Creating a robust financial picture is crucial for the survival and growth of any small business. Understanding your financial health allows you to make informed decisions, secure funding, and ultimately, thrive in a competitive market. A well-structured financial statement provides a clear and concise overview of your business’s performance, enabling proactive management and strategic planning. This article will guide you through creating a professional and effective financial statement template specifically tailored for small businesses, equipping you with the knowledge to navigate the complexities of financial reporting. The core of this guide revolves around understanding the essential components of a financial statement and how to present them effectively. Financial Statement Template For Small Business – a foundational tool for success.

The process of creating a financial statement can seem daunting, but breaking it down into manageable steps makes it achievable. It’s not just about numbers; it’s about communicating your business’s story. A clear and accurate financial statement builds trust with investors, lenders, and partners. It demonstrates accountability and provides a benchmark for future performance. Let’s delve into the key elements and how to construct a template that meets your specific needs.

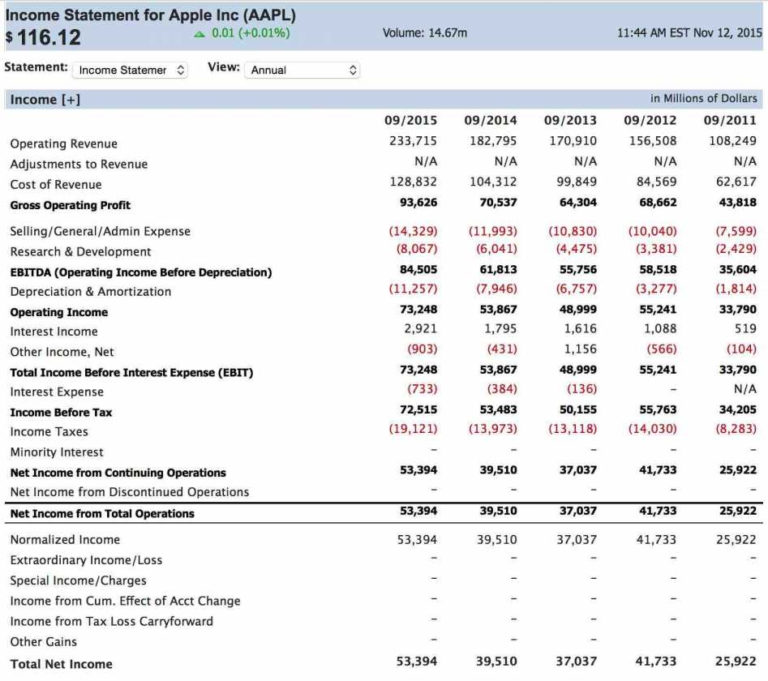

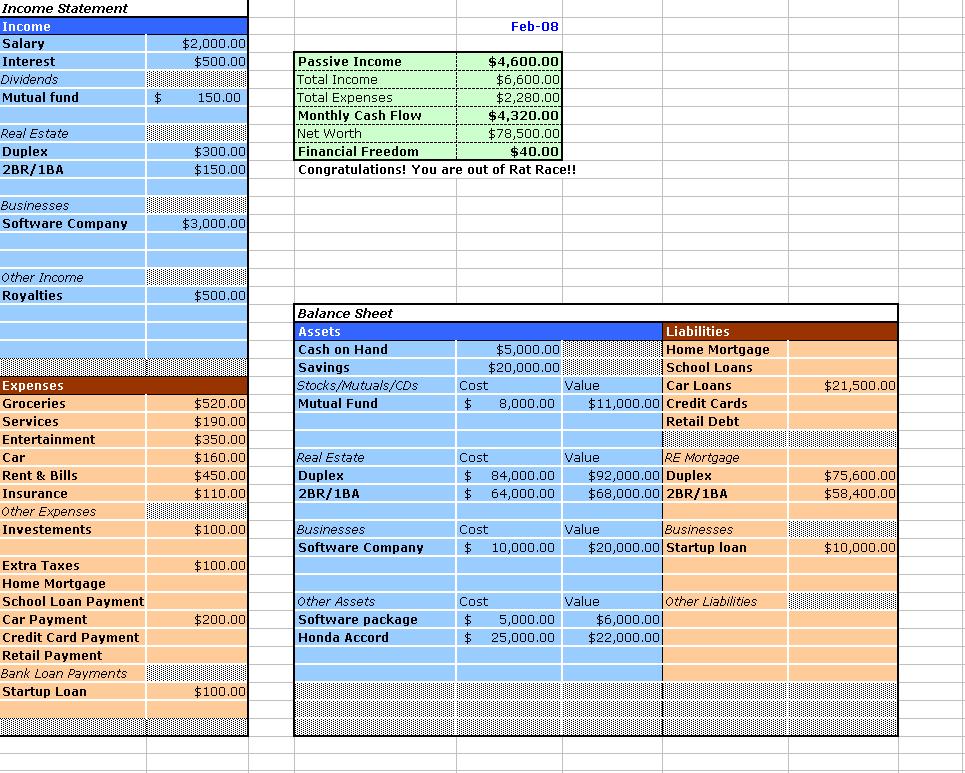

Before diving into the template itself, it’s important to grasp the fundamental components of a financial statement. There are generally three main statements: the Income Statement (also known as the Profit and Loss Statement), the Balance Sheet, and the Cash Flow Statement. Each statement provides a different perspective on your business’s financial position. The Income Statement shows your revenues, expenses, and ultimately, your net profit or loss over a specific period. The Balance Sheet presents a snapshot of your assets, liabilities, and equity at a specific point in time. The Cash Flow Statement tracks the movement of cash both into and out of your business. Understanding how these statements relate to each other is vital for a complete financial picture.

The Income Statement is the most frequently used statement for small businesses. It’s a detailed breakdown of your revenue streams and how they were converted into profit or loss. It’s a critical tool for monitoring profitability and identifying areas for improvement. The Balance Sheet, on the other hand, provides a snapshot of your assets, liabilities, and equity. It’s a more conservative view of your financial health, reflecting what you own and owe. The Cash Flow Statement is essential for understanding how your business generates and uses cash, highlighting potential cash flow challenges.

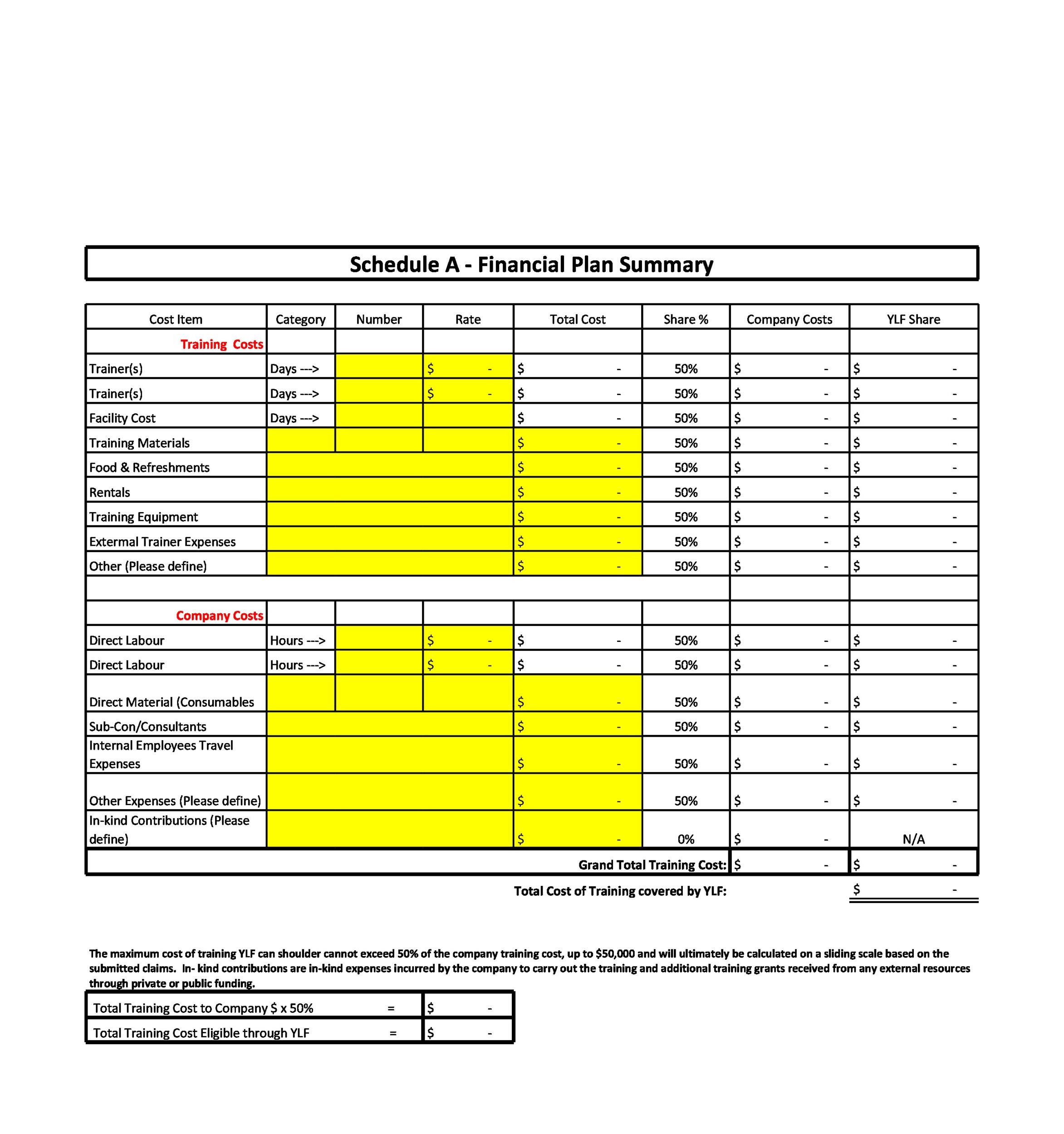

Now, let’s explore a practical template for creating your financial statement. This template is designed to be adaptable to various small business sizes and industries. Remember, this is a starting point – customize it to reflect your unique business operations.

Period: [Month/Year]

Creating a robust financial statement is a continuous process, not a one-time event. By understanding the core components, utilizing a well-structured template, and consistently monitoring your financial performance, you can gain valuable insights into your business’s health and make informed decisions to achieve your goals. A well-prepared financial statement is a powerful tool for driving growth, securing funding, and ultimately, building a successful and sustainable small business. Remember that this template is a foundation; adapt it to your specific circumstances and seek professional advice when needed. The key to success lies in diligent tracking, accurate reporting, and a commitment to continuous improvement. Financial Statement Template For Small Business – a vital tool for long-term prosperity.