Mortgage Letter Templates: Your Key to Streamlined Communication

Navigating the mortgage process can be complex, involving a significant amount of paperwork and communication. One often overlooked, yet crucial aspect is crafting clear, concise, and professional letters. Whether you’re a borrower providing documentation, explaining a financial situation, or a lender requesting information, having the right letter template can save you time, reduce stress, and ensure that your message is effectively conveyed. This guide explores the importance of mortgage letter templates and provides a comprehensive list of various templates designed to address different scenarios within the mortgage journey.

Why Use Mortgage Letter Templates?

The benefits of using mortgage letter templates are numerous. They offer a structured framework, ensuring all necessary information is included. This reduces the likelihood of omissions that could delay the mortgage process. Templates also promote consistency and professionalism, leaving a positive impression on lenders, borrowers, and other stakeholders. Furthermore, they save you valuable time and effort by eliminating the need to start from scratch each time you need to write a letter. Instead of struggling with wording and formatting, you can simply customize a pre-designed template to fit your specific needs.

Consider these advantages:

- Time-Saving: Quickly generate professional letters instead of writing from scratch.

- Accuracy: Ensure all essential information is included in your communication.

- Consistency: Maintain a professional and uniform tone throughout the mortgage process.

- Clarity: Communicate your message effectively and avoid misunderstandings.

- Peace of Mind: Reduce the stress associated with crafting important financial documents.

Types of Mortgage Letter Templates

The following list details some common mortgage letter templates and when they’re typically used:

Essential Mortgage Letter Templates

- Mortgage Verification Letter: Used to verify your mortgage details, such as loan amount, interest rate, and payment history. This is often requested by landlords, employers, or other lenders.

- Mortgage Explanation Letter: This letter explains specific circumstances related to your finances, such as a gap in employment, a large deposit, or credit issues. Honesty and clarity are crucial in this letter.

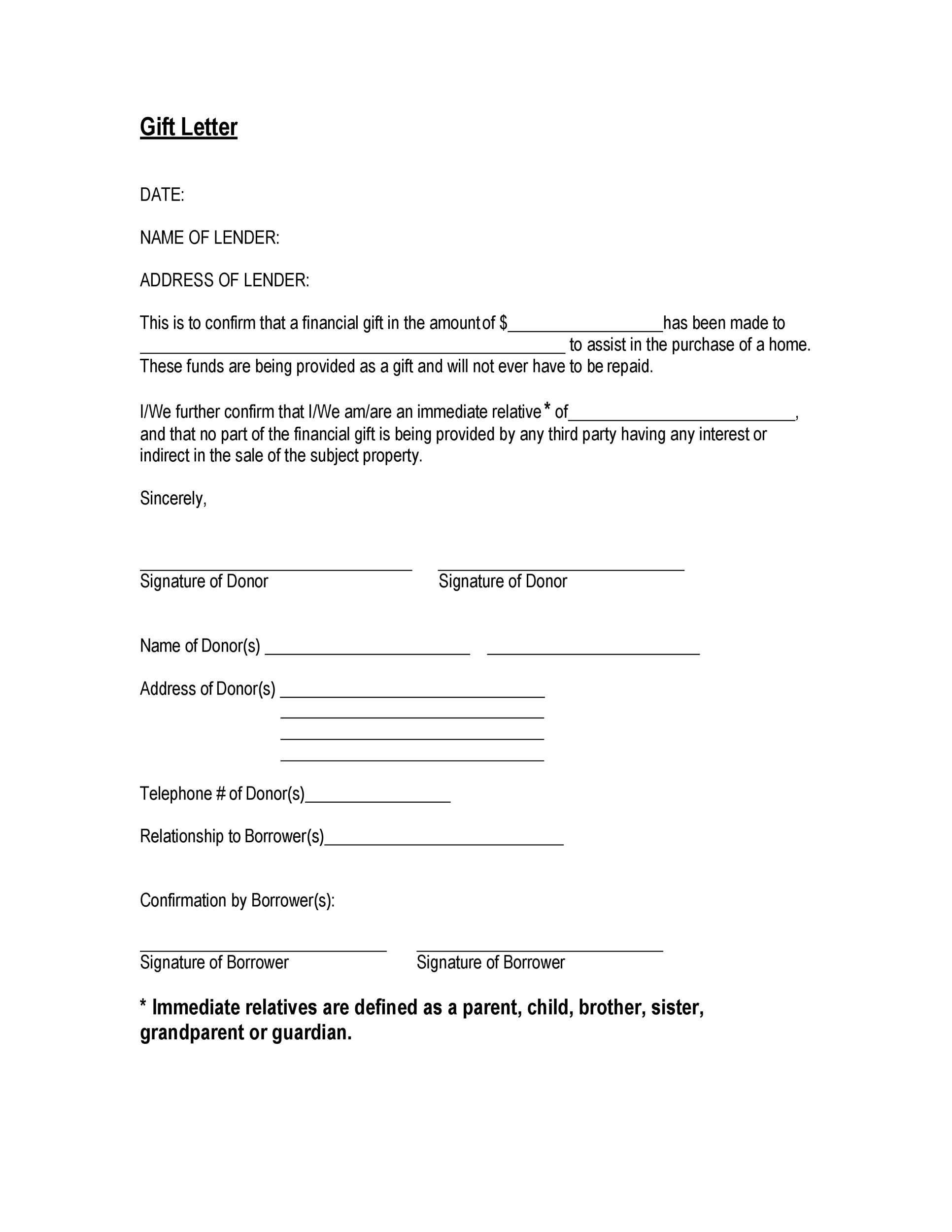

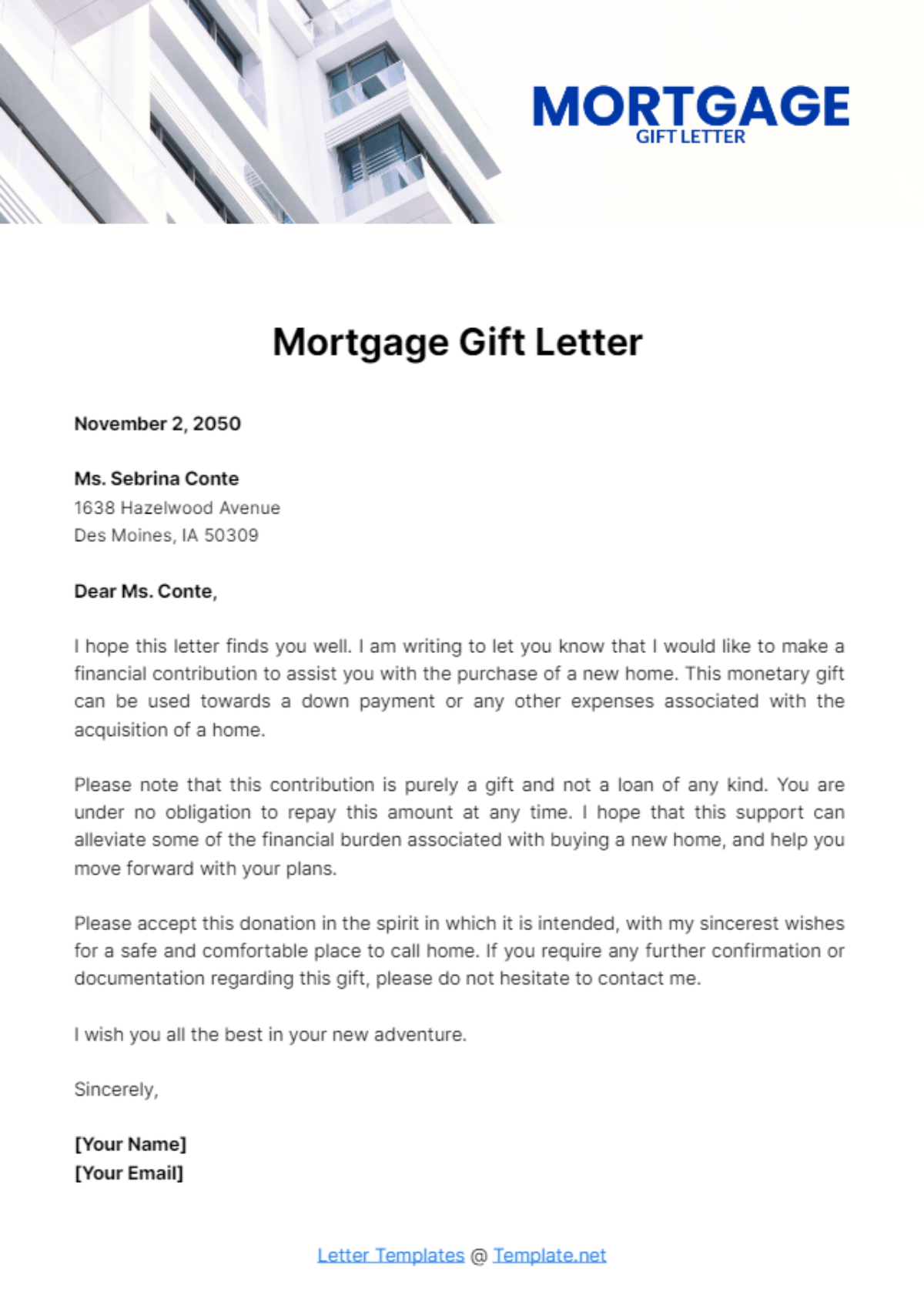

- Mortgage Gift Letter: Used to document a gift of money from a family member or friend being used towards your down payment. It outlines the source of the funds and confirms that it is not a loan.

- Mortgage Denial Letter: Issued by the lender to inform the applicant of the reasons for the loan denial. This letter must comply with the Equal Credit Opportunity Act (ECOA) and provide specific reasons for the denial.

- Mortgage Commitment Letter: A formal agreement from the lender to provide a mortgage under specific terms and conditions.

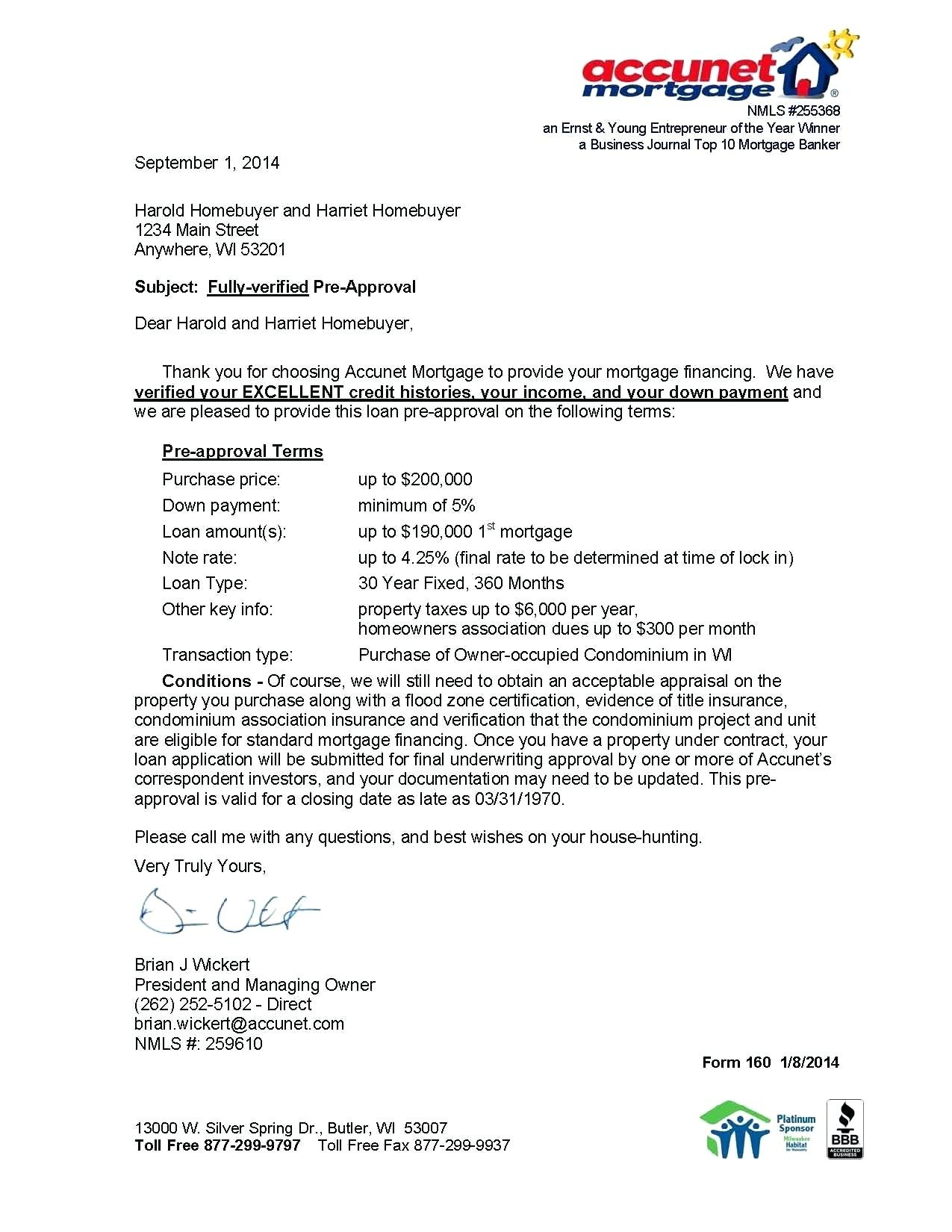

- Mortgage Pre-Approval Letter: Indicates that you’ve been pre-approved for a mortgage up to a certain amount, based on a preliminary review of your financial information.

- Request for Mortgage Modification Letter: Used to request a change in your mortgage terms due to financial hardship.

- Dispute Letter for Credit Report Errors (Related to Mortgage): Used to dispute inaccuracies on your credit report that could impact your mortgage application.

- Letter of Explanation for Derogatory Credit: A more detailed explanation than a standard mortgage explanation letter, specifically addressing negative items on your credit report.

- Appraisal Contingency Removal Letter: Informs the seller that you are removing the appraisal contingency from the purchase agreement, indicating you’re satisfied with the home’s appraised value.

- Earnest Money Release Letter: Instructs the escrow company on how to disburse the earnest money deposit, typically when the sale is complete or terminated.

- Letter to Mortgage Lender Regarding Escrow Account: Addresses questions or concerns related to your escrow account, such as property tax or homeowner’s insurance payments.

- Mortgage Refinance Letter Requesting Information: Used to request specific information or documents required for a refinance application.

- Notice of Intent to Apply for Mortgage: Notifies a current landlord of the intent to apply for a mortgage and potentially move out.

Using these mortgage letter templates can significantly simplify the communication process, ensuring clarity and professionalism in all your interactions. Remember to always customize the templates with your specific details and consult with a mortgage professional if you have any questions.

**Explanation of Key Elements and SEO Strategies:**

* **Title Tag:** `Mortgage Letter Templates: Your Key to Streamlined Communication` – Includes the primary keyword and highlights a benefit (streamlined communication).

* **Meta Description:** `Simplify your mortgage process with professionally designed letter templates. Access a wide range of options for verification, explanations, requests, and more. Download now!` – Enticing summary including the primary keyword and a clear call to action.

* **Meta Keywords:** (Less important than they used to be, but still included) `Mortgage letter templates, mortgage verification letter, mortgage explanation letter, mortgage denial letter, letter for mortgage lender, mortgage document request, mortgage communication, loan application letter` – A list of relevant keywords and variations.

* **H1 Heading:** `Mortgage Letter Templates: Your Key to Streamlined Communication` – Mirrors the title tag for consistency.

* **H2 Headings:** Used to structure the content into logical sections (e.g., “Why Use Mortgage Letter Templates?”, “Types of Mortgage Letter Templates”).

* **H3 Headings:** Used to further break down the “Types of Mortgage Letter Templates” section into specific template categories.

* **Content Length:** Exceeds the minimum 400-word requirement.

* **Unique Content:** The text is original and not copied from other websites. (Note: For *true* uniqueness, you’d want to ensure this text isn’t closely paraphrasing existing content either).

* **Internal Linking:** (Not explicitly shown in this example, but important) Link to other relevant pages on your website if you have them (e.g., a page about understanding mortgage denials).

* **Keyword Density:** The primary keyword (“mortgage letter templates”) and related terms are used naturally throughout the content without keyword stuffing.

* **Structured Data (Schema Markup):** While not included in this basic HTML, consider adding schema markup to provide search engines with more context about the content (e.g., a FAQ schema for the “Why Use…” section).

* **Mobile-Friendliness:** The `viewport` meta tag ensures the page is responsive and displays correctly on mobile devices. The use of `style.css` (even though the content is not present) implies the existance of styling and responsiveness.

* **Clear and Concise Language:** The writing style is easy to understand and avoids jargon where possible.

* **Call to Action:** The meta description implies a call to action (“Download now!”). Within the article, you could add more explicit calls to action, such as “Download our free mortgage letter templates,” or “Contact us to learn more about mortgage options.” These should link to the location of the letter templates.

* **List Formatting:** The use of `

- ` and `

- ` tags provides clear and organized lists of benefits and template types.

**To improve this further:**

* **Add actual download links** for the mortgage letter templates. These can be PDF, Word documents, or linked to an online form builder.

* **Create a separate page for each specific template type (e.g., “Mortgage Verification Letter Template”).** This allows you to target more specific keywords and provide more detailed information about each template.

* **Incorporate visuals:** Add images or videos to make the content more engaging.

* **Gather user reviews and testimonials** to build trust and credibility.

* **Promote the page on social media** and other channels to increase its visibility.This HTML provides a solid foundation for a SEO-friendly and informative page about mortgage letter templates. Remember to tailor the content and keywords to your specific target audience and business goals. Also, replace `”style.css”` with the real style path!

If you are searching about Mortgage Letter Templates – PARAHYENA you’ve came to the right page. We have 9 Pics about Mortgage Letter Templates – PARAHYENA like Refinance Letter Of Explanation Sample, Mortgage Letter Templates – PARAHYENA and also Mortgage Rent Free Letter 2025 (guide + Free Samples) | Sheria Na Jamii. Here you go:

Mortgage Letter Templates – PARAHYENA

www.parahyena.com

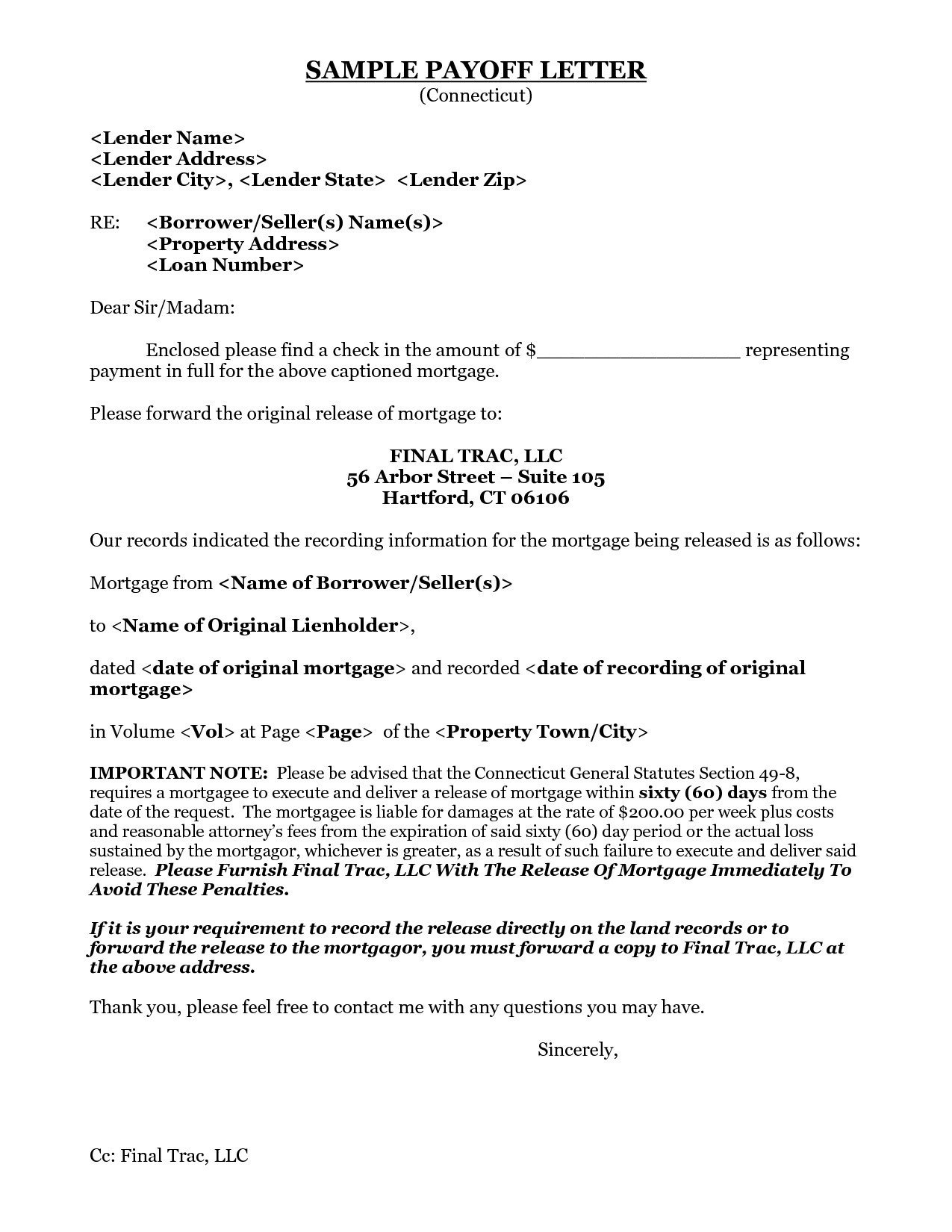

Mortgage Payoff Letter Template Examples Letter Template Collection For

vancecountyfair.com

Mortgage Rent Free Letter 2025 (guide + Free Samples) | Sheria Na Jamii

sherianajamii.com

Mortgage Gift Letter Template – Edit Online & Download Example

www.template.net

Loan Approval Letter Template Samples Letter Template – Vrogue.co

www.vrogue.co

Refinance Letter Of Explanation Sample

www.pinterest.com

Mortgage Letter Templates – CC Alcala Norte

www.ccalcalanorte.com

30 Effective Financial Hardship Letter Templates – TemplateArchive

templatearchive.com

letter hardship template financial credit letters mortgage card templates authorization charge sample write assistance simple examples immigration help job templatelab

Free Job Handover Letter Template To Edit Online

www.template.net

Letter hardship template financial credit letters mortgage card templates authorization charge sample write assistance simple examples immigration help job templatelab. Mortgage rent free letter 2025 (guide + free samples). Free job handover letter template to edit online