Buying a home is one of the biggest financial decisions most people will ever make. It’s a complex process filled with legal jargon, inspections, and negotiations. A crucial document in this process is the Home Purchase Agreement Template, a legally binding contract that outlines the terms of the sale between a buyer and a seller. This agreement serves as the foundation for the entire transaction, protecting both parties and ensuring a smooth transition to homeownership. Understanding its components and how to tailor it to your specific situation is paramount to a successful purchase. This guide will delve into the intricacies of this vital document, providing you with the knowledge you need to navigate the home buying process with confidence.

The process of purchasing a home can feel overwhelming, and having a solid understanding of the legal agreements involved is essential. A well-drafted Home Purchase Agreement Template isn’t just a piece of paper; it’s a safeguard, a roadmap, and a critical tool for ensuring your investment is protected. It details everything from the purchase price and financing terms to closing dates and contingencies. Without a clear and comprehensive agreement, misunderstandings and disputes can arise, potentially jeopardizing the entire deal. This article will break down the key elements of a Home Purchase Agreement Template, offering insights and guidance to help you make informed decisions and secure your dream home.

This document isn’t a one-size-fits-all solution. While a template provides a starting point, it’s crucial to customize it to reflect the specific circumstances of your transaction. Factors like location, property condition, and financing options will all influence the terms included in the agreement. Furthermore, consulting with a real estate attorney is highly recommended to ensure the agreement complies with local laws and protects your interests. Let’s explore the core components of a standard Home Purchase Agreement Template and how they contribute to a successful home sale.

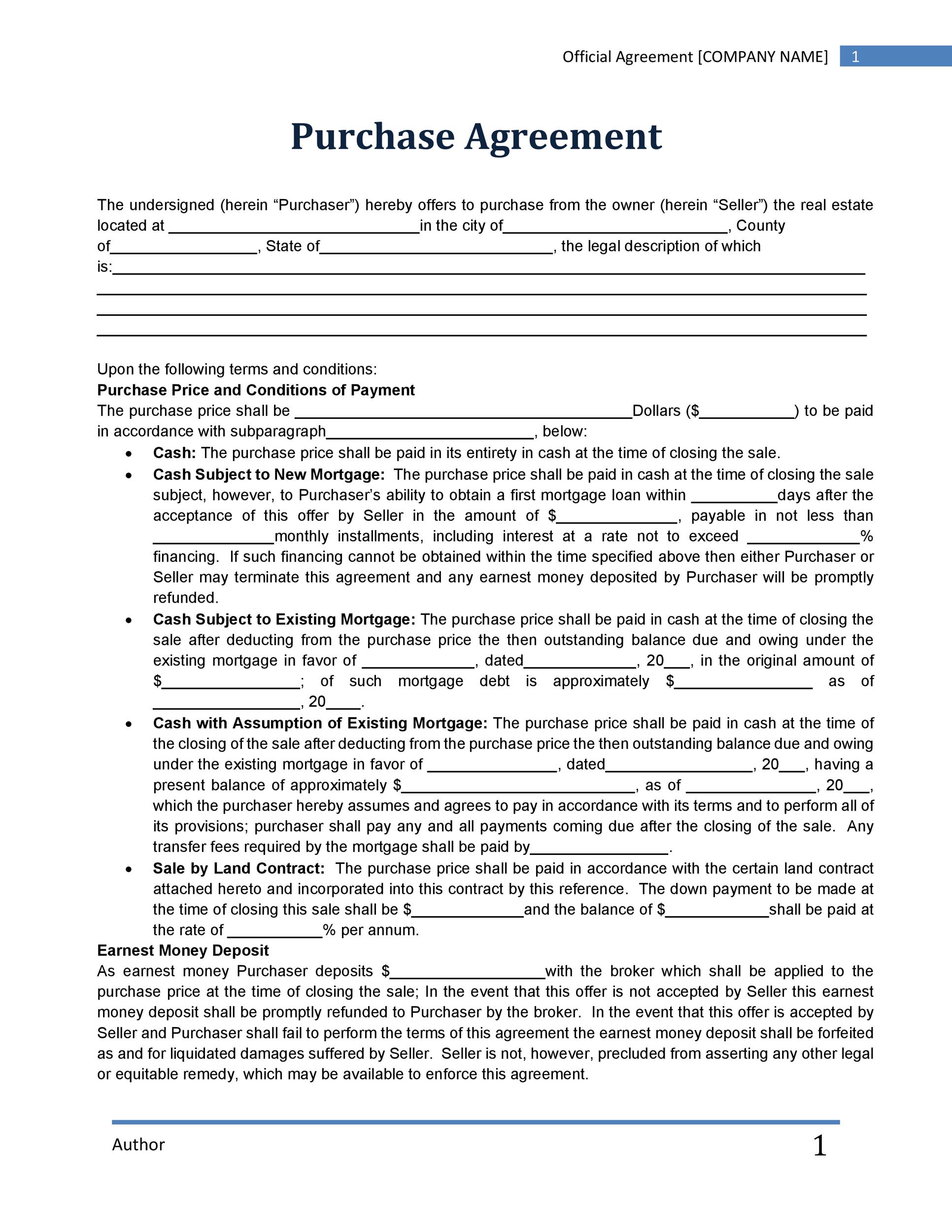

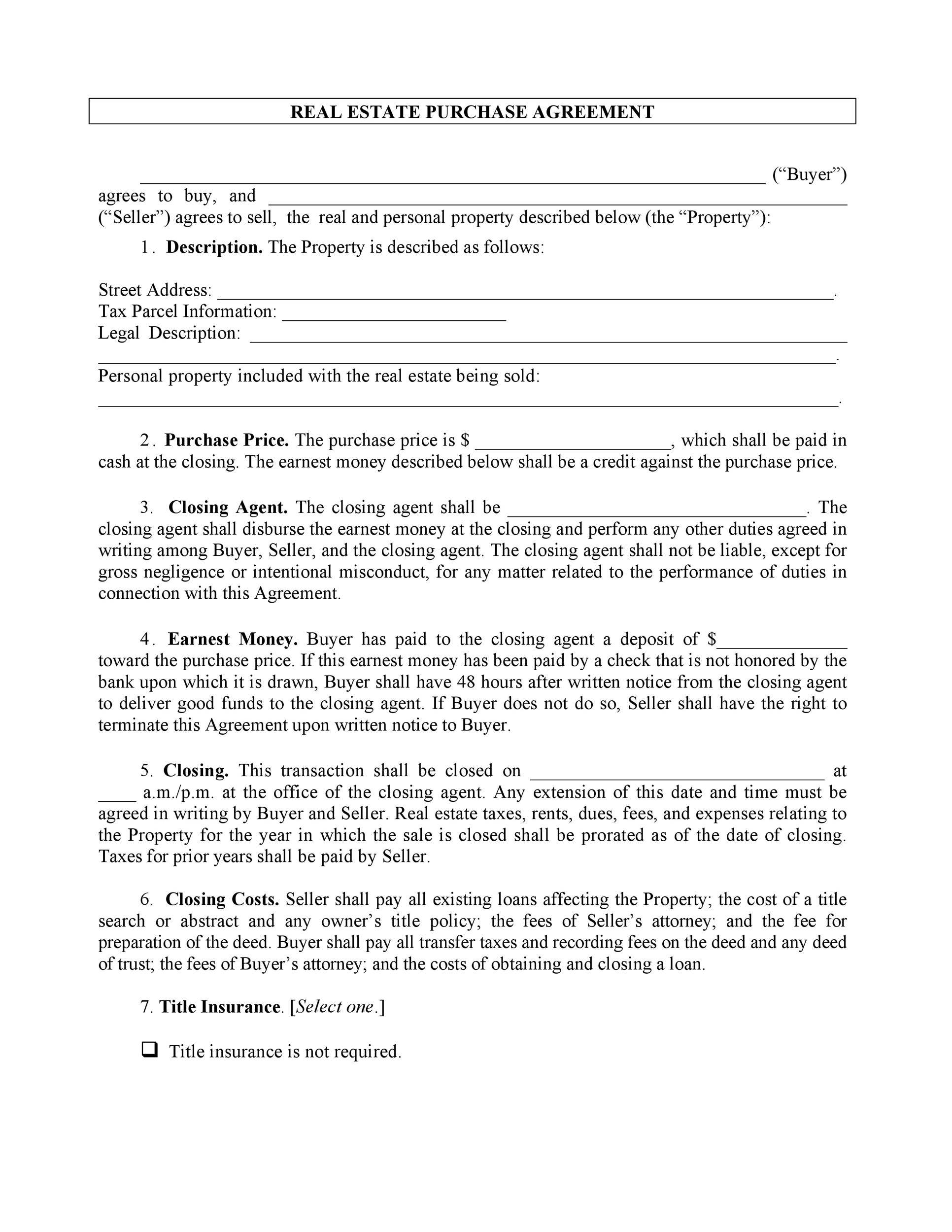

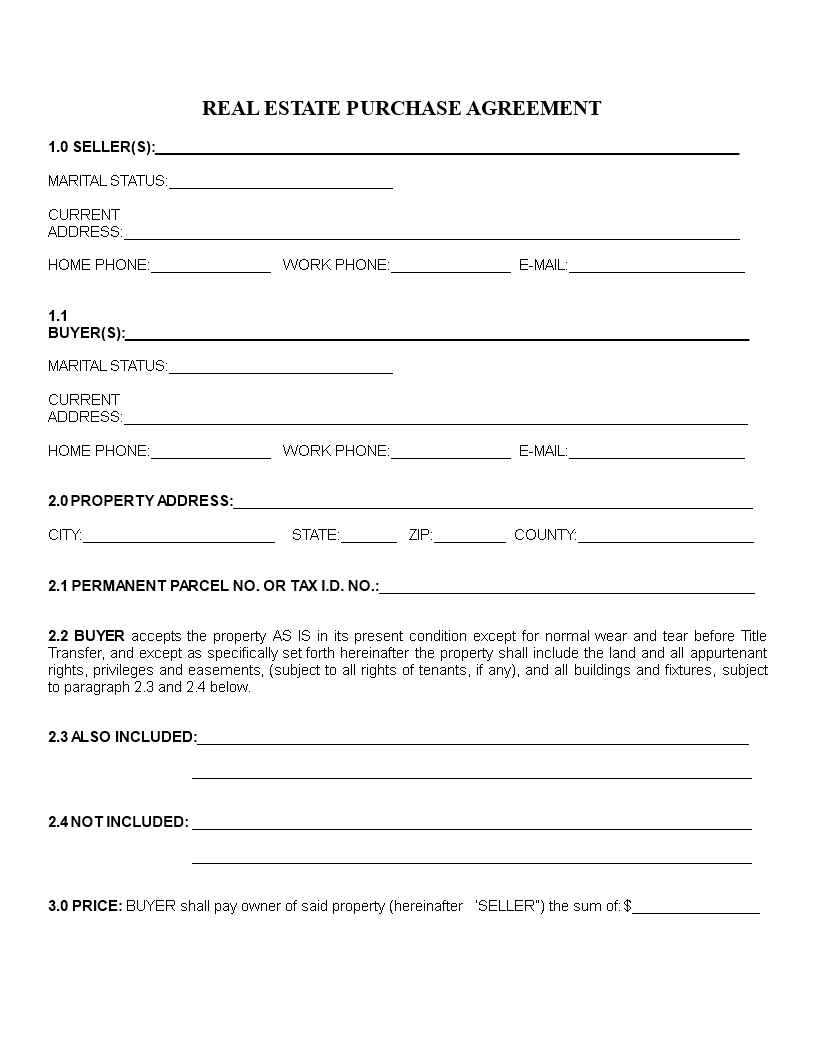

A Home Purchase Agreement Template typically includes several key sections, each addressing a specific aspect of the transaction. Understanding these components is the first step towards ensuring you’re comfortable with the terms and conditions.

The initial section clearly identifies the buyer and seller involved in the transaction. This includes full legal names, addresses, and contact information for both parties. It’s vital that this information is accurate to avoid any confusion or legal challenges later on.

This section provides a detailed description of the property being purchased. It includes the legal address, property size, and any relevant identifying features. A property description should be precise and unambiguous to prevent disputes about the boundaries or characteristics of the property. Often, a reference to the property’s legal description from the deed is included.

This is arguably the most critical section of the agreement. It specifies the agreed-upon purchase price for the property and outlines the method of payment. This includes details about earnest money, financing arrangements (e.g., mortgage loan), and the schedule for payments. Clearly defined payment terms are essential for avoiding misunderstandings and ensuring a smooth closing process.

Contingencies are clauses that allow either the buyer or seller to terminate the agreement without penalty if certain conditions aren’t met. Common contingencies include:

This section specifies the date on which the sale will be finalized and when the buyer will take possession of the property. It also outlines any requirements for transferring ownership and delivering keys. A clear closing date is crucial for coordinating all parties involved in the transaction.

Several variations of Home Purchase Agreement Templates exist, catering to different situations and jurisdictions.

This is the most common type of agreement, used for the purchase of a single-family home or condominium. It typically includes all the standard components discussed above.

This template is specifically designed for use in Massachusetts and incorporates state-specific legal requirements. It’s essential to use a template that aligns with your location.

This agreement is tailored for transactions involving a U.S. Department of Veterans Affairs (VA) loan. It includes specific provisions related to VA loan requirements and guarantees.

Used when purchasing a property that is in foreclosure, this agreement addresses unique challenges and risks associated with such transactions.

While using a template is a good starting point, it’s crucial to customize it to reflect your specific needs and circumstances.

Consider adding clauses to address unique aspects of the transaction, such as:

It’s highly recommended to have a real estate attorney review your Home Purchase Agreement Template before signing it. An attorney can ensure the agreement complies with local laws, protects your interests, and addresses any potential risks. They can also explain the legal implications of each clause and answer any questions you may have.

Several common mistakes can derail a home purchase. Being aware of these pitfalls can help you avoid costly errors.

Don’t skim through the document. Carefully read every clause and understand its implications before signing.

Contingencies are your safety net. Don’t waive them without careful consideration.

A thorough property inspection is crucial for identifying potential problems.

Consulting with a real estate attorney is a wise investment that can protect your interests.

The Home Purchase Agreement Template is a cornerstone of the home buying process, providing a framework for a legally sound and transparent transaction. By understanding its key components, customizing it to your specific needs, and seeking professional advice, you can significantly increase your chances of a successful and stress-free home purchase. Remember that this document is more than just a formality; it’s a vital tool for safeguarding your investment and ensuring a smooth transition into your new home. Taking the time to thoroughly review and understand the terms outlined in your agreement will empower you to make informed decisions and achieve your homeownership goals. Don’t hesitate to consult with real estate professionals and legal experts to navigate the complexities of the market and protect your interests throughout the entire process.