The complexities of debt can be overwhelming, leading to stress, anxiety, and a feeling of hopelessness. Navigating the process of debt settlement can feel daunting, but with the right approach and a well-crafted agreement, it’s possible to achieve a more manageable solution. This article provides a comprehensive guide to creating a robust Debt Settlement Agreement Letter Template, designed to protect your interests and facilitate a successful outcome. Understanding the key elements of this document is crucial for anyone seeking to negotiate a favorable settlement with creditors. The core of this template focuses on clarity, professionalism, and a proactive approach to resolving outstanding debts. Let’s delve into how to build a template that empowers you to take control of your financial situation.

A Debt Settlement Agreement Letter Template isn’t just a formality; it’s a strategic document that outlines the terms of a settlement agreement. It’s a crucial tool for negotiating with creditors, establishing a clear understanding of your rights and obligations, and ultimately, achieving a more manageable repayment plan. Without a solid template, negotiations can be unpredictable and potentially detrimental to your financial well-being. It’s vital to approach this process with a clear understanding of your debt, your financial situation, and your desired outcome. The template provides a framework for this process, ensuring that all key details are documented and agreed upon. Furthermore, a well-written template demonstrates your seriousness and commitment to resolving the debt.

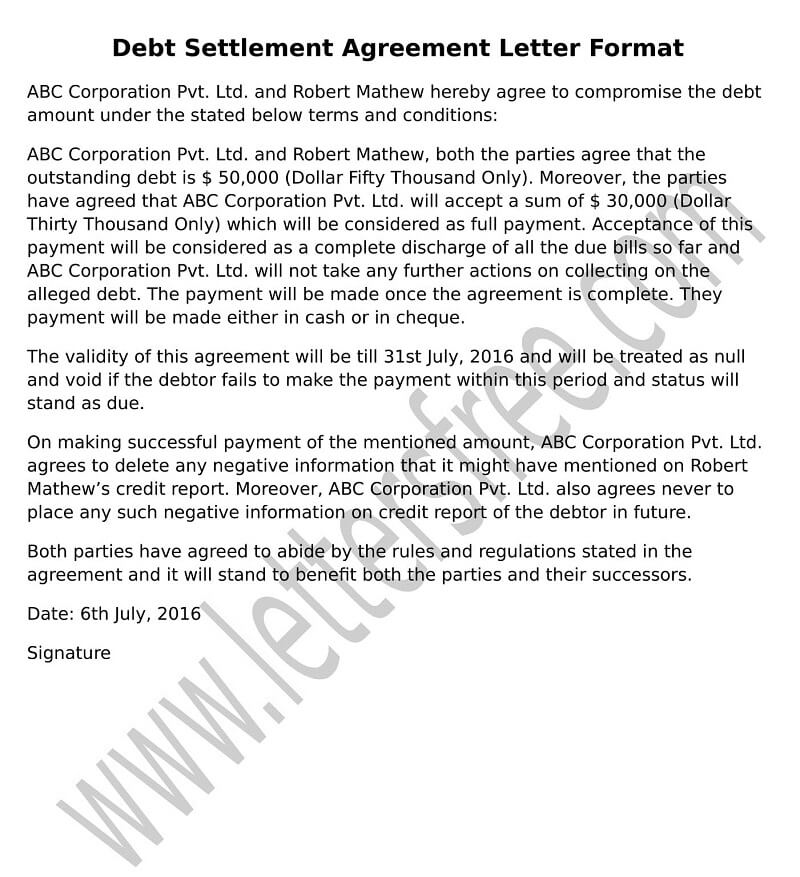

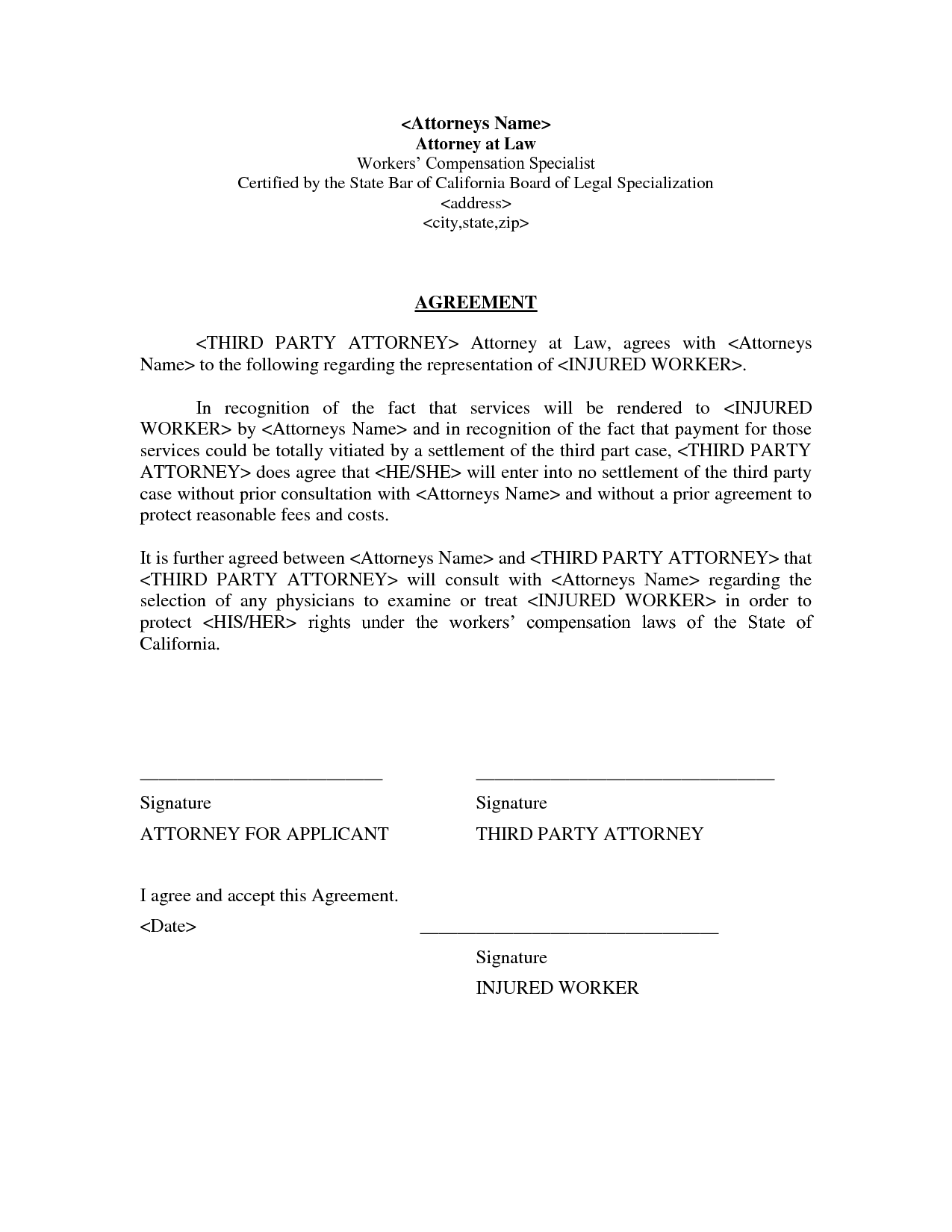

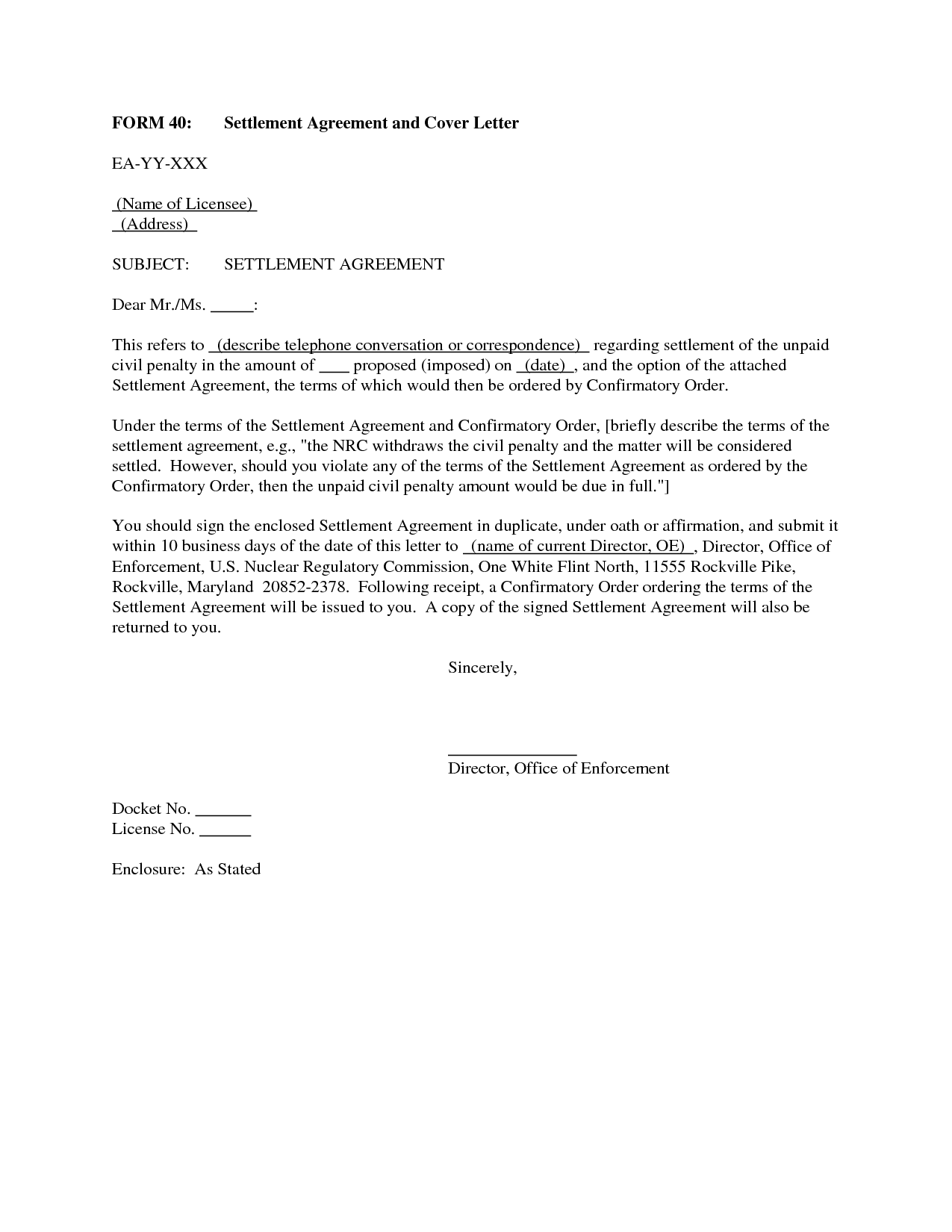

A successful Debt Settlement Agreement Letter Template typically includes several key components. Firstly, it clearly states the amount of debt being settled. Secondly, it outlines the creditor’s responsibilities, including providing documentation and responding to inquiries. Thirdly, it details the settlement process, including timelines and payment schedules. Fourthly, it establishes a dispute resolution mechanism, outlining how disagreements will be handled. Finally, it includes a confidentiality clause, protecting sensitive financial information. Each of these elements is carefully considered to ensure a fair and transparent settlement process. Remember, the goal is to create a document that protects your interests while fostering a collaborative relationship with your creditors.

Let’s examine each of the key components in more detail, illustrating how to incorporate them into a comprehensive template. The template should be easily understandable and adaptable to different situations. It’s important to tailor the language to reflect the specific circumstances of the debt settlement. A professional and well-organized template is a significant asset in any debt settlement negotiation.

The introduction of the Debt Settlement Agreement Letter Template should immediately establish the purpose and scope of the document. It should clearly state that the letter is a formal agreement outlining the terms of a debt settlement. It’s important to avoid ambiguity and ensure that all parties understand the intent of the document. A brief overview of the debt and the negotiation process can also be included here. For example: “This agreement, entered into as of [Date], outlines the terms of a debt settlement agreement between [Your Name/Company Name] and [Creditor Name] regarding outstanding debt of [Amount] for [Brief Description of Debt].” This introductory paragraph sets the tone and provides context for the rest of the document.

A crucial section is dedicated to clearly outlining the amount of debt being settled. This should include the original loan amount, accrued interest, and any associated fees. It’s beneficial to provide a detailed breakdown of the debt, making it easy for both parties to understand the total amount owed. Consider adding a line item for any late fees or penalties. For example: “The total outstanding balance of this debt is $ [Amount]. This includes interest accrued from [Start Date] to [End Date], as well as any applicable late fees outlined in the original loan agreement.” This section provides a precise record of the debt, preventing misunderstandings later on.

This section outlines the creditor’s responsibilities in the settlement process. It’s important to clearly state what they are required to do, such as providing documentation of the debt, responding to inquiries, and cooperating with the negotiation process. It’s also crucial to specify the timeframe within which the creditor must fulfill these obligations. For example: “The Creditor agrees to provide written documentation supporting the validity of the debt, including copies of loan statements, account statements, and any other relevant financial records. The Creditor will respond to all inquiries within [Number] business days.” This section establishes clear expectations and ensures accountability.

This is the core of the template, where you negotiate the specific terms of the settlement agreement. This section should address various aspects of the settlement, such as the payment schedule, interest rate, and any other agreed-upon terms. It’s important to be flexible and willing to compromise to reach a mutually agreeable solution. Consider including provisions for potential future debt repayment. For example: “The settlement agreement stipulates a monthly payment schedule of [Amount] commencing on [Date]. Interest will be calculated at [Interest Rate]% per annum. A dispute resolution mechanism will be established through mediation before resorting to litigation.” This section allows for a collaborative approach to resolving the debt.

A clear dispute resolution mechanism is essential to prevent disagreements from escalating and to ensure a fair and efficient settlement process. This section should outline the process for resolving disputes, such as mediation or arbitration. It should also specify the procedures for handling disagreements and the role of a neutral third party. For example: “Any disputes arising from this agreement will be resolved through mediation before resorting to litigation. If mediation fails, the parties will participate in arbitration according to the rules of [Arbitration Rules].” This section provides a framework for resolving disagreements in a structured and impartial manner.

A confidentiality clause is crucial to protect sensitive financial information shared during the negotiation process. It should clearly state that all communications and documents related to the debt settlement will be treated as confidential and not disclosed to third parties without the consent of all parties involved. For example: “All communications and documents related to this debt settlement agreement shall be treated as confidential and shall not be disclosed to any third party without the prior written consent of all parties involved.” This protects both parties from potential legal repercussions.

Specify the governing law and jurisdiction for the agreement. This clarifies which state or country’s laws will apply to the contract and where any legal disputes will be resolved. This is important for clarity and to avoid future misunderstandings. For example: “This agreement shall be governed by and construed in accordance with the laws of the State of [State]. Any disputes arising under this agreement shall be resolved in the courts of [City, State].”

Creating a Debt Settlement Agreement Letter Template is a significant step towards achieving a more manageable debt situation. By carefully considering each element of the template and tailoring it to your specific circumstances, you can significantly increase your chances of a successful and mutually beneficial settlement. Remember that clear communication, a collaborative approach, and a well-defined dispute resolution mechanism are key to navigating the complexities of debt settlement. Investing the time and effort to create a robust template is an investment in your financial future. Ultimately, a thoughtfully crafted agreement empowers you to take control of your debt and move towards a path of financial stability. Don’t hesitate to seek legal counsel to ensure the template accurately reflects your situation and protects your interests.