Navigating the world of recurring payments and automated billing can be complex, especially when ensuring compliance and protecting both your business and your customers. Establishing a clear and legally sound process for obtaining consent to charge a credit card is paramount. This process often relies on a well-crafted Authorization To Charge Credit Card Template, a document that outlines the terms of the agreement and provides a record of customer consent. Properly implemented, it streamlines billing, reduces disputes, and strengthens customer trust.

The need for such a template arises from consumer protection laws and the desire to avoid potential legal issues related to unauthorized charges. Without explicit authorization, recurring billing can be perceived as deceptive or fraudulent, leading to chargebacks, complaints, and even legal action. A robust template not only secures your business but also demonstrates a commitment to transparency and ethical business practices. It’s a critical component of any subscription service, membership program, or ongoing payment arrangement.

Creating a generic authorization form isn’t enough. It needs to be tailored to your specific business model and compliant with relevant regulations, such as the Fair Credit Billing Act (FCBA) and Payment Card Industry Data Security Standard (PCI DSS). Furthermore, the language used must be clear, concise, and easily understandable by the customer. Ambiguity can lead to disputes and invalidate the authorization.

The digital age has brought about various methods for obtaining authorization, from online forms to email confirmations. However, regardless of the method, the core principles remain the same: obtain explicit consent, clearly state the terms, and retain a verifiable record of the authorization. Choosing the right Authorization To Charge Credit Card Template and implementing it effectively is a significant investment in the long-term health and stability of your business.

Ultimately, a well-designed authorization form is more than just a legal document; it’s a tool for building trust and fostering positive customer relationships. It demonstrates that you value their business and are committed to providing a transparent and reliable service.

Before diving into the specifics of a template, it’s crucial to understand why authorization is so important. It’s not merely about legal compliance; it’s about establishing a clear agreement between your business and the customer. This agreement outlines the terms of the recurring billing arrangement, including the amount, frequency, and cancellation policy. Without this agreement, you risk facing chargebacks, which can be costly and damaging to your reputation.

Chargebacks occur when a customer disputes a transaction with their bank. If the bank finds in favor of the customer, your business is responsible for the chargeback fee, the refunded amount, and potentially additional penalties. A solid Authorization To Charge Credit Card Template can significantly reduce the risk of chargebacks by providing clear evidence of customer consent.

The Payment Card Industry Data Security Standard (PCI DSS) sets security requirements for businesses that handle credit card information. While a template itself doesn’t guarantee PCI DSS compliance, it’s a crucial component of a secure payment processing system. Properly managing and storing authorization forms is essential for demonstrating compliance.

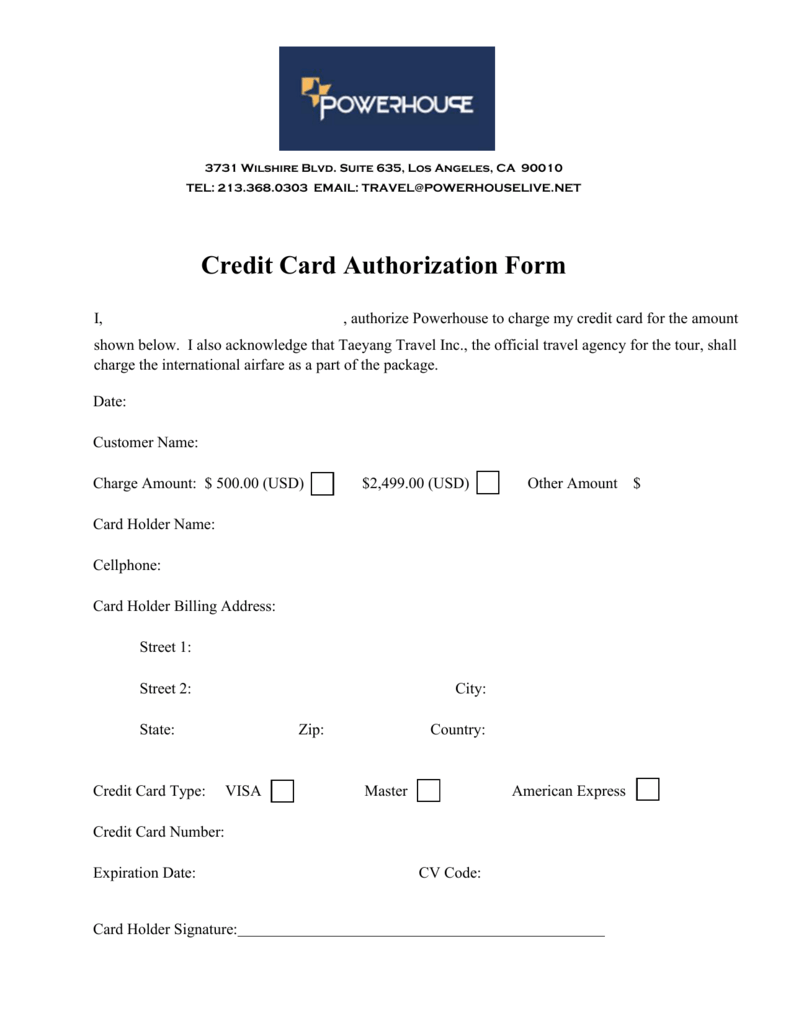

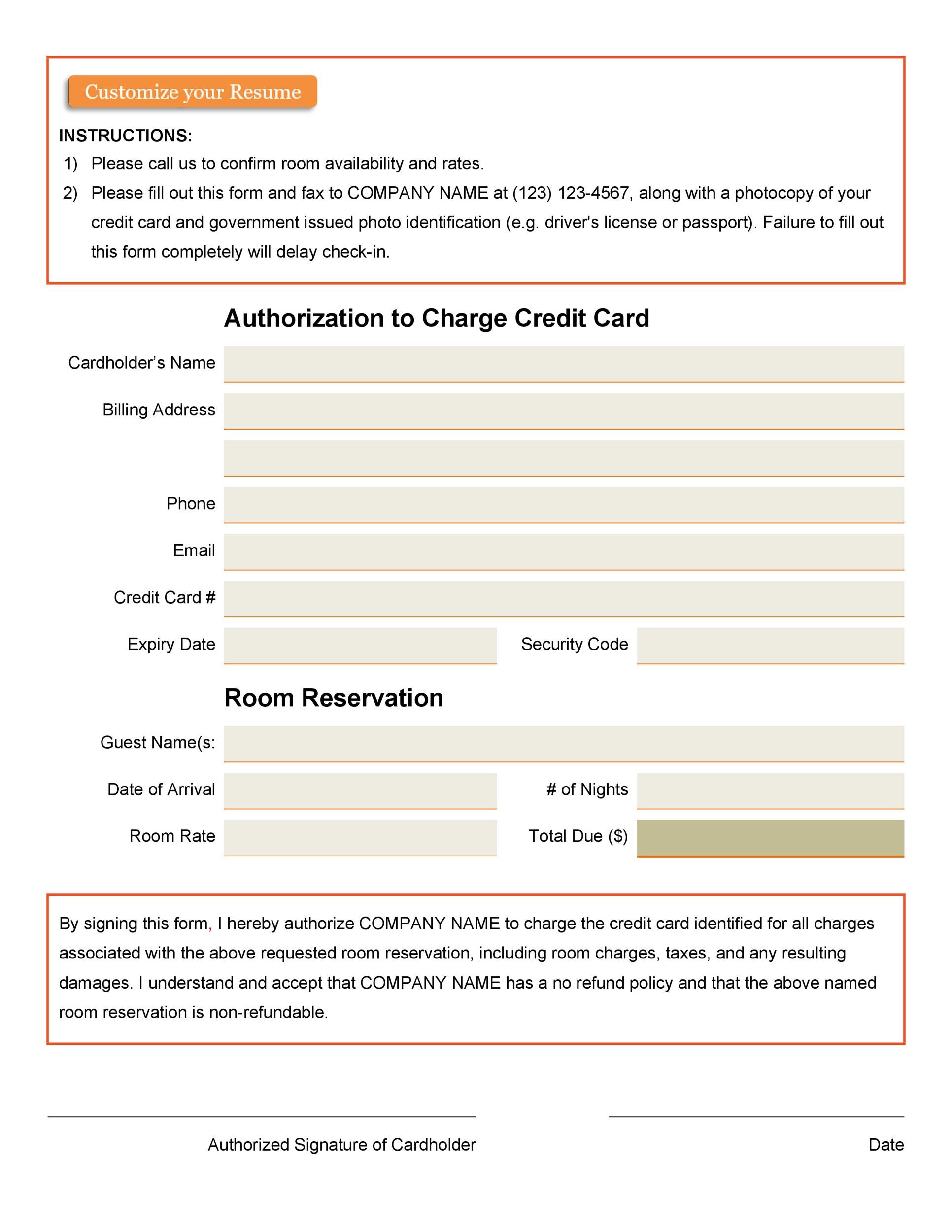

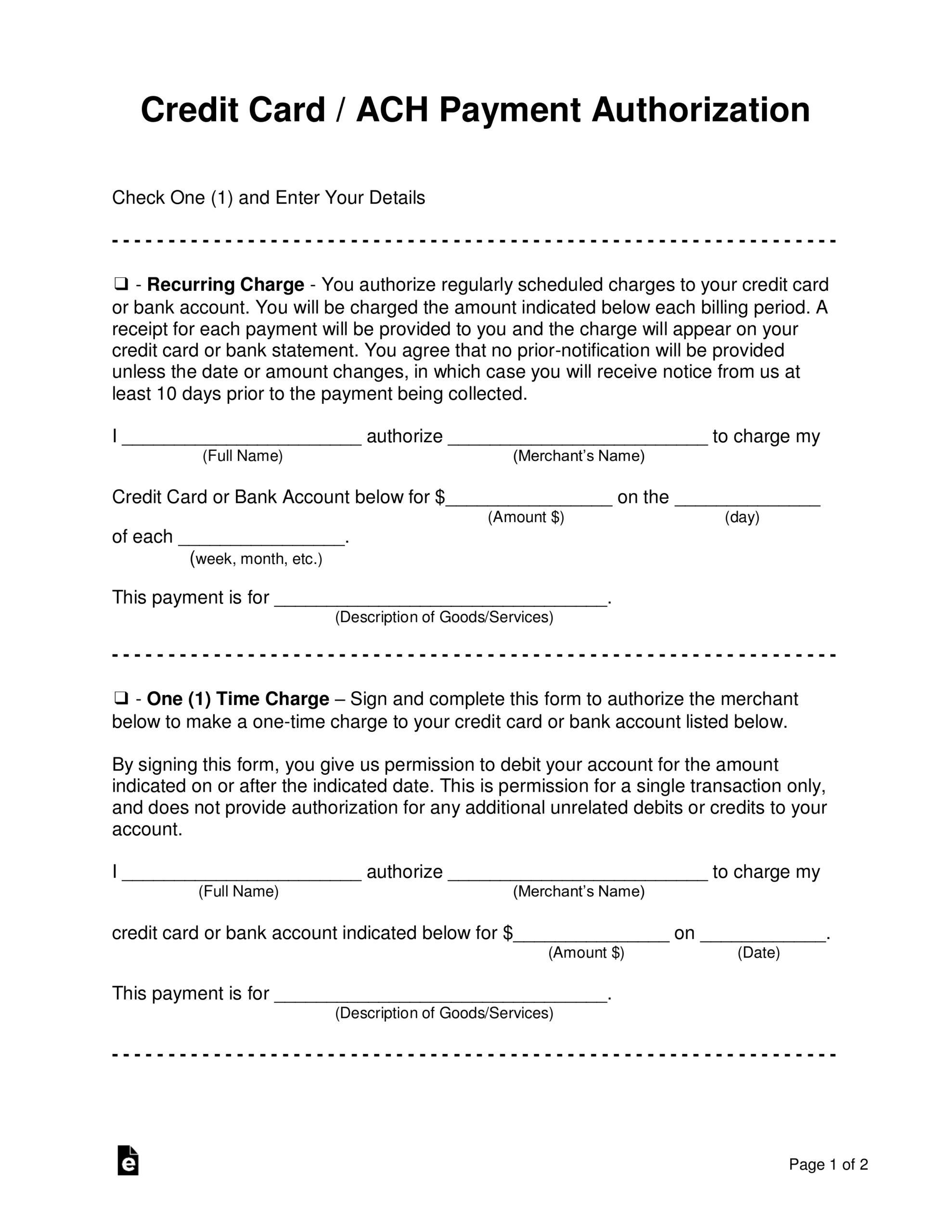

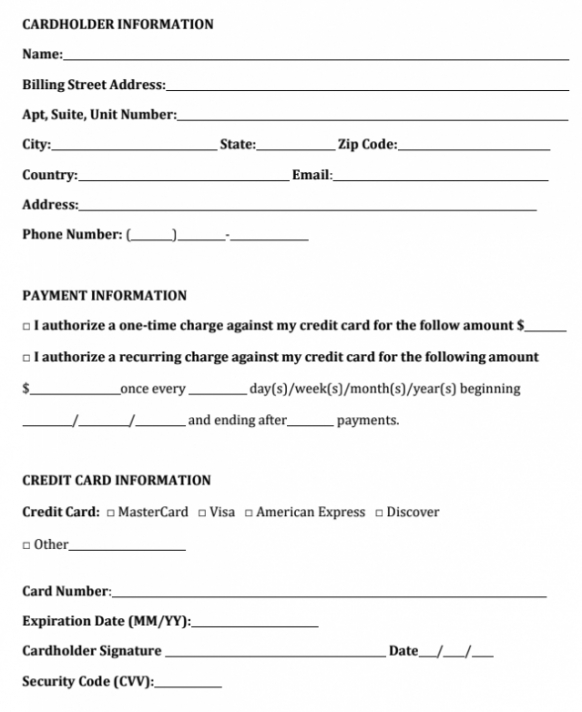

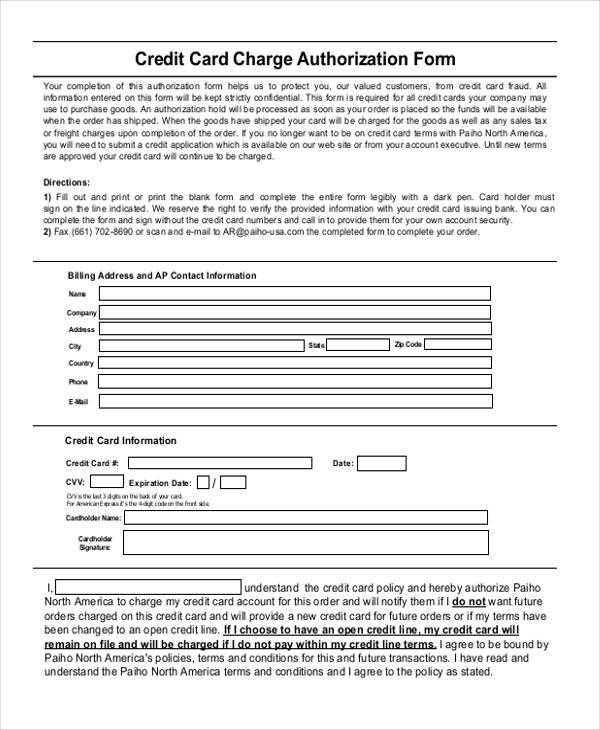

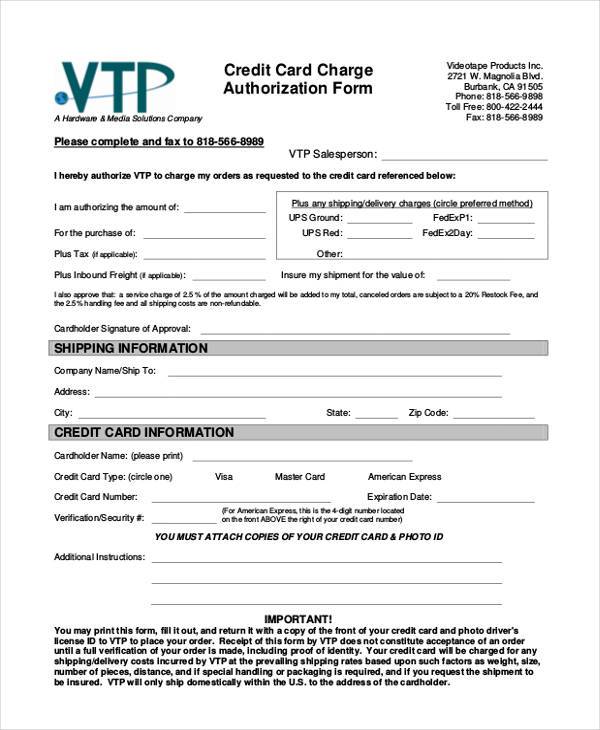

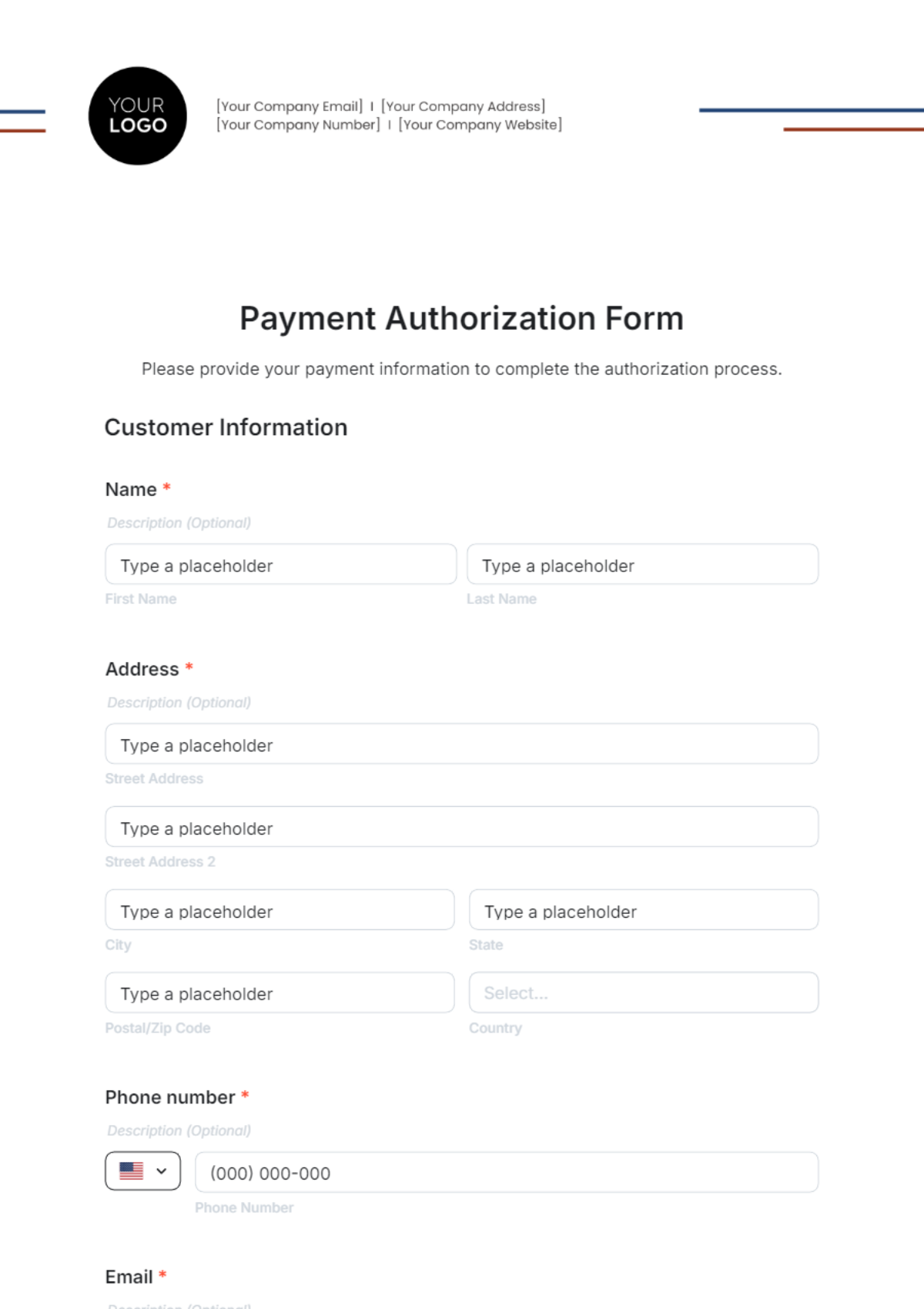

A comprehensive template should include several key elements to ensure its legality and effectiveness. These elements should be clearly stated and easily understood by the customer.

Different business models may require different types of templates. Here’s a breakdown of common variations:

These templates are specifically designed for subscription-based businesses, such as streaming services, software-as-a-service (SaaS), and membership programs. They typically include detailed information about the subscription plan, renewal terms, and cancellation procedures.

Similar to subscription services, membership programs often require a more detailed template that outlines the benefits of membership, renewal fees, and cancellation policies.

For businesses that charge recurring payments for specific services or products, a simpler template may suffice. However, it should still include all the essential elements mentioned above.

While physical templates are still used in some cases, online templates are becoming increasingly common. Online templates can be integrated into your website or payment processing system, making it easier to obtain and store authorization. Ensure your online Authorization To Charge Credit Card Template is accessible and compliant with accessibility guidelines.

Simply having a template isn’t enough. You need to use it correctly to ensure its effectiveness.

There are two main approaches to obtaining a credit card authorization: creating your own from scratch or using a pre-made template. Each approach has its advantages and disadvantages.

Navigating the legal landscape surrounding credit card authorizations can be challenging. It’s essential to stay up-to-date on relevant laws and regulations.

The Fair Credit Billing Act (FCBA) provides consumers with certain rights regarding credit card transactions, including the right to dispute unauthorized charges. A well-drafted authorization template can help you defend against chargeback disputes by providing clear evidence of customer consent.

If you operate in the European Union or process data of EU citizens, you must comply with the General Data Protection Regulation (GDPR). This includes obtaining explicit consent for data processing and providing customers with the right to access, rectify, and erase their personal data. Your Authorization To Charge Credit Card Template should reflect these requirements.

The Authorization To Charge Credit Card Template is a vital tool for any business that engages in recurring billing. It protects your business from chargebacks and legal disputes, ensures compliance with relevant regulations, and fosters trust with your customers. Whether you choose to create your own template or use a pre-made option, it’s essential to ensure that it’s clear, concise, and legally sound. By following best practices for obtaining, storing, and managing authorizations, you can streamline your billing process and build a sustainable business. Remember to regularly review and update your template to reflect changes in laws and regulations, and always prioritize transparency and customer consent.