An accounting firm business plan template is an essential tool for anyone looking to launch or grow their accounting practice. It provides a roadmap for success, outlining your firm’s goals, strategies, and financial projections. Without a solid plan, navigating the competitive landscape of the accounting industry can be challenging, leading to missed opportunities and potential pitfalls.

Starting an accounting firm requires meticulous planning and a clear vision. From defining your target market and service offerings to projecting revenue and managing expenses, a well-structured business plan serves as a guide, ensuring you stay on track and make informed decisions. This document is not just for securing funding; it’s a living document that evolves with your business.

Developing an accounting firm business plan forces you to critically analyze every aspect of your potential business. This includes evaluating the market, identifying your competitive advantages, and developing a robust marketing strategy. It helps you anticipate challenges, mitigate risks, and capitalize on opportunities, ultimately increasing your chances of building a successful and sustainable accounting practice. It’s more than just crunching numbers; it’s about crafting a viable and thriving business.

Whether you’re a solo practitioner or planning a multi-partner firm, taking the time to create a comprehensive business plan is a worthwhile investment. It’s a critical step in laying the foundation for a prosperous future in the accounting profession. In the following sections, we’ll delve into the key components of an effective business plan and provide guidance on how to tailor it to your specific needs and goals.

A well-crafted business plan is more than just a formality; it’s the cornerstone of a successful accounting firm. It serves as a roadmap, guiding your decisions and ensuring you stay focused on your long-term objectives. It also provides a valuable tool for attracting investors, securing loans, and building credibility with potential clients and partners.

Clarity of Vision: A business plan forces you to define your firm’s mission, vision, and values. This clarity helps you make strategic decisions that align with your overall goals.

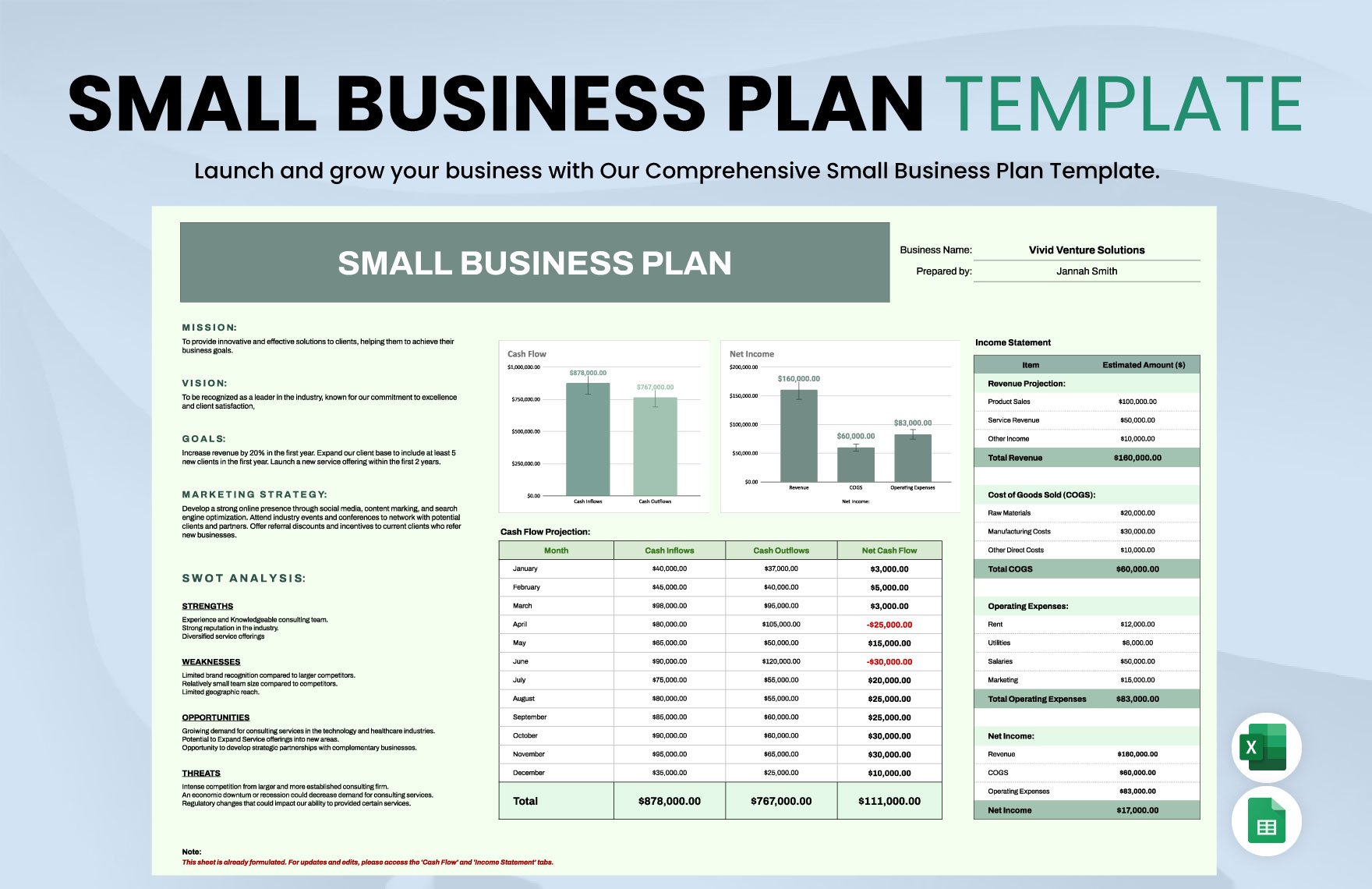

Financial Projections: Developing financial forecasts, including revenue projections, expense budgets, and cash flow statements, allows you to assess the financial viability of your firm and identify potential funding needs.

Market Analysis: A thorough market analysis helps you understand your target market, identify your competitors, and develop strategies to differentiate your firm and attract clients.

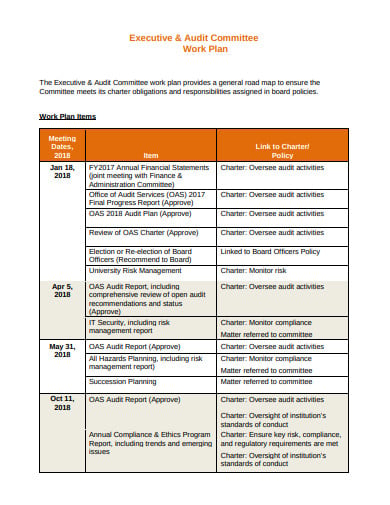

Strategic Planning: It outlines your marketing, sales, and operational strategies, ensuring you have a clear plan for achieving your goals.

Attracting Investors/Lenders: A well-prepared business plan demonstrates your professionalism and competence, making it easier to secure funding from investors or lenders.

A comprehensive accounting firm business plan template should include several key sections, each providing essential information about your firm. These sections typically cover the executive summary, company description, market analysis, services offered, marketing and sales strategy, management team, and financial projections.

The executive summary is a brief overview of your entire business plan. It should highlight the key aspects of your firm, including your mission, vision, target market, services, and financial projections. This is often the first section read by investors and lenders, so it’s crucial to make a strong impression.

This section provides a detailed description of your accounting firm, including its legal structure, ownership, location, and history (if applicable). It should also outline your firm’s mission, vision, and values. This section allows you to paint a picture of your firm for potential investors and clients.

A thorough market analysis is essential for understanding your target market and competitive landscape. This section should include information about the size of the market, growth trends, demographics, and key competitors. This will allow you to identify opportunities and potential threats, and position your firm effectively.

Clearly define the services your accounting firm will offer. This may include bookkeeping, tax preparation, auditing, financial planning, and consulting. Specify your niche if you plan to specialize in a particular industry or service. It’s important to highlight what makes your services unique and valuable to your target clients.

Outline your plan for attracting and retaining clients. This section should detail your marketing channels, sales tactics, and pricing strategy. Consider both online and offline marketing efforts, such as social media marketing, content marketing, networking events, and referrals.

Introduce the key members of your management team and highlight their experience and qualifications. This section is critical for building trust with investors and lenders, as it demonstrates the competence and capability of the individuals leading the firm.

This section includes detailed financial forecasts for your firm, including revenue projections, expense budgets, cash flow statements, and balance sheets. These projections should be realistic and based on thorough market research and analysis. They should also demonstrate the financial viability of your firm and its potential for profitability.

While an accounting firm business plan template provides a solid framework, it’s essential to tailor it to your specific circumstances and goals. Don’t simply fill in the blanks without careful consideration. Take the time to research your market, analyze your competitors, and develop realistic financial projections.

Target Market: Clearly define your target market and tailor your services and marketing efforts to meet their specific needs. Don’t try to be everything to everyone.

Competitive Advantage: Identify your unique selling proposition (USP) and highlight what makes your firm different from the competition.

Financial Projections: Be realistic and conservative in your financial projections. It’s better to underestimate your revenue and overestimate your expenses than the other way around.

Regular Updates: Treat your business plan as a living document and update it regularly as your firm grows and evolves.

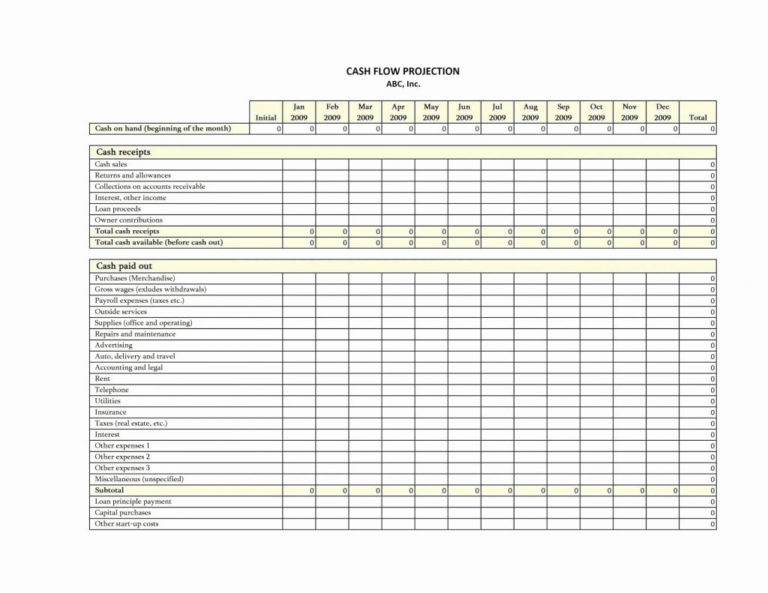

Accurate financial projections are crucial for securing funding and managing your firm’s finances effectively. This section should include detailed forecasts for revenue, expenses, cash flow, and profitability.

Income Statement: Projects your firm’s revenue, expenses, and net income over a specific period (e.g., monthly, quarterly, annually).

Balance Sheet: Provides a snapshot of your firm’s assets, liabilities, and equity at a specific point in time.

Cash Flow Statement: Tracks the movement of cash into and out of your firm, helping you manage your liquidity and avoid cash flow problems.

Service Revenue: Project the revenue you expect to generate from each service you offer.

Client Acquisition: Estimate the number of new clients you expect to acquire each month or year.

Pricing Strategy: Determine your pricing strategy and project your average revenue per client.

Fixed Costs: Budget for fixed costs such as rent, salaries, insurance, and utilities.

Variable Costs: Budget for variable costs such as marketing, travel, and supplies.

Contingency Fund: Allocate a contingency fund for unexpected expenses.

Attracting and retaining clients is essential for the success of your accounting firm. Your business plan should outline your marketing and sales strategies, including your target market, marketing channels, and sales tactics.

Online Marketing: Leverage online marketing channels such as social media, content marketing, search engine optimization (SEO), and email marketing.

Networking: Attend industry events and network with potential clients and referral partners.

Referrals: Encourage existing clients to refer new clients to your firm.

Traditional Marketing: Consider traditional marketing channels such as print advertising, radio advertising, and direct mail.

Consultative Selling: Focus on understanding your clients’ needs and providing customized solutions.

Value Proposition: Clearly communicate the value you provide to your clients.

Relationship Building: Build strong relationships with your clients and referral partners.

Creating a comprehensive accounting firm business plan template is a critical step in launching or growing your accounting practice. It provides a roadmap for success, outlining your firm’s goals, strategies, and financial projections. By carefully considering each section of the plan and tailoring it to your specific needs and goals, you can increase your chances of building a thriving and sustainable accounting practice. Remember to regularly review and update your plan as your firm evolves to ensure it remains relevant and effective.