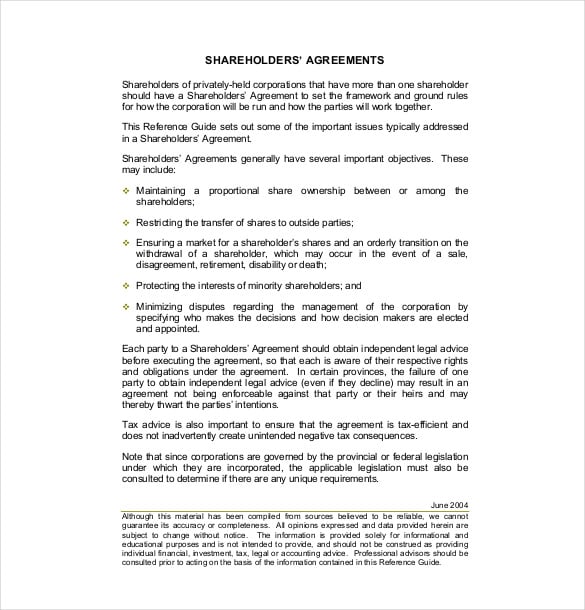

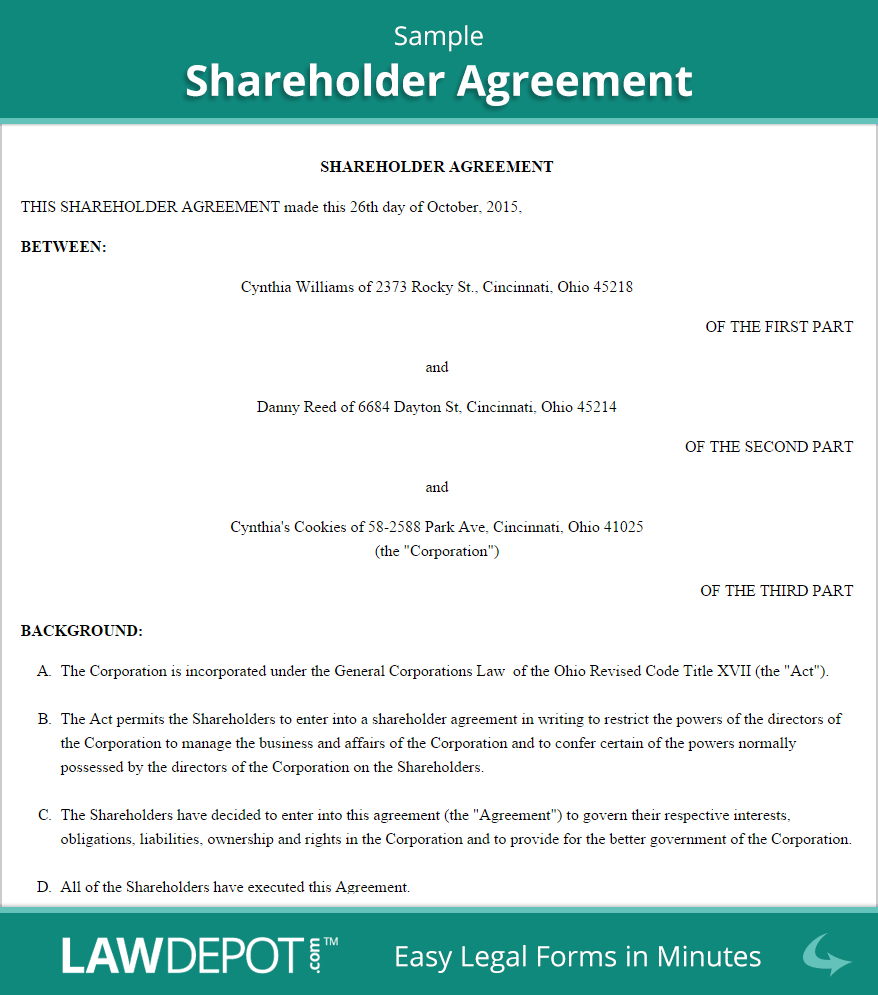

The formation of a business partnership or acquisition often hinges on a clear and legally sound agreement outlining the rights and responsibilities of all involved parties. A Minority Shareholder Agreement Template is a critical document that protects the interests of minority shareholders, ensuring they have a voice in the company’s direction and mitigating potential disputes. This article provides a comprehensive overview of what a Minority Shareholder Agreement Template entails, covering key provisions, best practices, and considerations for creating a robust agreement. Understanding these elements is crucial for any business owner considering a significant investment or partnership. This template is a starting point; it’s essential to tailor the agreement to the specific circumstances of your business and consult with legal counsel to ensure it’s legally sound and reflects your intentions. The core purpose of this agreement is to foster a collaborative and mutually beneficial relationship, minimizing risks and promoting stability.

The benefits of a well-drafted Minority Shareholder Agreement Template extend far beyond simply protecting individual shareholder interests. It’s a proactive tool that can significantly improve a business’s long-term prospects. By establishing clear expectations and defining roles and responsibilities, it reduces the likelihood of disagreements and costly litigation. Furthermore, it can facilitate smoother transactions, particularly in acquisitions and mergers, ensuring a fair and equitable process for all stakeholders. A strong agreement demonstrates a commitment to transparency and good faith, building trust and fostering a positive working relationship among partners. Ignoring the need for such an agreement can expose a business to significant legal and financial risks. It’s a vital investment in the future success of the organization.

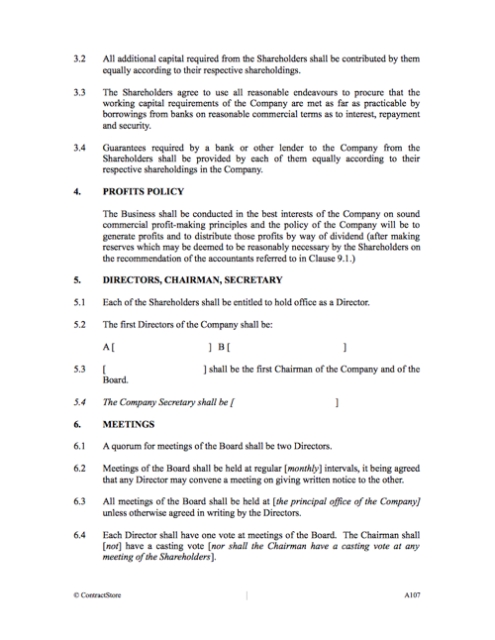

A comprehensive Minority Shareholder Agreement Template typically addresses several critical areas. Firstly, it defines the rights and responsibilities of each shareholder, outlining their voting power, decision-making authority, and obligations. Secondly, it establishes procedures for handling disputes, specifying mediation or arbitration as preferred methods of resolution. Thirdly, the agreement addresses issues related to the transfer of shares, including restrictions on sale or assignment, and the process for exercising pre-emptive rights. Fourthly, it covers the rights of directors and officers, outlining their fiduciary duties and limitations on their authority. Finally, it addresses confidentiality and non-compete clauses, protecting sensitive business information. A thorough review of these provisions is paramount to ensure they align with the specific needs of the business.

A crucial element of a Minority Shareholder Agreement Template is clearly defining the roles and responsibilities of each shareholder. This section should outline the specific duties of each party, including their responsibilities for financial reporting, operational management, and strategic planning. It’s important to specify who is responsible for what, and to establish clear lines of accountability. For example, the majority shareholder may be responsible for overseeing the overall strategy, while the minority shareholders may focus on specific operational areas. A well-defined role assignment minimizes confusion and potential conflicts of interest. Furthermore, the agreement should address the responsibilities of key personnel, such as the board of directors and management team. A clear delineation of these responsibilities is essential for effective governance.

The Minority Shareholder Agreement Template meticulously details the voting rights of each shareholder. This section specifies how votes are cast, the quorum requirements, and the process for resolving shareholder votes. It’s important to establish a fair and transparent voting system that reflects the interests of all shareholders. The agreement should also address the rights of the board of directors to make decisions on behalf of the shareholders. It’s crucial to define the process for shareholder approval of significant corporate actions, such as mergers, acquisitions, and changes to the company’s bylaws. A robust voting mechanism ensures that minority shareholders have a meaningful voice in shaping the company’s future.

A significant aspect of a Minority Shareholder Agreement Template is the process for transferring shares. The agreement should outline the conditions under which shares can be transferred, including restrictions on transfer to certain individuals or entities. It’s important to define the process for exercising pre-emptive rights, allowing minority shareholders to purchase shares before they are offered to the public. The agreement should also address the rights of the company to approve or deny transfers of shares. Furthermore, it should specify the process for handling shareholder disputes related to share transfers. A carefully crafted transfer clause protects the interests of minority shareholders and prevents unwanted changes to their ownership.

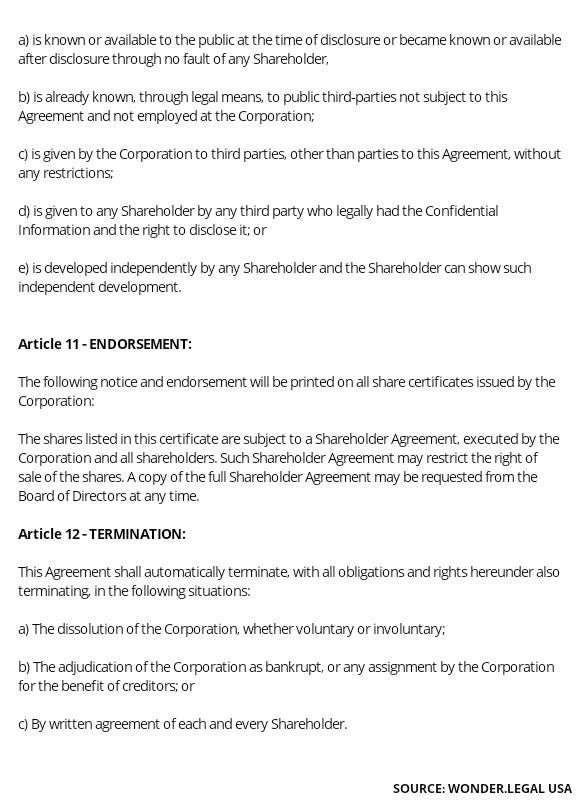

Protecting sensitive business information is a critical concern for any shareholder. A Minority Shareholder Agreement Template should include robust confidentiality clauses, prohibiting shareholders from disclosing confidential information to third parties. These clauses should be carefully drafted to ensure they are enforceable and protect the company’s legitimate business interests. Non-compete clauses, which restrict shareholders from competing with the company for a specified period of time after leaving, are often included to safeguard the company’s competitive advantage. However, these clauses must be carefully scrutinized to ensure they are reasonable and do not unduly restrict a shareholder’s ability to pursue their own business opportunities.

To facilitate smooth and efficient resolution of disputes, a Minority Shareholder Agreement Template should include a clear dispute resolution mechanism. This could include mediation, arbitration, or litigation. Mediation offers a less formal and less expensive alternative to litigation, while arbitration provides a more structured and binding process. The agreement should specify the procedures for selecting a mediator or arbitrator, and the governing law for resolving disputes. Clearly defined procedures minimize the risk of protracted and costly litigation.

Before entering into a Minority Shareholder Agreement Template, it’s essential to conduct thorough due diligence on the potential partner or acquisition target. This includes reviewing their financial records, legal history, and business operations. Consulting with experienced legal counsel is crucial to ensure the agreement is tailored to the specific circumstances of the transaction and protects the interests of all parties. A lawyer specializing in corporate law and shareholder agreements can help identify potential risks and negotiate favorable terms. Proper due diligence and legal guidance are vital for minimizing the potential for disputes and ensuring a successful transaction.

A well-crafted Minority Shareholder Agreement Template is an indispensable tool for any business considering a significant investment or partnership. By clearly defining rights, responsibilities, and procedures, it fosters a collaborative and mutually beneficial relationship. While the specific provisions of the agreement will vary depending on the nature of the business and the circumstances of the transaction, the core principles of transparency, fairness, and protection remain constant. Investing time and resources in drafting a robust agreement is a strategic imperative that can significantly enhance the long-term success of the business. Remember that this template is a starting point; continuous review and adaptation are essential to ensure it remains relevant and effective as the business evolves. Ultimately, a thoughtfully designed agreement is a cornerstone of a successful and sustainable business relationship.