Managing a business’s finances effectively is paramount to its success, yet the process can often feel overwhelming, especially for small business owners and startups. One of the foundational tools for financial tracking is a business ledger, which systematically records all financial transactions. The good news is that you don’t always need expensive software to maintain this crucial record. Many entrepreneurs are discovering the immense value and convenience of a Business Ledger Template Excel Free, providing an accessible and robust solution for organizing income and expenses without incurring additional costs. This approach not only streamlines financial management but also empowers businesses to gain clearer insights into their financial health.

A well-maintained ledger acts as the backbone of your accounting system. It allows you to meticulously track every dollar that comes in and goes out, ensuring accuracy for tax purposes, budgeting, and financial reporting. Without a proper ledger, businesses risk losing track of vital financial information, leading to errors, compliance issues, and a lack of understanding regarding their profitability.

For those new to accounting or operating on a tight budget, the idea of setting up a comprehensive financial tracking system can seem daunting. However, Excel, with its powerful spreadsheet capabilities, offers a user-friendly environment to create and manage these records. A template takes this convenience a step further by providing a pre-structured framework, eliminating the need to build a ledger from scratch and allowing users to immediately input their data.

This article will delve into the world of free Excel business ledger templates, exploring their benefits, essential features, and how to effectively utilize them to simplify your financial record-keeping. Whether you’re a freelancer, a small business owner, or managing a side hustle, understanding and employing a dedicated ledger is a critical step towards financial clarity and sustainable growth.

At its core, a business ledger is a book or collection of accounts that records financial transactions. It serves as the primary record for all economic events related to a business, providing a historical log of every income and expense. Think of it as the financial diary of your business, meticulously detailing every transaction from the moment it occurs.

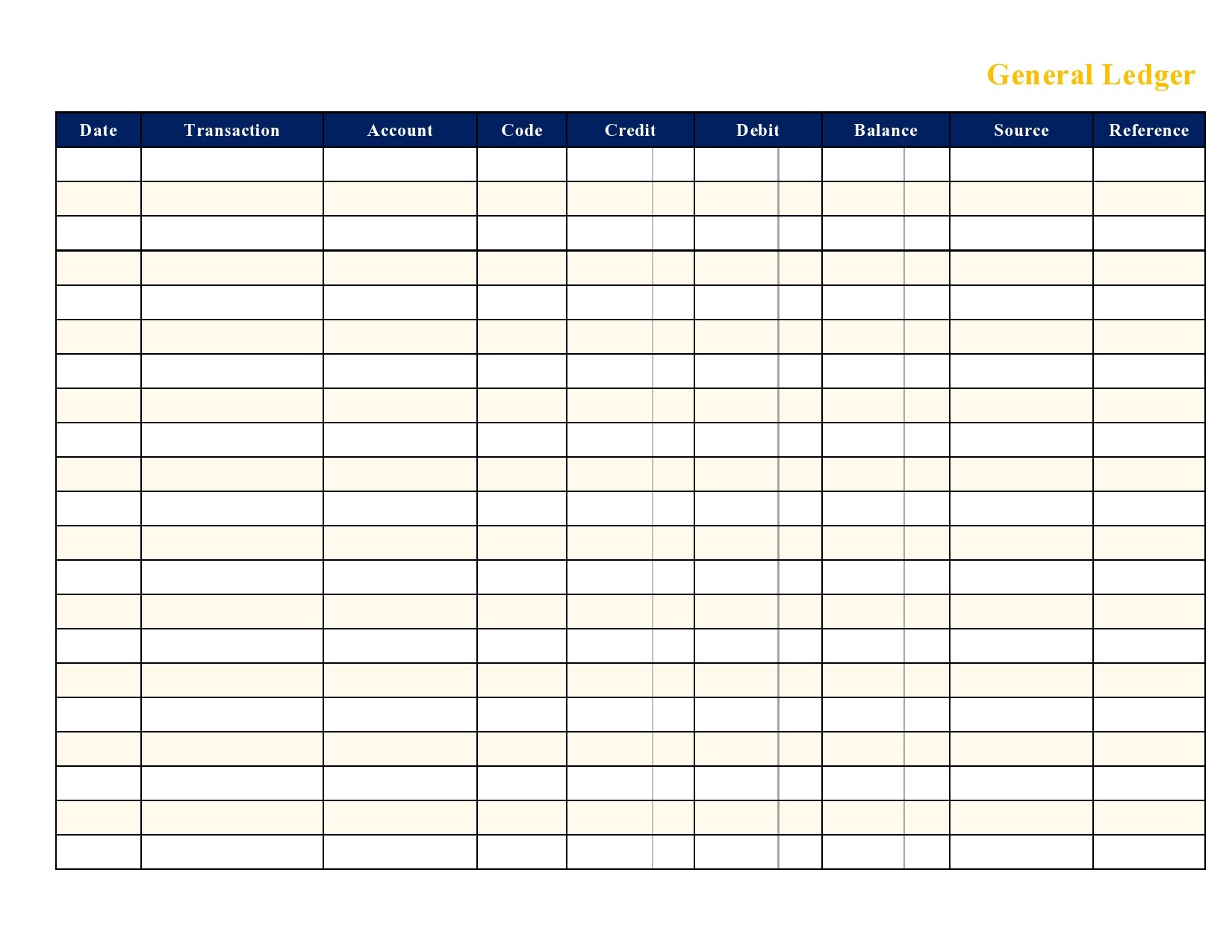

Each entry in a ledger typically includes the date, a description of the transaction, the amount, and which accounts are affected. For instance, when you make a sale, that transaction is recorded as income. When you pay for supplies, it’s recorded as an expense. This systematic approach ensures that nothing slips through the cracks, offering a comprehensive overview of your financial activities.

The necessity of a business ledger extends far beyond mere record-keeping. It is fundamental for several critical business functions:

While various accounting software solutions exist, a Business Ledger Template Excel Free offers a compelling alternative, especially for businesses seeking cost-effective and flexible financial management tools. The widespread availability and versatility of Excel make it an ideal platform for managing financial records.

Choosing Excel for your ledger offers numerous benefits:

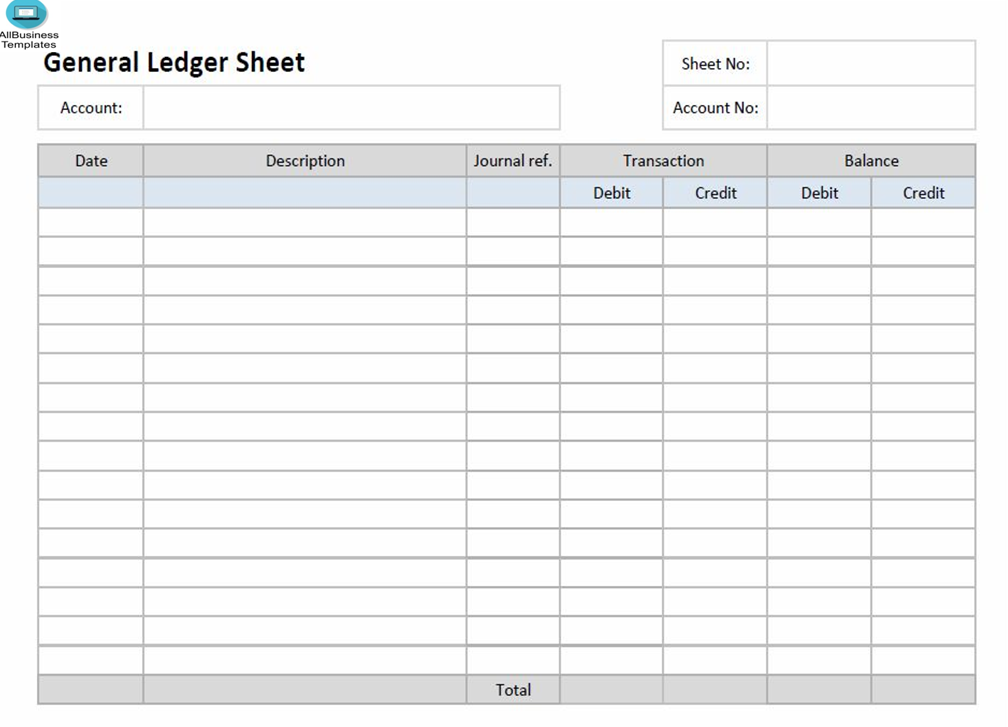

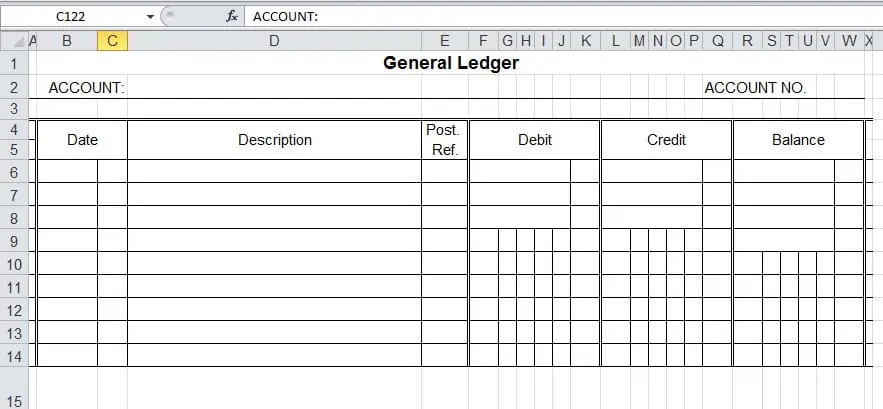

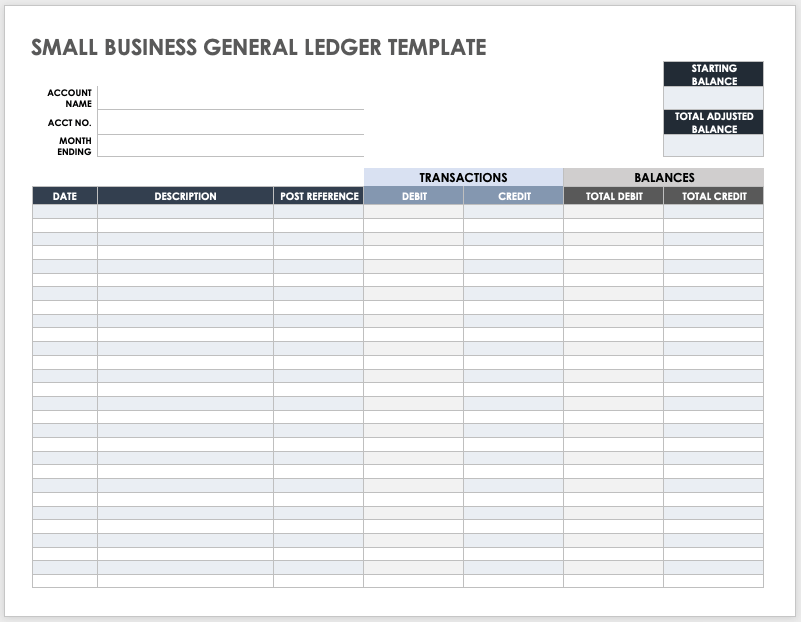

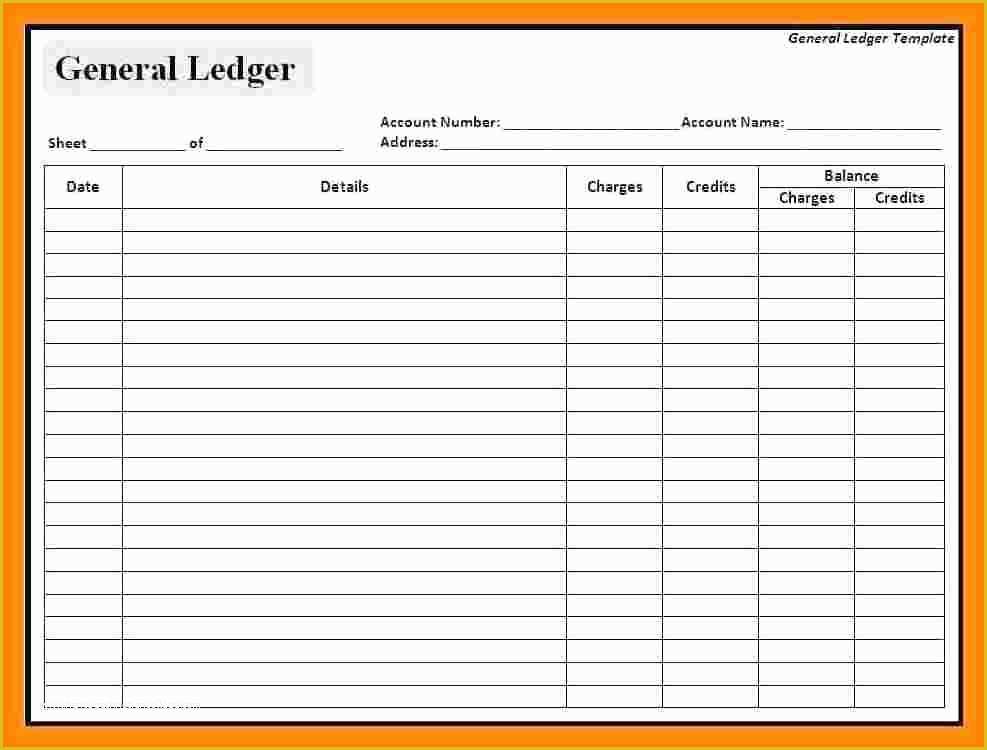

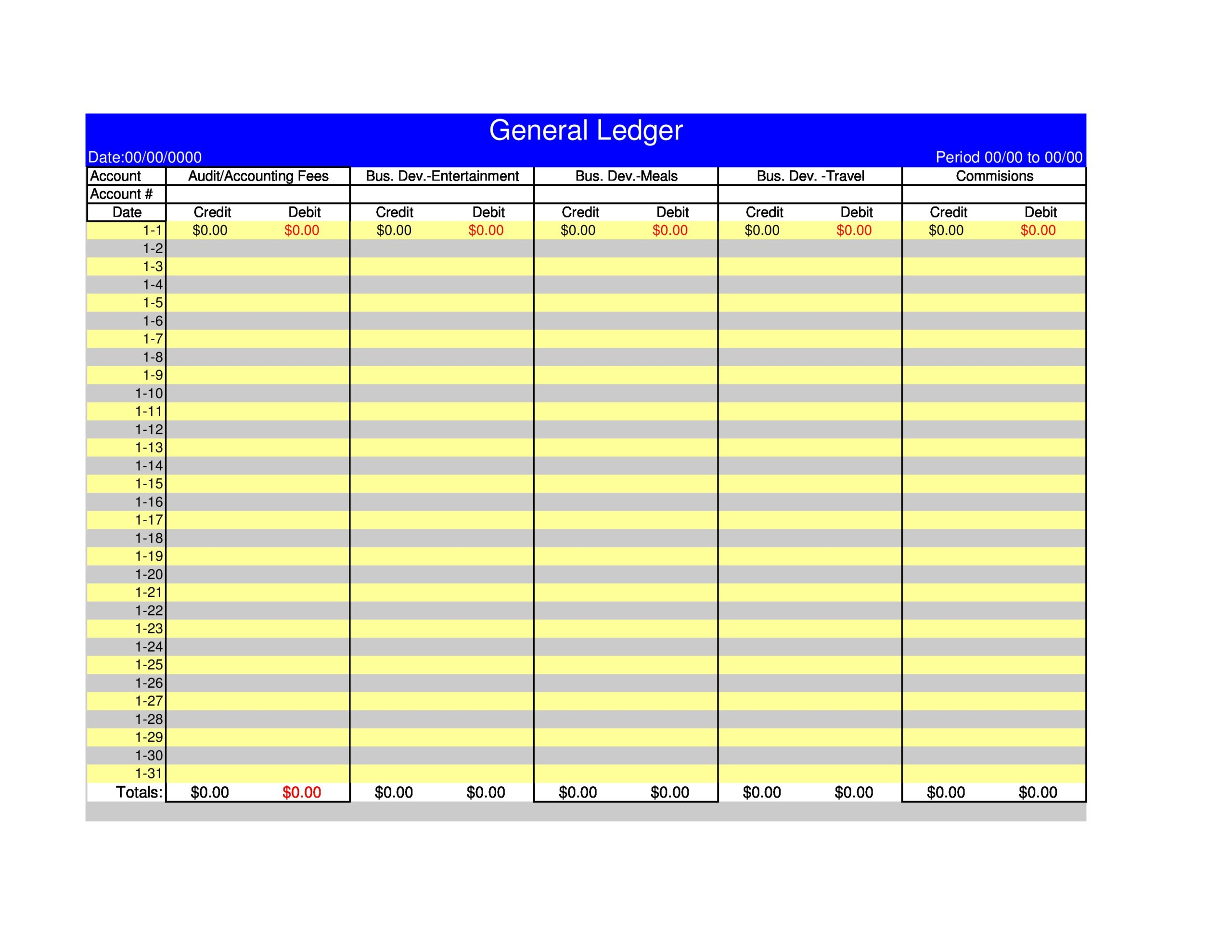

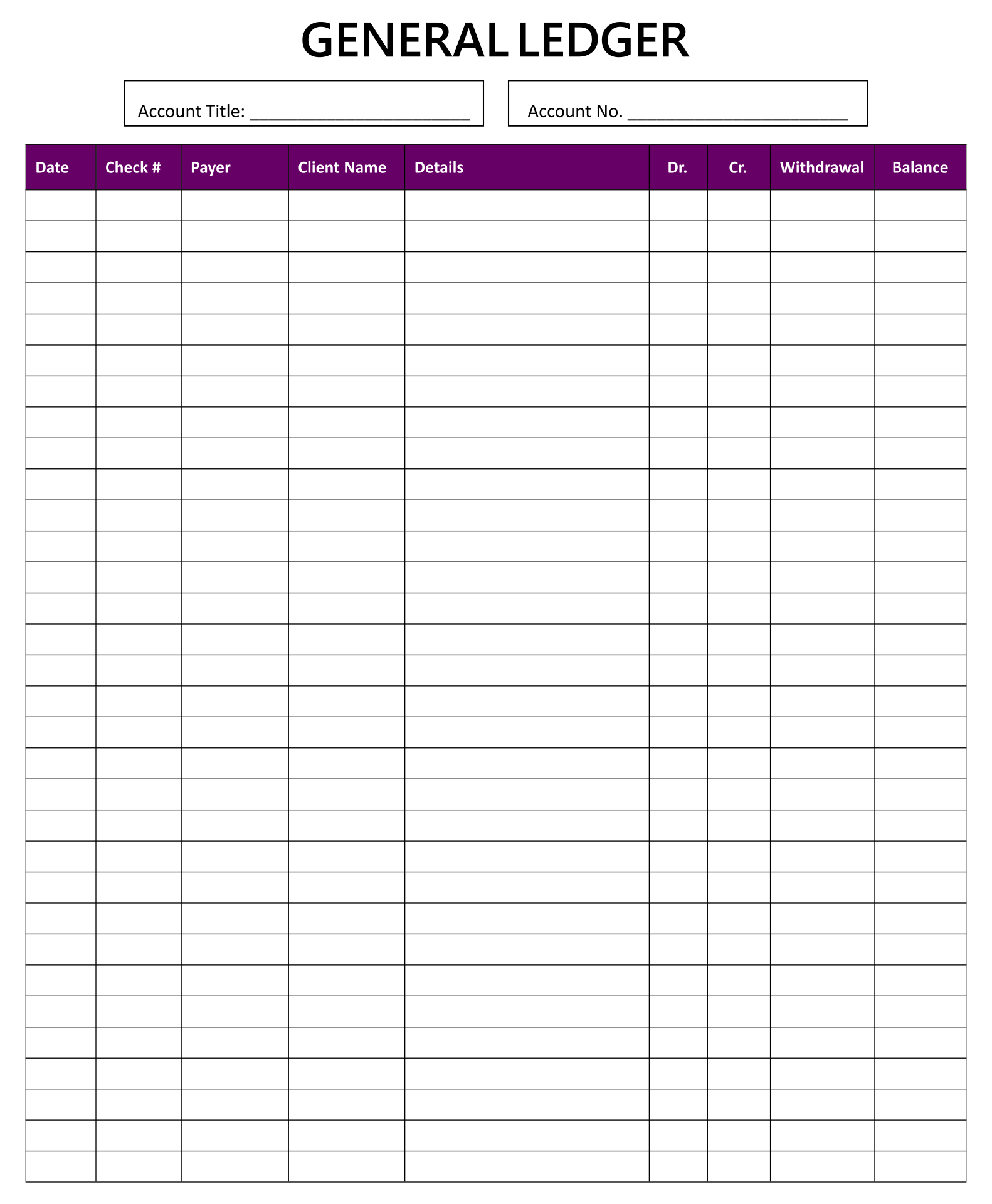

Not all free templates are created equal. An effective Business Ledger Template Excel Free should include several fundamental components to ensure comprehensive and accurate financial tracking. When selecting or designing your template, look for these essential features.

A robust ledger template typically includes, but is not limited to, the following columns:

While basic columns are a start, some free templates go further, offering features that significantly enhance usability:

Once you’ve chosen or customized your Business Ledger Template Excel Free, the key to its effectiveness lies in consistent and accurate data entry. Here’s a step-by-step guide to making the most of your ledger.

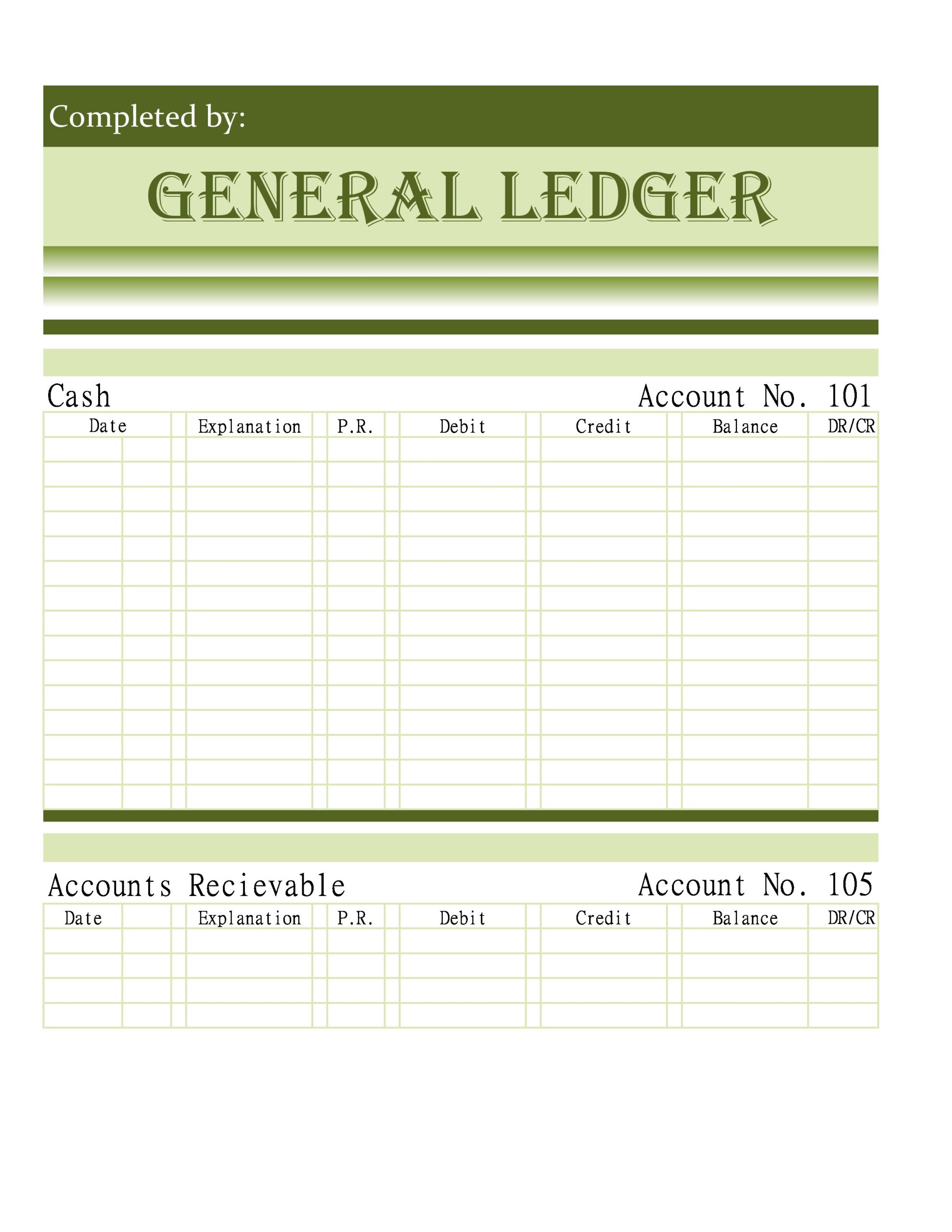

While a general ledger is the overarching record, businesses often utilize specialized ledgers for more detailed tracking of specific types of transactions. Understanding these can help you decide if your Business Ledger Template Excel Free needs to incorporate elements of these specialized formats.

This is the primary ledger, encompassing all financial transactions. Every transaction from subsidiary ledgers eventually flows into the general ledger. It provides a summary of all accounts (assets, liabilities, equity, revenues, expenses) and serves as the foundation for financial statements like the balance sheet and income statement.

These ledgers provide detailed breakdowns for specific accounts from the general ledger. They offer granular information without cluttering the main general ledger.

For a small business using a Business Ledger Template Excel Free, you might start with a comprehensive general ledger and, as your business grows, consider creating separate tabs within the same Excel workbook for subsidiary ledgers if needed.

The power of a free Excel ledger template extends beyond simple record-keeping. When used strategically, it becomes a valuable tool for business analysis and decision-making, contributing directly to growth.

Once your data is consistently entered, you can leverage Excel’s features to gain insights:

While a Business Ledger Template Excel Free is an excellent starting point, there comes a time when a business might outgrow its capabilities. Indicators that it might be time to consider dedicated accounting software include:

Even when upgrading, the discipline of maintaining accurate records learned through using an Excel ledger will be invaluable.

The journey to financial clarity and business success often begins with meticulous record-keeping. A Business Ledger Template Excel Free stands out as an incredibly powerful, accessible, and cost-effective tool for entrepreneurs, small businesses, and freelancers alike. It demystifies the process of tracking income and expenses, providing a structured framework that is easy to implement and customize.

By consistently recording every transaction, categorizing expenditures, and regularly reconciling your accounts, you gain invaluable insights into your financial health. This visibility empowers you to make informed decisions, manage cash flow effectively, simplify tax preparation, and identify opportunities for growth and efficiency. While your business may eventually evolve to require more sophisticated accounting solutions, starting with a free Excel ledger template builds a solid foundation for financial literacy and disciplined management. Embrace this practical tool to take control of your finances and pave the way for a more organized and prosperous business future.