Managing a retail business, restaurant, or any establishment handling cash transactions requires meticulous record-keeping. Accurate financial tracking is paramount for profitability, inventory management, and overall business health. A cornerstone of this process is the End Of Day Cash Register Report Template, a vital document that summarizes all transactions and cash handling activities for a specific period. This report provides a snapshot of your financial performance, allowing you to reconcile cash drawers, identify discrepancies, and make informed business decisions.

The importance of a well-structured and consistently used report cannot be overstated. Without it, businesses risk errors, theft, and a lack of clarity regarding their financial standing. It’s more than just counting money; it’s about establishing a system that promotes accountability and provides valuable data for analysis. Many businesses, especially smaller ones, might initially rely on manual calculations, but as operations grow, a standardized template becomes essential for efficiency and accuracy.

Choosing the right template, or even creating your own, is a crucial step. The ideal template should be easy to understand, customizable to your specific needs, and capable of integrating with your existing point-of-sale (POS) system. Furthermore, it should be designed to minimize errors and streamline the reconciliation process. Investing time in setting up a robust reporting system now will save countless hours and potential headaches down the road.

The digital age has brought about a wealth of options, from simple spreadsheets to sophisticated POS software with built-in reporting features. Understanding the different types of templates available and their respective advantages is key to selecting the best solution for your business. This article will explore the essential components of an End Of Day Cash Register Report Template, discuss different formats, and provide guidance on how to customize it to meet your unique requirements.

Finally, consistent adherence to the reporting process is just as important as the template itself. Training employees on proper procedures, regularly reviewing reports, and implementing internal controls are all vital steps in maintaining financial integrity and maximizing the benefits of this essential business tool.

A comprehensive End Of Day Cash Register Report Template typically includes several key sections, each designed to capture specific financial data. These sections work together to provide a complete picture of the day’s transactions. Let’s break down the most common and important components.

This section is the foundation of the report, detailing the total sales generated during the day. It should include:

This section focuses specifically on cash-related transactions:

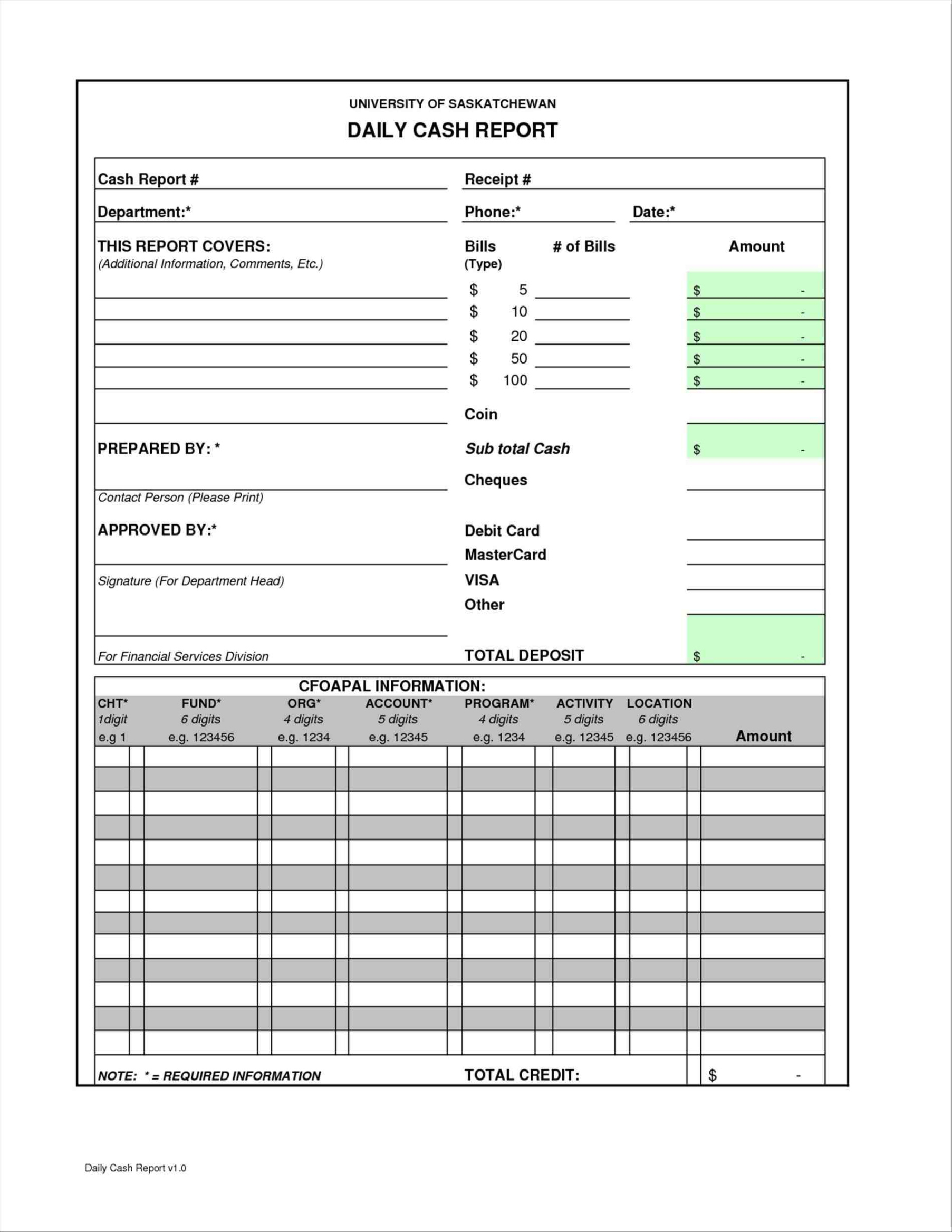

This section details transactions processed through credit and debit cards:

This section accounts for any other payment methods accepted:

This is arguably the most critical section. It summarizes the reconciliation process:

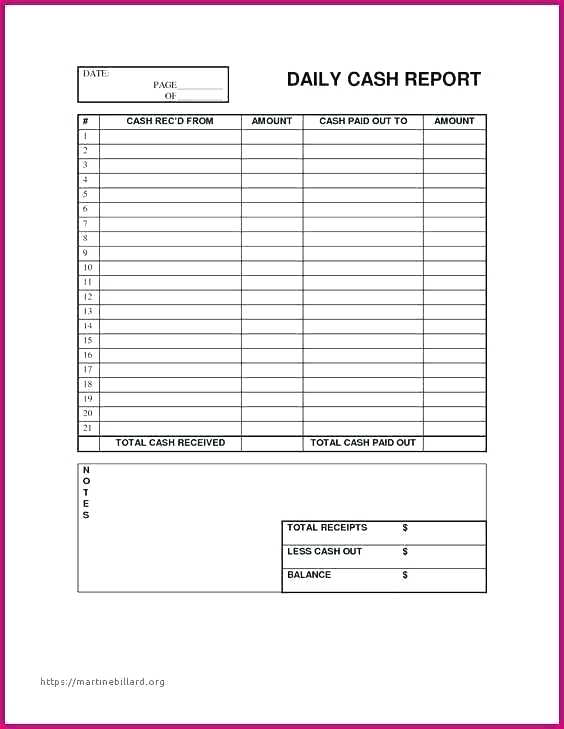

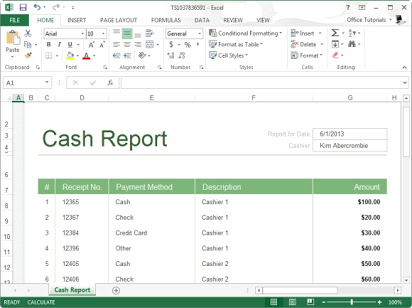

The format of your End Of Day Cash Register Report Template can vary depending on your business needs and the tools you use. Here are some common formats:

Spreadsheets are a popular choice for smaller businesses or those with limited budgets. They offer flexibility and customization options. You can easily create your own template from scratch or download pre-made templates online. The advantage is that they are readily accessible and require no specialized software. However, they can be prone to manual errors and may not integrate seamlessly with POS systems.

Many modern POS systems automatically generate End Of Day Cash Register Report Templates as part of their functionality. These reports are typically more accurate and efficient, as they are directly linked to the sales data captured by the POS system. They often offer advanced features like sales analytics and inventory tracking. The downside is that you are reliant on the POS system’s reporting capabilities.

For businesses that prefer a more traditional approach, printed forms can be used. These forms typically have pre-printed fields for each data point. While they are simple to use, they are less flexible than spreadsheets and can be more time-consuming to manage.

Cloud-based solutions offer a combination of the benefits of spreadsheets and POS integration. They allow you to access your reports from anywhere and often provide advanced analytics and reporting features.

A generic template might not perfectly suit your business’s specific needs. Customization is key to ensuring the report provides the most relevant and useful information.

Consider adding categories relevant to your business. For example, a restaurant might include sections for food sales, beverage sales, and dessert sales. A retail store might categorize sales by department or product type.

Tracking sales by employee can help identify top performers and areas for improvement. Include fields for employee ID or name.

Linking your report to your inventory management system can provide valuable insights into product performance and stock levels.

Allow space for notes and comments to explain any unusual transactions or discrepancies.

Simply having a template isn’t enough. Consistent and proper usage is crucial for maximizing its benefits.

Ensure all employees who handle cash are thoroughly trained on the reporting process.

Reconcile the cash drawer daily, following the steps outlined in the template.

Store completed reports securely to protect against loss or theft.

Review reports regularly to identify trends, potential problems, and areas for improvement.

Establish internal controls to prevent fraud and errors. This might include requiring dual signatures for cash payouts or conducting surprise cash counts.

Selecting the appropriate End Of Day Cash Register Report Template is a critical decision that can significantly impact your business’s financial management. Consider the following factors:

The End Of Day Cash Register Report Template is an indispensable tool for any business that handles cash transactions. By understanding its components, choosing the right format, customizing it to your needs, and following best practices, you can ensure accurate financial tracking, identify discrepancies, and make informed business decisions. Regularly reviewing and analyzing these reports provides valuable insights into your business’s performance, allowing you to optimize operations and maximize profitability. Investing in a robust reporting system is an investment in the long-term health and success of your business.