The world of business relies heavily on agreements, and one of the most fundamental is the loan agreement. These documents outline the terms and conditions of a loan, protecting both the lender and the borrower. A well-drafted loan agreement is crucial for minimizing risk and establishing clear expectations. This guide provides a comprehensive overview of what to include in a blank loan agreement template, ensuring a solid foundation for any financial transaction. Blank Loan Agreement Template – understanding its components is vital for anyone seeking to secure a loan. This template serves as a starting point, and it’s highly recommended to have a legal professional review it before finalizing any agreement. The goal is to create a document that is both legally sound and practical for your specific needs.

The process of creating a loan agreement can seem daunting, but breaking it down into manageable sections makes it much easier. It’s important to remember that this is a template, and you’ll need to tailor it to your unique circumstances. Consider the specific type of loan you’re seeking – a personal loan, a business loan, or a secured loan – as the requirements and clauses will vary accordingly. A poorly drafted agreement can lead to disputes and legal complications, so taking the time to create a professional document is a worthwhile investment. Furthermore, it’s advisable to consult with a legal expert to ensure the agreement complies with all applicable laws and regulations.

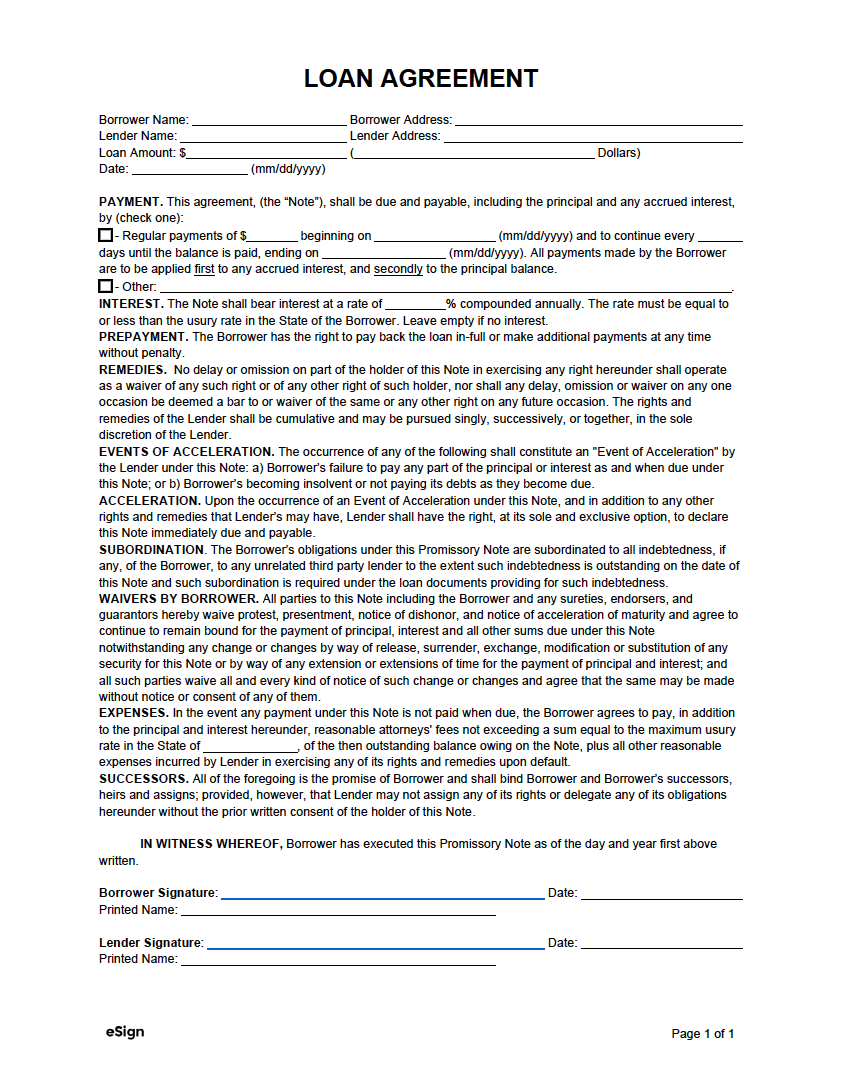

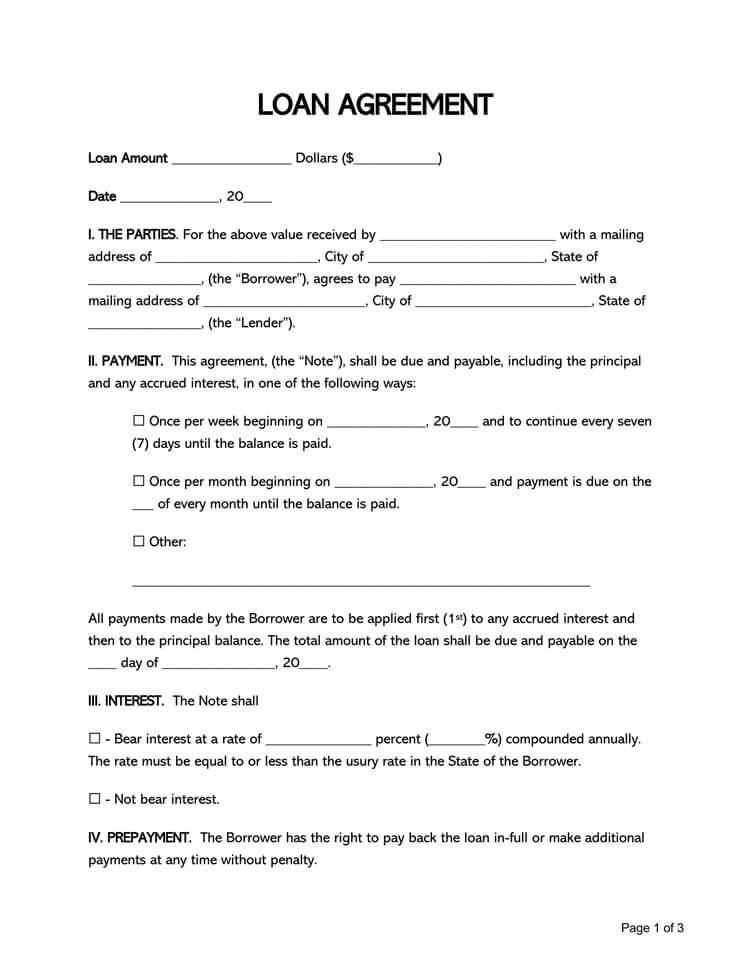

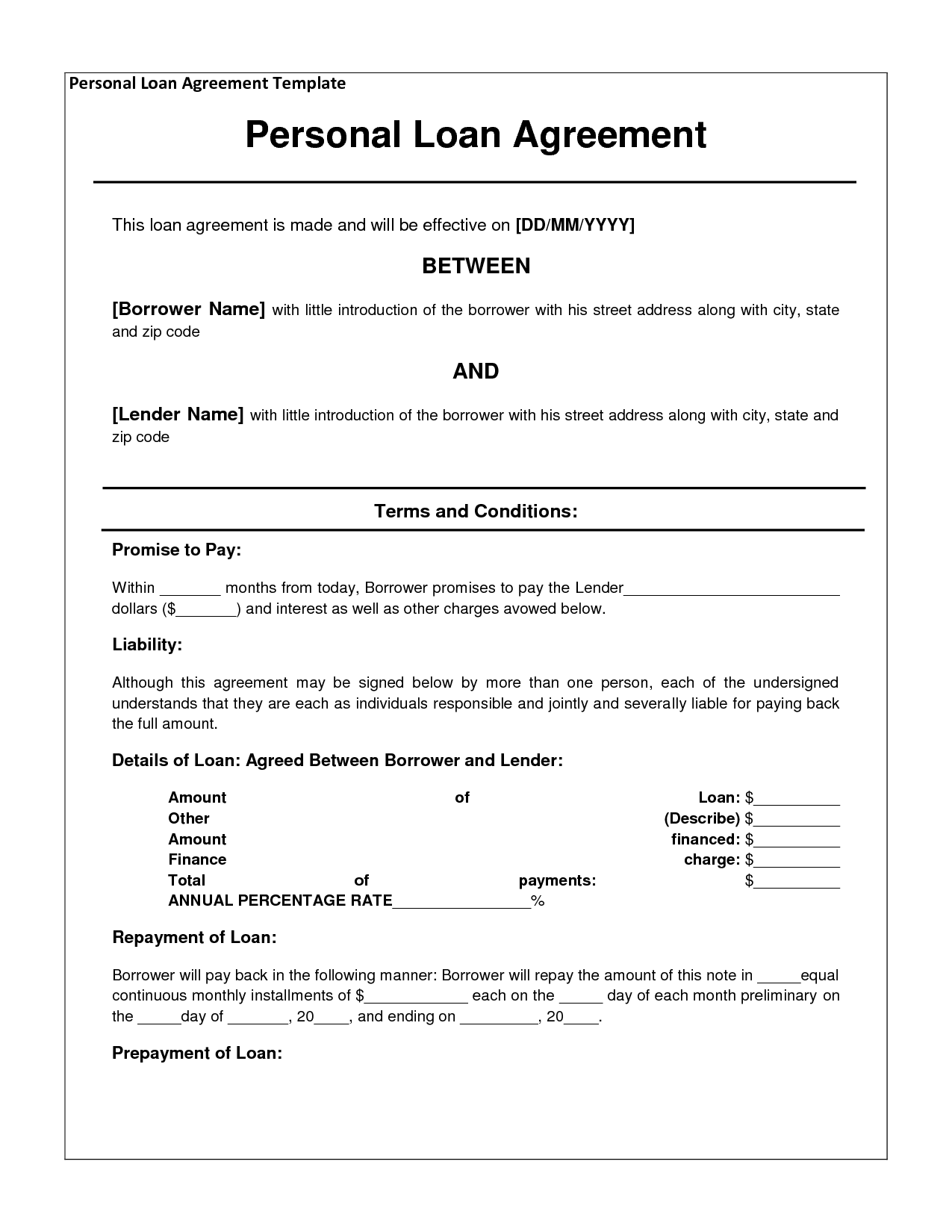

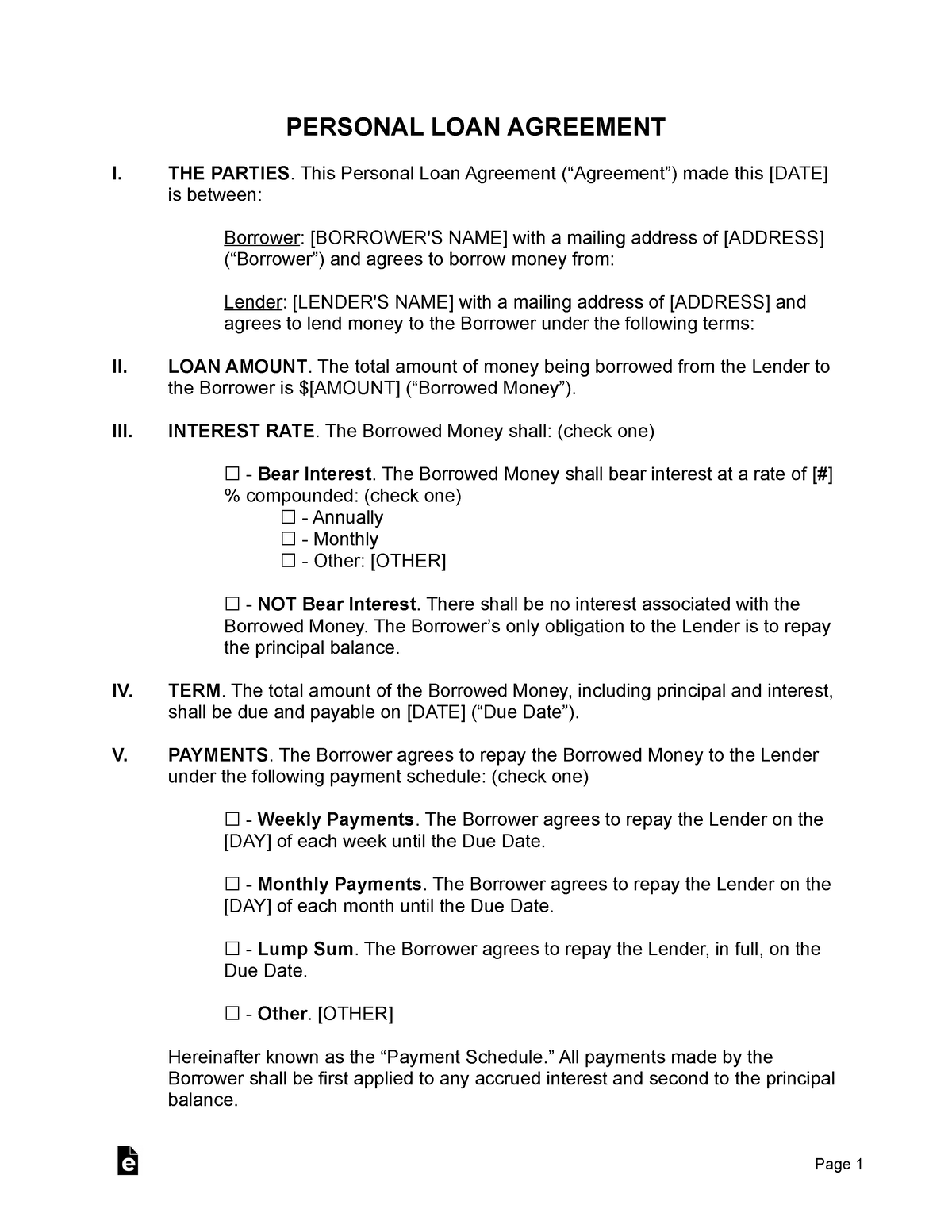

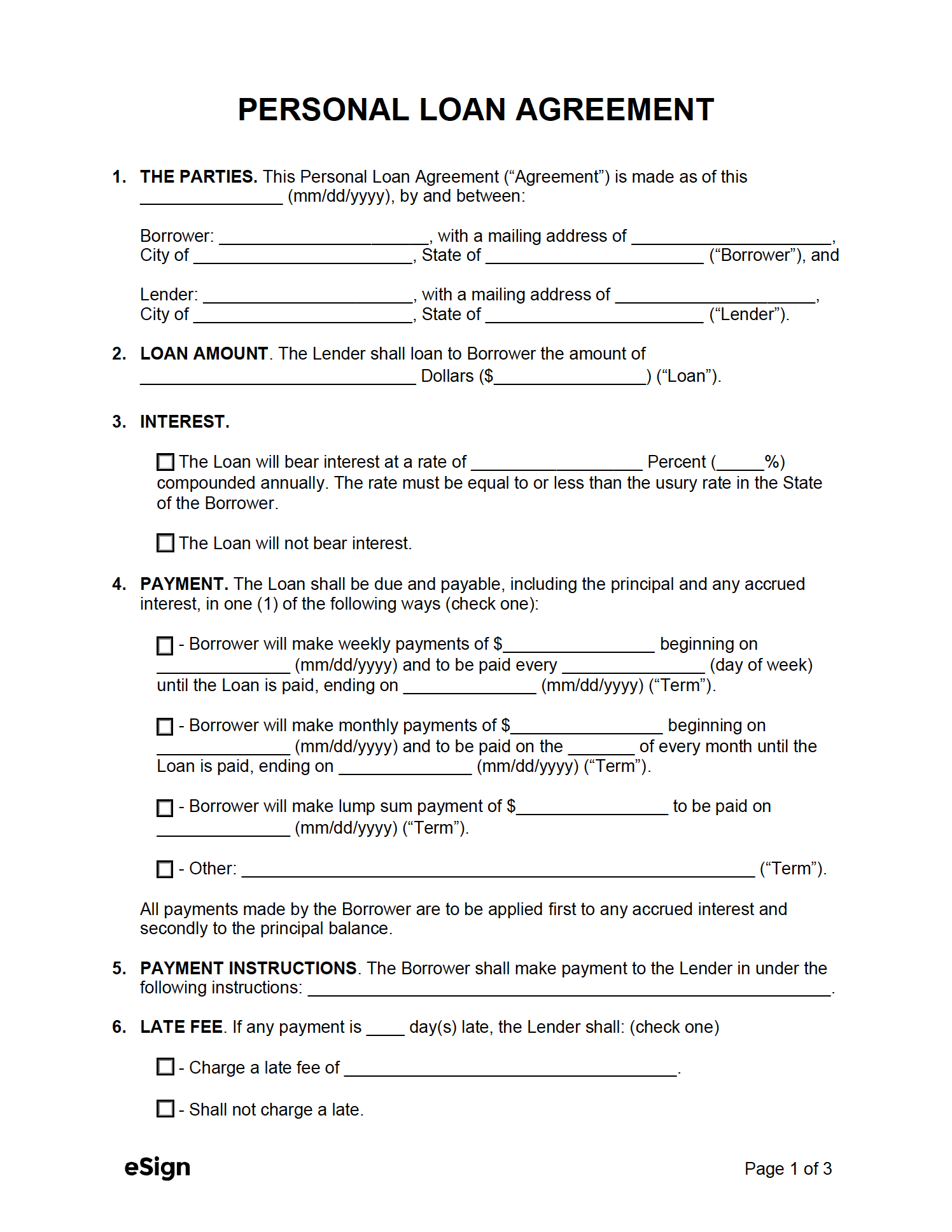

Before diving into the specifics, let’s examine the essential components that typically form a blank loan agreement. These elements are designed to protect all parties involved. A comprehensive agreement will address key areas such as the principal amount, interest rates, repayment schedule, collateral, and default provisions. The clarity and precision of these elements are paramount to a successful loan. A robust agreement minimizes the potential for misunderstandings and costly disputes down the line. It’s a foundational document that sets the stage for a mutually beneficial relationship.

Let’s explore the key sections that should be included in a blank loan agreement. Each section plays a vital role in defining the terms of the loan.

Identification of Parties: This section clearly identifies the lender and the borrower. It’s crucial to include full legal names, addresses, and contact information for both parties. It’s also beneficial to include the legal structure of the borrower (e.g., sole proprietorship, partnership, corporation) as this can impact liability and tax implications. Proper identification is essential for legal purposes.

Loan Purpose: A detailed description of the purpose for which the loan is being sought is critical. This clarifies the intended use of the funds and helps to avoid ambiguity. Be specific – avoid vague descriptions. For example, instead of “business expenses,” specify “funding for marketing campaign.”

Loan Amount: The exact amount of the loan is clearly stated. It’s wise to include a breakdown of the loan amount, if applicable, and the currency in which it will be paid. This prevents misunderstandings about the financial commitment.

Interest Rate and Payment Schedule: The interest rate (if any) and the repayment schedule are fundamental. Specify the type of interest rate (e.g., fixed, variable) and the payment frequency (e.g., monthly, quarterly). A detailed schedule outlining when payments are due and the amount of each payment is essential. Consider including a clause addressing potential interest rate adjustments.

Repayment Terms: This section outlines the duration of the loan and the conditions for repayment. Specify the repayment schedule, including the date of the first payment and the total repayment amount. Consider including a clause addressing potential penalties for late payments.

Collateral (if applicable): If collateral is offered as security for the loan, this section details the type of collateral, its value, and the lender’s right to seize and sell it if the borrower defaults. It’s vital to clearly define the collateral and its value. Properly documenting and valuing collateral is crucial for protecting the lender’s interests.

Default Provisions: This section outlines the consequences of default. It specifies the remedies available to the lender, such as legal action, acceleration of the loan, and the possibility of foreclosure. It’s important to clearly define the lender’s rights and responsibilities in the event of default.

Governing Law and Dispute Resolution: This section specifies the jurisdiction whose laws will govern the agreement and the method for resolving disputes. It may also include a clause specifying the method for resolving disputes (e.g., mediation, arbitration). Choosing a clear and predictable dispute resolution process can streamline the process and reduce legal costs.

It’s absolutely essential to have a qualified legal professional review any blank loan agreement template before you use it. A lawyer can ensure that the agreement complies with all applicable laws and regulations, protects your interests, and minimizes the risk of future disputes. They can also tailor the agreement to your specific circumstances and ensure that it accurately reflects your intentions. Don’t attempt to draft a loan agreement without professional guidance.

While the core components outlined above are essential, consider these additional factors when creating a blank loan agreement:

Creating a robust and legally sound blank loan agreement template is a critical step in securing a successful loan. By carefully considering the key components, understanding the importance of legal review, and addressing potential risks, you can protect your interests and establish a solid foundation for your financial relationship. Remember that this template is a starting point – always seek professional advice to ensure it meets your specific needs and complies with all applicable laws. The consistent use of Blank Loan Agreement Template will contribute to a more secure and predictable financial landscape. Ultimately, a well-crafted agreement fosters trust and promotes a mutually beneficial partnership.