Starting a new bookkeeping relationship requires clarity and trust. A well-drafted Bookkeeping Letter of Engagement is crucial for setting clear expectations, outlining responsibilities, and preventing misunderstandings down the line. This document serves as the foundation of your working relationship with your bookkeeper or bookkeeping firm. It’s more than just a formality; it’s a safeguard for both parties, ensuring a smooth and productive collaboration. Without a clear agreement, you risk scope creep, payment disputes, and a general lack of accountability.

Thinking about using a template for your Bookkeeping Letter of Engagement? Great idea! A template can save you time and ensure you cover all the essential elements. However, remember that a template is just a starting point. You’ll need to customize it to accurately reflect the specific services you’re offering or receiving, the unique needs of your business, and any agreed-upon timelines or deliverables. This article explores the key components of a Bookkeeping Letter of Engagement template and highlights the importance of tailoring it to your particular circumstances.

Key Elements of a Bookkeeping Letter of Engagement Template

A comprehensive Bookkeeping Letter of Engagement template should cover several critical areas. Let’s break down the essentials:

-

1. Identification of Parties:

Clearly state the full legal names and addresses of both the client (your business) and the bookkeeper or bookkeeping firm. This section eliminates any ambiguity about who is entering into the agreement. Include contact information for key personnel.

-

2. Scope of Services:

This is arguably the most important section. Be as specific as possible about the services the bookkeeper will provide. Examples include:

- Recording financial transactions

- Reconciling bank accounts

- Preparing financial statements (e.g., Profit & Loss, Balance Sheet)

- Managing accounts payable and receivable

- Payroll processing

- Sales tax preparation and filing

- Budgeting and forecasting

- Providing financial reports on a [frequency] basis

Also, explicitly state what services are not included. This prevents future misunderstandings and potential disputes. For instance, mention if tax preparation beyond sales tax is not part of the agreement.

-

3. Responsibilities of Both Parties:

Clearly define what each party is responsible for. What information will the client provide, and in what format? What is the timeline for providing this information? What is the bookkeeper responsible for delivering, and by when? Examples include:

- Client Responsibilities: Providing accurate and timely financial records, access to bank accounts, expense reports, etc.

- Bookkeeper Responsibilities: Maintaining accurate records, preparing financial statements, meeting deadlines, etc.

-

4. Fees and Payment Terms:

Outline the fee structure clearly. Is it hourly, fixed fee, or a combination? Specify the payment terms, including when payments are due and acceptable payment methods. Include details on late payment penalties, if any. Consider adding a clause about how fees will be adjusted if the scope of work changes.

-

5. Term and Termination:

Specify the length of the agreement and the conditions under which either party can terminate it. What notice period is required? What happens to data and records upon termination? Include a clause addressing the possibility of a premature termination fee.

-

6. Confidentiality:

A strong confidentiality clause is essential to protect sensitive financial information. This clause should state that the bookkeeper will keep all client information confidential and will not disclose it to any third party without the client’s consent, except as required by law.

-

7. Data Security:

In today’s digital world, data security is paramount. Outline the measures the bookkeeper takes to protect client data, including software used, data backup procedures, and security protocols. Comply with relevant data privacy regulations.

-

8. Governing Law and Dispute Resolution:

Specify the governing law for the agreement (e.g., the laws of a particular state or jurisdiction). Include a clause outlining the process for resolving disputes, such as mediation or arbitration.

-

9. Acceptance:

Include a space for both parties to sign and date the agreement, indicating their acceptance of the terms.

Why Tailoring Your Bookkeeping Letter of Engagement is Crucial

While a template provides a solid foundation, simply downloading and using it without customization can lead to problems. Every business is unique, and its bookkeeping needs are equally unique. Customization ensures the agreement accurately reflects the specific services required, the complexities of the business, and any special arrangements made. Failing to customize could result in disputes over the scope of work, unexpected fees, or inadequate data protection. Consulting with a legal professional or experienced bookkeeping consultant to review and tailor your template is highly recommended. They can help you identify potential loopholes, ensure compliance with relevant regulations, and provide valuable insights to create a truly effective Bookkeeping Letter of Engagement.

In conclusion, a Bookkeeping Letter of Engagement is a vital tool for building a strong and successful relationship with your bookkeeper. By using a comprehensive template and taking the time to customize it to your specific needs, you can establish clear expectations, protect your interests, and ensure a smooth and productive collaboration. Remember to seek professional advice to ensure your agreement is legally sound and meets your business requirements.

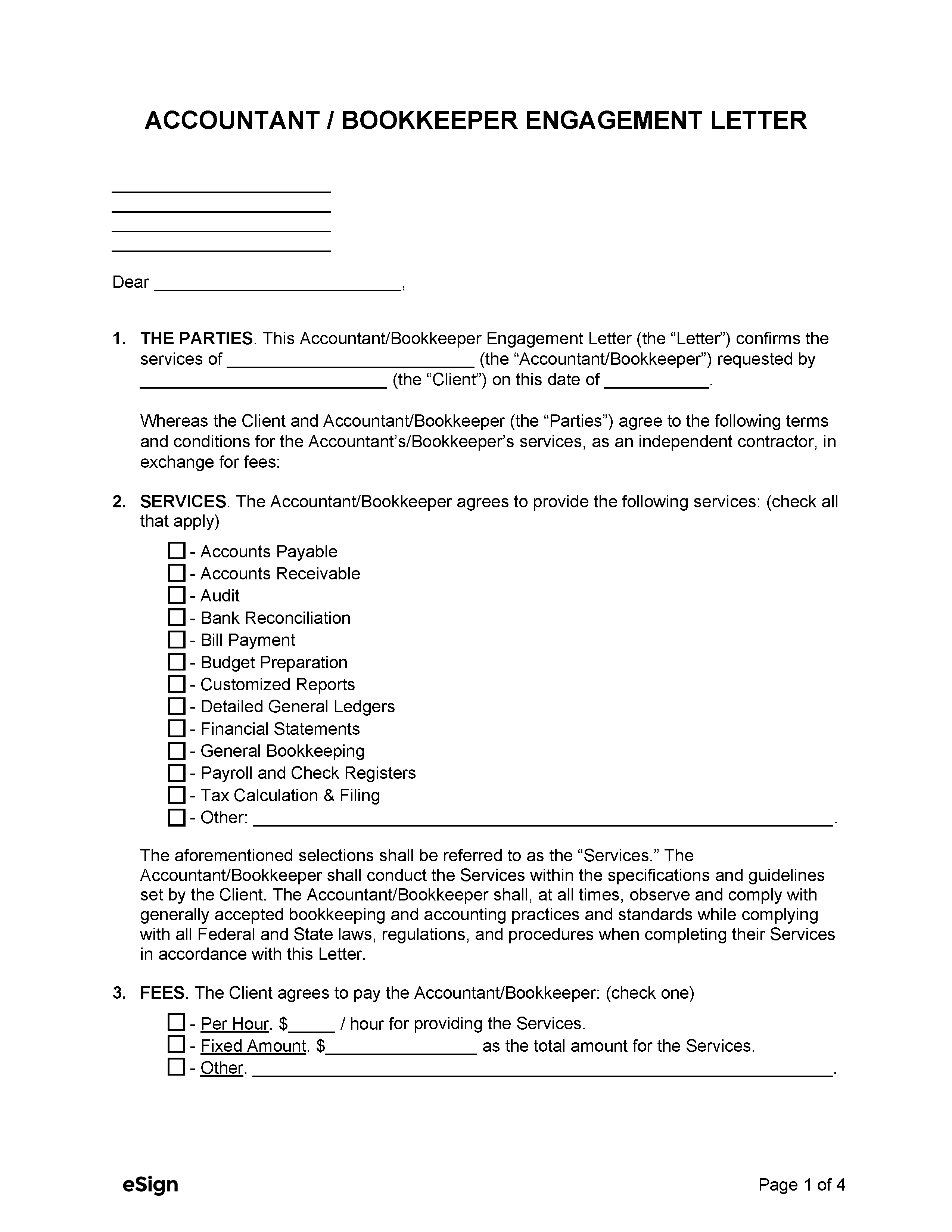

If you are looking for Bookkeeping Engagement Letter Template Samples Letter – vrogue.co you’ve visit to the right page. We have 9 Images about Bookkeeping Engagement Letter Template Samples Letter – vrogue.co like Bookkeeping Engagement Letter Template Samples Letter Cover Templates, Bookkeeping Engagement Letter Template Collection | Letter Template and also Bookkeeping Letter Of Engagement Template | The Best Professional Template. Here it is:

Bookkeeping Engagement Letter Template Samples Letter – Vrogue.co

www.vrogue.co

Bookkeeping Engagement Letter Template Samples Letter – vrogue.co

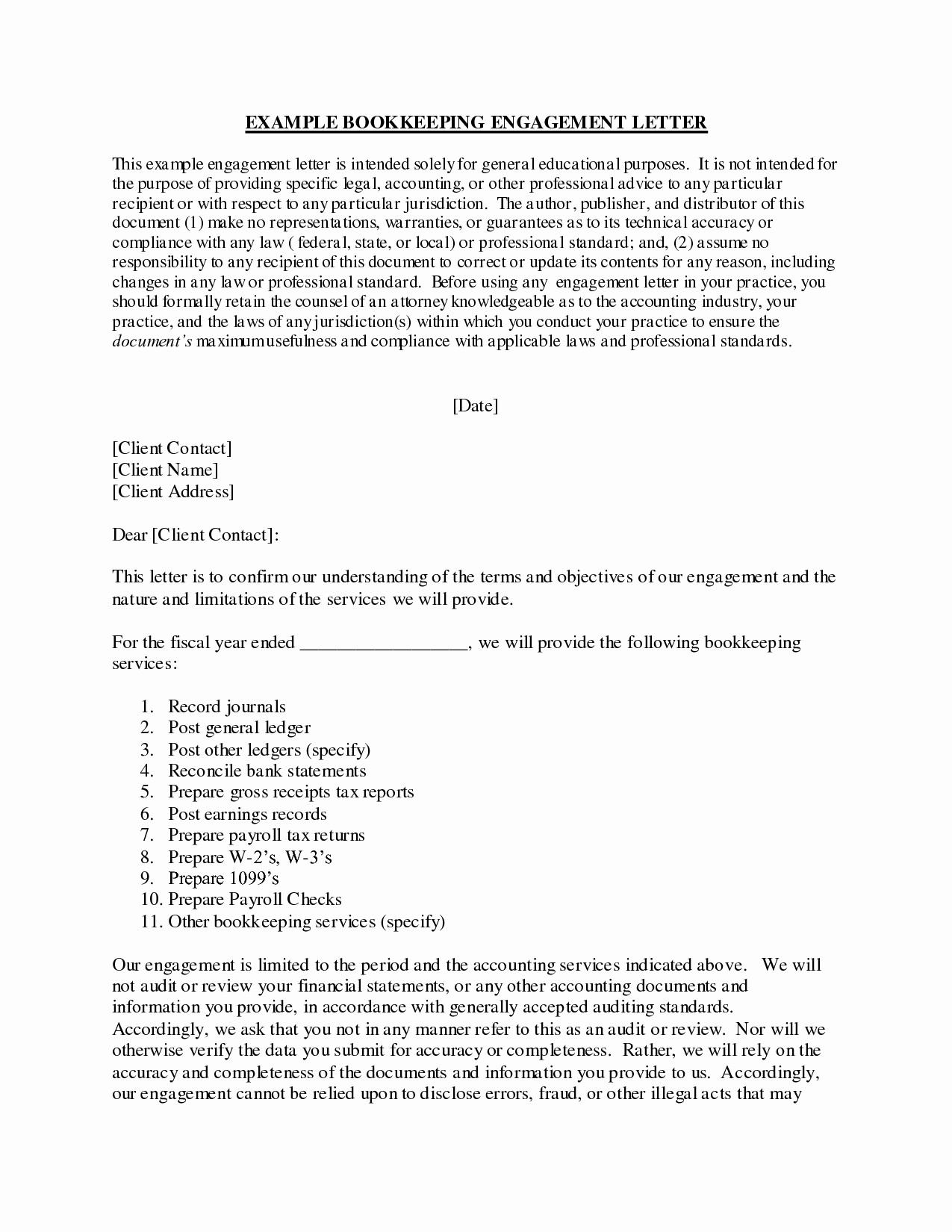

Bookkeeping Engagement Letter Template Collection | Letter Template

db-excel.com

Bookkeeping Engagement Letter Template Collection | Letter Template …

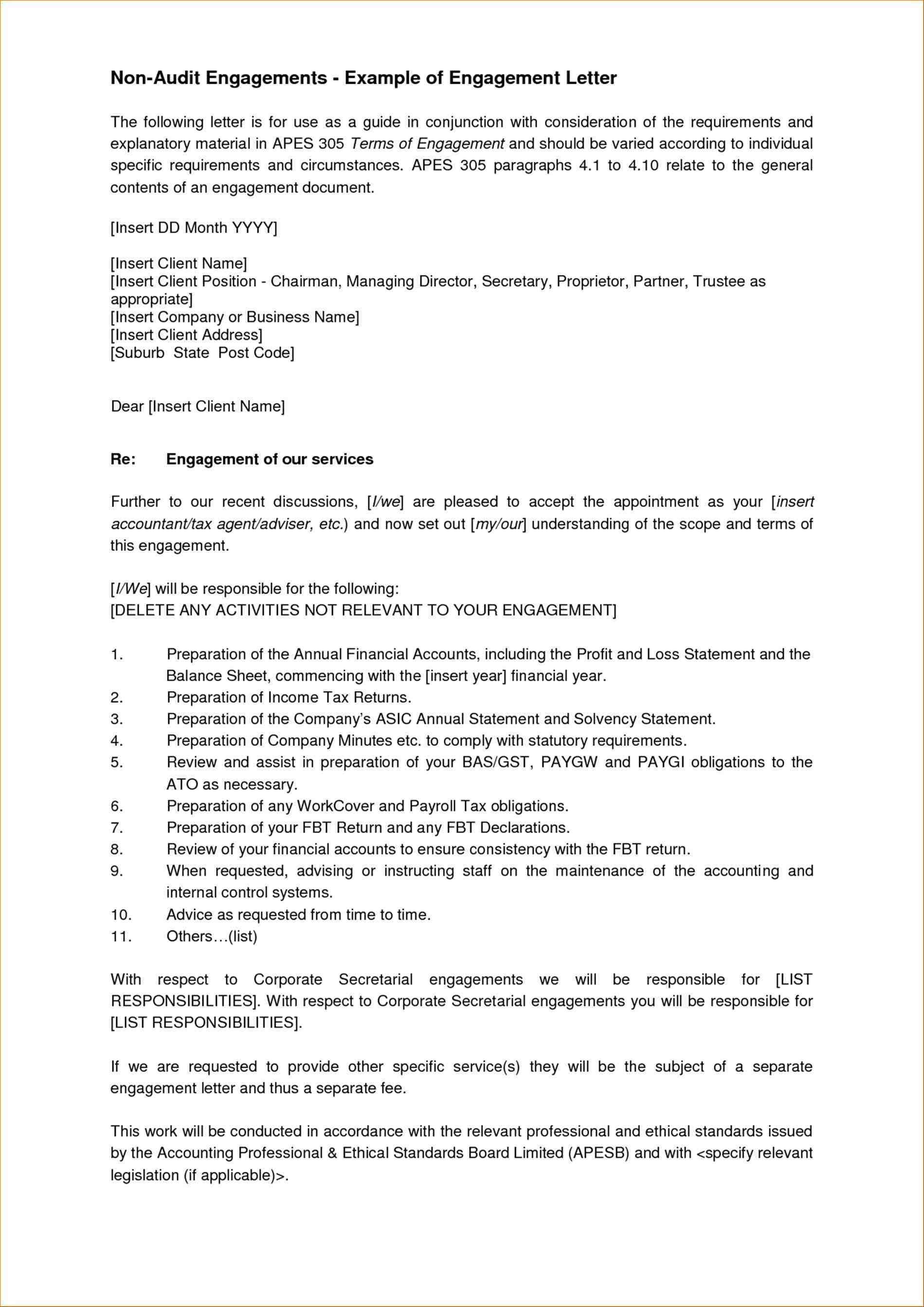

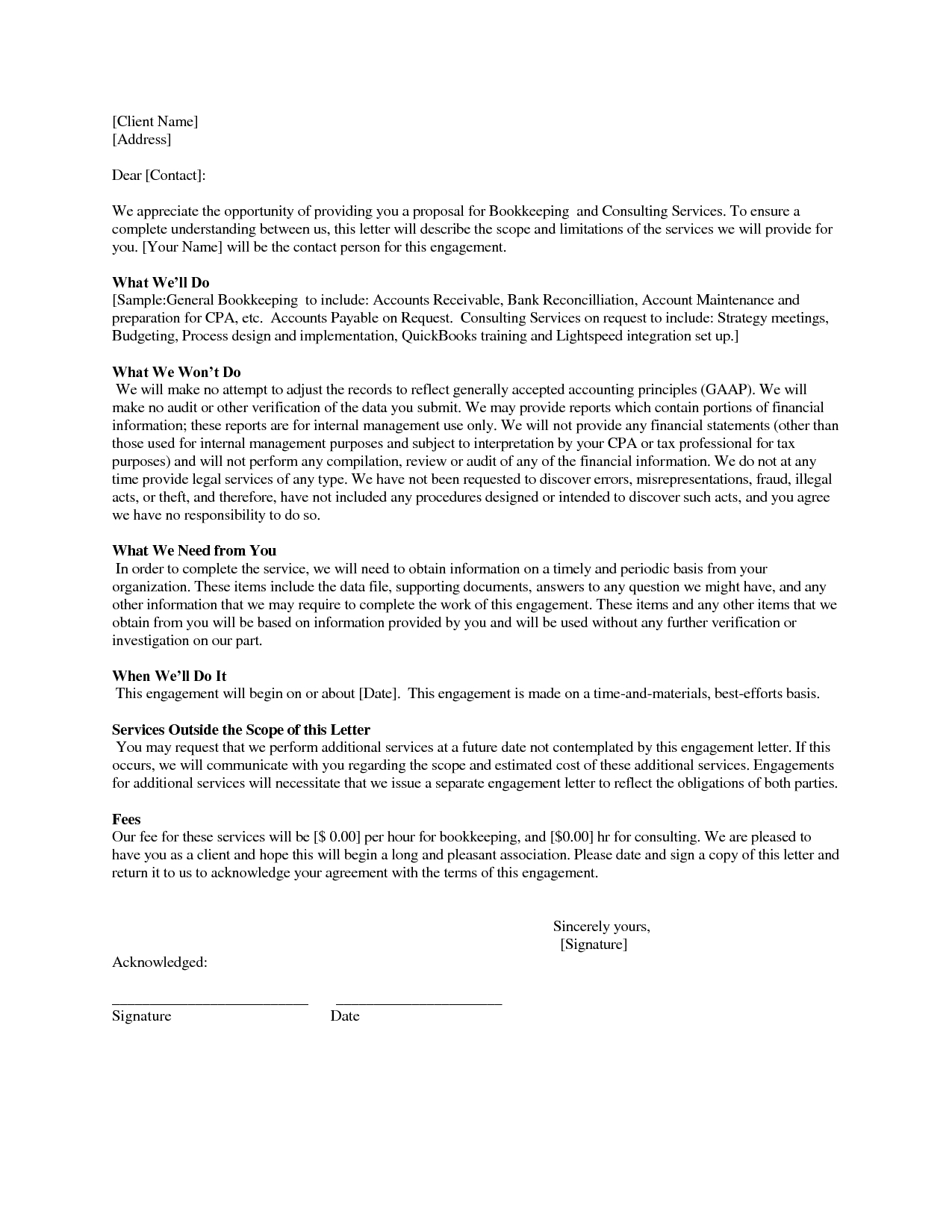

Bookkeeping Engagement Letter Template Download Throughout Bookkeeping

db-excel.com

Bookkeeping Engagement Letter Template Download throughout Bookkeeping …

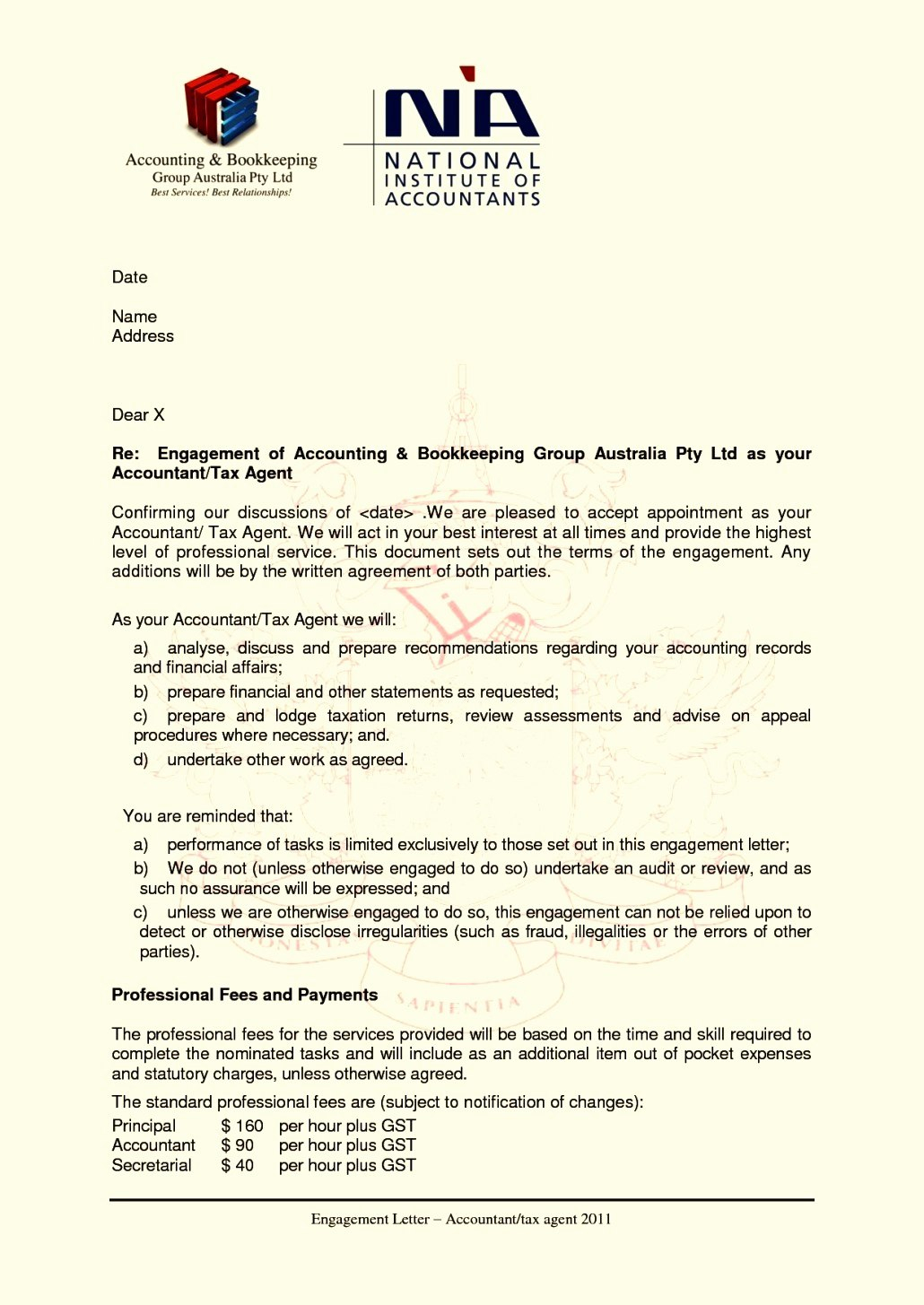

Bookkeeping Engagement Letter Template Samples Letter Cover Templates

vancecountyfair.com

Bookkeeping Engagement Letter Template Samples Letter Cover Templates …

Engagement Letter

fity.club

Engagement Letter

Bookkeeping Engagement Letter Template Free Templates Sample

giursettaqyhlessonmedia.z14.web.core.windows.net

Bookkeeping Engagement Letter Template Free Templates Sample

Bookkeeping Letter Of Engagement Template | The Best Professional Template

bestprofessional-template.blogspot.com

Bookkeeping Letter Of Engagement Template | The Best Professional Template

5+ Letter Of Engagement Template – HaseebAryaa

haseebaryaa.blogspot.com

5+ Letter Of Engagement Template – HaseebAryaa

Magnificent Letter Engagement Template For Bookkeeper S – Cover And

db-excel.com

Magnificent Letter Engagement Template For Bookkeeper S – Cover and …

Bookkeeping engagement letter template collection. Bookkeeping engagement letter template samples letter. bookkeeping engagement letter template collection