Business Forecast Spreadsheet Template – A vital tool for strategic planning and financial management. In today’s dynamic business environment, accurately predicting future trends and analyzing potential outcomes is no longer a luxury, but a necessity. A well-designed business forecast spreadsheet template provides the framework for making informed decisions, optimizing resource allocation, and ultimately, achieving sustainable growth. This article will explore the key components of a robust spreadsheet, offering practical guidance on creating a template that meets your specific needs. Understanding how to structure your data and utilize the template effectively is crucial for maximizing its value. Let’s delve into how to build a powerful tool for your business.

The foundation of any successful business forecast relies on a solid spreadsheet. It’s more than just a collection of numbers; it’s a dynamic representation of your business’s potential, allowing you to anticipate challenges and capitalize on opportunities. A thoughtfully constructed spreadsheet can significantly improve your ability to manage cash flow, track performance, and make strategic adjustments. Choosing the right software – Microsoft Excel, Google Sheets, or dedicated forecasting tools – depends on your budget and technical expertise. However, the core principles remain the same: organization, accuracy, and adaptability. This guide will walk you through the essential elements of a business forecast spreadsheet template.

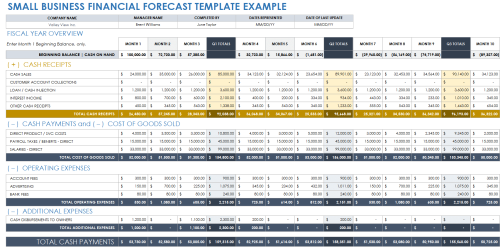

Before diving into specific features, let’s establish the fundamental building blocks of a comprehensive forecast. A good spreadsheet should include columns for key performance indicators (KPIs), historical data, and projected figures. The most crucial column is typically “Revenue,” representing the anticipated income generated. Alongside revenue, you’ll need columns for “Cost of Goods Sold (COGS),” “Operating Expenses,” “Capital Expenditures,” and “Other Income/Expenses.” These categories provide a detailed breakdown of your business’s financial picture. Don’t underestimate the importance of a clear and consistent naming convention for your columns – this will make the spreadsheet easier to understand and maintain. Consider using a consistent format for dates, currencies, and percentages.

Let’s examine several key sections that contribute to a comprehensive business forecast. Each section is designed to provide a focused analysis of different aspects of your business.

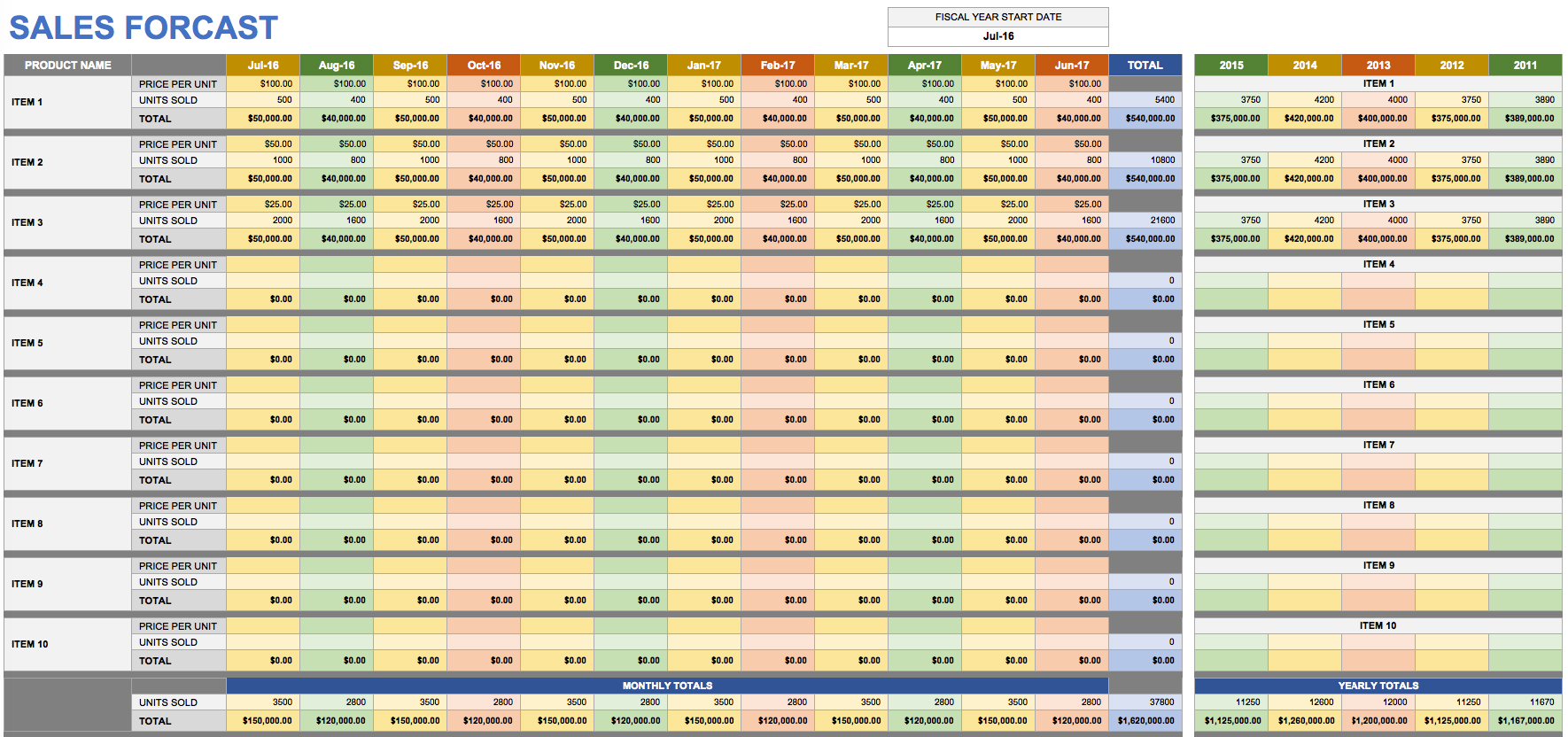

The first step in any forecast is to analyze your past performance. This section should include a detailed history of revenue, expenses, and profitability. You can use this data to identify trends, seasonality, and potential areas for improvement. Creating a trend line graph visualizing your revenue over time is highly recommended. This allows you to quickly identify patterns and spot potential issues before they escalate. Consider including a breakdown of expenses by category – this will help you understand where your money is going and identify areas where you can reduce costs. A well-maintained historical data section is the bedrock of a reliable forecast.

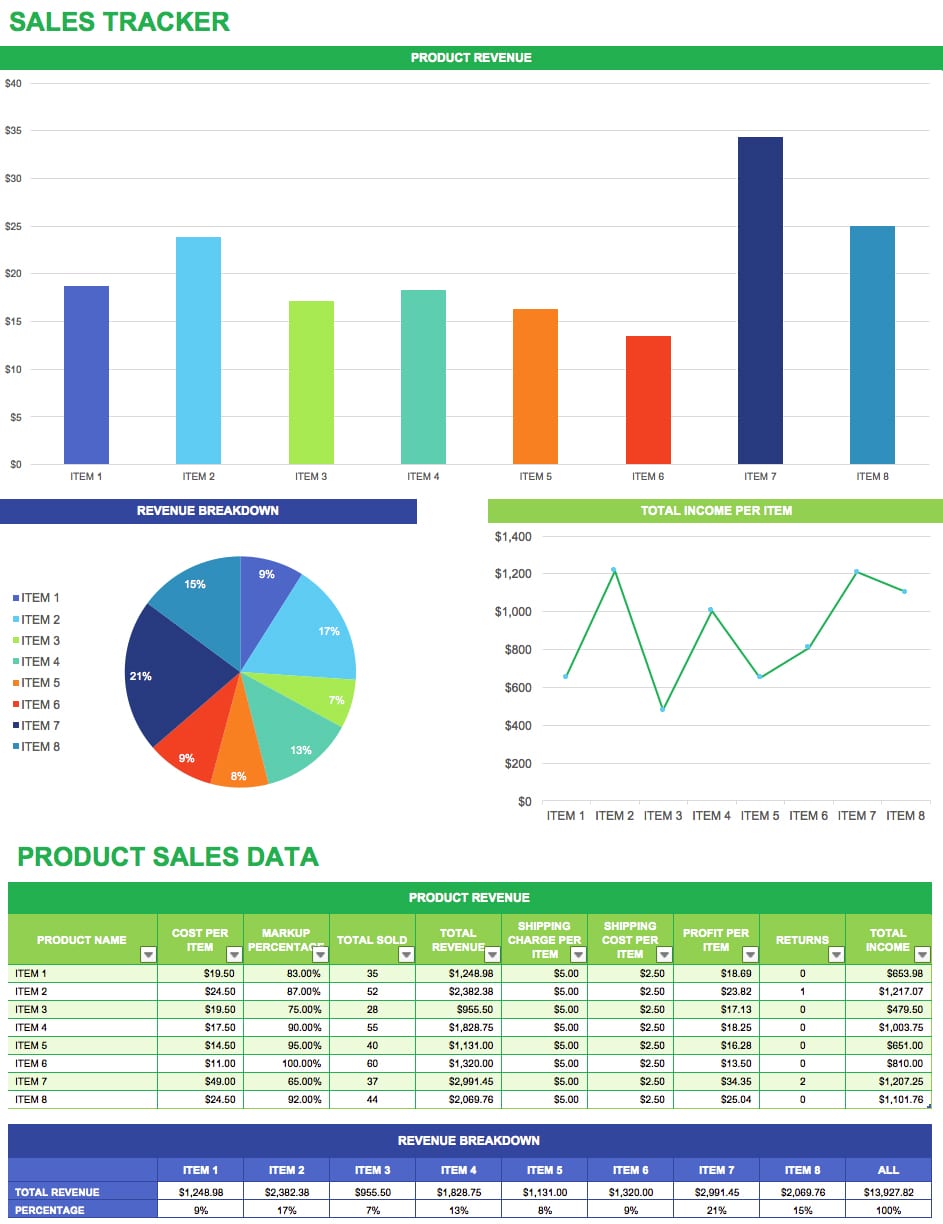

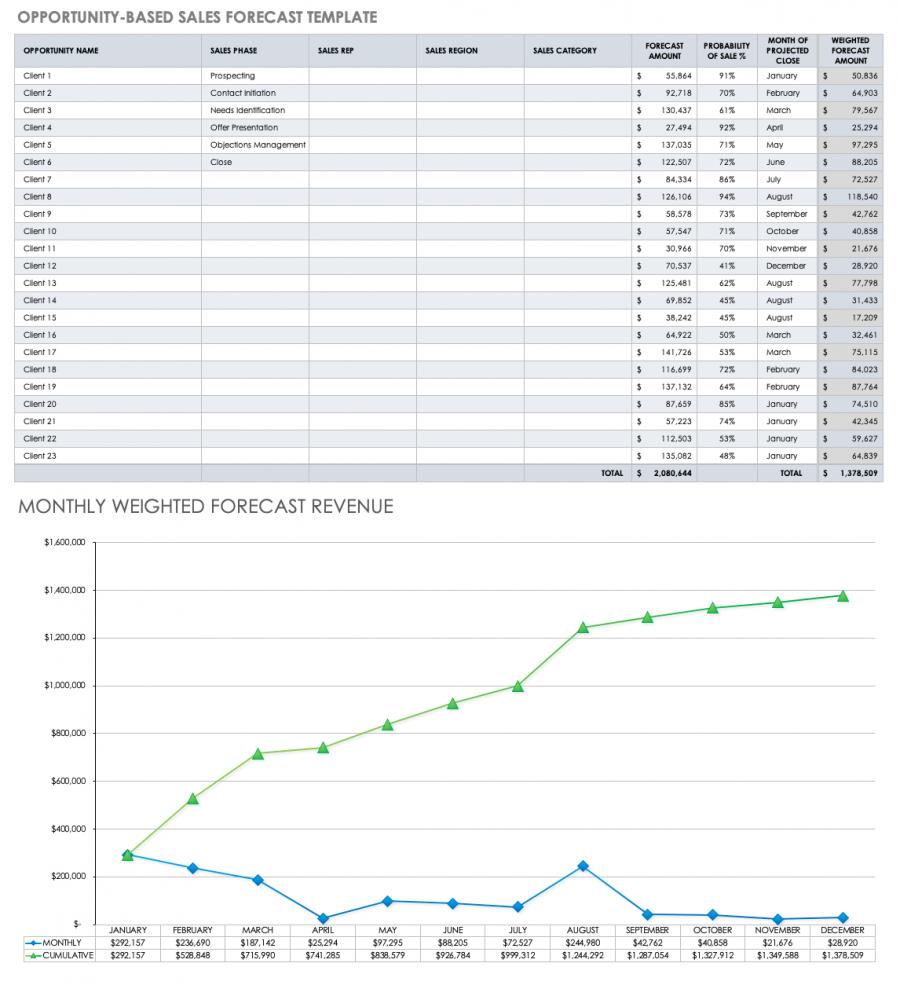

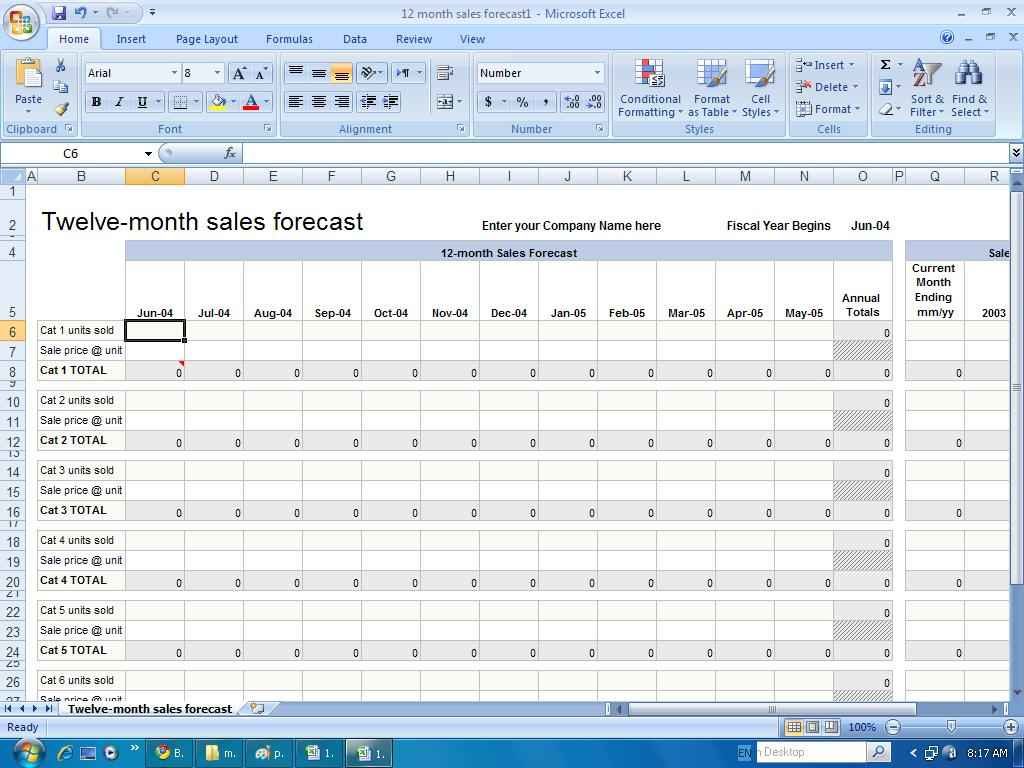

The sales forecast is arguably the most critical component of any business forecast. It’s based on your historical data, market trends, and anticipated marketing efforts. You can forecast sales for different product lines, regions, or customer segments. Employing a rolling forecast – projecting sales over a period of time (e.g., monthly, quarterly) – is generally more accurate than a single-period forecast. Consider using a combination of forecasting methods, such as moving averages or exponential smoothing, to improve the accuracy of your projections. Remember to factor in potential market fluctuations and competitive pressures.

The expense budget is essential for managing your business’s financial resources. It should include a detailed breakdown of all anticipated expenses, categorized by department or function. This allows you to identify areas where you can optimize spending and control costs. Consider using a zero-based budgeting approach, where every expense is justified and must be approved. Regularly reviewing and adjusting your expense budget is crucial for maintaining financial stability. Don’t forget to include contingency funds for unexpected expenses.

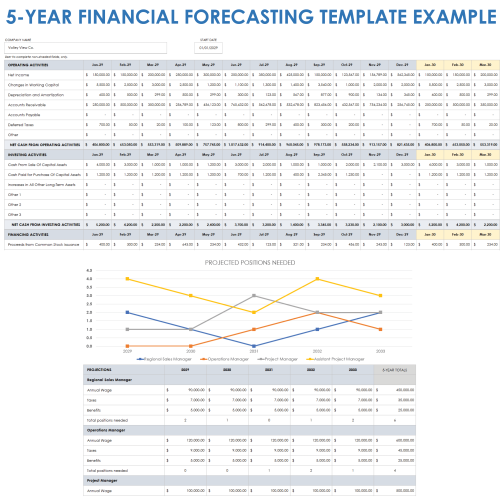

Cash flow is the lifeblood of any business. A cash flow projection shows how much cash will be coming in and going out over a specific period. This is particularly important for businesses with fluctuating revenues or significant inventory. The spreadsheet should include a detailed breakdown of incoming and outgoing cash, along with projected payment terms. Identifying potential cash flow gaps and proactively addressing them is key to avoiding financial distress. Using a cash flow forecasting tool can significantly simplify this process.

This section focuses on the impact of planned marketing and sales activities on revenue. Include projected sales from marketing campaigns, anticipated customer acquisition costs, and estimated conversion rates. Consider using a simple cost-benefit analysis to determine the return on investment (ROI) of different marketing initiatives. This allows you to prioritize your efforts and allocate resources effectively. Tracking the performance of your marketing campaigns is crucial for optimizing your strategy.

If your business requires significant capital investments (e.g., new equipment, renovations), a dedicated section is needed. This section should outline planned capital expenditures, including estimated costs, timelines, and potential return on investment. It’s important to carefully assess the financial implications of these investments and ensure they align with your overall business strategy. A well-documented capital expenditure plan can help you make informed decisions about long-term investments.

Creating a truly effective business forecast spreadsheet template requires more than just filling in the blanks. Here are some best practices:

A well-structured business forecast spreadsheet template is an indispensable tool for any business owner or manager. By carefully analyzing historical data, projecting future trends, and managing cash flow, you can gain a deeper understanding of your business’s financial health and make informed decisions. Remember that a forecast is not a prediction of the future; it’s a tool for planning and anticipating challenges. Investing time and effort in creating a robust spreadsheet will undoubtedly pay dividends in the long run. Ultimately, a proactive approach to forecasting allows you to position your business for success. Don’t underestimate the power of a thoughtfully designed spreadsheet to drive growth and profitability.

The process of creating a comprehensive business forecast spreadsheet template is a significant investment in your business’s future. It requires careful planning, diligent data collection, and a commitment to ongoing analysis. However, the rewards – improved financial management, better decision-making, and increased profitability – are well worth the effort. By consistently utilizing this template and adapting it to your specific business needs, you can unlock the full potential of your financial data and achieve sustainable success. Continuous refinement and optimization of your spreadsheet are essential to maintaining its effectiveness over time.