Running a business is all about managing cash flow effectively. While you might have strong sales and excellent products or services, delayed payments from customers can seriously hamper your ability to grow and invest. That’s where invoice discounting comes in, providing a vital lifeline by unlocking the value tied up in your unpaid invoices. But before you jump in, you need a solid Invoice Discounting Agreement in place. This agreement outlines the terms and conditions between you (the seller of the invoices) and the finance provider (the discounter), ensuring a smooth and transparent relationship. Without a clearly defined agreement, you could face unexpected costs, disputes, or even damage your reputation.

Understanding Invoice Discounting and the Importance of a Template

Invoice discounting allows businesses to receive immediate cash against their unpaid invoices. Essentially, you’re selling your invoices at a discounted rate to a finance provider who then collects the full payment from your customers when it’s due. This injects working capital into your business much faster than waiting for your customers to pay, enabling you to meet operational expenses, invest in expansion, and capitalize on new opportunities.

A well-drafted Invoice Discounting Agreement Template is crucial because it provides a framework for this financial transaction. It sets out the rights and responsibilities of both parties, minimizing potential conflicts and ensuring legal compliance. Using a reliable template saves you time and money compared to drafting an agreement from scratch, and it helps you avoid costly legal pitfalls.

Key Elements of a Comprehensive Invoice Discounting Agreement Template

An effective Invoice Discounting Agreement Template should cover several key areas to protect your interests and ensure a successful financing arrangement. Here are some of the most important components:

- Parties Involved: Clearly identifies the seller (your business) and the discounter (the finance provider). Includes legal names, addresses, and contact information.

- Definitions: Defines key terms such as “Eligible Invoices,” “Discount Rate,” “Advance Rate,” “Recourse” and “Non-Recourse.” Clear definitions are essential to avoid ambiguity.

- Eligible Invoices: Specifies the criteria invoices must meet to be eligible for discounting. This might include factors like customer creditworthiness, invoice age, and industry sector.

- Discount and Advance Rates: Details the discount rate applied to the invoices (the discounter’s fee) and the advance rate (the percentage of the invoice value you receive upfront). Specifies how these rates are calculated and when they might change.

- Recourse vs. Non-Recourse: Defines whether you are liable if your customer fails to pay the invoice. Recourse discounting means you are responsible for unpaid invoices, while non-recourse means the discounter assumes the risk (though this usually comes with higher fees and stricter eligibility criteria).

- Payment Terms: Outlines how and when the discounter will pay you the advance and how and when you will reimburse them upon customer payment. Specifies procedures for handling invoice payments, including bank account details.

- Reporting Requirements: Details the information you must provide to the discounter, such as invoice details, customer updates, and payment records. Specifies the frequency and format of these reports.

- Representations and Warranties: Your assurances to the discounter that the invoices are valid, legally enforceable, and free from any liens or encumbrances.

- Termination Clause: Specifies the conditions under which either party can terminate the agreement, including notice periods and any associated penalties.

- Confidentiality: Ensures that both parties protect the confidential information shared during the discounting process.

- Governing Law and Dispute Resolution: Specifies the jurisdiction whose laws will govern the agreement and the methods for resolving disputes (e.g., arbitration or litigation).

- Fees and Expenses: Details all fees and expenses associated with the discounting arrangement, including origination fees, service fees, and late payment fees.

Choosing the right Invoice Discounting Agreement Template is crucial for securing your business’s financial future. Make sure the template is comprehensive, easy to understand, and legally sound. Consider consulting with a legal professional to ensure the template meets your specific needs and protects your interests. A well-structured agreement will provide clarity, reduce risks, and facilitate a successful and mutually beneficial invoice discounting relationship, allowing you to unlock the cash flow you need to grow and thrive.

If you are looking for Invoice Discounting Agreement Template you’ve came to the right place. We have 9 Pics about Invoice Discounting Agreement Template like Invoice Letter Template Gallery regarding Invoice Discounting Agreement, Invoice Discounting Agreement Template – Detrester.com and also Invoice Discounting Agreement Template. Read more:

Invoice Discounting Agreement Template

ar.inspiredpencil.com

Invoice Letter Template Gallery Regarding Invoice Discounting Agreement

vancecountyfair.com

Itemized Invoice Template – PARAHYENA

www.parahyena.com

Invoice Discounting Agreement Template – Detrester.com

www.detrester.com

Invoice Discounting Agreement Template – 10+ Examples Of Professional

vancecountyfair.com

Invoice Discounting Agreement Template

ar.inspiredpencil.com

Invoice Discounting Agreement Template

greatdesignlayouttemplates.blogspot.com

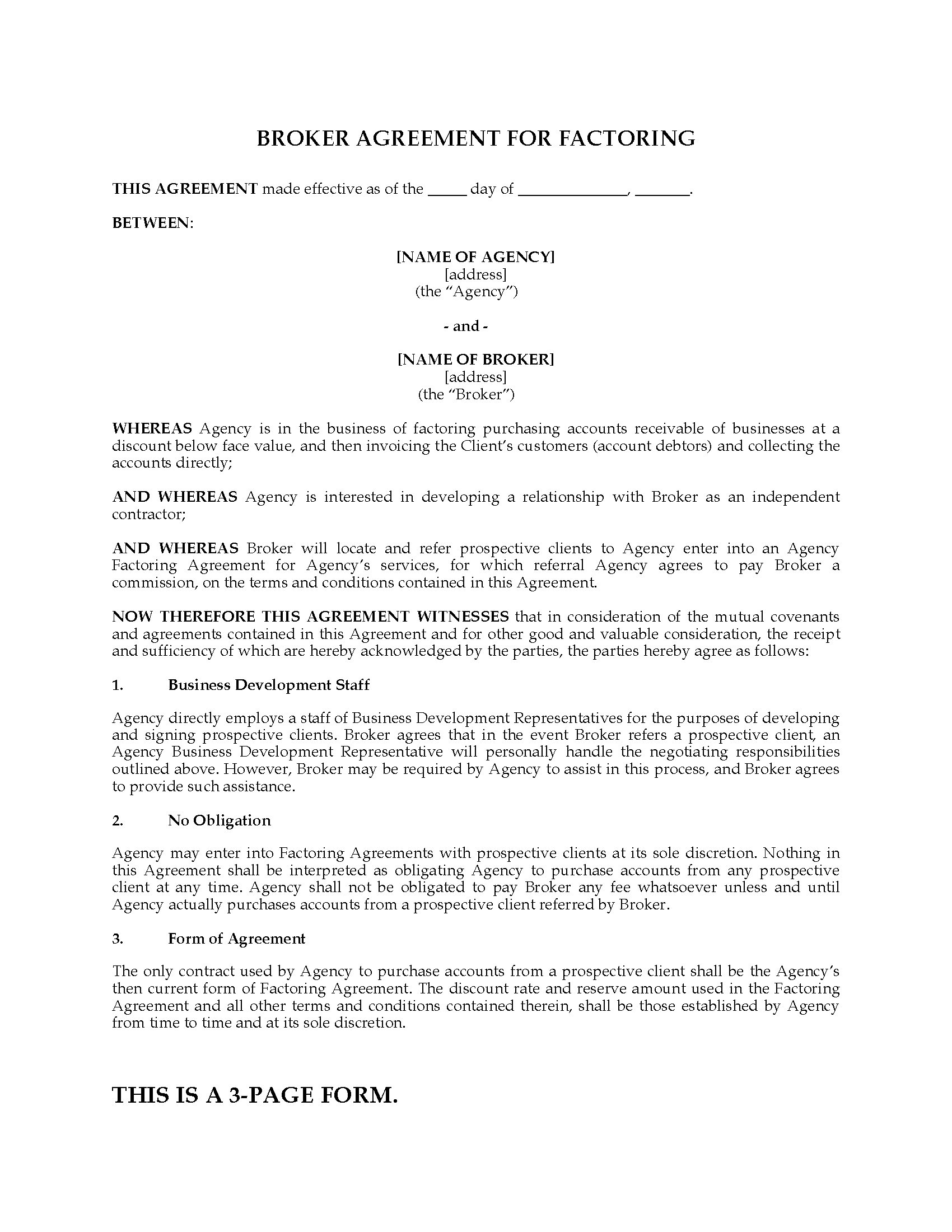

Factoring Agreement | Business Template Throughout Invoice Discounting

footballwchs.com

Invoice Discounting Agreement Template – Detrester.com

www.detrester.com

Itemized invoice template – parahyena. Invoice discounting agreement template. Invoice discounting agreement template