A promissory note is a crucial financial instrument that outlines the terms and conditions of a loan agreement between a lender and a borrower. A well-drafted promissory notes template provides a legally sound framework to ensure both parties understand their obligations, fostering transparency and minimizing potential disputes. This document serves as a written promise to repay a debt, encompassing vital details such as the principal amount, interest rate, repayment schedule, and any applicable penalties for late payments.

Creating a comprehensive promissory note can be complex, especially when considering the specific legal requirements that vary by jurisdiction. Therefore, leveraging a reliable promissory notes template can be an invaluable resource. It offers a starting point that can be customized to suit the specific terms of the loan, ensuring that all essential elements are included. Using a template helps to avoid overlooking critical provisions that could weaken the enforceability of the agreement.

These templates can be found in a variety of formats and levels of complexity, catering to different types of loans, ranging from simple personal loans between friends and family to more intricate commercial loans involving businesses. The key is to choose a promissory notes template that aligns with the nature of the transaction and to carefully review and adapt it to reflect the precise agreed-upon terms.

Ultimately, a properly executed promissory note strengthens the lender’s position by providing documented evidence of the debt and the borrower’s commitment to repay it. It serves as a formal acknowledgment of the financial obligation, thereby reducing the risk of misunderstandings or disagreements down the line. This document is a cornerstone of responsible lending and borrowing practices.

A promissory note, at its core, is a written agreement where a borrower promises to repay a specific sum of money to a lender on a predetermined date or according to a defined schedule. It is more formal than a simple IOU and holds significant legal weight. This makes it an important tool for managing financial transactions and protecting the interests of both the lender and the borrower.

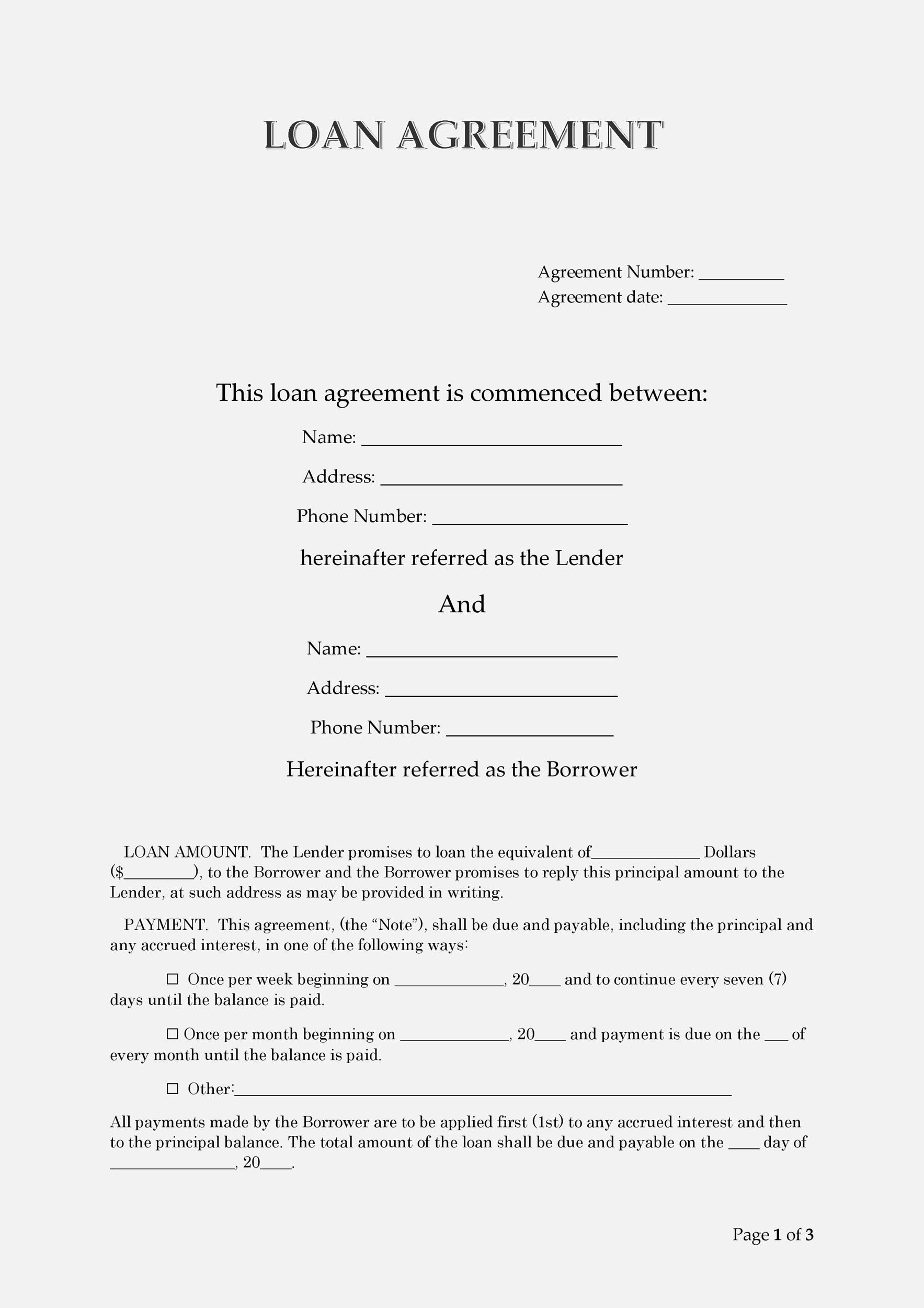

Several essential elements must be included in a promissory note to ensure its validity and enforceability:

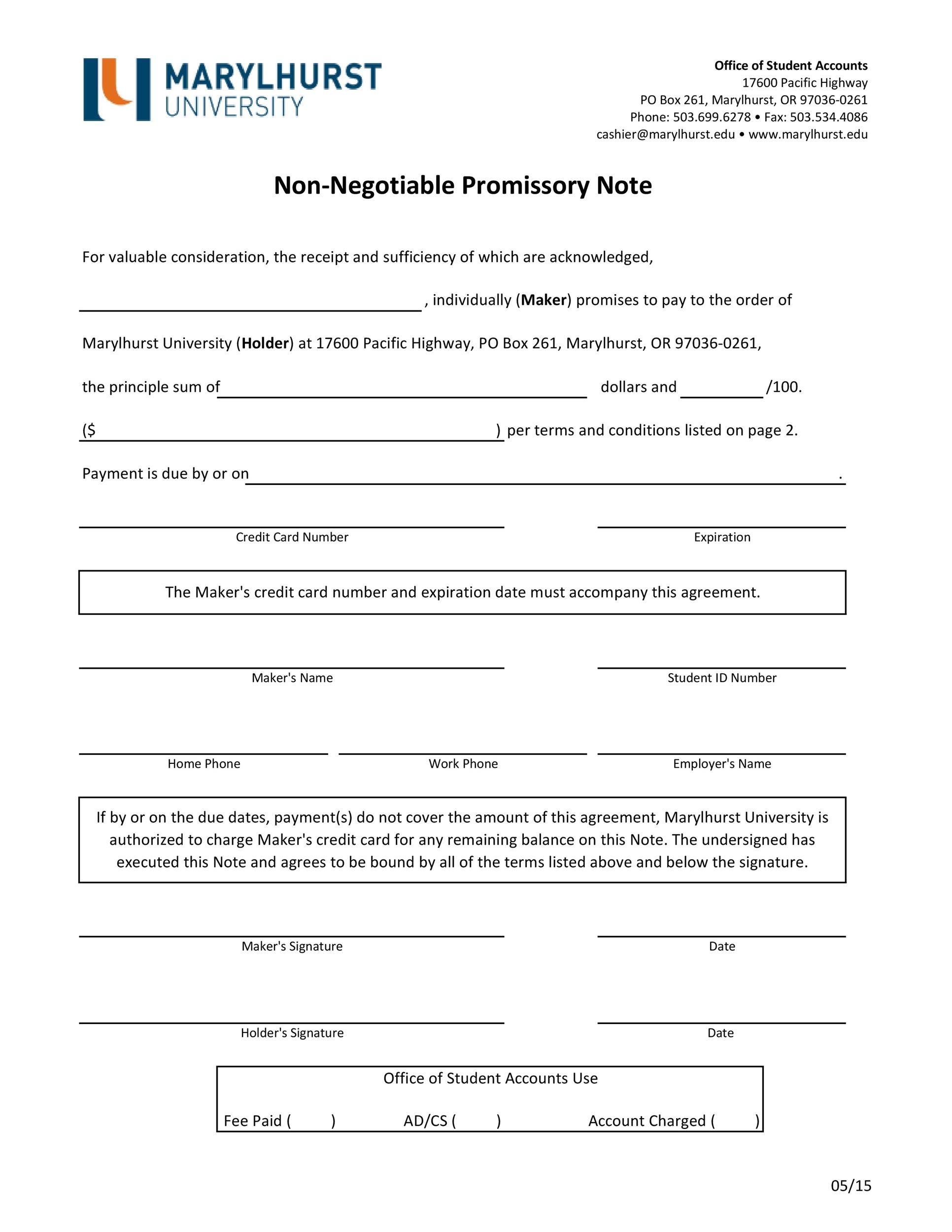

Parties Involved: Clearly identify both the lender (the payee) and the borrower (the maker). Include their full legal names and addresses.

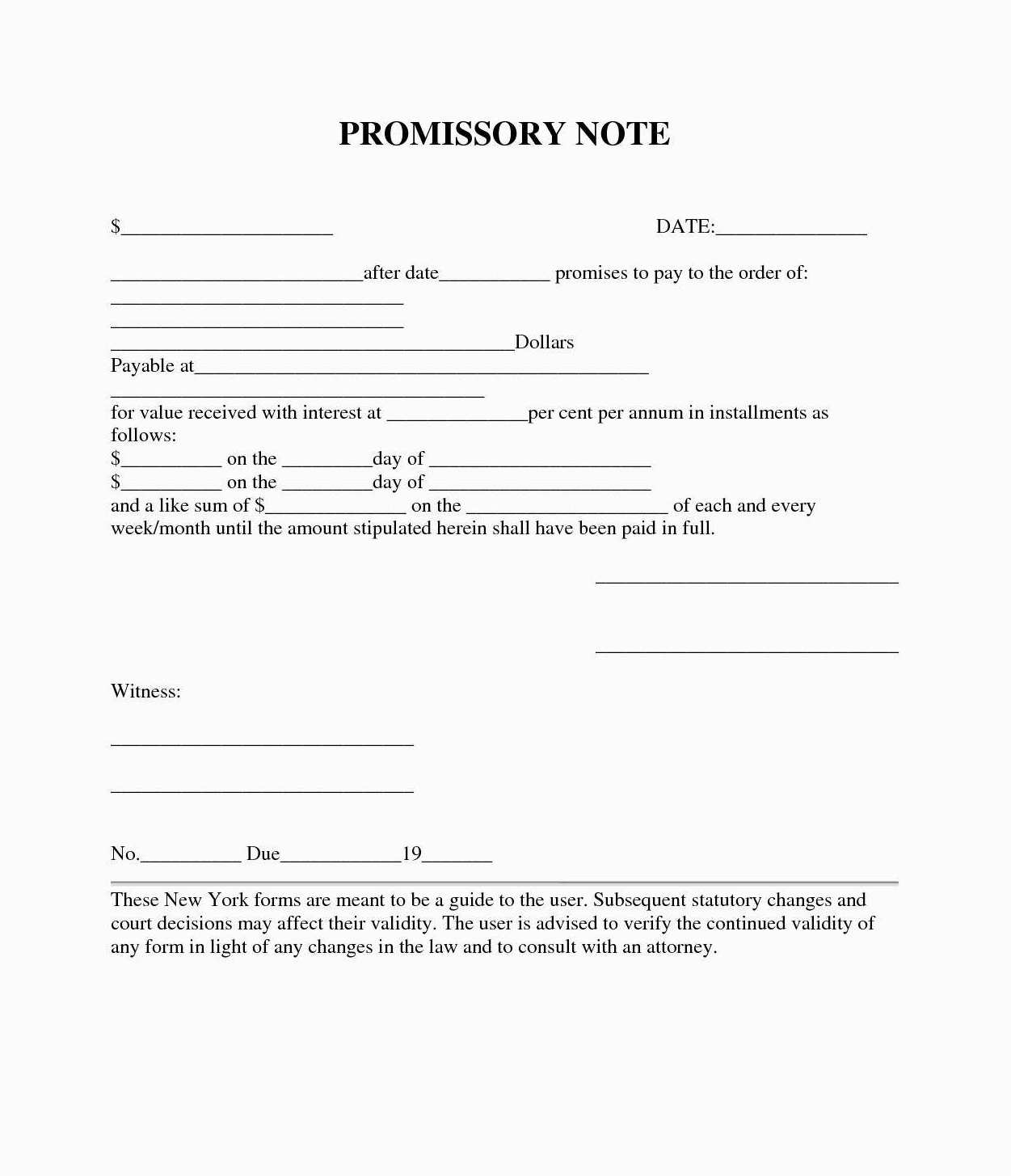

Principal Amount: Specify the exact amount of money being borrowed.

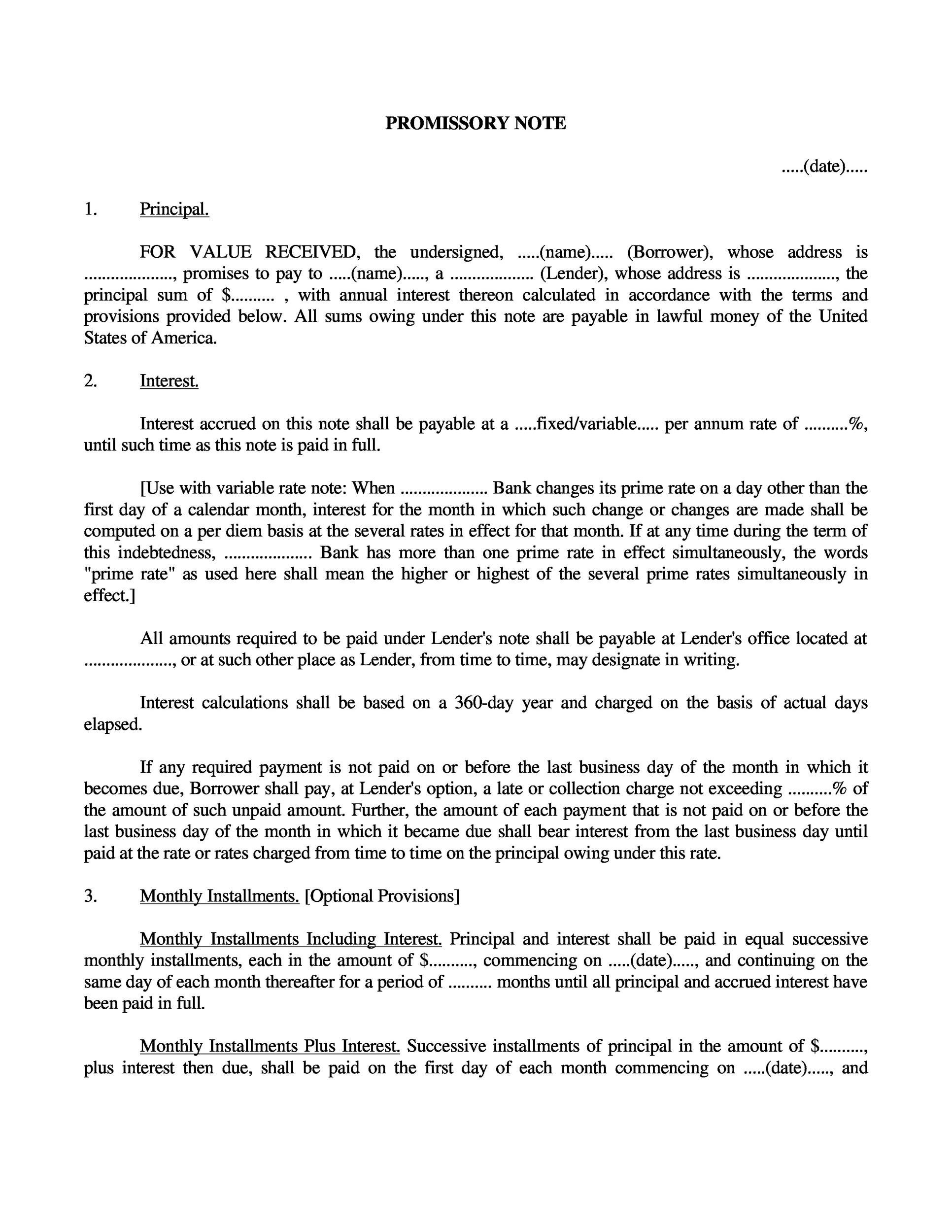

Interest Rate: If interest is being charged, state the annual interest rate clearly. Many jurisdictions have usury laws that limit the maximum permissible interest rate.

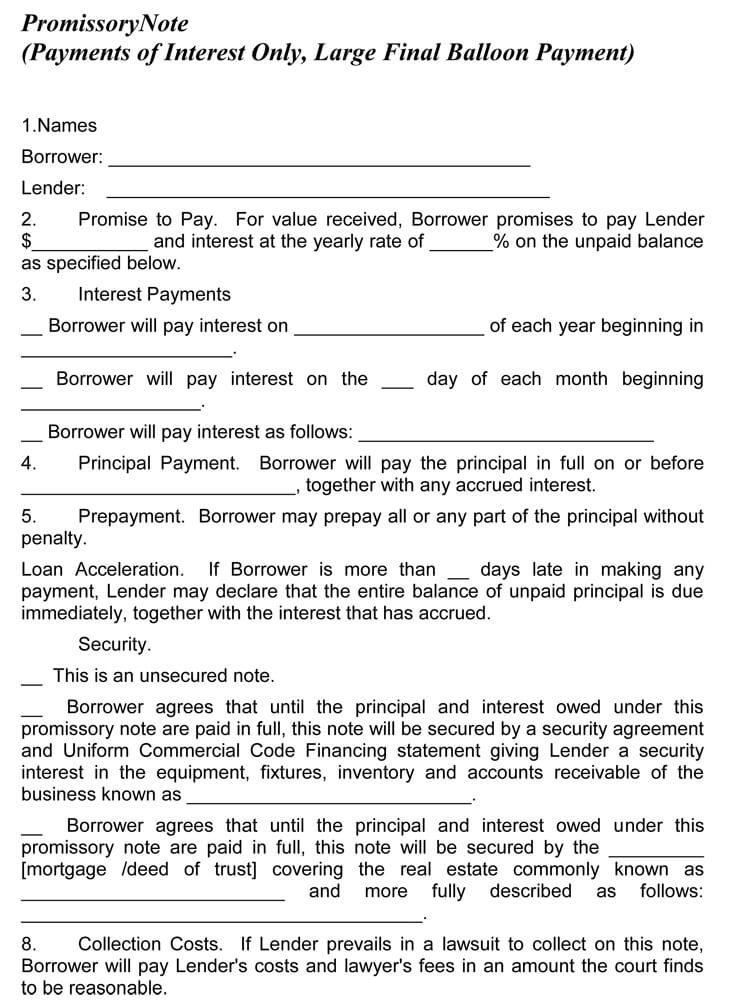

Repayment Schedule: Outline the frequency and amount of payments. This could be weekly, monthly, quarterly, or a lump-sum payment on a specific date.

Maturity Date: Indicate the date when the entire loan balance, including principal and interest, is due.

Late Payment Penalties: Specify any fees or penalties that will be assessed for late payments.

Default Provisions: Describe what constitutes a default and the lender’s recourse in the event of a default, such as acceleration of the loan (demanding immediate repayment of the entire balance).

Governing Law: Indicate the state or jurisdiction whose laws will govern the interpretation and enforcement of the promissory note.

Signatures: Both the lender and the borrower must sign and date the promissory note to acknowledge their agreement to its terms. Notarization can add further legal weight.

Creating a promissory note from scratch can be daunting. A promissory notes template offers several advantages:

Time-Saving: Templates provide a pre-structured document, saving you the time and effort of drafting one from the ground up.

Accuracy: Templates ensure that all essential elements are included, reducing the risk of omissions that could compromise the document’s validity.

Legal Compliance: Reputable templates are often designed to comply with relevant legal requirements, helping you avoid legal pitfalls.

Customization: Templates are easily customizable to fit the specific terms of your loan agreement.

Professionalism: Using a template creates a polished and professional document, enhancing credibility and fostering trust.

Promissory notes come in various forms, each designed to suit different lending scenarios:

Simple Promissory Note: This is the most basic type, outlining the principal amount, interest rate, and repayment schedule. It’s typically used for simple loan agreements between individuals or small businesses.

Demand Promissory Note: This type allows the lender to demand repayment at any time, with reasonable notice given to the borrower.

Installment Promissory Note: This note specifies a regular payment schedule, with fixed amounts due over a set period.

Secured Promissory Note: This type of note is backed by collateral, such as real estate or personal property. If the borrower defaults, the lender can seize the collateral to recover the debt.

Unsecured Promissory Note: This note is not backed by collateral and relies solely on the borrower’s promise to repay. It’s typically used when the lender trusts the borrower’s creditworthiness.

Several resources offer promissory notes templates:

Online Legal Websites: Websites specializing in legal forms and templates often provide a variety of promissory note options.

Software Providers: Some software companies offer document creation tools that include promissory note templates.

Legal Professionals: Consulting with an attorney is always a good idea, especially for complex loan agreements. They can provide a customized promissory note tailored to your specific needs.

When selecting a template, ensure it is from a reputable source and that it is compliant with the laws of your jurisdiction. Review the template carefully and adapt it to reflect the specific terms of your agreement.

While free templates are readily available, they may not always be the best option. Paid templates often offer more comprehensive coverage, better legal compliance, and greater customization options. Consider the complexity of your loan agreement and your comfort level with legal documents when deciding between a free and paid template.

Once you’ve selected a promissory notes template, customization is key to ensuring it accurately reflects your agreement:

Review Carefully: Read the entire template thoroughly to understand all its provisions.

Fill in the Blanks: Complete all the required fields accurately, including the names and addresses of the parties, the principal amount, the interest rate, and the repayment schedule.

Adjust the Terms: Modify any clauses that don’t align with your agreement. For example, you may need to adjust the late payment penalties or default provisions.

Add Specific Clauses: Include any additional clauses that are relevant to your situation, such as provisions for prepayment, assignment, or waiver.

Seek Legal Advice: If you’re unsure about any aspect of the template, consult with an attorney to ensure it meets your needs and complies with applicable laws.

Even with a well-drafted promissory note, there’s always a risk that the borrower will default. If this happens, the lender has several options for enforcing the note:

Negotiation: Try to work out a payment plan or other arrangement with the borrower.

Demand Letter: Send a formal demand letter to the borrower, outlining the amount owed and demanding payment.

Mediation: Attempt to resolve the dispute through mediation, where a neutral third party helps the parties reach a settlement.

Litigation: If all else fails, the lender can file a lawsuit against the borrower to recover the debt.

The specific legal procedures for enforcing a promissory note vary by jurisdiction, so it’s important to consult with an attorney.

While using a promissory notes template can be helpful, it’s not a substitute for legal advice. An attorney can review your specific situation, advise you on the legal requirements in your jurisdiction, and ensure that the promissory note is tailored to your needs. They can also represent you in the event of a dispute.

A promissory notes template is a valuable tool for creating a legally sound loan agreement. By understanding the key elements of a promissory note, selecting the right template, and customizing it to reflect your specific terms, you can protect your interests and minimize the risk of disputes. However, it’s essential to remember that a template is just a starting point, and seeking legal advice is always recommended, especially for complex transactions. A properly executed and well-understood promissory note is a cornerstone of responsible lending, fostering trust and clarity between parties involved in financial agreements.