Many small business owners find themselves juggling multiple roles, often including managing their finances. Fortunately, readily available accounting spreadsheet templates for small business can significantly simplify this task. These templates offer a structured way to track income, expenses, and overall financial health, without the need for expensive software or extensive accounting knowledge. They provide a practical, cost-effective solution for maintaining accurate records and making informed business decisions.

Effectively utilizing these templates can transform how a small business manages its finances. From tracking cash flow to generating basic financial reports, the right spreadsheet can empower owners to stay on top of their numbers and gain valuable insights into their business performance. Choosing the appropriate template and understanding how to use it are crucial steps in leveraging this powerful tool. This article will explore the various types of accounting spreadsheets available, guide you in selecting the best option for your needs, and provide tips for maximizing their benefits.

Whether you’re just starting your business or looking for a more streamlined way to manage your finances, exploring the world of accounting spreadsheet templates can be a game-changer. They offer a flexible, customizable solution that can adapt to your specific business requirements and help you achieve your financial goals. The simplicity and accessibility of these templates make them an invaluable resource for any small business owner seeking to gain better control over their finances.

Accounting spreadsheet templates offer a multitude of advantages for small businesses. The most obvious is the cost-effectiveness; many templates are available for free or at a fraction of the cost of dedicated accounting software. This makes them an accessible option for startups and businesses operating on a tight budget.

Another key benefit is their ease of use. Most templates are designed to be user-friendly, with clear instructions and pre-built formulas that automate calculations. This eliminates the need for advanced accounting knowledge and allows business owners to focus on other aspects of their operations. Furthermore, the customizability of spreadsheets allows businesses to tailor them to their specific needs, adding or removing columns and categories as required. This flexibility ensures that the template accurately reflects the business’s unique financial structure.

Finally, using spreadsheets for accounting promotes better financial visibility. By meticulously tracking income and expenses, business owners gain a clearer understanding of their cash flow, profitability, and overall financial health. This improved visibility empowers them to make informed decisions about pricing, budgeting, and investment.

Several types of accounting spreadsheet templates cater to different needs within a small business. Here are some of the most common:

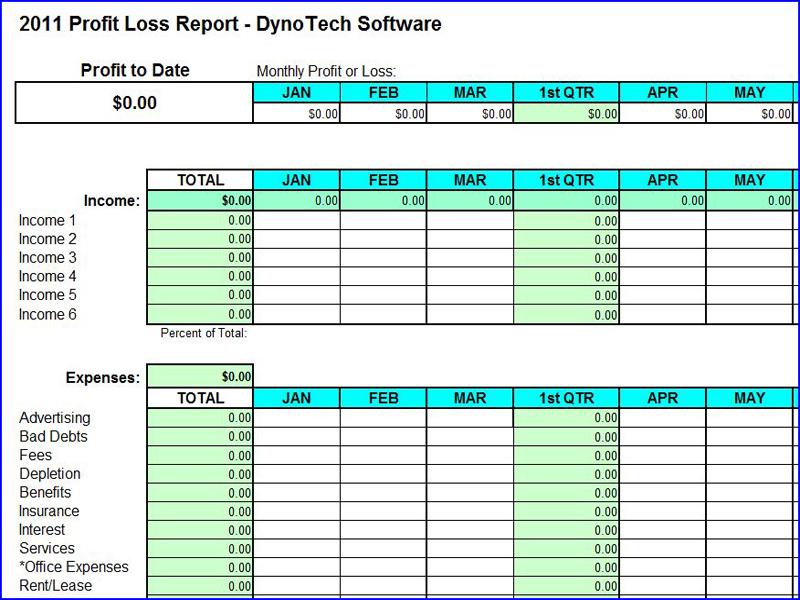

Income Statement Template: This template helps track revenue and expenses over a specific period (e.g., monthly, quarterly, annually) to calculate net profit or loss. It typically includes sections for sales revenue, cost of goods sold, operating expenses, and taxes.

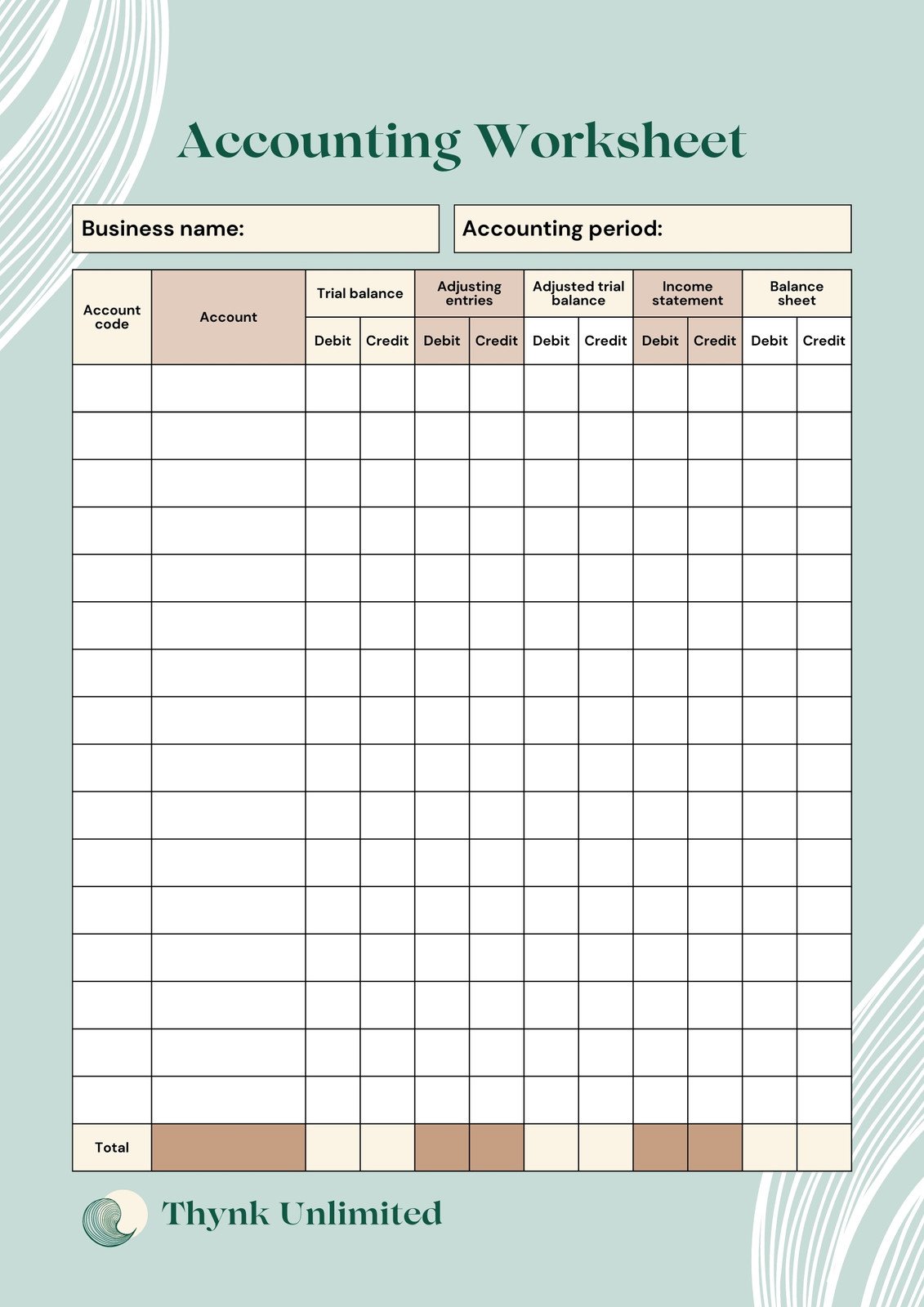

Balance Sheet Template: A balance sheet template provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity.

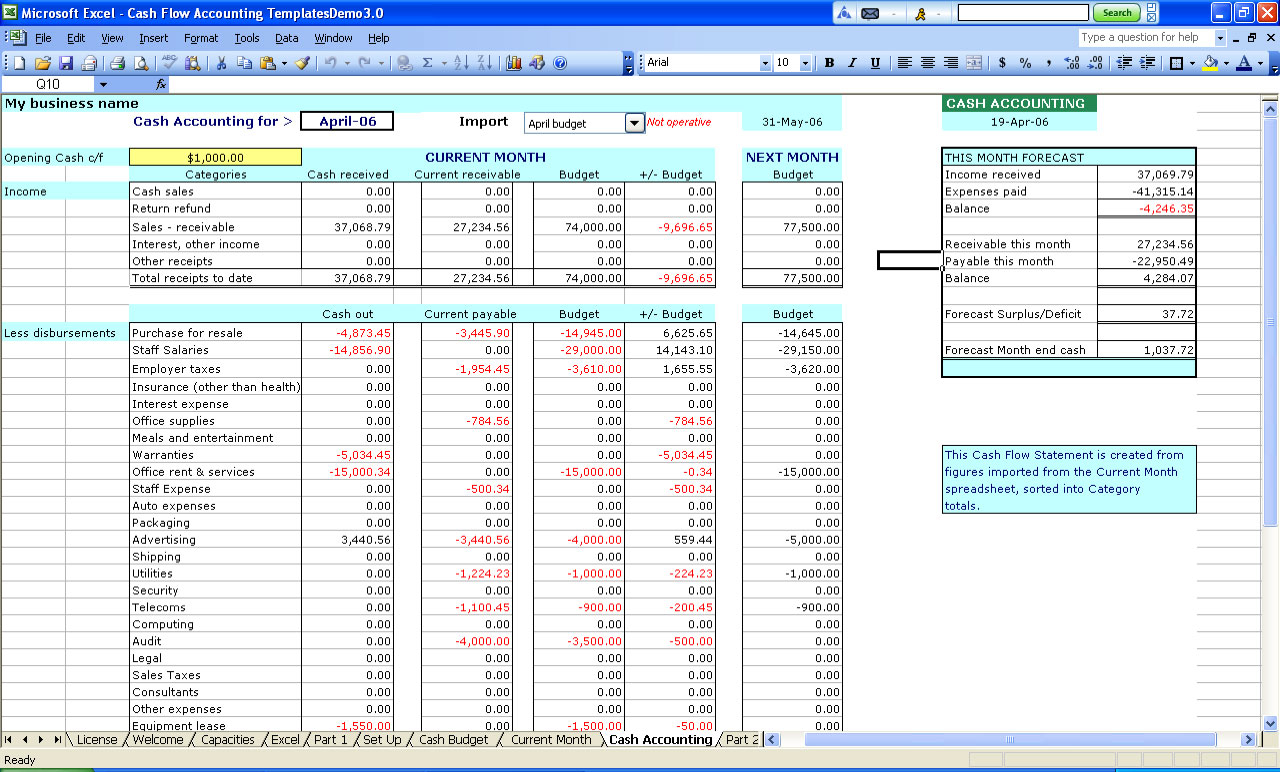

Cash Flow Statement Template: This template tracks the movement of cash both into and out of the business over a period of time. It categorizes cash flows into operating activities, investing activities, and financing activities.

Budgeting Template: Budgeting templates are used to plan and forecast future income and expenses. They can be customized to create monthly, quarterly, or annual budgets and can be compared against actual performance to identify variances.

Invoice Template: While not strictly an accounting template, invoice templates are crucial for tracking sales and managing accounts receivable. They allow businesses to create professional-looking invoices and track payment status.

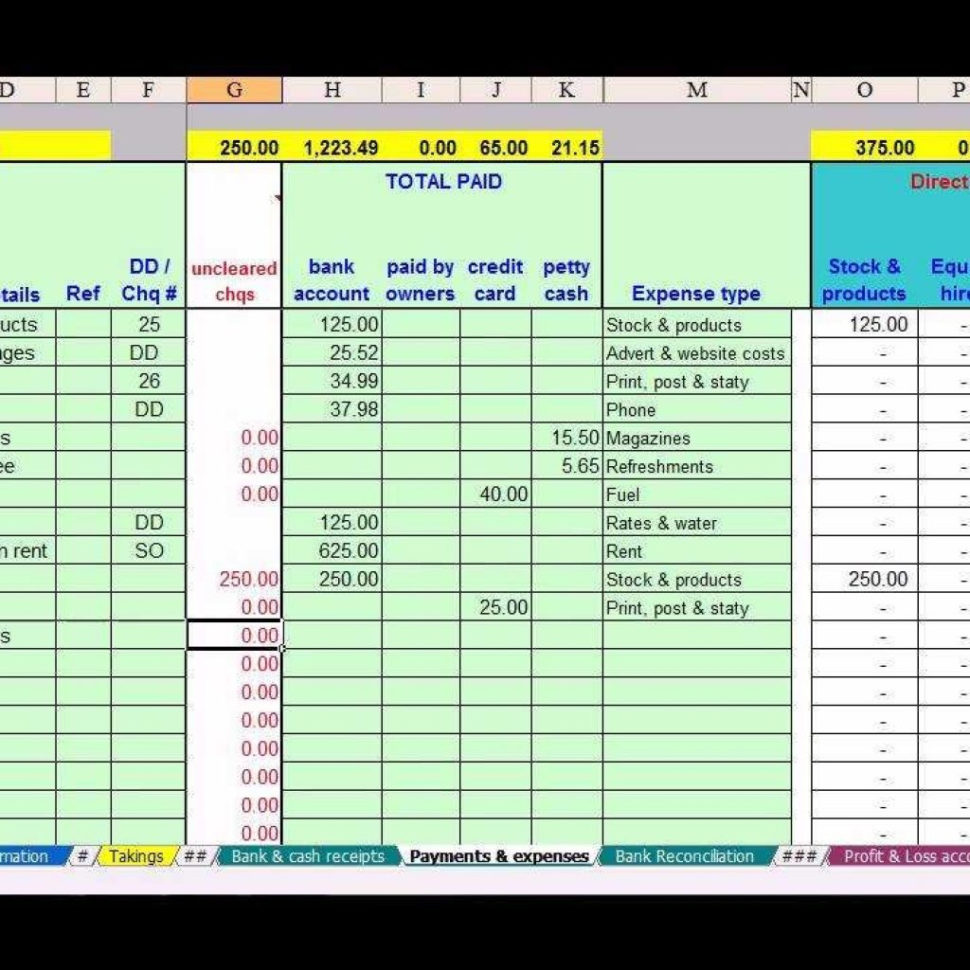

Expense Tracker Template: An expense tracker helps to monitor all business-related expenses, categorizing them for better analysis and tax reporting.

Selecting the right accounting spreadsheet templates for small business is crucial for ensuring accurate and efficient financial management. Consider the following factors when making your choice:

Business Size and Complexity: A small, simple business may only need basic templates for income statements and expense tracking. Larger, more complex businesses may require more comprehensive templates, including balance sheets and cash flow statements.

Specific Accounting Needs: Identify your specific accounting needs. Do you need to track inventory? Manage accounts receivable and payable? Ensure the template you choose addresses these specific requirements.

Ease of Use: Look for templates that are user-friendly and easy to understand. Clear instructions and pre-built formulas can save you time and reduce the risk of errors.

Customizability: Choose a template that can be easily customized to fit your business’s unique needs. You should be able to add or remove columns, change categories, and modify formulas as required.

Integration with Other Tools: Consider whether the template can be integrated with other tools you use, such as your bank account or payment processor. This can automate data entry and reduce manual work.

Cost: While many free templates are available, some premium templates offer more features and support. Consider your budget and the value you’ll receive from a paid template.

Once you’ve chosen the appropriate accounting spreadsheet template, the next step is to set it up and start using it effectively.

Customize the Template: Begin by customizing the template to reflect your business’s specific needs. Add your company name and logo, and adjust the categories and columns to match your chart of accounts.

Input Historical Data: If you’re switching from another accounting system or starting mid-year, input your historical financial data into the template. This will provide a baseline for tracking future performance.

Establish a Routine for Data Entry: Consistency is key to effective spreadsheet accounting. Establish a routine for entering data regularly, such as daily or weekly. This will help you stay on top of your finances and avoid overwhelming data entry tasks.

Use Formulas and Functions: Take advantage of the built-in formulas and functions in the spreadsheet software to automate calculations and generate reports. Learn how to use functions like SUM, AVERAGE, and IF to streamline your work.

Regularly Review and Analyze Data: Don’t just enter data and forget about it. Regularly review and analyze your financial data to identify trends, track performance against budget, and make informed business decisions.

Back Up Your Data: It’s crucial to regularly back up your spreadsheet data to prevent data loss. Store your backups in a secure location, such as a cloud storage service or an external hard drive.

To get the most out of your accounting spreadsheet templates, consider these tips:

Use Clear and Consistent Naming Conventions: Use clear and consistent naming conventions for your spreadsheet files and worksheets. This will make it easier to find and manage your data.

Use Data Validation to Prevent Errors: Use data validation rules to limit the type of data that can be entered into certain cells. This can help prevent errors and ensure data accuracy.

Create Charts and Graphs to Visualize Data: Use charts and graphs to visualize your financial data. This can make it easier to identify trends and patterns.

Use Pivot Tables to Analyze Data: Pivot tables are a powerful tool for analyzing large amounts of data. Use them to summarize your data and identify key insights.

Automate Data Entry with Macros: If you have repetitive tasks, consider using macros to automate them. Macros can save you time and reduce the risk of errors.

Seek Professional Advice When Needed: Don’t hesitate to seek professional advice from an accountant or financial advisor if you have questions or need help interpreting your financial data.

Even with the best intentions, mistakes can happen when using accounting spreadsheets. Here are some common pitfalls to avoid:

Incorrect Formulas: Double-check all formulas to ensure they are accurate and calculating correctly. Even a small error in a formula can lead to significant discrepancies in your financial data.

Data Entry Errors: Data entry errors are common, especially when entering large amounts of data. Regularly review your data for accuracy and correct any errors promptly.

Not Reconciling Bank Statements: Reconcile your bank statements regularly to ensure that your spreadsheet data matches your bank records. This will help you identify any discrepancies and prevent fraud.

Not Backing Up Data: Failure to back up your data is a major risk. Regularly back up your spreadsheet files to a secure location to prevent data loss in case of a computer crash or other disaster.

Not Updating Templates: As your business grows and changes, your accounting needs may evolve. Periodically review and update your templates to ensure they continue to meet your needs.

Accounting spreadsheet templates for small business provide a practical and accessible solution for managing finances. By understanding the different types of templates available, choosing the right one for your needs, and following best practices for setup and usage, you can leverage these tools to gain better control over your business’s financial health. While they may not replace dedicated accounting software for larger or more complex businesses, they offer a cost-effective and user-friendly alternative for many small business owners.

Accounting spreadsheet templates offer a powerful and accessible tool for small business owners seeking to manage their finances effectively. By understanding the benefits, types, and best practices associated with these templates, entrepreneurs can gain valuable insights into their business performance, make informed decisions, and ultimately achieve greater financial success. From tracking income and expenses to generating essential financial reports, accounting spreadsheets provide a versatile solution that empowers small businesses to take control of their financial destiny.