Facing overwhelming debt can feel like an uphill battle. Interest rates keep climbing, late fees pile up, and the sheer weight of it all can be incredibly stressful. But don’t despair! There are ways to take control and work towards a more manageable financial future. One powerful tool in your arsenal is the **Debt Negotiation Letter**. This letter allows you to formally propose a repayment plan to your creditors, potentially reducing your overall debt or lowering your monthly payments. It’s a crucial first step in taking charge and negotiating a better financial position. This post will guide you through the process, offering insights and a Debt Negotiation Letter Template to get you started.

Why Use a Debt Negotiation Letter?

A Debt Negotiation Letter isn’t a magic bullet, but it offers several potential benefits:

- Potential for Debt Reduction: Creditors may be willing to accept a lump-sum payment for less than the full amount owed, especially if they believe you’re at risk of defaulting entirely.

- Lower Monthly Payments: You can propose a more manageable repayment plan with lower monthly installments, easing the pressure on your budget.

- Reduced Interest Rates: Negotiating a lower interest rate can significantly reduce the total amount you pay over time.

- Waived Fees: You can request the waiver of late fees or other charges, further reducing your debt burden.

- Formal Record: A written letter provides a clear and documented record of your communication and proposed terms, which can be helpful in case of disputes.

- Demonstrates Good Faith: Sending a Debt Negotiation Letter shows your creditor that you’re taking responsibility for your debt and are actively working towards a solution. This can improve your chances of a favorable outcome.

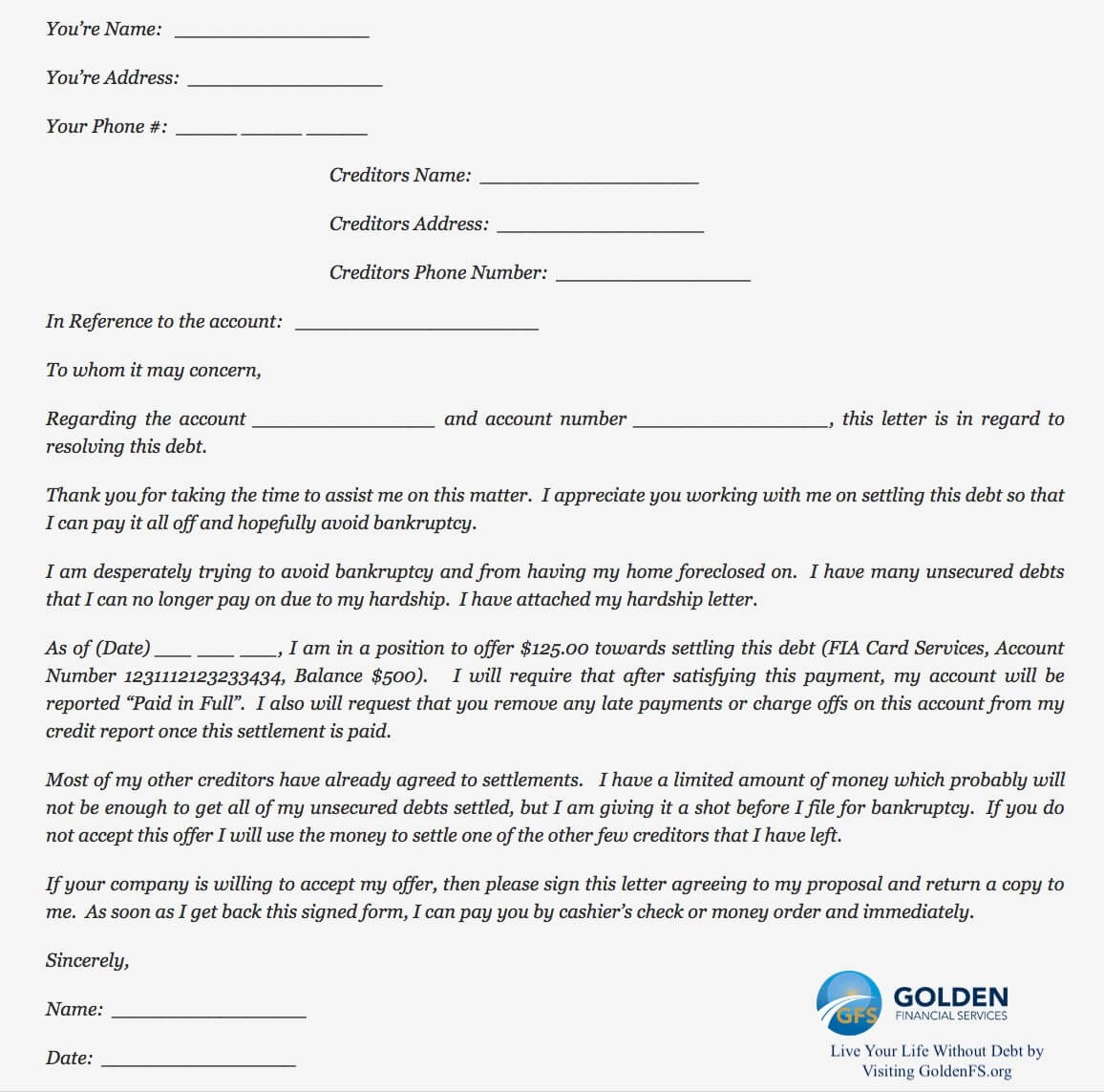

Key Components of a Successful Debt Negotiation Letter

Crafting an effective Debt Negotiation Letter requires careful planning and attention to detail. Here’s what you should include:

- Your Information: Include your full name, address, phone number, and account number.

- Creditor Information: Clearly state the creditor’s name, address, and contact information (if available).

- Clearly State the Debt: Identify the specific debt you’re negotiating, including the original amount, current balance, and any relevant dates.

- Explain Your Financial Situation: Be honest and transparent about why you’re struggling to repay the debt. Explain any hardships you’re facing, such as job loss, illness, or unexpected expenses.

- Propose a Repayment Plan: Clearly outline your proposed repayment plan. This could involve a lump-sum settlement, a reduced monthly payment, or a lower interest rate. Be realistic and offer a plan that you can genuinely afford.

- State Your Commitment: Emphasize your commitment to resolving the debt and your willingness to work with the creditor.

- Set a Deadline: Include a reasonable deadline for the creditor to respond to your proposal.

- Express Gratitude: Thank the creditor for their time and consideration.

Debt Negotiation Letter Template

Use this template as a starting point and customize it to fit your specific situation.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Creditor's Name]

[Creditor's Address]

Subject: Debt Negotiation - Account Number: [Your Account Number]

Dear [Creditor Contact Person, if known, otherwise "Sir/Madam"],

I am writing to you regarding account number [Your Account Number], which currently has a balance of [Current Balance]. I am experiencing financial difficulties and am unable to meet the current repayment terms.

[Explain your financial hardship. Be specific and honest. For example: "Due to a recent job loss, I am currently unemployed and have limited income." or "Unexpected medical expenses have placed a significant strain on my finances."]

I am committed to resolving this debt and would like to propose the following repayment plan:

[Clearly outline your proposed repayment plan. Choose one of the following options, or create a combination that suits your situation:]

* **Option 1: Lump-Sum Settlement:** I am able to offer a lump-sum payment of [Amount] as full settlement of the debt. This represents [Percentage]% of the current balance. I can make this payment within [Number] days of your acceptance.

* **Option 2: Reduced Monthly Payments:** I propose to make monthly payments of [Amount] for a period of [Number] months. This would result in a total repayment of [Total Amount], which takes into account my current financial constraints.

* **Option 3: Lower Interest Rate:** I request a reduction in the interest rate to [Interest Rate]% in order to make the debt more manageable.

I understand that you may not be able to accept my proposal. However, I believe that this is a fair and reasonable offer given my current financial circumstances.

I would appreciate it if you would consider my proposal and respond within [Number] days, by [Date]. You can reach me at [Your Phone Number] or [Your Email Address].

Thank you for your time and consideration. I look forward to hearing from you soon.

Sincerely,

[Your Signature]

[Your Typed Name]

Important Considerations:

- Send Your Letter via Certified Mail: This provides proof that the creditor received your letter.

- Keep Copies: Make copies of your letter and any correspondence with the creditor for your records.

- Be Prepared to Negotiate: The creditor may not accept your initial offer. Be prepared to negotiate and compromise.

- Consult with a Professional: If you’re struggling with debt, consider consulting with a credit counselor or financial advisor.

- Don’t Stop Paying (If Possible): If you can afford to make partial payments while negotiating, do so. This demonstrates good faith and may improve your chances of a favorable outcome.

Negotiating debt can be a challenging but ultimately rewarding process. By using a well-crafted Debt Negotiation Letter and being prepared to communicate effectively with your creditors, you can take control of your finances and work towards a brighter financial future. Remember to be honest, realistic, and persistent. Good luck!

If you are searching about Debt Negotiation Letter Template – Detrester.com you’ve came to the right page. We have 9 Images about Debt Negotiation Letter Template – Detrester.com like Settlement Letter Template Examples Letter Template Collection intended, Do It Yourself Debt Settlement Easy Steps regarding Debt Negotiation and also Debt Negotiation Letter Template. Read more:

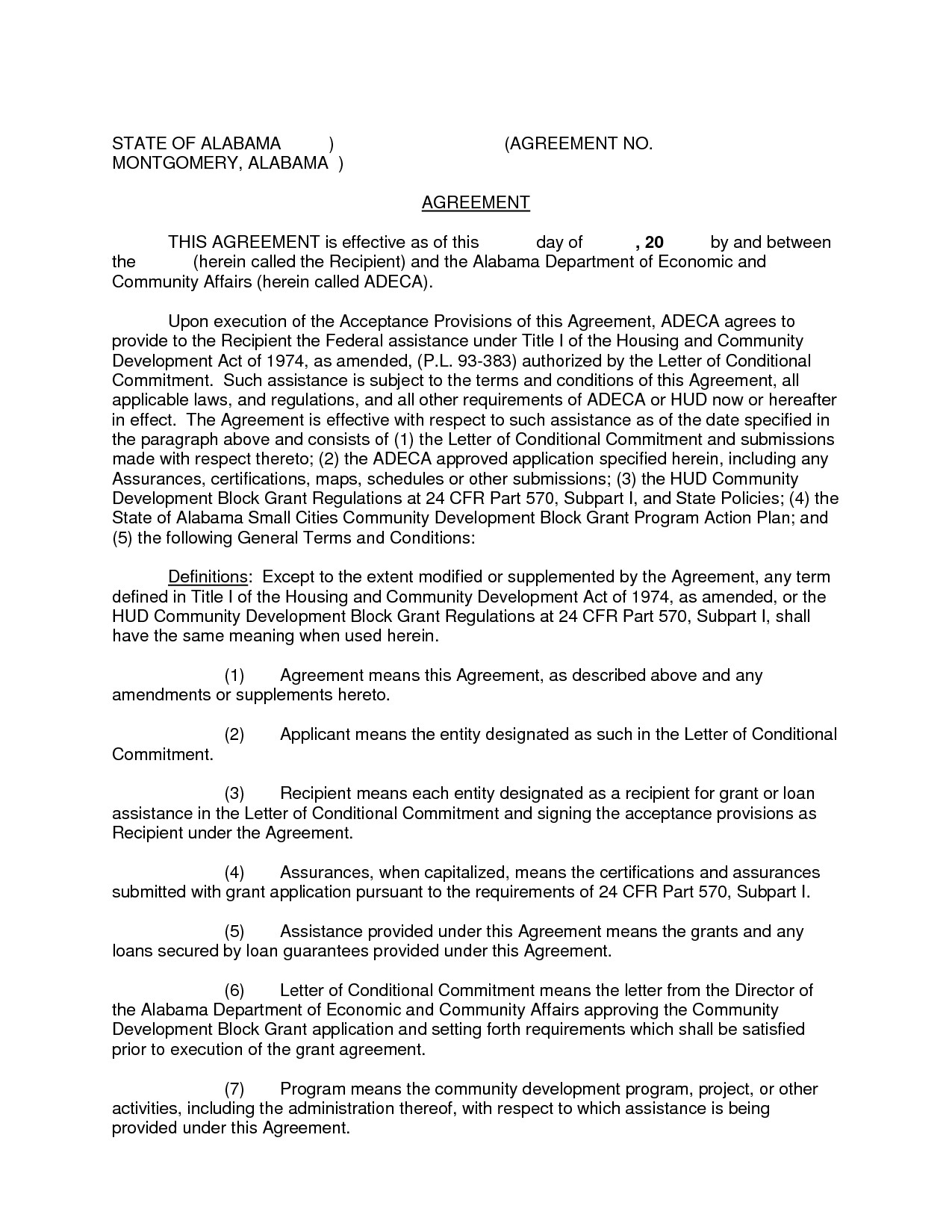

Debt Negotiation Letter Template – Detrester.com

www.detrester.com

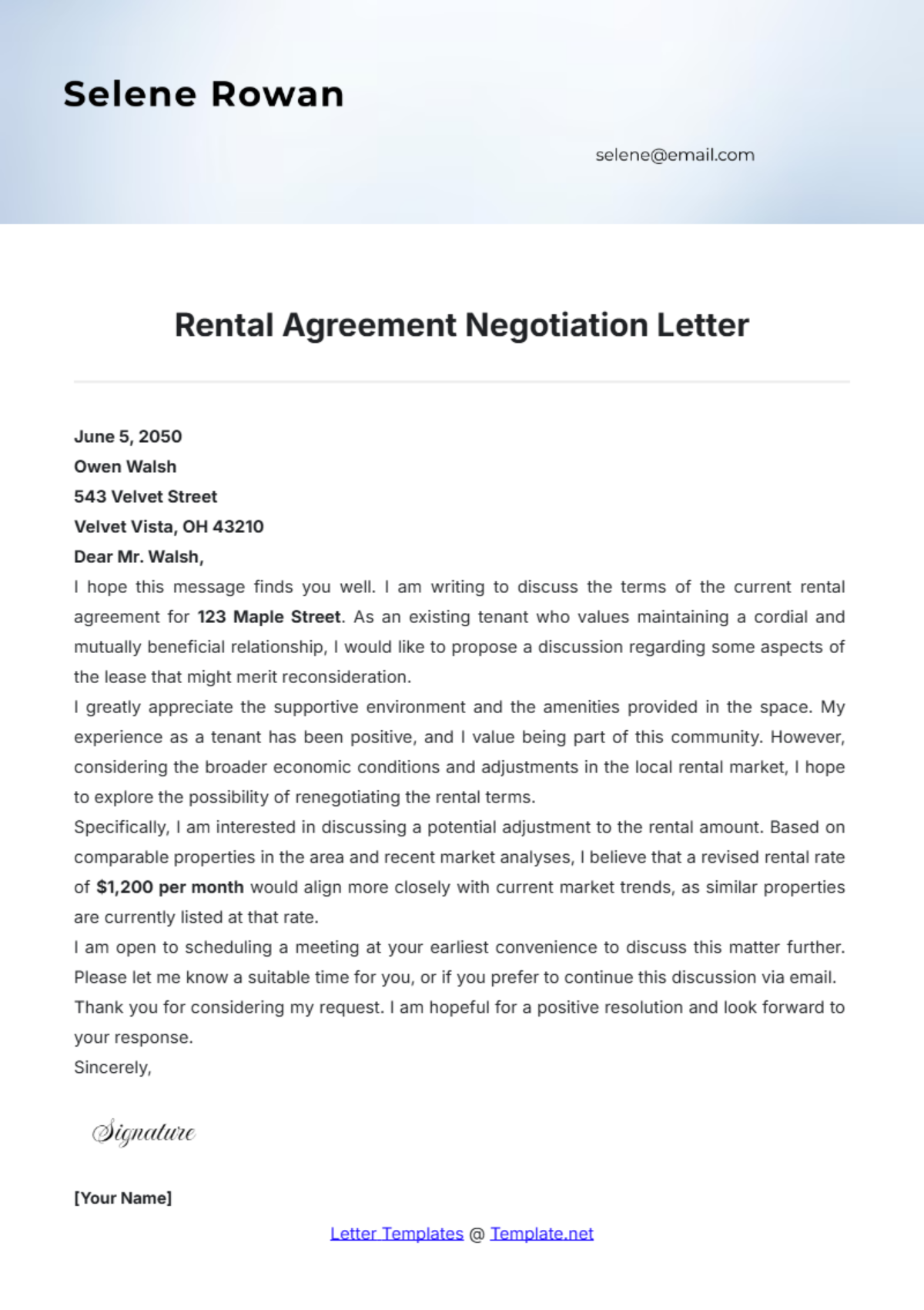

Free Negotiation Templates To Edit Online

www.template.net

Debt Negotiation Letter Template

old.sermitsiaq.ag

Free Negotiation Templates To Edit Online

www.template.net

Counter Offer Letter To Employee Template – Infoupdate.org

infoupdate.org

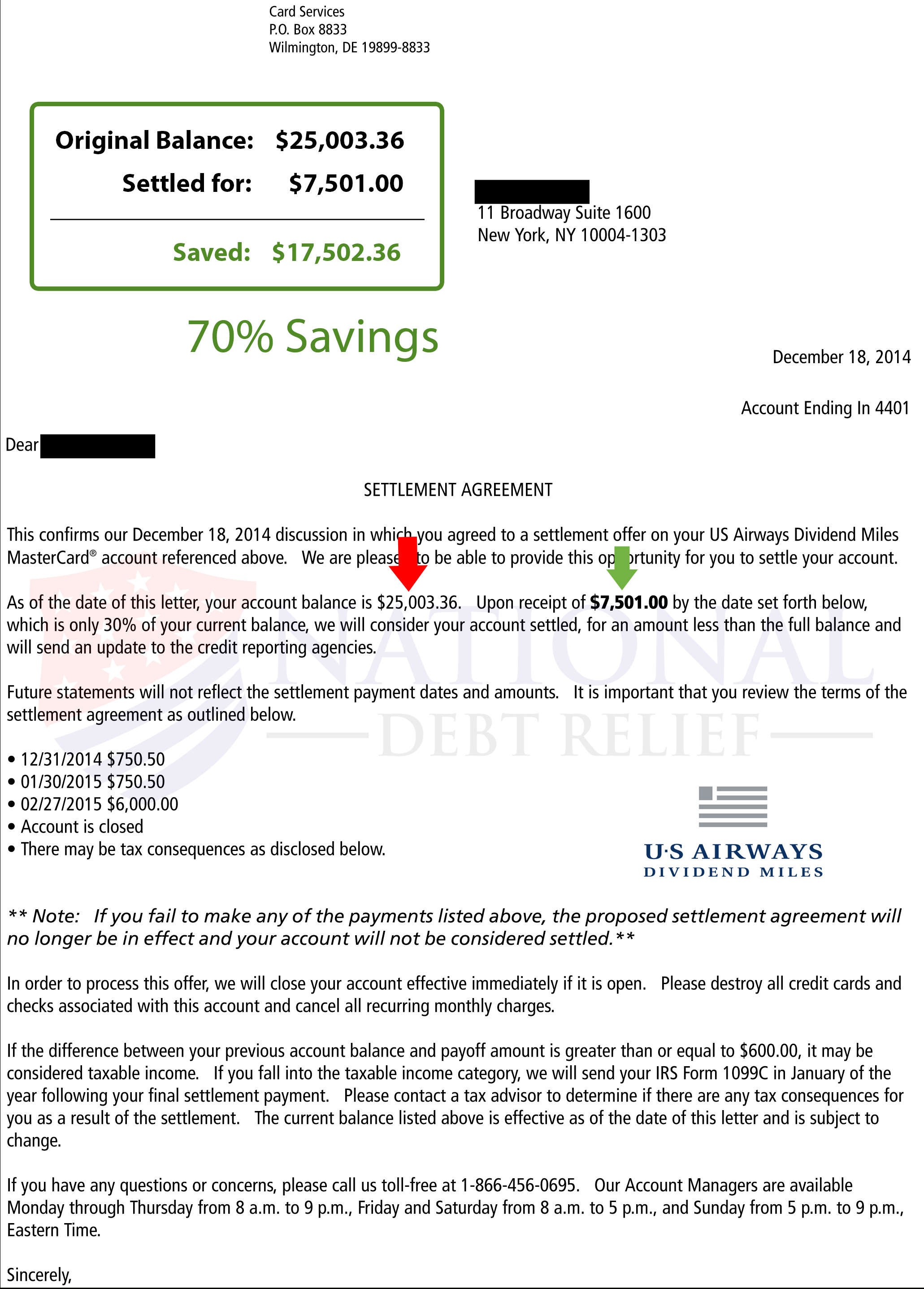

Debt Settlement Letters Within Debt Negotiation Letter Template – 10

vancecountyfair.com

debt settlement

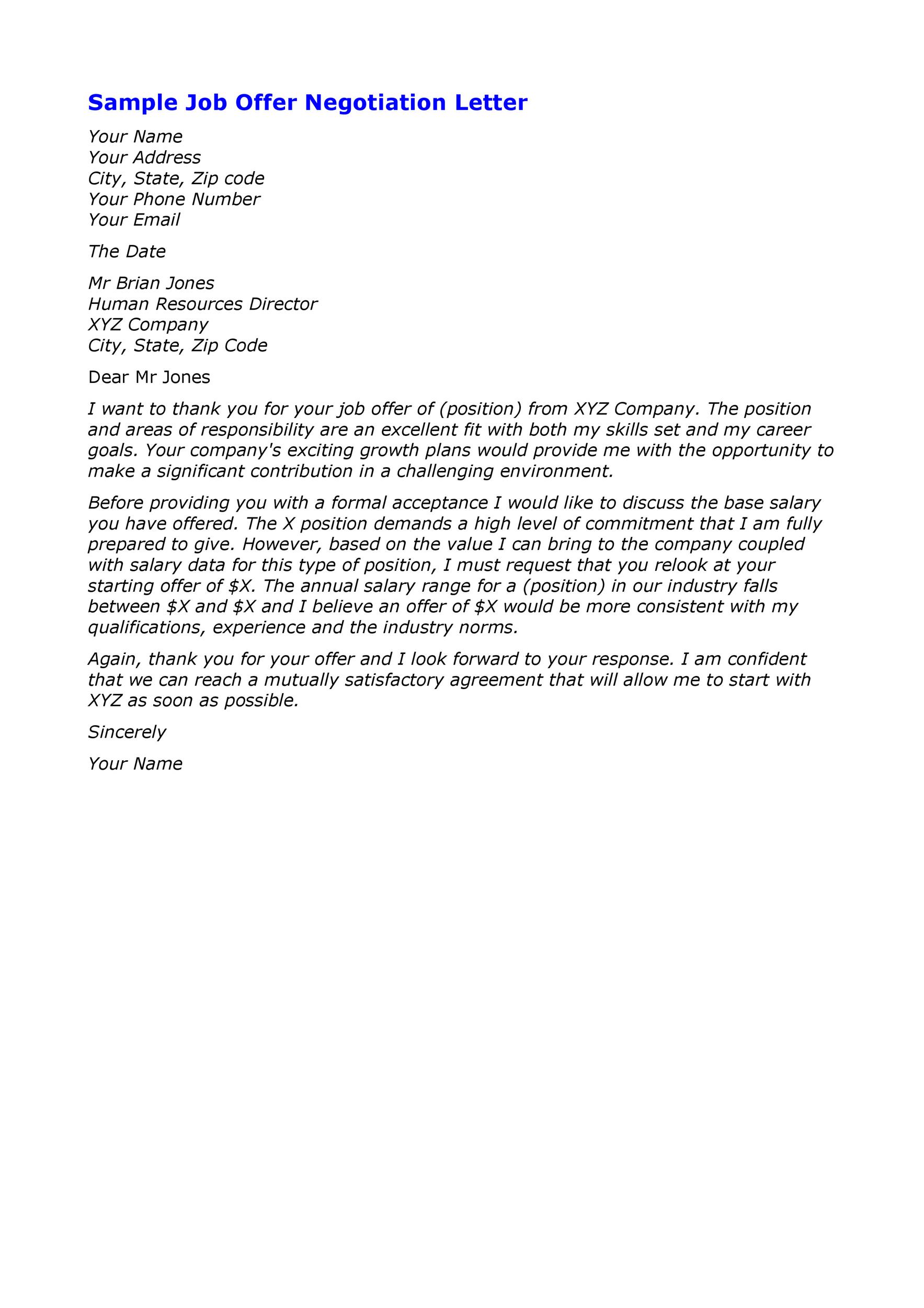

Negotiation Letter Template

old.sermitsiaq.ag

Do It Yourself Debt Settlement Easy Steps Regarding Debt Negotiation

vancecountyfair.com

Settlement Letter Template Examples Letter Template Collection Intended

vancecountyfair.com

Debt negotiation letter template. Do it yourself debt settlement easy steps regarding debt negotiation. Debt settlement