Running a small business is an exhilarating, yet often stressful, endeavor. You’re juggling everything from product development and marketing to customer service and, crucially, managing your finances. Effective bookkeeping isn’t just about keeping track of expenses; it’s about understanding your business’s financial health, making informed decisions, and ultimately, achieving sustainable growth. That’s where bookkeeping templates come in – they provide a structured and efficient way to manage your finances, freeing up your time and reducing the risk of costly errors. This guide will explore the importance of bookkeeping for small businesses, introduce various template options, and offer practical advice on getting started. Bookkeeping For Small Business Templates is more than just software; it’s a foundational element of a thriving business.

The importance of bookkeeping cannot be overstated, especially for small businesses. Many small business owners underestimate the value of proper financial management, leading to missed opportunities and potential financial difficulties. Without a clear understanding of your income and expenses, it’s difficult to plan for the future, secure funding, or even make strategic decisions about expansion. A well-maintained bookkeeping system provides the data needed to track performance, identify trends, and proactively address potential problems. Furthermore, it’s a critical component of tax compliance, ensuring you’re meeting your legal obligations and avoiding penalties. Ignoring bookkeeping can lead to a cascade of problems, from inaccurate tax filings to strained relationships with suppliers. Investing in bookkeeping isn’t an expense; it’s an investment in the long-term success of your business.

Before diving into specific templates, it’s essential to grasp the core principles of effective bookkeeping. The foundation of a successful system lies in accurate record-keeping. This means diligently tracking all income and expenses, categorizing transactions correctly, and maintaining organized financial documents. Different types of transactions – sales, purchases, payroll, rent, utilities – require different tracking methods. Consistency is key – establishing a regular schedule for recording transactions will prevent data loss and ensure you’re always working with the most up-to-date information. Furthermore, understanding your business’s accounting cycle – from invoicing to payment – is crucial for efficient bookkeeping. This cycle should be clearly defined and consistently followed. Finally, utilizing accounting software or a spreadsheet can significantly streamline the process, but the underlying principles of accurate record-keeping remain paramount.

Numerous bookkeeping templates are available, catering to different business sizes and needs. Choosing the right template is a critical step in establishing a solid foundation for your financial management. Here are a few popular options, categorized by complexity and cost:

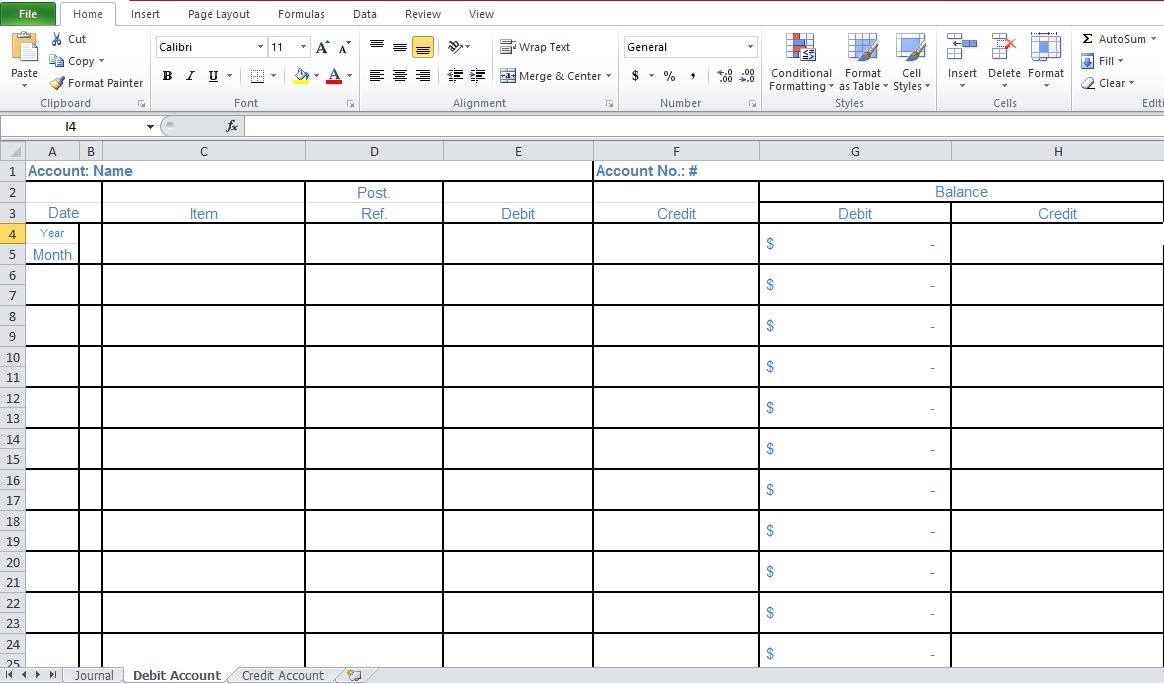

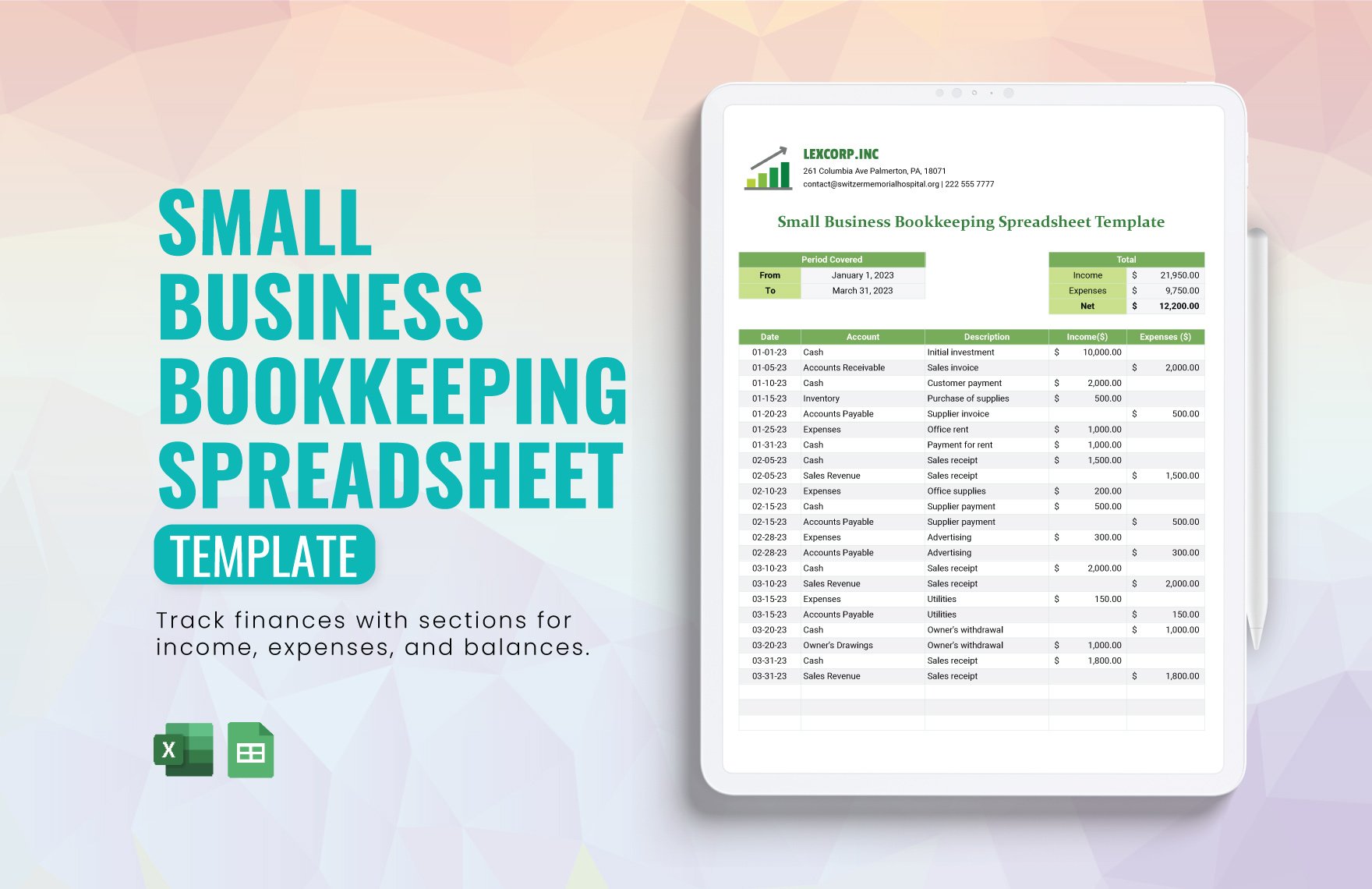

For very small businesses with limited transactions, a simple spreadsheet can be a cost-effective starting point. These templates typically involve creating columns for date, description, amount, and category. While they lack advanced features, they’re easy to learn and customize. Popular options include Google Sheets and Microsoft Excel. These are great for tracking basic income and expenses, but they often require manual data entry and can become cumbersome as your business grows. Bookkeeping For Small Business Templates that utilize spreadsheets are often the most accessible option.

Online accounting software platforms, such as QuickBooks Online, Xero, and FreshBooks, offer a wide range of templates tailored to specific business types. These platforms typically provide features like invoicing, expense tracking, bank reconciliation, and reporting. They often include pre-built templates for various industries, simplifying the setup process. These are generally more expensive than spreadsheets but offer significant advantages in terms of automation, data security, and scalability. Bookkeeping For Small Business Templates that integrate with these platforms are highly recommended.

Dedicated bookkeeping software, such as Wave Accounting, is designed specifically for small businesses and offers a comprehensive suite of features. These platforms often include features like automated bank reconciliation, tax preparation assistance, and reporting tools. They are typically subscription-based and can be a good option for businesses that need advanced features and support. Bookkeeping For Small Business Templates that integrate with dedicated software are often the most robust and feature-rich.

Effective bookkeeping isn’t just about recording transactions; it’s about understanding your business’s financial performance. Here’s a breakdown of key categories and tasks:

Accurately recording all income sources is fundamental. This includes tracking sales revenue, service fees, interest income, and any other sources of income. Categorizing income streams allows you to analyze profitability and identify areas for improvement. Maintaining a detailed record of sales data, including product/service descriptions and sales channels, is crucial for accurate revenue reporting.

Tracking all business expenses is equally important. Categorizing expenses – rent, utilities, marketing, salaries, supplies – allows you to understand where your money is going and identify areas where you can reduce costs. Maintaining a detailed record of all expenses, including receipts and invoices, is essential for tax compliance. Consider using a mileage tracking system if you have business-related travel expenses.

Regular financial reporting is vital for making informed business decisions. Key reports include the income statement (profit and loss statement), balance sheet, and cash flow statement. These reports provide a snapshot of your business’s financial health and help you assess profitability, liquidity, and solvency. Using accounting software or spreadsheets to generate these reports is essential.

Efficient invoice management is critical for collecting payments from customers. Creating professional invoices, sending invoices promptly, and tracking invoice status are all essential parts of the process. Automating invoice reminders can help you improve cash flow.

Regular bank reconciliation is crucial for ensuring the accuracy of your financial records. This involves comparing your bank statements to your accounting records to identify and resolve any discrepancies. This process ensures that your financial data is accurate and reliable.

Implementing a robust bookkeeping system offers numerous benefits for small businesses. Here are some key advantages:

Bookkeeping is not just a necessary expense for small businesses; it’s a strategic investment in their long-term success. By implementing a well-structured system and consistently tracking your finances, you can gain control of your business’s financial health, reduce risks, and ultimately, achieve sustainable growth. The right bookkeeping template, coupled with a commitment to accurate record-keeping, will empower you to make informed decisions and navigate the challenges of running a small business with confidence. Bookkeeping For Small Business Templates are readily available, and the benefits far outweigh the initial investment. Don’t wait until you’re struggling to manage your finances – start today!