Navigating the probate process after the loss of a loved one can be a challenging and emotionally taxing experience. One crucial step in this process is accurately valuing the deceased’s assets. This often requires obtaining a professional probate valuation, documented in a formal letter. Understanding the purpose and content of a Probate Valuation Letter is essential for executors and administrators to ensure compliance with legal requirements and fair distribution of assets to beneficiaries. A well-prepared Probate Valuation Letter provides a transparent and defensible record of the estate’s worth, minimizing potential disputes and streamlining the probate proceedings.

Understanding the Importance of a Probate Valuation Letter

A Probate Valuation Letter serves as an official document providing an opinion of value for assets within an estate at a specific date, usually the date of death. This valuation is critical for several reasons:

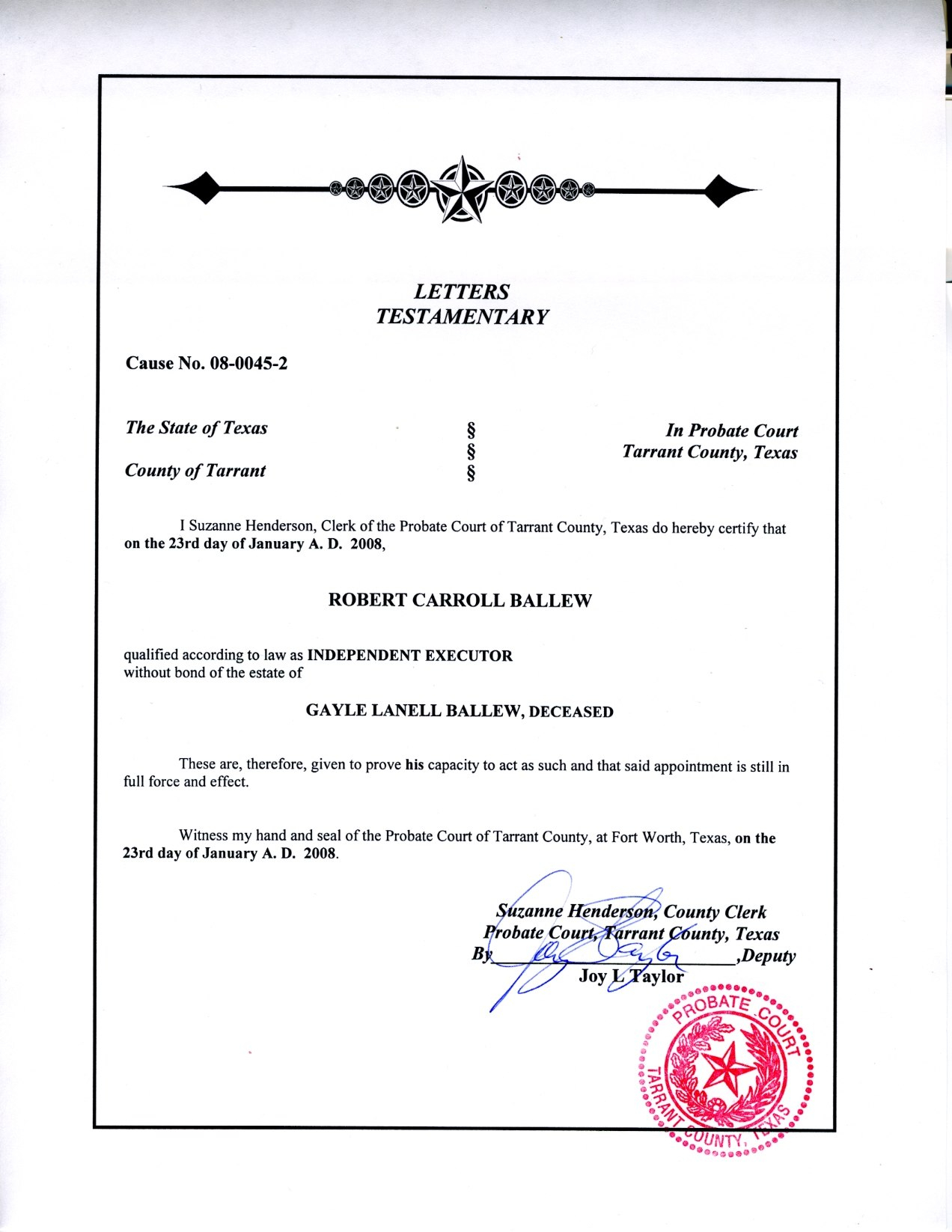

- Legal Compliance: Probate courts require an accurate accounting of all assets to determine estate taxes and ensure proper distribution according to the will or state law.

- Tax Implications: The valuation establishes the “stepped-up basis” for inherited assets, potentially reducing capital gains taxes when beneficiaries eventually sell those assets.

- Fair Distribution: A professional valuation ensures that assets are divided fairly among beneficiaries, minimizing disagreements and potential legal challenges.

- Insurance Purposes: The valuation may be needed to update insurance policies on inherited properties or valuables.

- Transparency and Accountability: The letter provides a clear and defensible record of how the estate’s value was determined, fostering transparency and accountability for the executor or administrator.

Without a proper valuation, the estate could face delays, legal challenges, and potential tax penalties. Seeking professional assistance from a qualified appraiser or valuer is highly recommended to ensure accuracy and compliance.

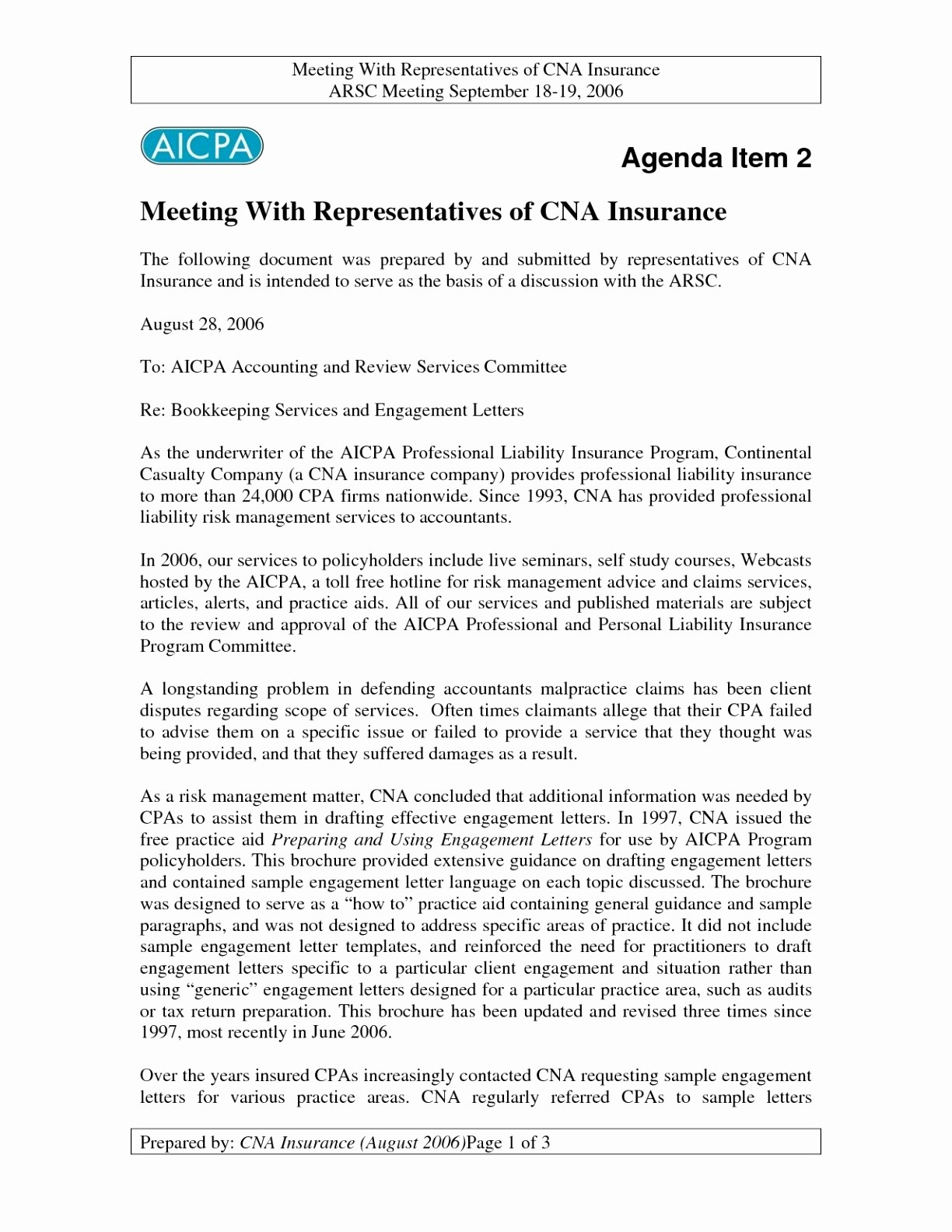

Key Elements of a Comprehensive Probate Valuation Letter Template

While specific requirements may vary based on jurisdiction and the type of asset being valued, a comprehensive Probate Valuation Letter Template typically includes the following elements. This template is a general guideline and should be adapted to reflect the specific circumstances of the estate and the relevant legal requirements.

Essential Sections for Your Probate Valuation Letter

- Heading and Introductory Paragraph:

- Appraiser/Valuer’s Name, Contact Information, and Credentials.

- Date of the Valuation Letter.

- Name of the Deceased and Date of Death.

- Purpose of the Valuation (e.g., for probate purposes).

- Identification of the Estate Executor or Administrator.

- Property Description:

- A detailed description of the asset being valued (e.g., address for real estate, make and model for a vehicle, description of personal property).

- Any relevant details such as condition, age, and specific features.

- Photographs, if applicable, to document the asset’s condition.

- Valuation Methodology:

- Explanation of the method used to determine the value (e.g., comparable sales approach for real estate, market value for publicly traded securities).

- Sources of data used (e.g., real estate databases, auction records, expert opinions).

- Assumptions and Limiting Conditions:

- Statement of any assumptions made during the valuation process.

- Identification of any factors that could affect the accuracy of the valuation.

- Disclaimers regarding the scope of the valuation (e.g., not a structural inspection).

- Valuation Conclusion:

- Clear statement of the appraiser’s opinion of value for the asset as of the date of death.

- Currency used for the valuation.

- Certification and Signature:

- A signed certification by the appraiser attesting to the accuracy and impartiality of the valuation.

- Any relevant professional designations or licenses held by the appraiser.

It’s crucial to remember that this is a template, and the specific information required will depend on the nature of the asset being valued and the relevant jurisdiction. Consulting with a legal professional and a qualified appraiser is always recommended to ensure compliance and accuracy.

If you are looking for Valuation Letter Template The Best Professional Templ – vrogue.co you’ve came to the right page. We have 9 Pictures about Valuation Letter Template The Best Professional Templ – vrogue.co like Letter Of Probate Flakkeeweer throughout Probate Valuation Letter, Probate Valuation Letter Template – PARAHYENA and also Probate Spreadsheet Template Google Spreadshee probate spreadsheet. Here you go:

Valuation Letter Template The Best Professional Templ – Vrogue.co

www.vrogue.co

And Business Valuation Letter Sample – Guiaubuntupt Inside Valuation

vancecountyfair.com

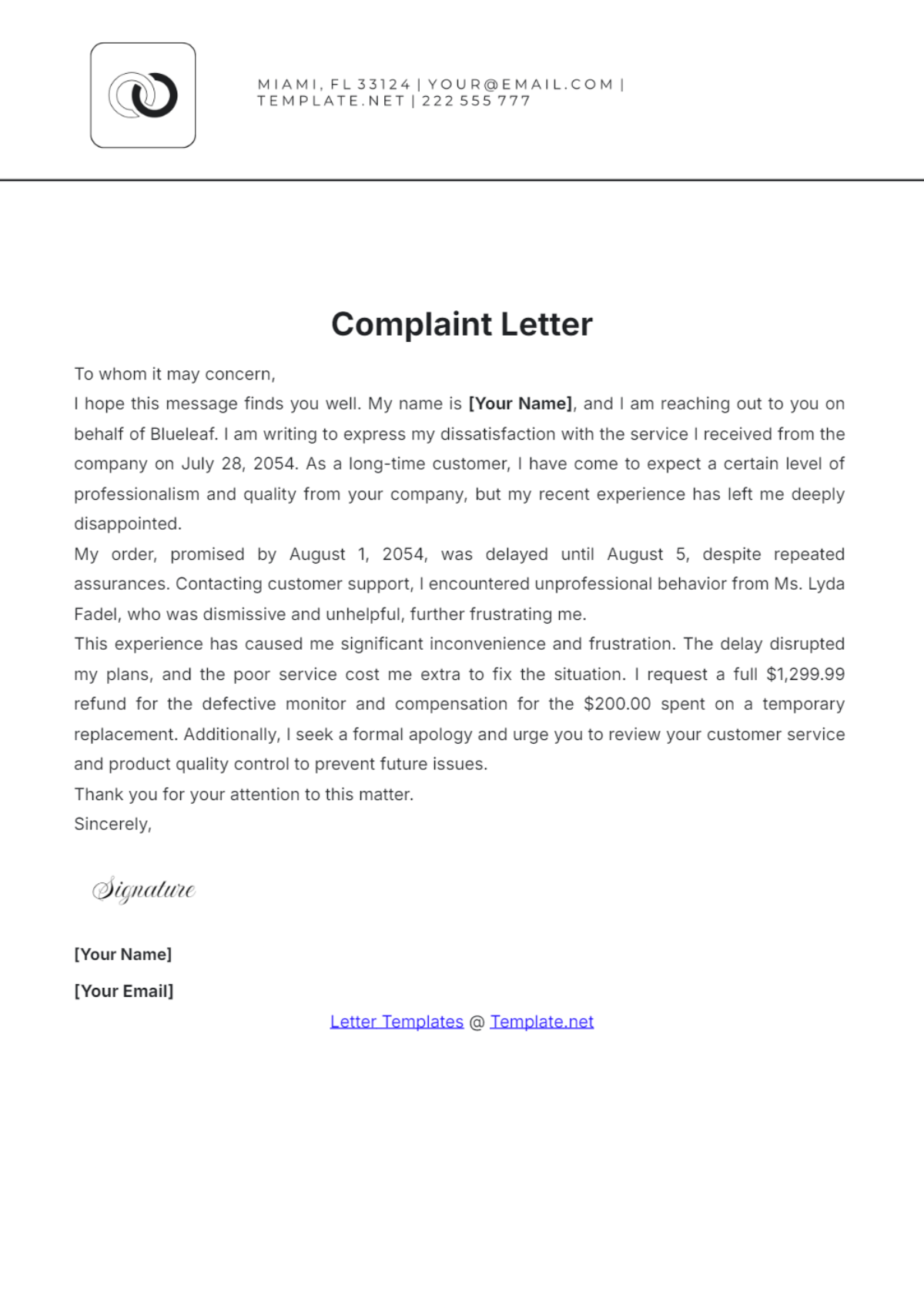

Free Property Valuation Letter Template To Edit Online

www.template.net

A Stepbystep Guide Onwhat Happens During Probate With Regard To Probate

vancecountyfair.com

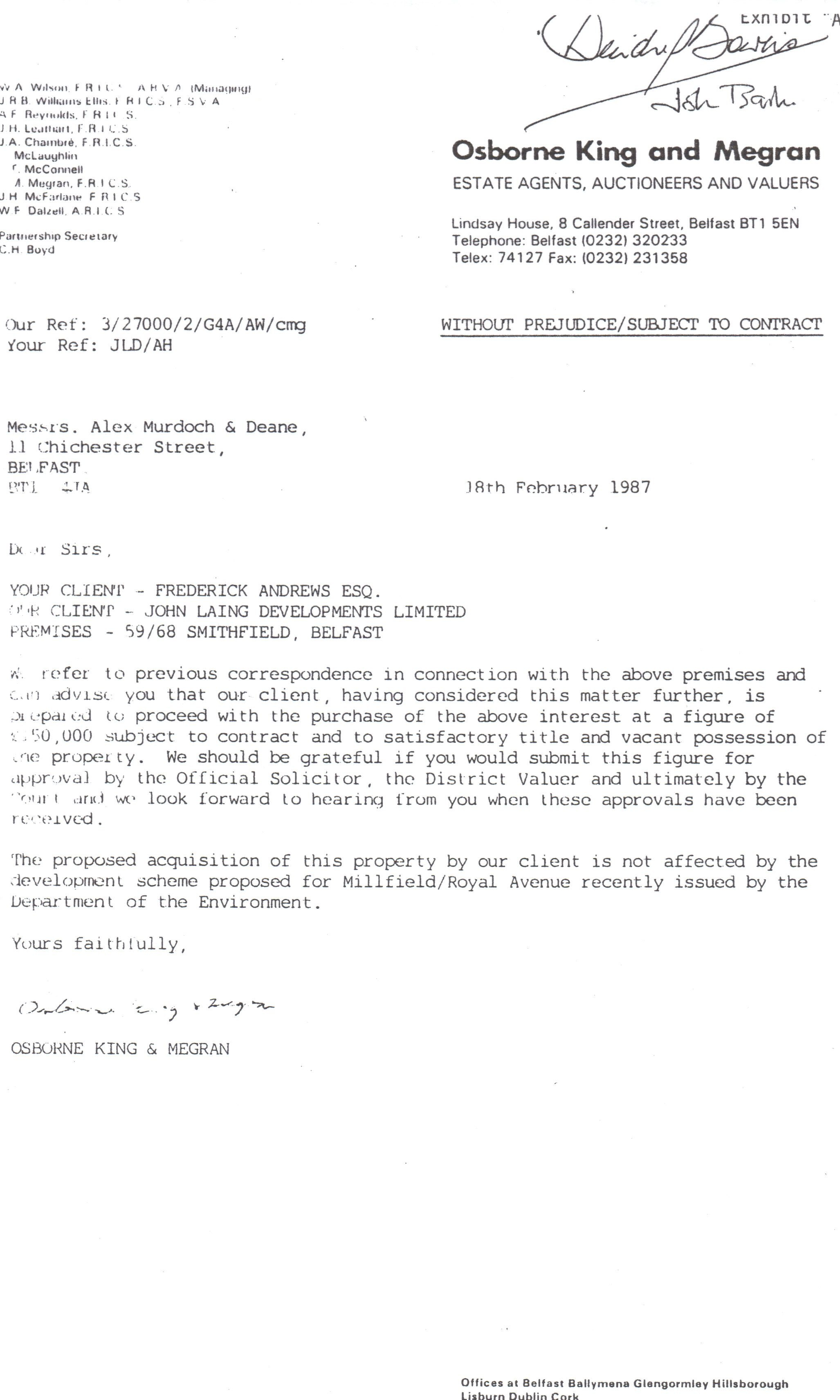

Estate Agent Valuation Letter Template – Bisatuh Within Probate

vancecountyfair.com

valuation letter probate

Probate Valuation Letter Template – PARAHYENA

www.parahyena.com

Probate Spreadsheet Template Google Spreadshee Probate Spreadsheet

db-excel.com

accounting template spreadsheet probate estate how excel make templates within an google regard elegant beautiful worksheets business small inside db

Valuation Letter Template – Detrester.com

www.detrester.com

Letter Of Probate Flakkeeweer Throughout Probate Valuation Letter

vancecountyfair.com

Probate spreadsheet template google spreadshee probate spreadsheet. Valuation letter probate. And business valuation letter sample – guiaubuntupt inside valuation