Creating a robust financial plan is critical for any business, regardless of size or industry. A key component of this plan is the creation of well-structured business budgets templates that allow for accurate forecasting, expense tracking, and performance evaluation. Effectively utilizing these templates can significantly improve decision-making and lead to sustainable growth.

A well-designed budget isn’t just about numbers; it’s a roadmap that guides your company towards its financial goals. It clarifies priorities, identifies potential risks, and provides a benchmark against which to measure actual performance. By meticulously planning your income and expenses, you can make informed decisions about resource allocation, investment opportunities, and cost-cutting measures.

Furthermore, effective budgeting fosters a culture of financial accountability within your organization. When employees understand the budget and their role in achieving it, they are more likely to be mindful of expenses and contribute to overall financial health. This collaborative approach to budgeting can lead to greater efficiency and a stronger sense of ownership.

In the following sections, we will explore the different types of business budgets, the essential components of an effective budget template, and how to choose the right template for your specific business needs. We will also delve into practical tips and best practices for creating and managing your business budget effectively.

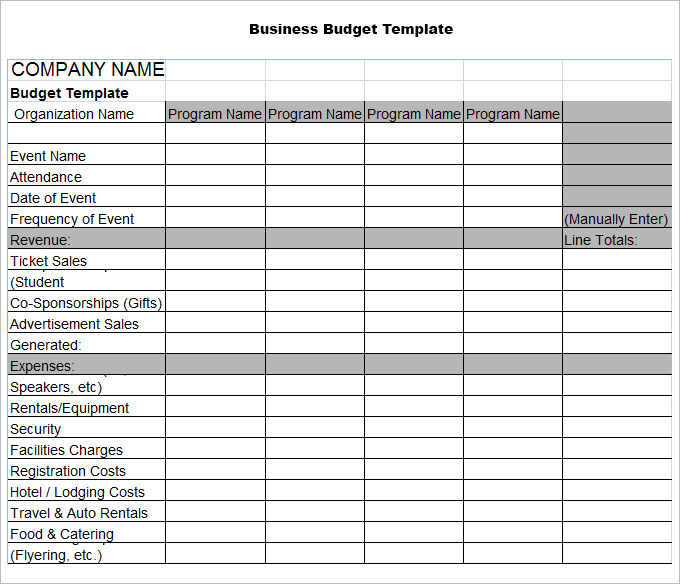

Different businesses require different types of budgets to address their specific needs and operational structures. Here are some of the most common types:

Master Budget: This is a comprehensive budget that encompasses all other budgets within the organization. It typically includes the operating budget, financial budget, and capital expenditure budget. It provides a high-level overview of the company’s overall financial plan.

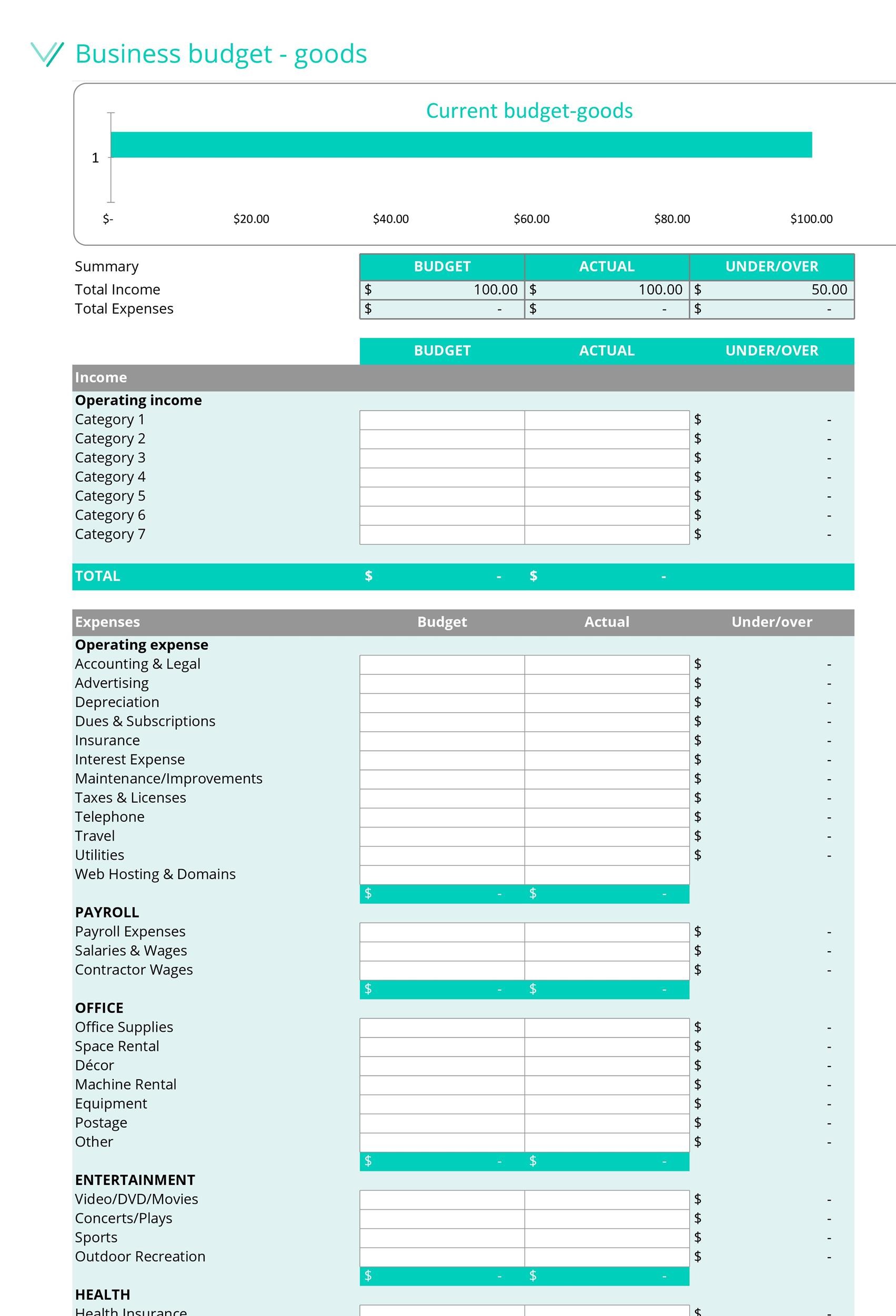

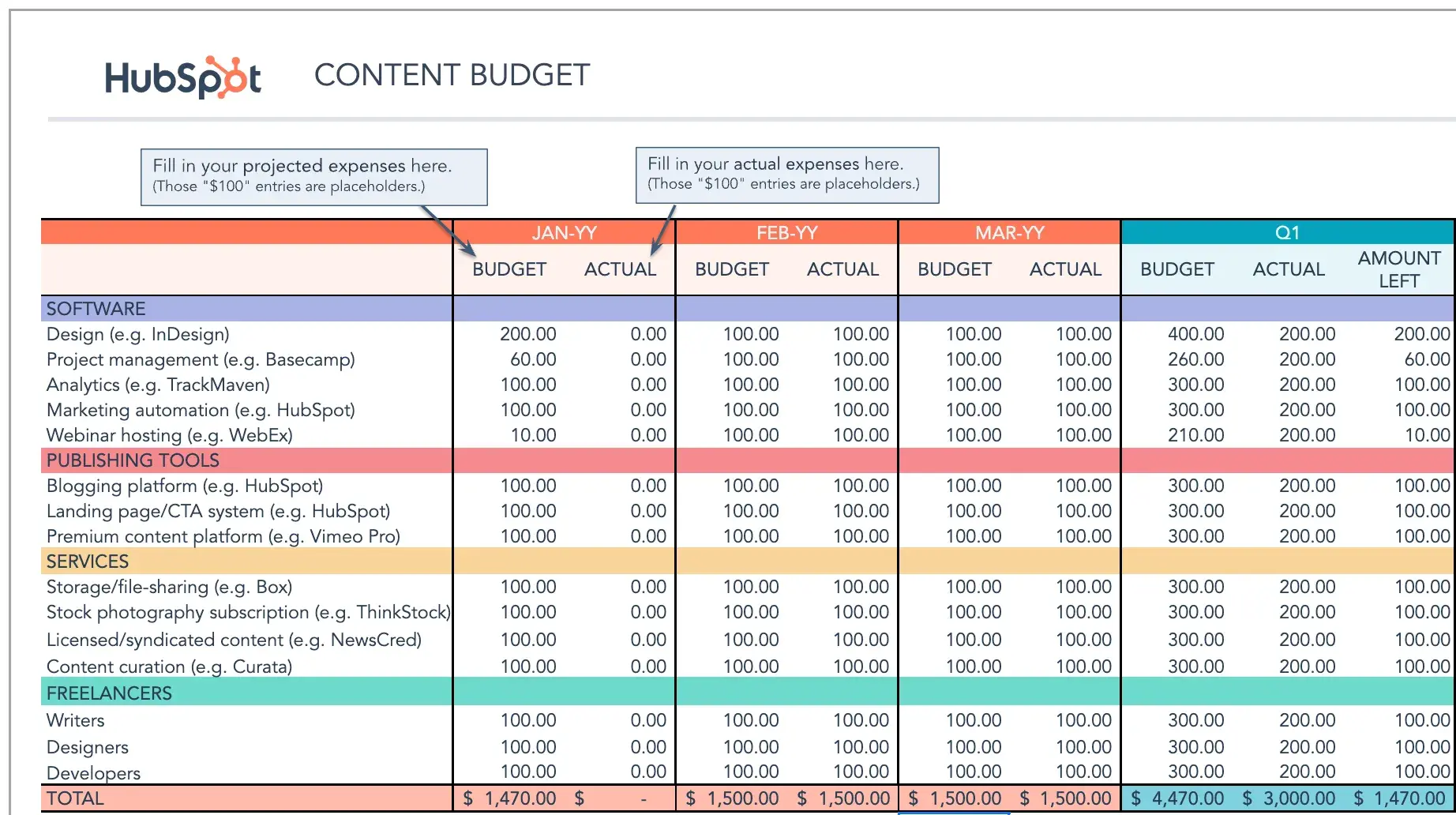

Operating Budget: This budget focuses on the day-to-day operations of the business, including revenue projections, cost of goods sold, and operating expenses. It’s essential for managing profitability and controlling costs.

Financial Budget: This budget covers the company’s financial position, including cash flow, balance sheet projections, and financing needs. It helps manage liquidity and ensure the company has sufficient funds to meet its obligations.

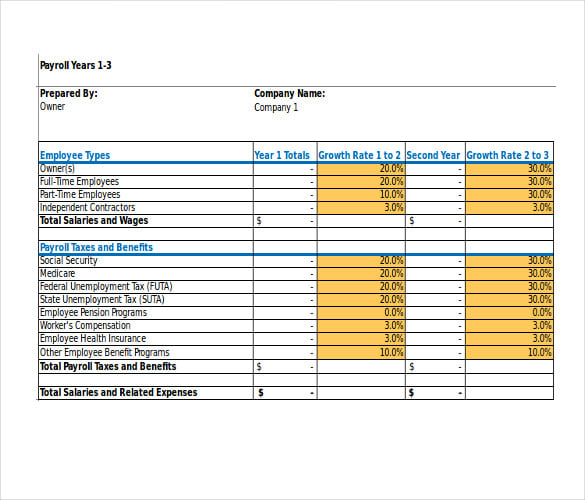

Capital Expenditure Budget: This budget outlines planned investments in long-term assets, such as property, plant, and equipment (PP&E). It’s crucial for strategic planning and ensuring the company has the resources needed for future growth.

Cash Flow Budget: This budget projects the inflow and outflow of cash over a specific period. It’s vital for managing short-term liquidity and ensuring the company can meet its immediate financial obligations.

Sales Budget: This budget forecasts the expected sales revenue for a specific period. It’s the foundation for all other budgets and drives many operational decisions.

Production Budget: This budget outlines the planned production levels needed to meet the sales forecast. It’s crucial for managing inventory levels and production costs.

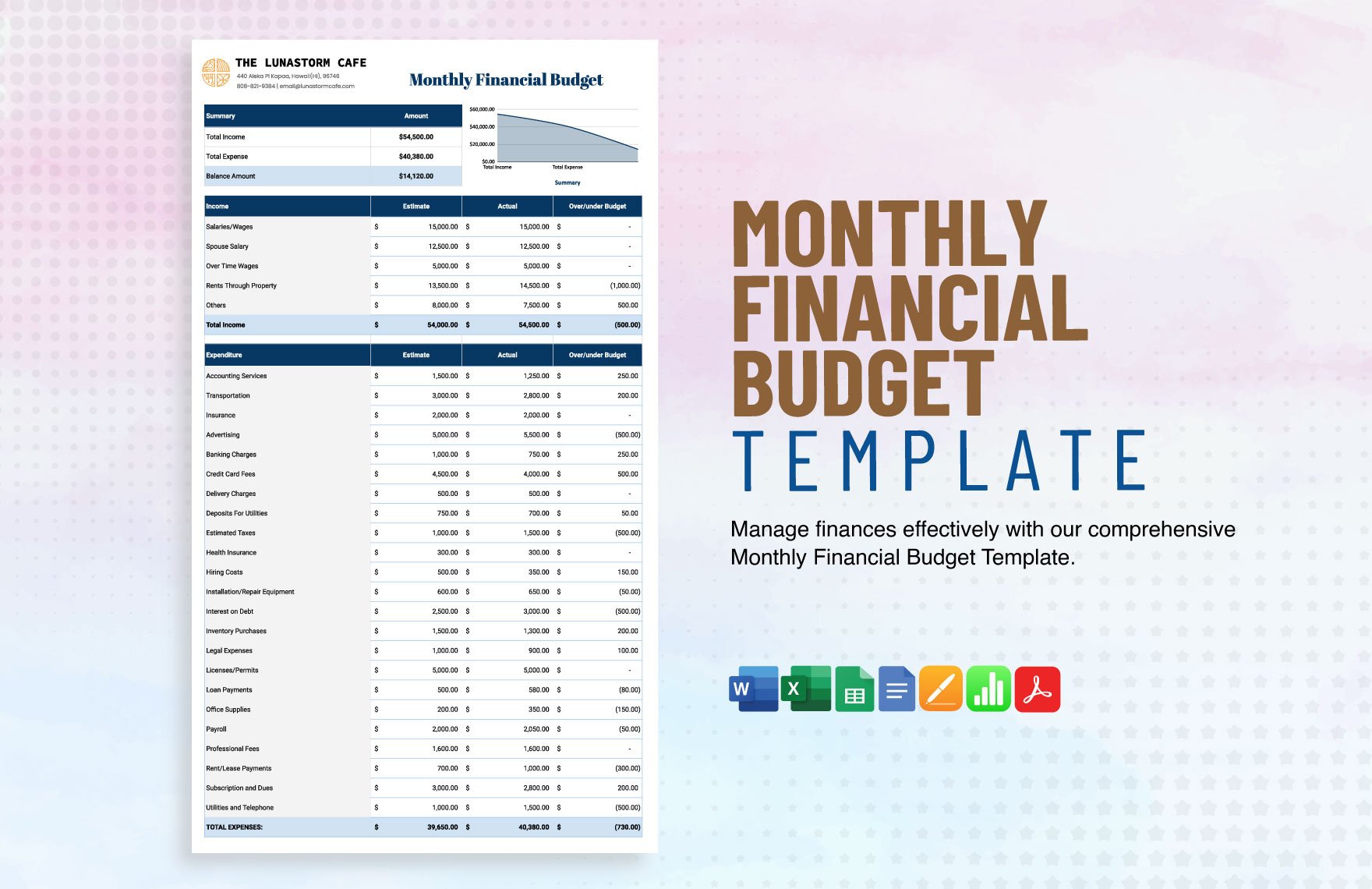

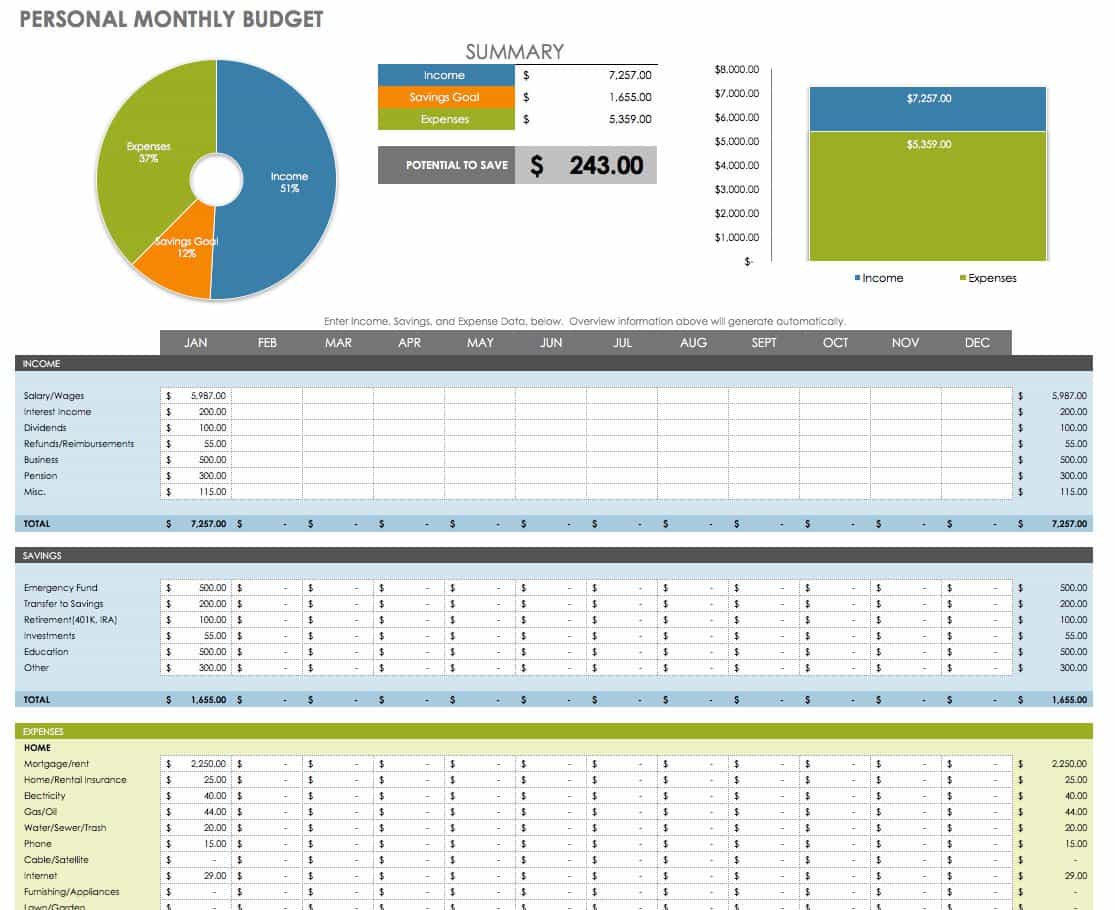

An effective business budgets templates should include several key components to ensure it is comprehensive, accurate, and easy to use.

Revenue Projections: A realistic estimate of expected sales revenue, broken down by product, service, or customer segment. This projection should be based on historical data, market trends, and sales forecasts.

Cost of Goods Sold (COGS): The direct costs associated with producing or acquiring the goods or services sold by the business. This includes raw materials, direct labor, and manufacturing overhead.

Operating Expenses: The expenses incurred in running the business, such as salaries, rent, utilities, marketing, and administrative costs. These expenses should be categorized and tracked carefully.

Capital Expenditures: Planned investments in long-term assets, such as equipment, buildings, and software. These expenditures should be justified by a clear return on investment (ROI).

Financing Costs: The costs associated with borrowing money, such as interest payments and loan fees. These costs should be factored into the budget to accurately reflect the company’s financial performance.

Cash Flow Projections: A forecast of the expected inflow and outflow of cash, taking into account revenue, expenses, and financing activities. This projection is crucial for managing liquidity and ensuring the company can meet its financial obligations.

Variance Analysis: A comparison of actual results to budgeted amounts, with explanations for any significant differences. This analysis helps identify areas where the company is performing well or needs improvement.

Selecting the right business budgets templates is crucial for effective financial planning. Consider the following factors when making your choice:

Business Size and Complexity: A small business with simple operations may only need a basic budget template, while a large, complex organization will require a more sophisticated template with multiple modules and features.

Industry-Specific Needs: Certain industries have unique budgeting requirements. For example, a manufacturing company will need a detailed production budget, while a service-based business may focus more on labor costs and marketing expenses.

Software Compatibility: Choose a template that is compatible with your existing accounting software and other business systems. This will streamline the budgeting process and reduce the risk of errors.

Customization Options: Select a template that can be easily customized to meet your specific needs. You should be able to add or remove categories, adjust formulas, and create custom reports.

Ease of Use: The template should be user-friendly and easy to understand, even for those with limited financial expertise. Look for templates with clear instructions, helpful tips, and automated calculations.

Cost: Budget templates range in price from free to several hundred dollars. Consider your budget and the features you need when making your decision. Free templates may be suitable for small businesses with simple needs, while larger organizations may benefit from investing in a more comprehensive paid template.

Creating an effective business budget requires careful planning and attention to detail. Here are some tips to help you get started:

Start with Realistic Assumptions: Base your revenue and expense projections on realistic assumptions, using historical data, market research, and industry trends. Avoid being overly optimistic or pessimistic.

Involve Key Stakeholders: Include key stakeholders from different departments in the budgeting process. This will ensure that the budget is comprehensive, accurate, and reflects the needs of the entire organization.

Use a Top-Down and Bottom-Up Approach: Combine a top-down approach, where senior management sets overall goals and targets, with a bottom-up approach, where department managers develop detailed budgets for their areas of responsibility.

Build in Flexibility: Create a budget that is flexible enough to adapt to changing market conditions and unforeseen events. Consider using scenario planning to prepare for different potential outcomes.

Regularly Review and Update the Budget: Review your budget regularly, at least monthly, and update it as needed to reflect actual performance and changing circumstances.

Use Budgeting Software: Consider using budgeting software to streamline the budgeting process, automate calculations, and improve accuracy. Many software packages offer features such as variance analysis, reporting, and scenario planning.

Budgeting can be challenging, and it’s easy to make mistakes that can undermine the effectiveness of your financial plan. Here are some common mistakes to avoid:

Ignoring Market Trends: Failing to consider market trends and industry developments when forecasting revenue and expenses can lead to inaccurate projections and poor decision-making.

Underestimating Expenses: Underestimating expenses is a common mistake that can lead to budget overruns and financial difficulties. Be sure to include all relevant costs, including overhead, taxes, and financing expenses.

Overestimating Revenue: Overestimating revenue can lead to unrealistic expectations and poor financial planning. Be conservative in your revenue projections and base them on solid data and analysis.

Failing to Track Actual Performance: Creating a budget is only the first step. You must also track actual performance against the budget to identify areas where you are on track or need improvement.

Ignoring Cash Flow: Focusing solely on profitability without considering cash flow can lead to liquidity problems. Make sure to create a cash flow budget to manage your short-term financial obligations.

Lack of Communication: Failing to communicate the budget to employees and stakeholders can lead to confusion and a lack of accountability. Make sure everyone understands their role in achieving the budget goals.

Effective use of business budgets templates can significantly contribute to a company’s financial success by providing a clear roadmap for achieving financial goals. These templates, when properly implemented and managed, enable informed decision-making, improved resource allocation, and enhanced financial accountability. By consistently monitoring performance against the budget, businesses can identify potential issues early on and take corrective action. The result is a more resilient and financially stable organization, better equipped to navigate challenges and capitalize on opportunities.

In conclusion, business budgets templates are an indispensable tool for effective financial planning and management. By understanding the different types of budgets, selecting the right template for your business, and following best practices for creating and managing your budget, you can improve your company’s financial performance and achieve your long-term goals. Remember to regularly review and update your budget, involve key stakeholders in the process, and avoid common budgeting mistakes. With careful planning and consistent execution, you can leverage the power of budgeting to drive sustainable growth and financial success.