Business bank reconciliation is a critical process for ensuring the accuracy of financial records and maintaining a reliable audit trail. It’s more than just matching transactions; it’s about verifying that your bank statements accurately reflect your company’s financial activity. A well-executed reconciliation process can prevent errors, identify discrepancies, and ultimately strengthen your financial controls. This comprehensive guide will explore the key aspects of business bank reconciliation, providing you with the knowledge and tools to streamline this essential task. Business Bank Reconciliation Template is the cornerstone of sound financial management.

The process of bank reconciliation involves comparing your company’s records with your bank’s records to identify and resolve any differences. This comparison is typically done on a monthly or quarterly basis, but it can be adjusted based on your company’s needs. It’s a proactive step that helps prevent costly errors and ensures your financial data is accurate and trustworthy. A robust reconciliation process is vital for regulatory compliance and maintaining a strong financial reputation. Without it, you risk misrepresenting your financial position to stakeholders, investors, and regulators.

The benefits of a consistent and effective bank reconciliation process are numerous. Firstly, it reduces the risk of errors and fraud. Secondly, it provides a clear picture of your company’s cash flow and overall financial health. Thirdly, it streamlines accounting processes and saves time and resources. Finally, it enhances the credibility of your financial statements. A well-maintained reconciliation system demonstrates a commitment to accuracy and transparency. Investing in the right tools and training is essential for success.

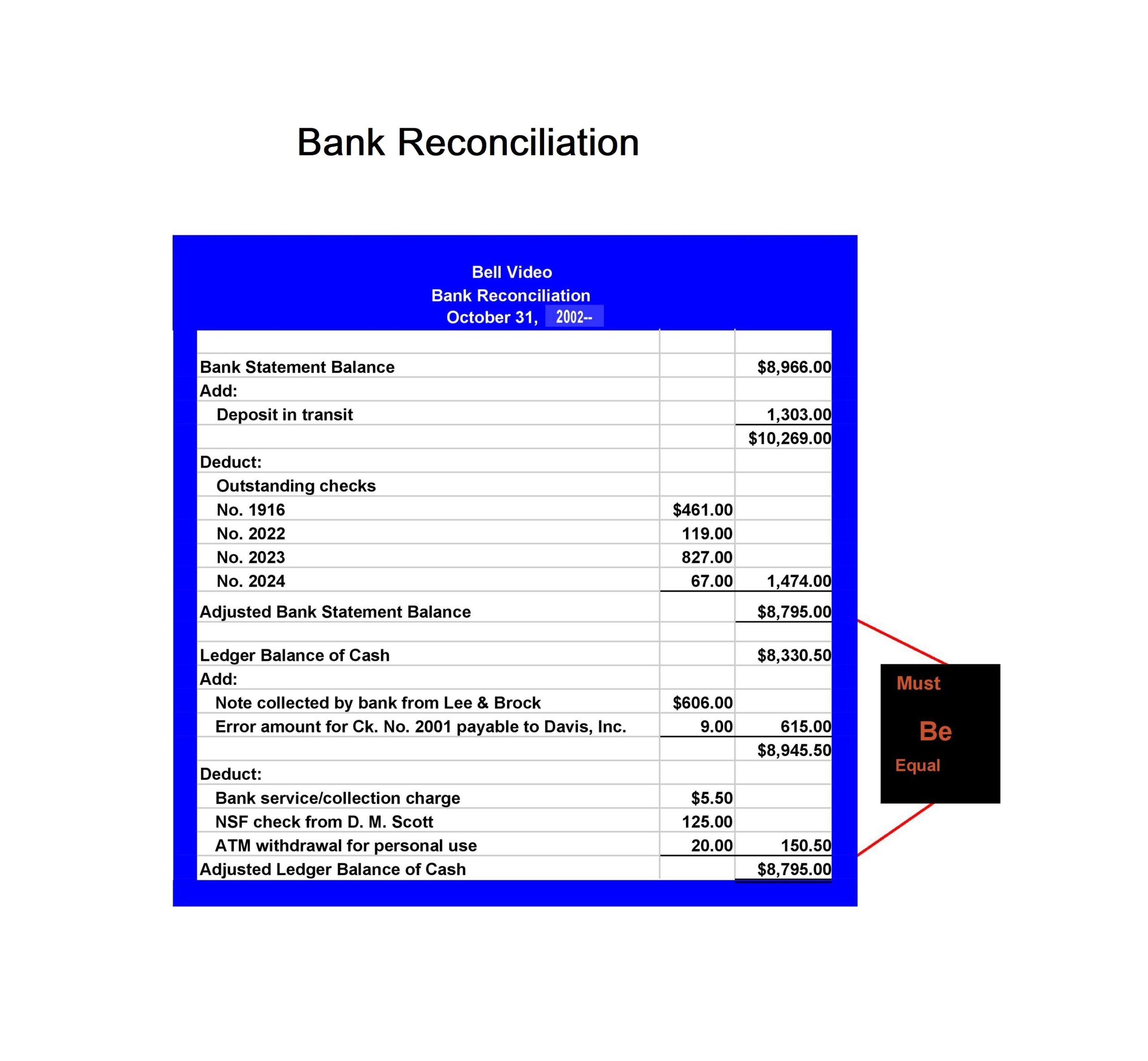

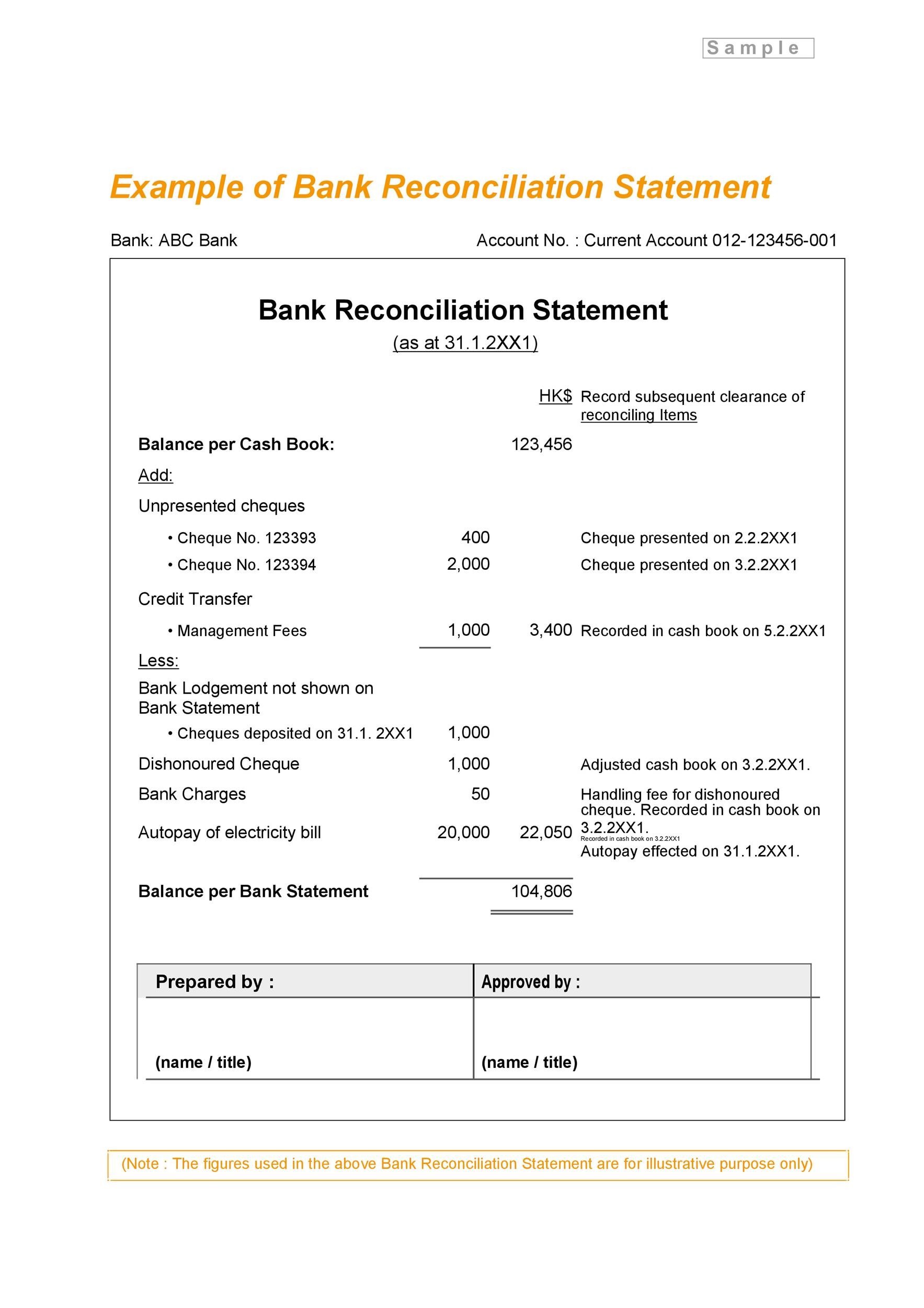

Before diving into the specifics, it’s important to understand the fundamental principles behind bank reconciliation. The core idea is to identify and account for all transactions that have occurred in both your company’s bank accounts and your bank’s accounts. This includes deposits, withdrawals, transfers, and any other transactions that affect your company’s balance. Simply matching transactions isn’t enough; you need to understand why they differ. This requires a thorough understanding of your bank’s transaction processing and your own company’s accounting procedures.

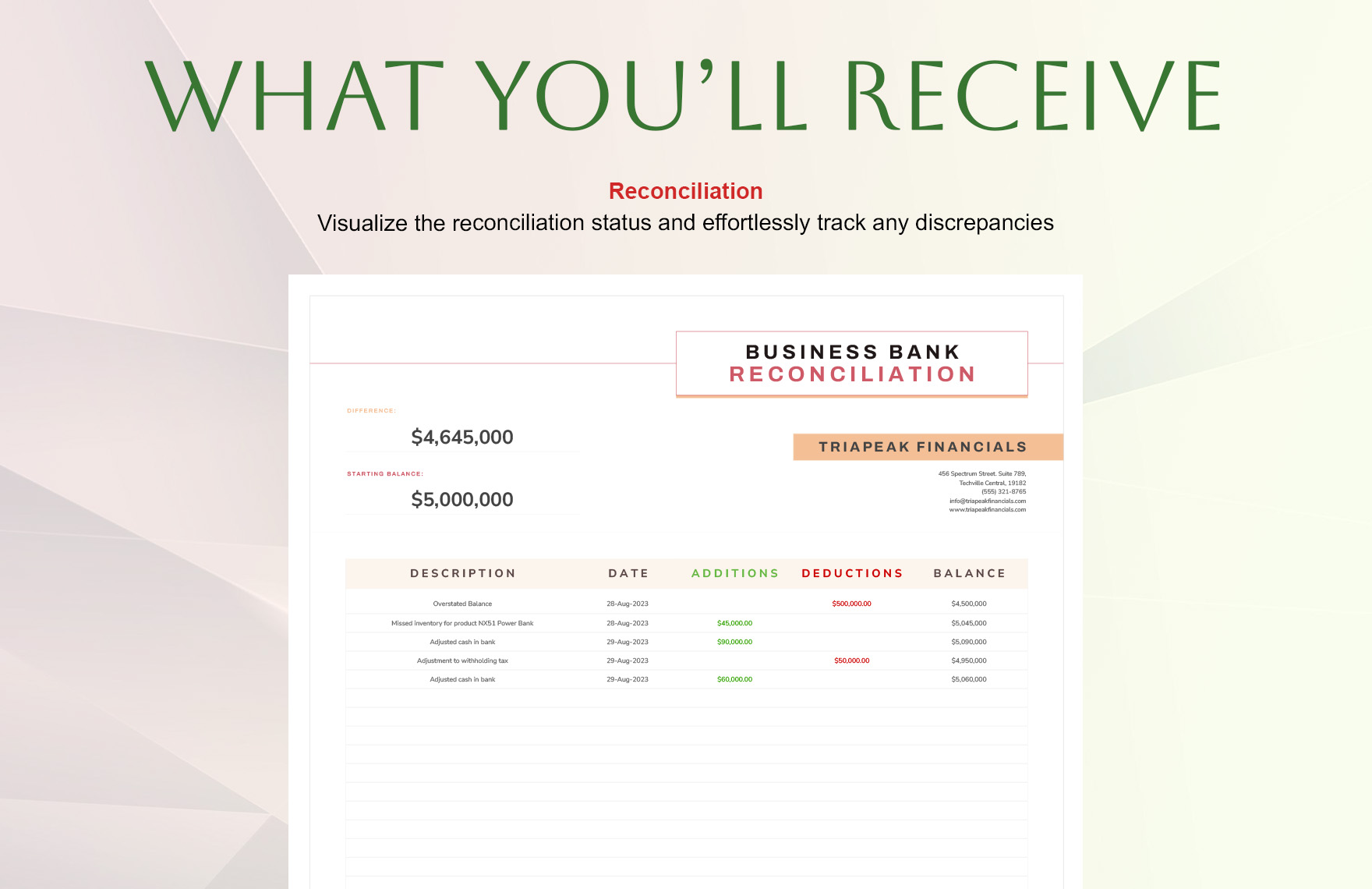

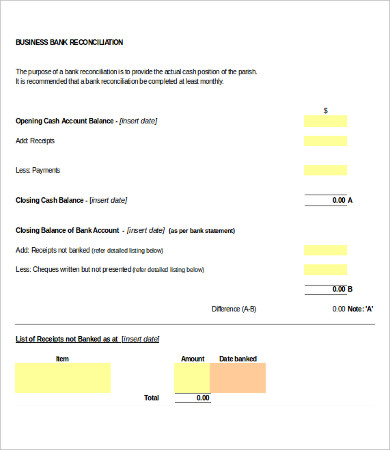

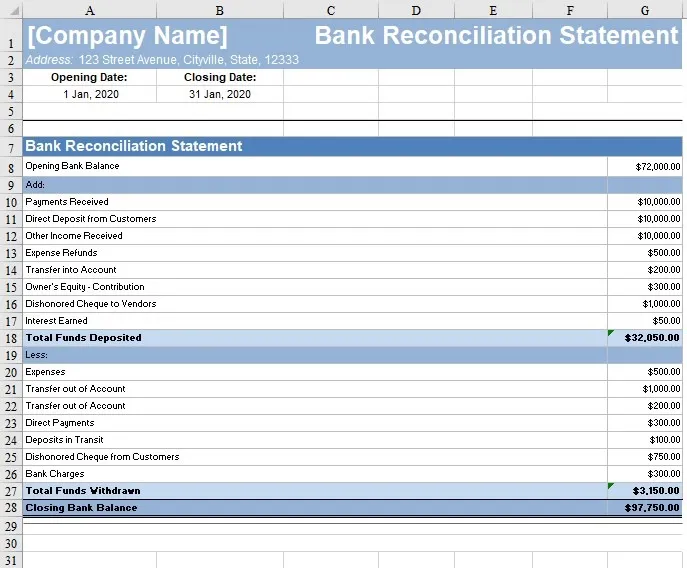

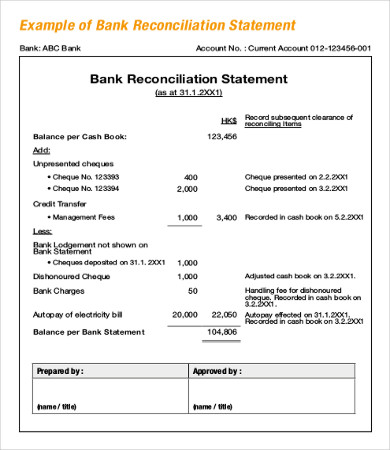

The process typically begins with a reconciliation report from your bank. This report summarizes all transactions that have occurred since the last reconciliation. It highlights any discrepancies or differences between your company’s records and your bank’s records. The report will often include a detailed explanation of the discrepancies and the reasons for them. It’s crucial to carefully review this report to understand the root cause of any issues.

The heart of bank reconciliation lies in matching transactions. This involves comparing the details of each transaction – the date, amount, and description – from both your company’s records and your bank’s records. The goal is to ensure that all transactions are accurately reflected in both systems. This often involves a significant amount of manual work, particularly when dealing with complex transactions or multiple accounts.

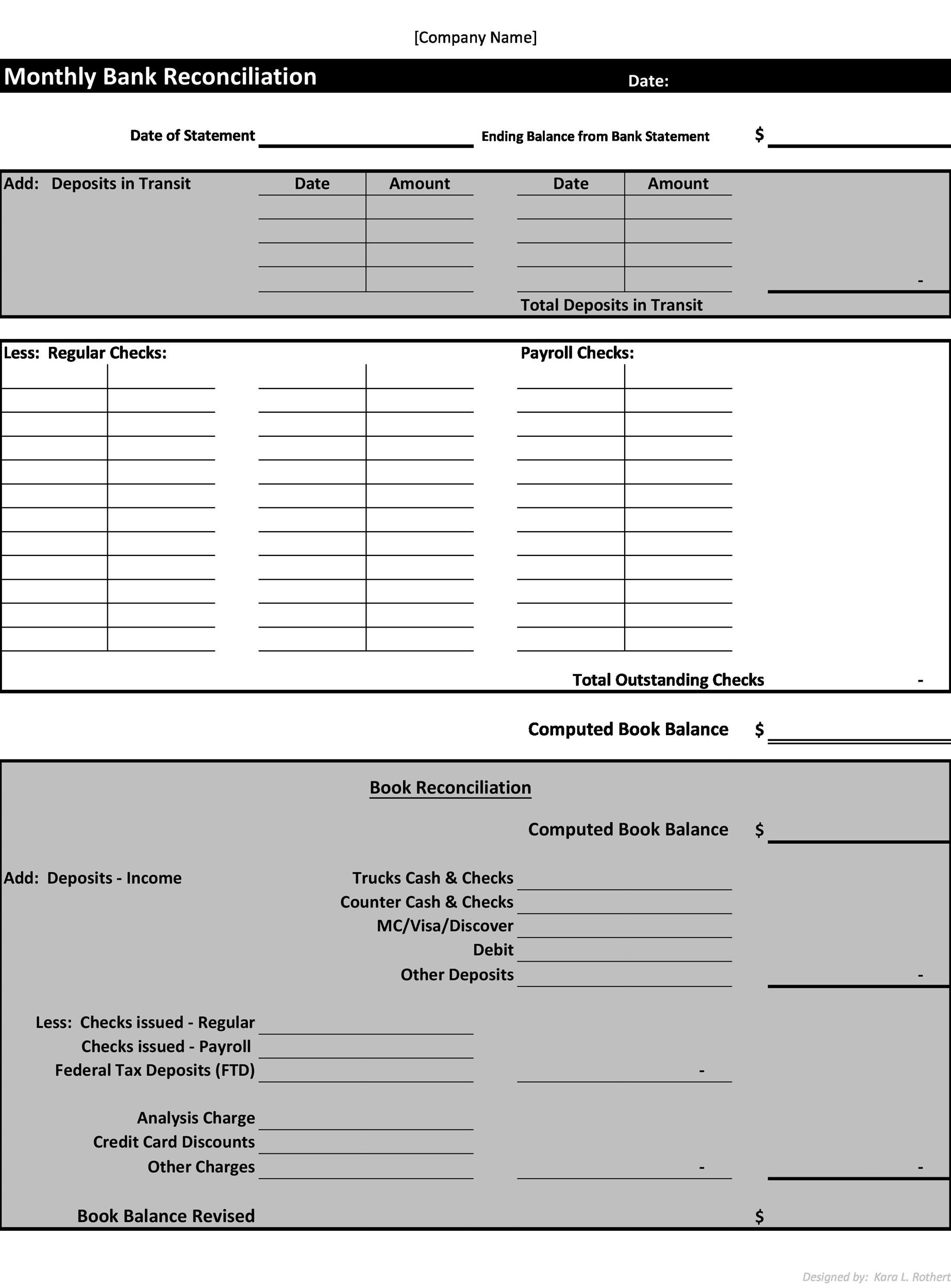

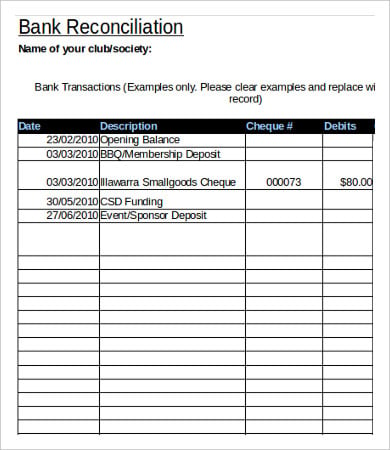

A common method for matching transactions is to use a matching spreadsheet. This spreadsheet allows you to easily compare transactions and identify any discrepancies. It’s important to use a consistent naming convention for your transactions to make it easier to track and analyze the data. Consider using a dedicated reconciliation software to automate the matching process and improve accuracy. Many modern accounting software packages offer built-in reconciliation features.

Several common issues can arise during bank reconciliation. One of the most frequent problems is incorrect deposits. This can happen if a deposit is made to the wrong account or if the deposit amount is not properly recorded. Another common issue is incorrect withdrawals. This can occur if a withdrawal is made to the wrong account or if the withdrawal amount is not properly recorded. Furthermore, discrepancies can arise due to errors in data entry or system processing.

Understanding the difference between a deposit and a withdrawal is critical. A deposit is an inflow of cash, while a withdrawal is an outflow of cash. Carefully reviewing the transaction details and comparing them to your bank’s records is essential for identifying these errors. Don’t simply assume that a transaction is correct based on the date or amount; always verify the details.

Beyond the basic matching process, there are several more advanced techniques that can be used to improve the accuracy and efficiency of bank reconciliation. These techniques often involve using data analytics and automation. For example, you can use data analytics to identify patterns and trends in your bank statements that may indicate potential errors. Automation tools can streamline the reconciliation process, reducing the risk of human error and saving time.

One particularly useful technique is using a “split-by” matching method. This method allows you to compare transactions that have the same date but different amounts. This is particularly helpful when dealing with transactions that are recorded in multiple accounts. It helps to identify any discrepancies that may not be apparent through simple matching.

Investing in reconciliation software can significantly simplify and improve the bank reconciliation process. These tools automate many of the manual tasks involved, such as matching transactions, generating reports, and tracking discrepancies. Popular options include [Insert Example Software Names Here – e.g., BlackLine, Float, Xero]. These solutions often offer features like workflow automation, audit trails, and real-time reporting. Choosing the right software depends on your company’s size, complexity, and specific needs.

A robust audit trail is essential for effective bank reconciliation. An audit trail is a record of all transactions that have occurred, including the date, amount, and description of each transaction. It provides a clear history of your company’s financial activity and helps to identify any discrepancies. Properly documenting your reconciliation process and maintaining a complete audit trail is crucial for demonstrating compliance with regulatory requirements.

Several best practices can help ensure the accuracy and efficiency of your bank reconciliation process. These include:

Business bank reconciliation is a fundamental component of sound financial management. By consistently and accurately reconciling your bank statements with your company’s records, you can reduce the risk of errors, improve your financial controls, and enhance the credibility of your financial statements. A well-executed reconciliation process is not just about matching transactions; it’s about ensuring the accuracy and reliability of your financial data. Investing in the right tools and training is essential for success. Business Bank Reconciliation Template is a vital tool for achieving these goals. Properly managing your bank reconciliation process will contribute significantly to the overall health and stability of your business.