A clear snapshot of your current financial standing is crucial for effective money management, loan applications, and achieving long-term financial goals. One of the best tools for gaining this clarity is a blank personal financial statement template. Using such a template helps you organize your assets, liabilities, and net worth, providing a comprehensive overview of your financial health at a specific point in time.

Understanding your financial position is not just for the wealthy or those with complex investments. Whether you’re planning for retirement, saving for a down payment on a house, or simply trying to get a handle on your spending, a personal financial statement can be an invaluable asset. It provides a clear and concise picture of where you stand and highlights areas where you can improve.

The beauty of a blank personal financial statement template lies in its versatility. It can be tailored to fit your unique circumstances, regardless of your income level or financial complexity. From simple spreadsheets to sophisticated financial planning software, various options are available to suit your needs and preferences. This article will explore the benefits of using these templates, the key components they include, and how to effectively utilize them to improve your financial well-being.

By regularly updating your personal financial statement, you can track your progress towards your financial goals and make informed decisions about your money. It empowers you to take control of your finances and build a secure future. This article will provide the necessary insights and resources to effectively use a blank personal financial statement template to achieve your financial aspirations.

A personal financial statement is a summary of an individual’s assets, liabilities, and net worth at a specific point in time. It’s like a financial photograph, capturing your current financial health. Unlike an income statement, which shows your income and expenses over a period, a financial statement provides a snapshot of your financial position on a specific date.

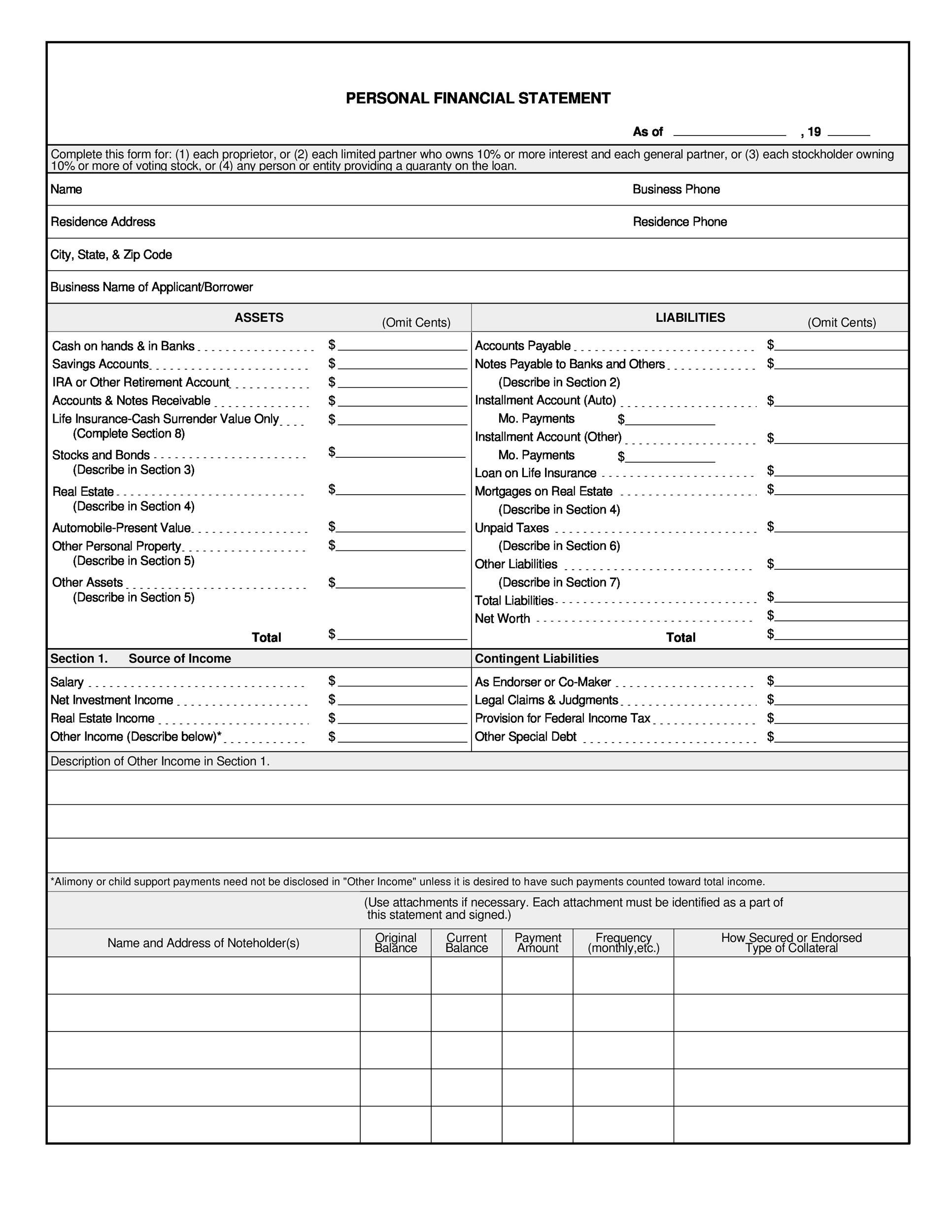

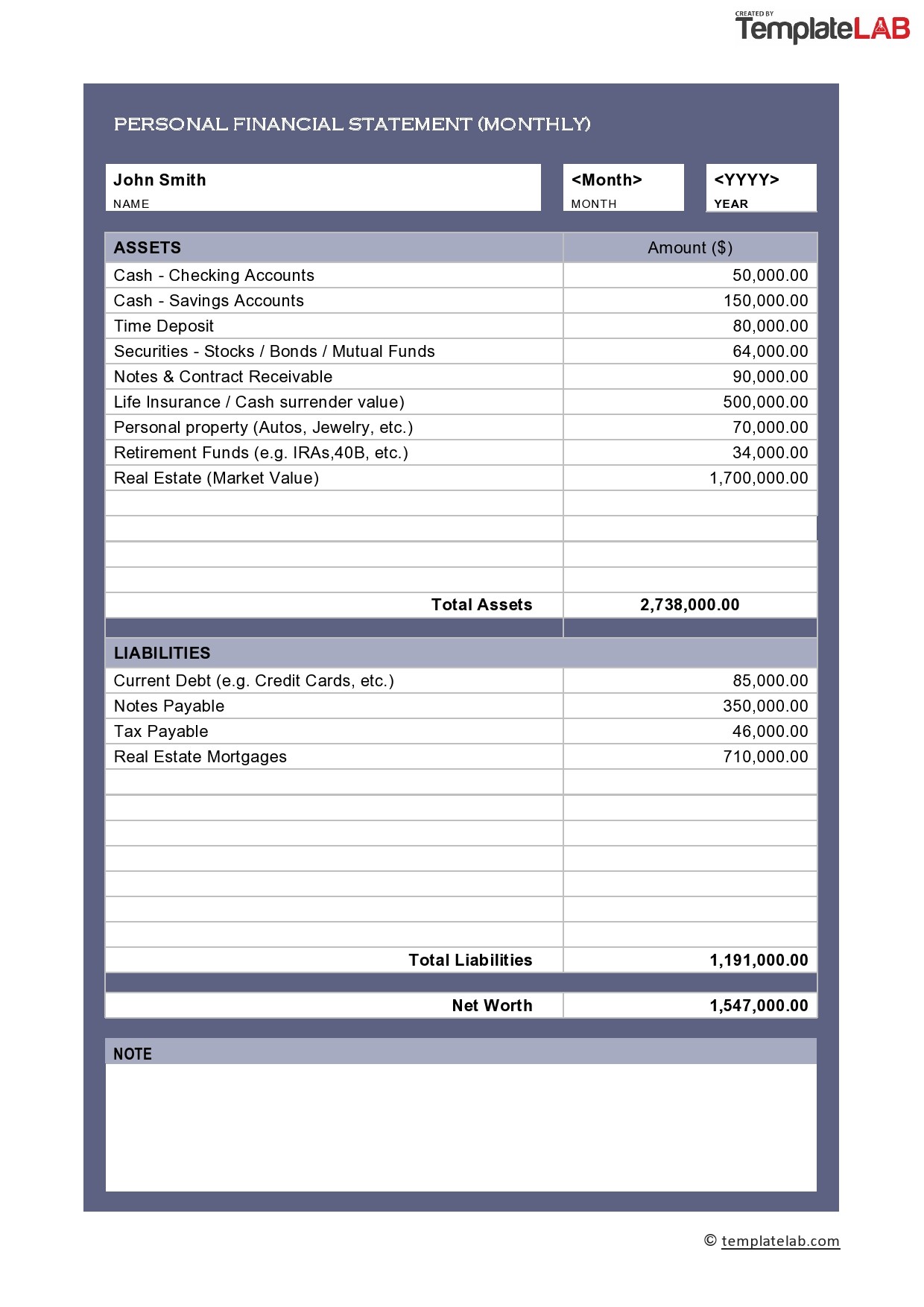

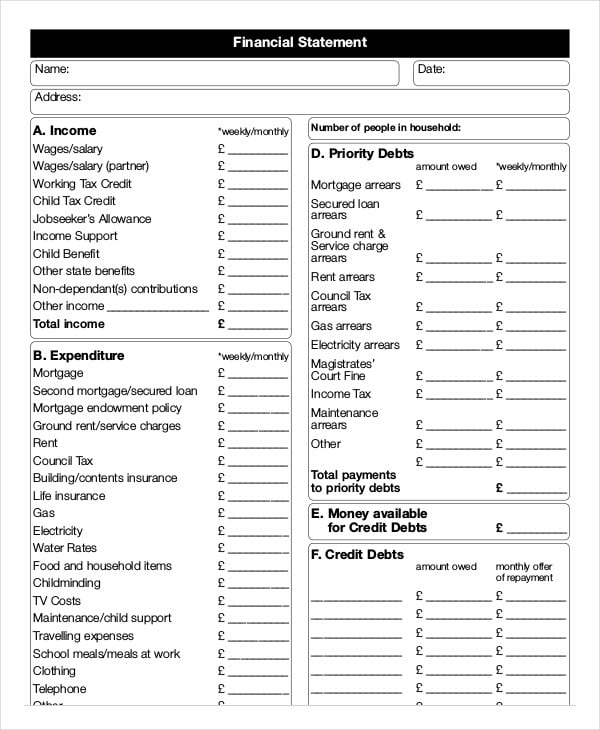

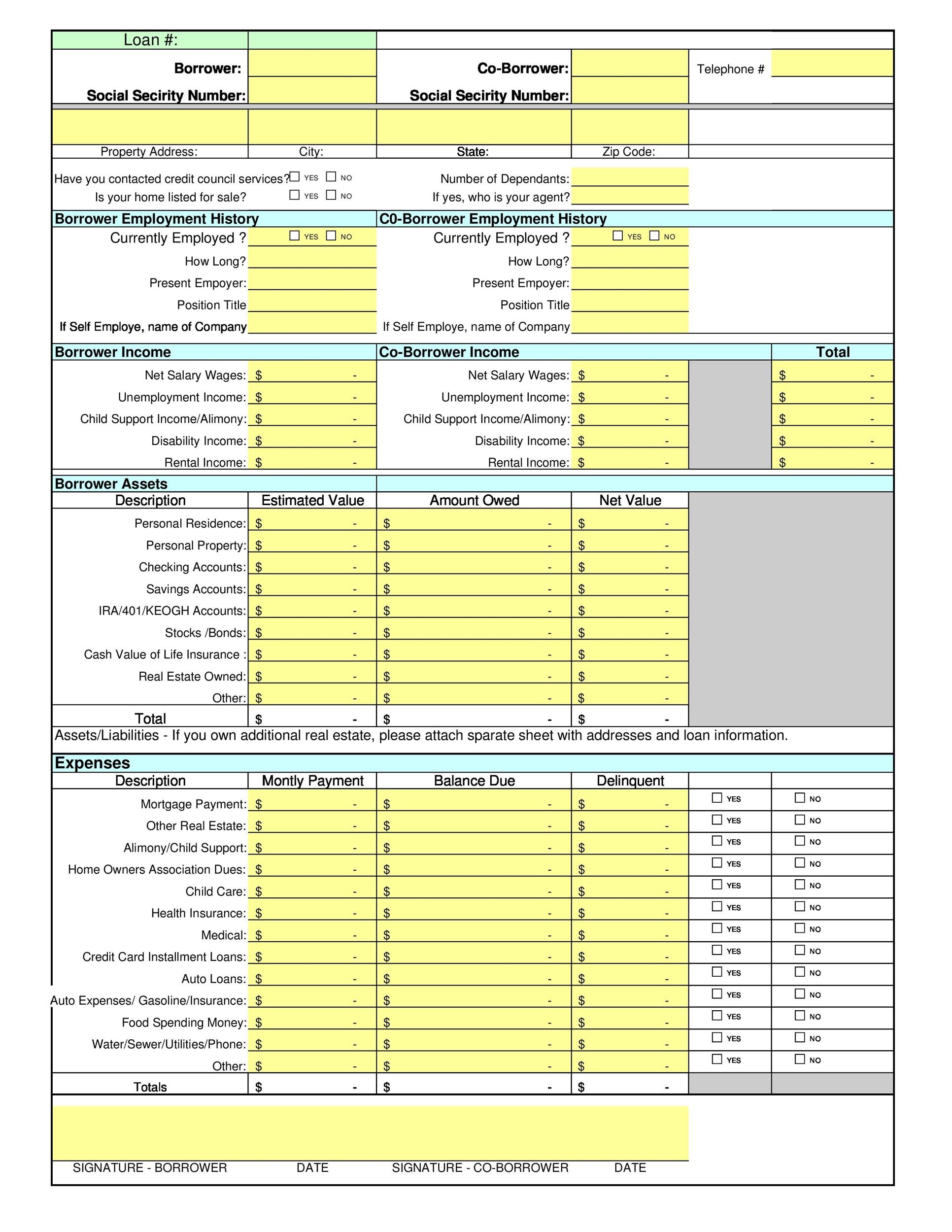

The main components of a personal financial statement include:

Assets: These are items you own that have monetary value. Examples include cash, savings accounts, investments (stocks, bonds, mutual funds), real estate, vehicles, and personal property. Assets are typically listed at their fair market value.

Liabilities: These are your debts and obligations. Examples include mortgages, car loans, student loans, credit card balances, and personal loans. Liabilities are typically listed at the outstanding balance owed.

Net Worth: This is the difference between your assets and liabilities. It represents your overall financial worth. A positive net worth indicates that your assets exceed your liabilities, while a negative net worth indicates the opposite. Net Worth is calculated as: Assets – Liabilities = Net Worth

A personal financial statement serves several important purposes:

Financial Planning: It provides a clear picture of your current financial situation, which is essential for setting financial goals and developing a plan to achieve them.

Loan Applications: Lenders often require a personal financial statement as part of the loan application process. It helps them assess your ability to repay the loan.

Investment Decisions: Understanding your net worth and asset allocation can help you make informed investment decisions.

Tracking Progress: By regularly updating your financial statement, you can track your progress towards your financial goals and identify areas where you need to improve.

Using a blank personal financial statement template offers numerous advantages compared to creating one from scratch. It provides structure, ensures completeness, and saves time.

A pre-designed template provides a clear and organized structure for listing your assets and liabilities. This helps you avoid overlooking important items and ensures that your financial statement is comprehensive and easy to understand.

Templates typically include all the necessary categories and subcategories, prompting you to consider all aspects of your financial situation. This helps ensure that your financial statement is complete and accurate.

Using a template saves you the time and effort of designing your own financial statement from scratch. You can simply fill in the blanks with your relevant information, which is much faster and easier than creating a document from zero.

Templates often have a professional and polished appearance, which can be important if you’re sharing your financial statement with lenders or financial advisors.

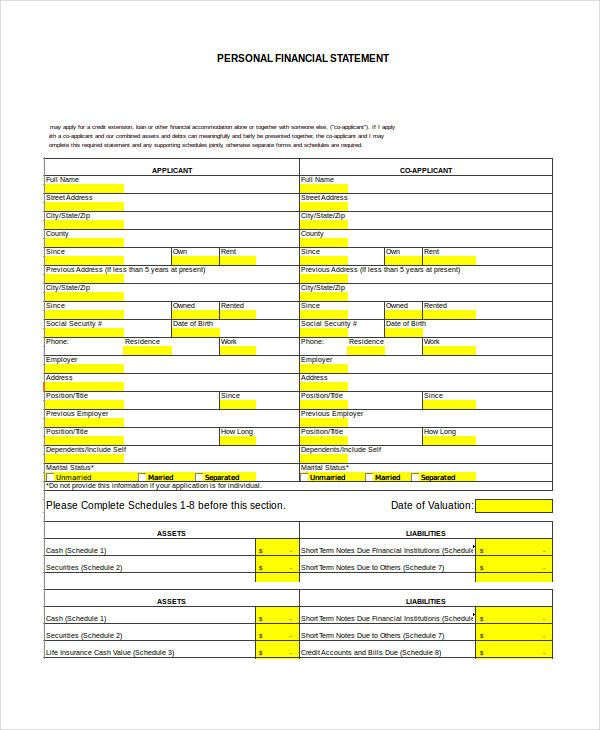

While offering a structured format, a good blank personal financial statement template can still be adapted to individual needs. Categories can be added, removed, or modified to better reflect one’s unique financial situation.

Selecting the appropriate template is crucial for its effectiveness. Consider your needs and the template’s features.

Simplicity: Choose a template that is easy to understand and use, especially if you’re new to financial statements.

Customization: Look for a template that allows you to customize the categories and subcategories to fit your specific financial situation.

Format: Templates are available in various formats, such as spreadsheets (Excel, Google Sheets) and PDF documents. Choose the format that you’re most comfortable with.

Features: Some templates include additional features, such as automatic calculations, charts, and graphs. Consider whether these features are important to you.

Accessibility: Ensure the template is accessible across different devices and platforms.

Numerous resources offer blank personal financial statement templates:

Online Search: A simple online search for “blank personal financial statement template” will yield numerous results.

Financial Websites: Many financial websites offer free templates and resources.

Software Providers: Financial planning software often includes templates for creating personal financial statements.

Credit Unions and Banks: Many financial institutions provide templates to their members or customers.

A good template will have sections like:

Each of these should have sub-sections to list specific accounts or items and their values.

Once you’ve selected a template, the next step is to gather your financial information and fill it out accurately.

Before you start filling out the template, gather all the necessary financial documents, such as:

Identify the Date: The financial statement should be dated, as it represents your financial position at a specific point in time.

List Your Assets: Start by listing all your assets, including cash, bank accounts, investments, real estate, vehicles, and personal property. Be sure to use the fair market value for each asset.

List Your Liabilities: Next, list all your liabilities, including mortgages, car loans, student loans, credit card balances, and personal loans. Use the outstanding balance owed for each liability.

Calculate Your Net Worth: Subtract your total liabilities from your total assets to calculate your net worth.

Review and Verify: Carefully review your financial statement to ensure that all information is accurate and complete.

A well-prepared personal financial statement is a powerful tool for financial planning.

Your financial statement can help you identify areas where you need to improve and set realistic financial goals. For example, if you have a high level of debt, you might set a goal to reduce your debt by a certain amount each year.

By reviewing your assets and liabilities, you can gain insights into your spending habits and identify areas where you can cut back. This can help you create a budget that aligns with your financial goals.

Your financial statement can help you determine your risk tolerance and develop an appropriate investment strategy. For example, if you have a high net worth and a long time horizon, you might be comfortable with a more aggressive investment strategy.

Regularly updating your financial statement allows you to track your progress towards your financial goals and make adjustments as needed. It also provides a clear picture of how your net worth is changing over time. Using a blank personal financial statement template is essential for tracking your progress.

While a blank personal financial statement template can simplify the process, it’s still essential to avoid common pitfalls.

One of the most common mistakes is overvaluing assets. It’s important to use realistic estimates of fair market value. Inflating asset values can create a misleading picture of your financial health.

Failing to include all liabilities is another common mistake. Be sure to list all debts and obligations, no matter how small. Omitting liabilities can significantly distort your net worth.

Using outdated information can also lead to inaccuracies. Be sure to use the most recent statements and documents available.

Inconsistent formatting can make your financial statement difficult to read and understand. Use a consistent format throughout the document.

Failing to review your financial statement for accuracy and completeness is a critical mistake. Always take the time to carefully review your work before sharing it with others.

A blank personal financial statement template is an invaluable tool for gaining a clear understanding of your financial health. By accurately documenting your assets, liabilities, and net worth, you can set realistic financial goals, track your progress, and make informed decisions about your money. Choosing the right template, gathering your financial information, and avoiding common mistakes are all essential steps in creating an effective financial statement. Regularly updating and reviewing your financial statement will empower you to take control of your finances and build a secure future.