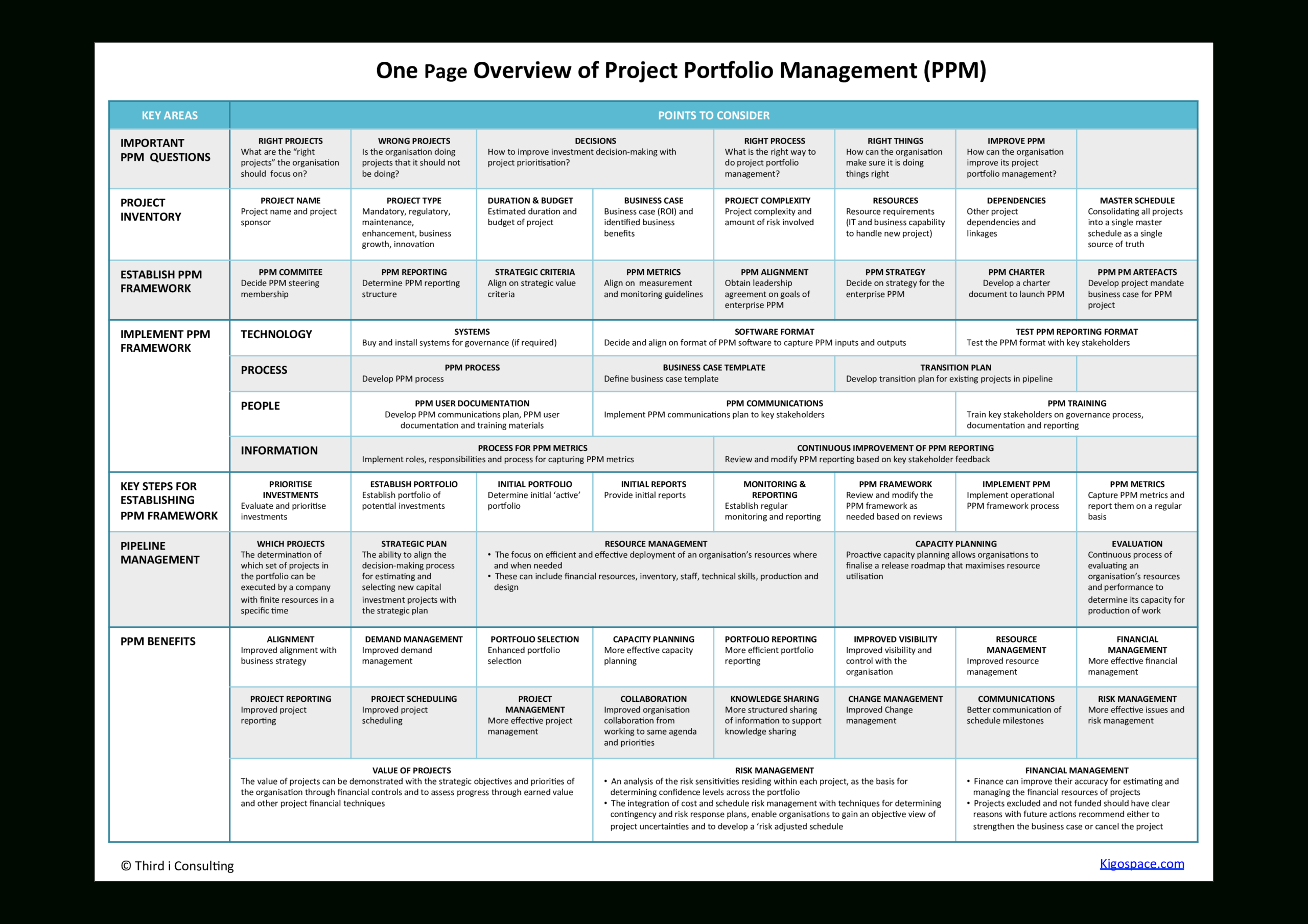

Portfolio management reporting is more than just generating charts and graphs; it’s about providing actionable insights to inform strategic decisions. Effective reporting isn’t a one-time task; it’s an ongoing process of analysis, refinement, and communication. Portfolio Management Reporting Templates are designed to streamline this process, offering a flexible and customizable framework for capturing key performance indicators (KPIs) and presenting them in a clear, concise, and visually appealing manner. They’re a crucial tool for investors, portfolio managers, and anyone involved in managing investment portfolios. Choosing the right template is paramount to ensuring your reports are both informative and impactful. This article will explore the benefits of using these templates, the key elements they contain, and how to tailor them to your specific needs. Let’s delve into how these templates can transform your portfolio management efforts.

The modern investment landscape demands more than just static data. Investors need to understand why their portfolios are performing, not just what they are performing. Traditional spreadsheets often struggle to capture the nuances of portfolio performance, making it difficult to identify trends, assess risk, and make informed decisions. Portfolio Management Reporting Templates address this challenge by providing a structured approach to data collection, analysis, and presentation. They move beyond simple summaries and offer a more holistic view of portfolio health. The benefits extend beyond simply fulfilling regulatory requirements; they foster greater transparency, accountability, and ultimately, improved investment outcomes. Without consistent, well-documented reporting, it’s difficult to demonstrate due diligence and justify investment strategies.

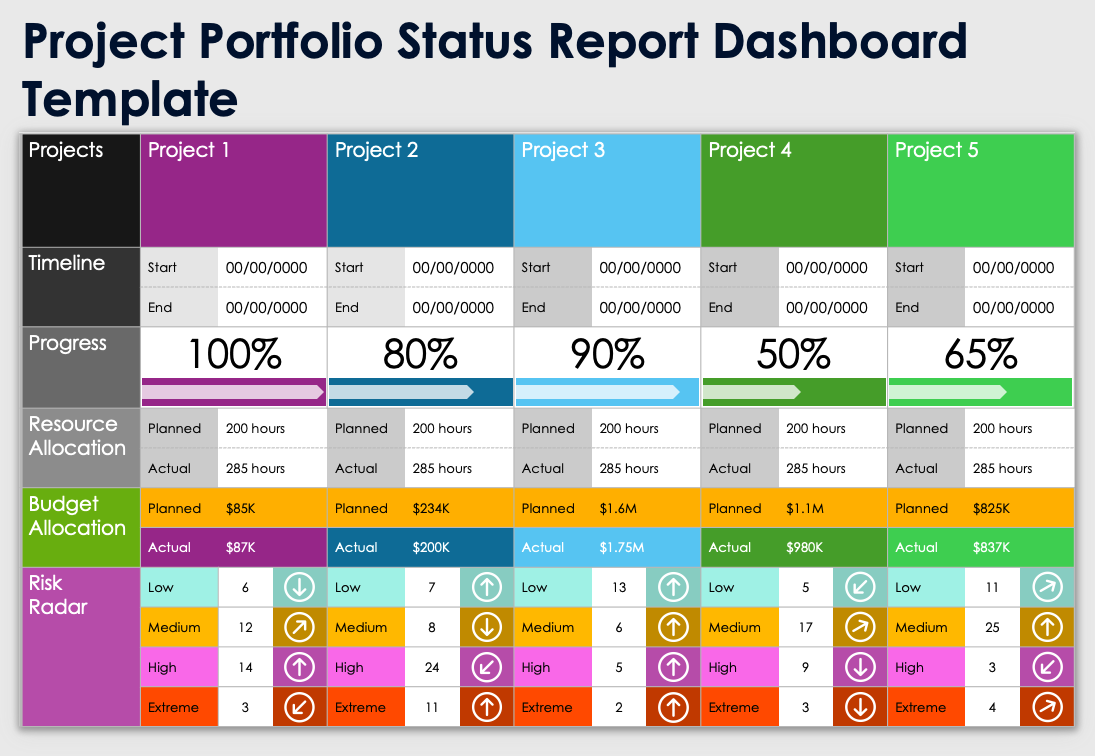

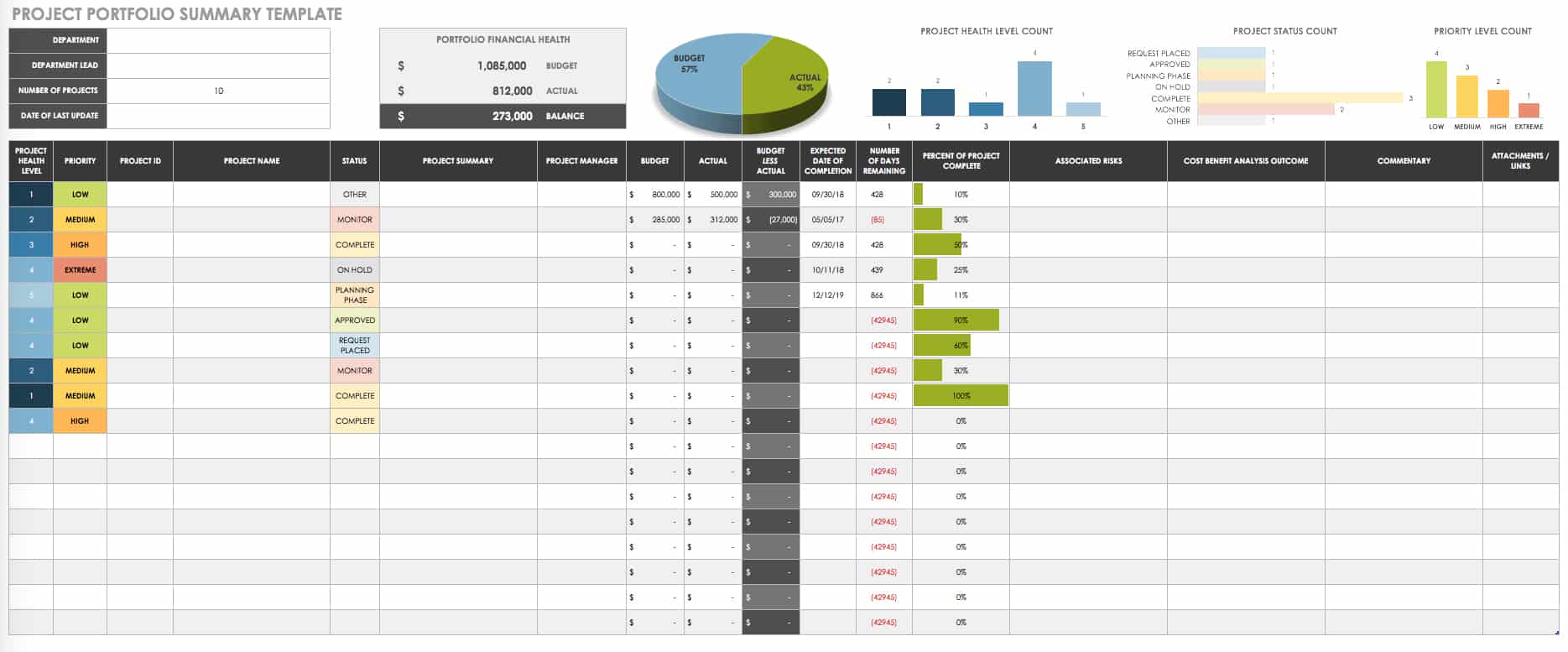

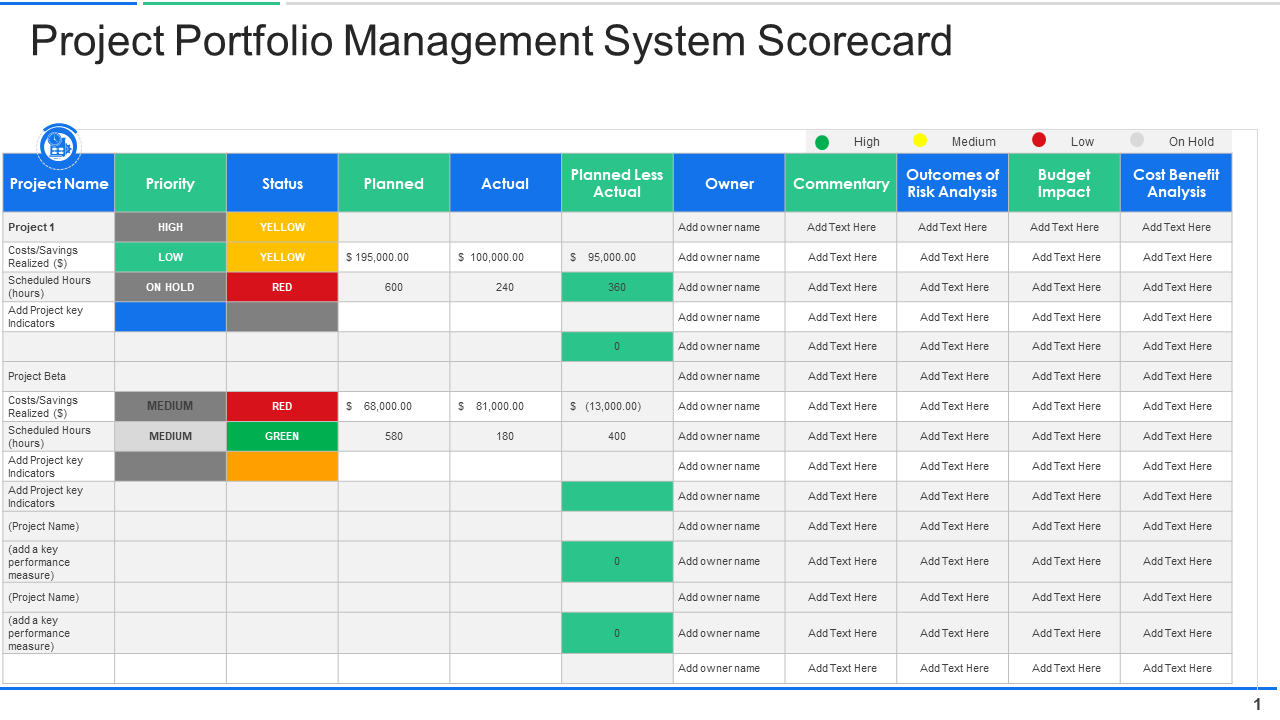

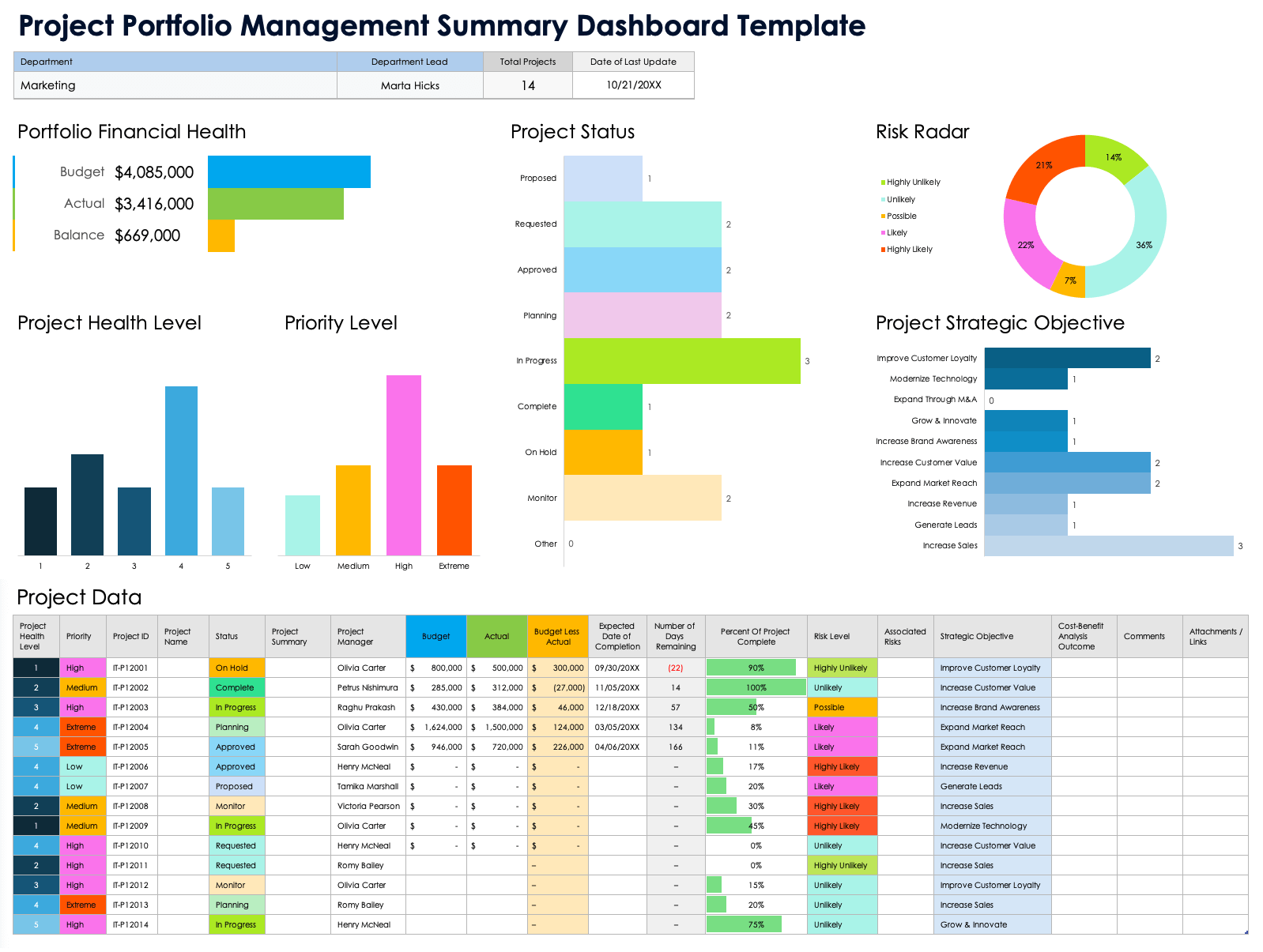

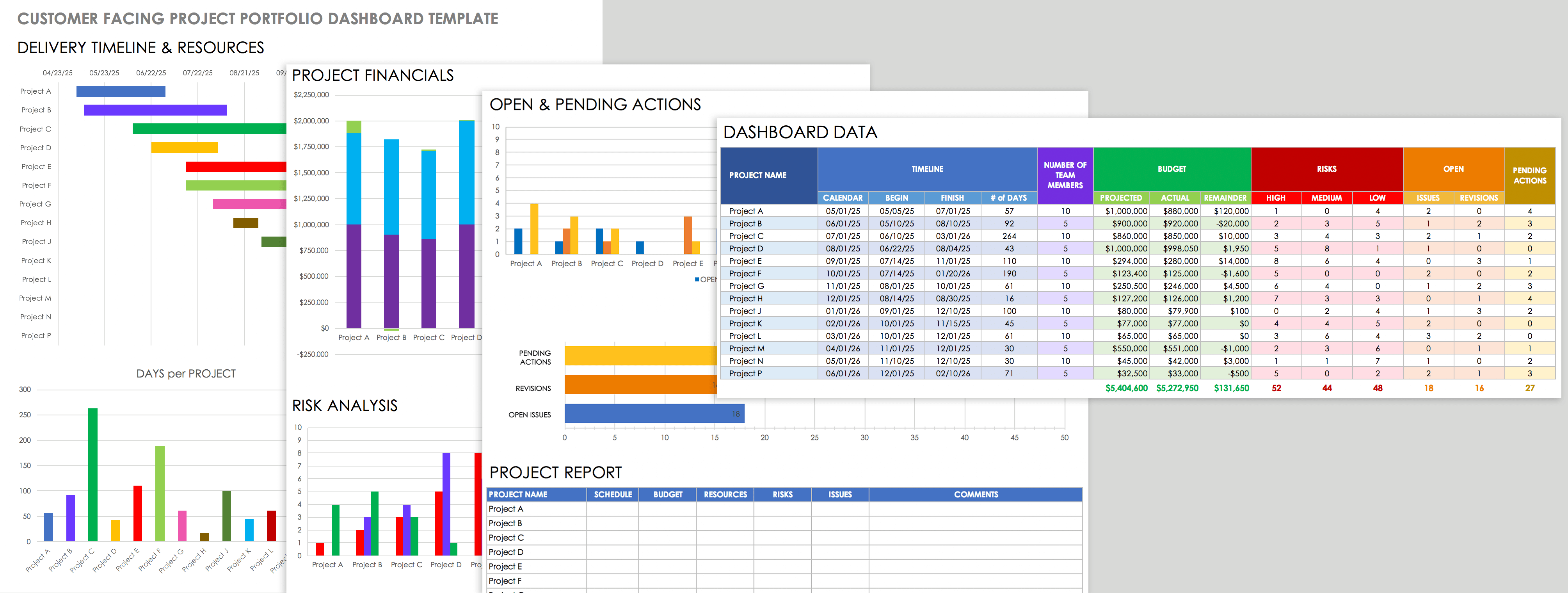

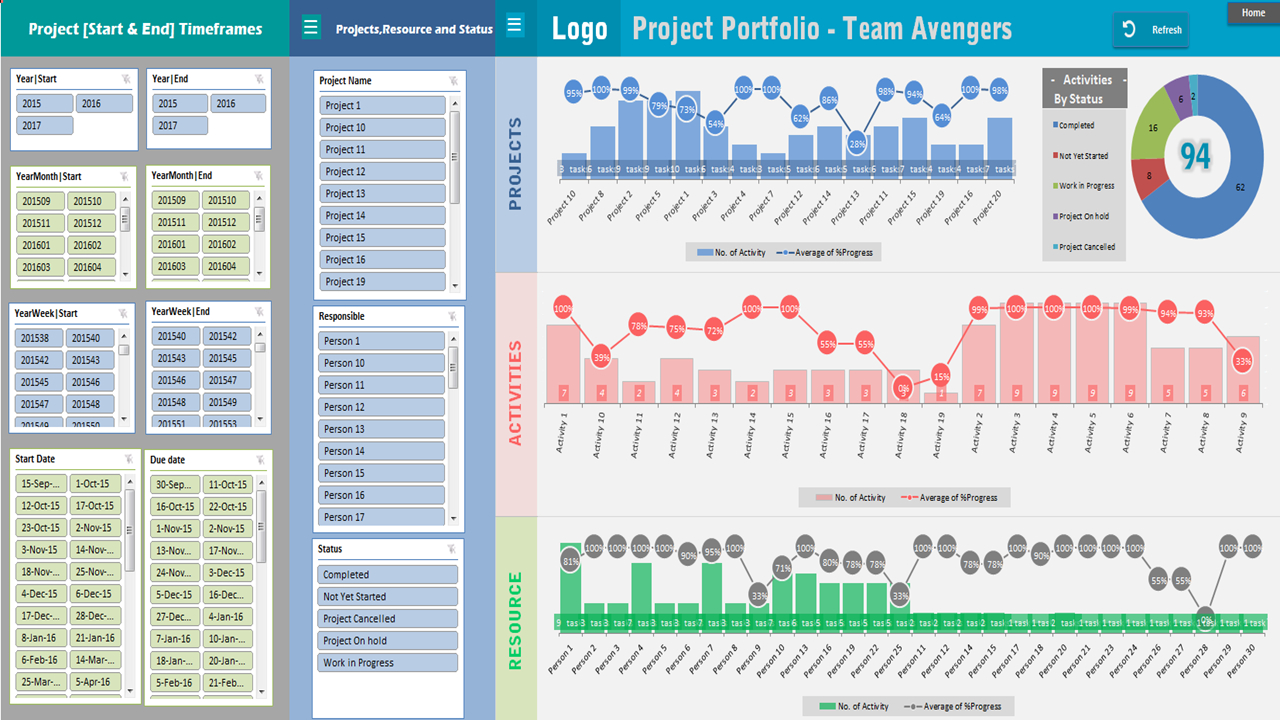

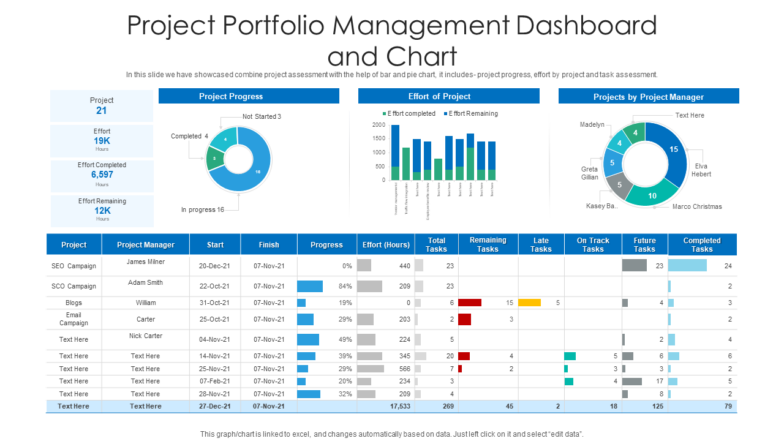

A truly effective portfolio management reporting template should incorporate several key elements. Firstly, it needs to include a clear definition of the portfolio’s objectives and risk tolerance. This foundational element ensures that all reporting efforts are aligned with the overall strategic goals. Secondly, it requires tracking of key performance indicators (KPIs) such as returns, Sharpe ratio, volatility, and asset allocation. These metrics provide a quantifiable measure of portfolio performance. Thirdly, robust data collection is essential. This involves establishing consistent data sources and processes for gathering information. Finally, a visually appealing and easily digestible format is crucial – often incorporating charts, graphs, and tables.

This template focuses on a high-level overview of portfolio performance. It typically includes:

This template provides a more granular view of portfolio performance, delving into specific aspects:

This template is specifically designed to assess and manage portfolio risk. It includes:

This template is tailored to individual client needs and preferences. It often includes:

Increasingly, investors are demanding transparency regarding the ESG performance of their portfolios. This template incorporates:

Effective portfolio management reporting relies heavily on data visualization. Charts and graphs are far more engaging and informative than raw numbers. Portfolio Management Reporting Templates should utilize a variety of chart types – line charts, bar charts, pie charts, and scatter plots – to effectively communicate complex data. Choosing the right chart type is crucial for conveying the intended message. For example, a line chart is ideal for showing trends over time, while a bar chart is better for comparing values across categories. Furthermore, clear and concise labels, titles, and legends are essential for ensuring that the visualizations are easily understood.

Portfolio Management Reporting Templates are an indispensable tool for investors, portfolio managers, and anyone seeking to understand and manage investment portfolios effectively. By providing a structured framework for data collection, analysis, and presentation, these templates empower stakeholders to make informed decisions, mitigate risk, and achieve their investment goals. The continued evolution of portfolio management techniques necessitates adaptable reporting tools. As investment strategies become more sophisticated, the need for robust and insightful reporting will only continue to grow. Investing in the right technology and training is key to successfully implementing and utilizing these templates. Ultimately, well-crafted portfolio management reports are a cornerstone of successful investment management.