities of each partner, and the procedures for dissolving the partnership. A robust agreement serves as a roadmap for navigating the transition and mitigating potential conflicts. A poorly drafted agreement can lead to significant legal challenges and costly disputes. It’s recommended to consult with legal counsel to ensure the agreement accurately reflects the intentions of all parties involved. The agreement should address scenarios such as death, disability, retirement, or a change in the business’s direction.

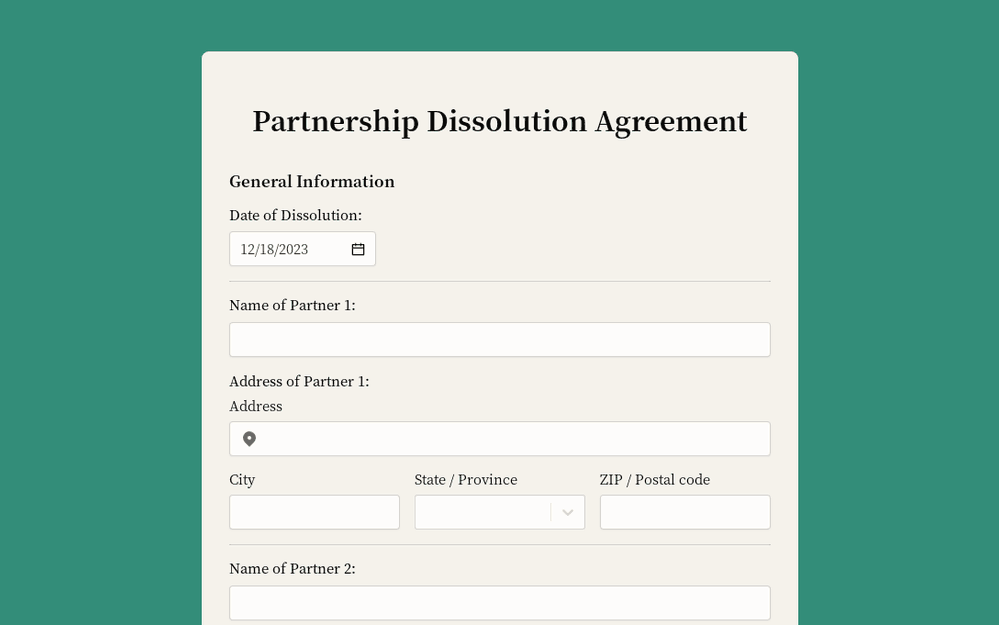

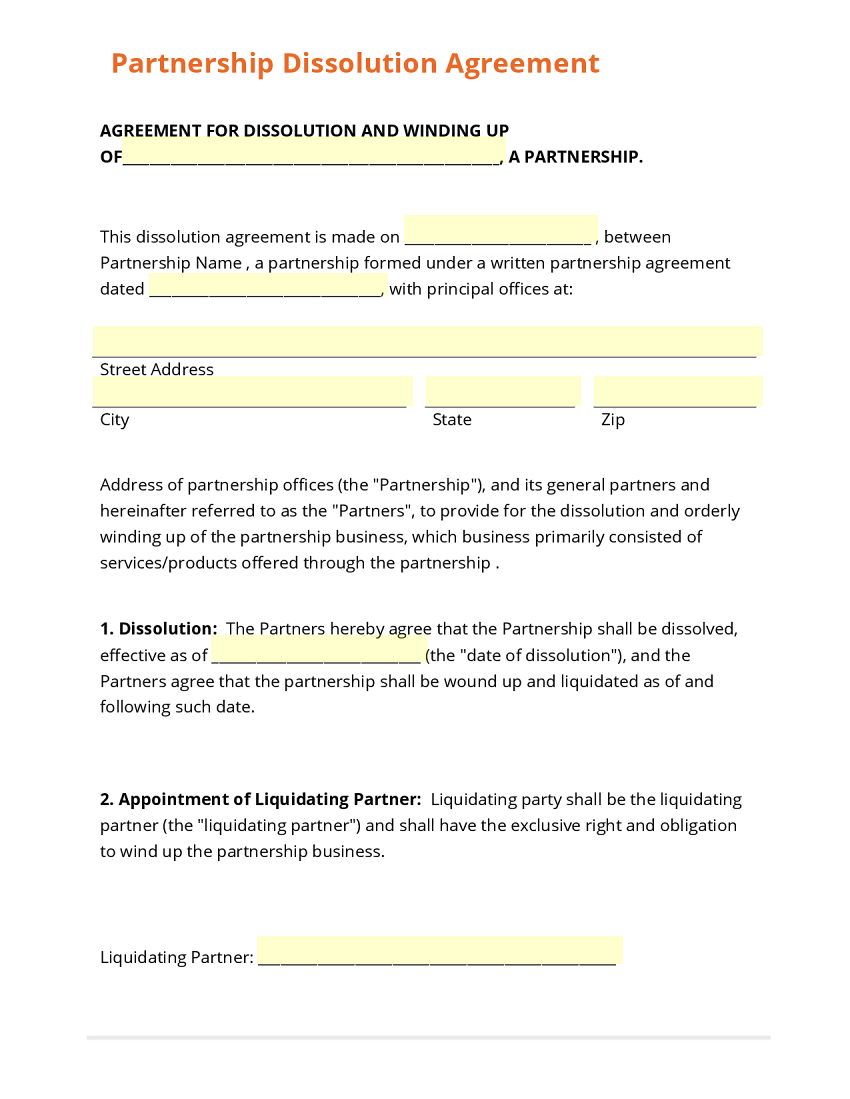

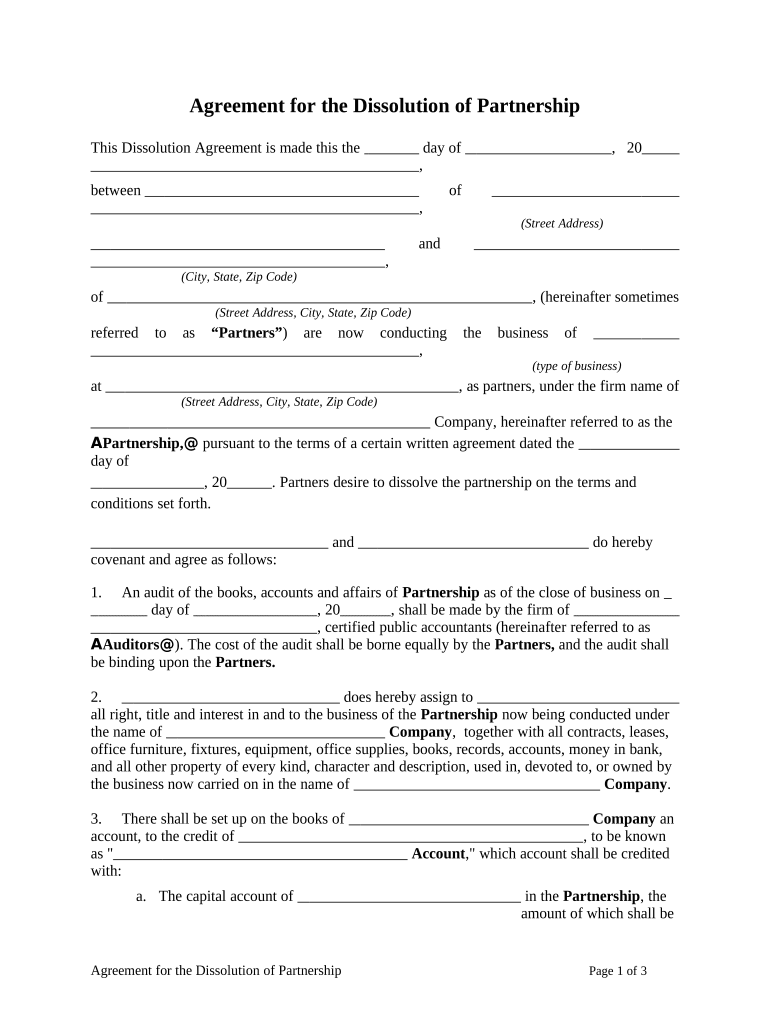

The legal requirements for dissolving a partnership vary depending on the jurisdiction. However, several key elements are generally required. Firstly, the partnership agreement itself must be formally executed and signed by all partners. Secondly, a formal notice must be served on all partners, typically through a registered process server, informing them of the impending dissolution. Thirdly, a formal dissolution meeting (or vote) must be held, where partners can discuss and agree on the terms of dissolution. Finally, the dissolution must be documented in writing, typically through a formal dissolution document. Failure to comply with these requirements can result in legal challenges and potential liabilities. It’s crucial to understand the specific laws governing partnership dissolution in the relevant state or country.

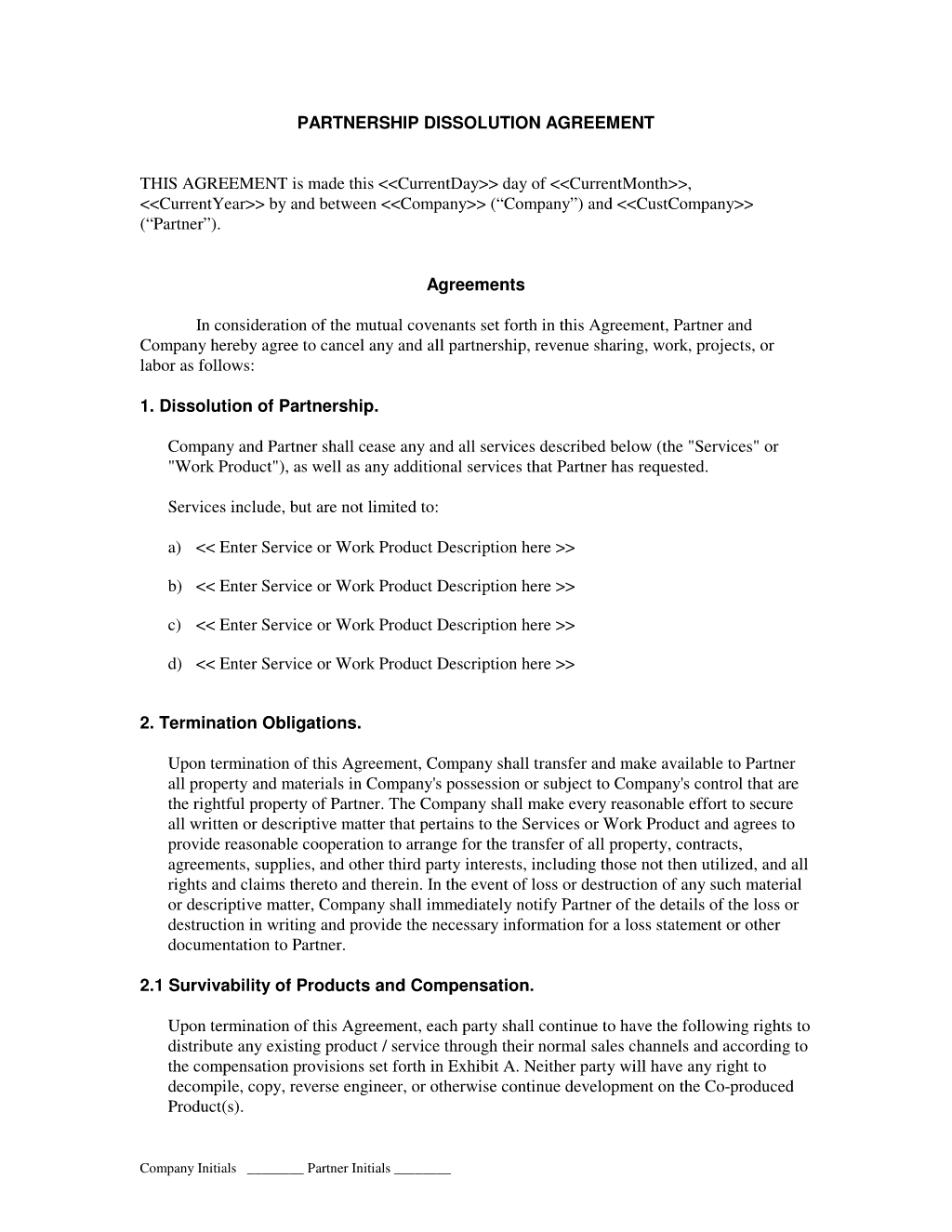

A comprehensive dissolution agreement should include several key clauses designed to protect the interests of all partners. Here are some essential elements:

The dissolution process typically involves the following steps:

Dissolution can have significant tax implications for both the partnership and its partners. It’s crucial to consult with a tax advisor to understand the tax consequences of the dissolution, including potential capital gains taxes and income tax liabilities. The partnership may be required to file a final tax return, and partners may be subject to tax on any distributions they receive. Proper tax planning is essential to minimize tax liabilities during and after the dissolution.

Even after the dissolution is complete, ongoing considerations are important. Maintaining clear communication and a collaborative approach is vital for a smooth transition. Regularly reviewing the partnership agreement and addressing any potential issues proactively can help to prevent disputes and ensure a successful outcome. Consider establishing a process for resolving disagreements before they escalate into formal disputes. Maintaining a professional and respectful relationship with all partners is key to maintaining a positive and productive partnership.

Dissolution of a partnership agreement is a complex but essential process. A well-drafted agreement, coupled with careful planning and execution, can minimize risks and ensure a smooth transition for all involved. Understanding the legal requirements, key clauses, and the dissolution process is paramount for any business owner or partner contemplating the termination of their partnership. By prioritizing clear communication, proactive planning, and legal counsel, partners can navigate this transition successfully and preserve the long-term viability of their business. Remember, a proactive approach to dissolution planning can significantly reduce potential headaches and legal challenges.

This template provides a general overview and should be reviewed and adapted by legal counsel to meet the specific needs of the partnership. It is not a substitute for professional legal advice.