Crafting a robust business plan necessitates a clear understanding of your company’s financial standing, and a crucial component of that understanding lies in the creation of a well-structured Business Plan Balance Sheet Template. This template serves as a snapshot of your company’s assets, liabilities, and equity at a specific point in time, providing valuable insights for investors, lenders, and internal stakeholders. It is a fundamental tool for projecting future financial performance and demonstrating the financial viability of your business venture.

A balance sheet is more than just a collection of numbers; it’s a narrative of your company’s financial health. By carefully organizing and analyzing the data within a Business Plan Balance Sheet Template, you can identify potential risks, highlight opportunities for growth, and make informed decisions about resource allocation. It acts as a benchmark against which you can measure progress and track the impact of strategic initiatives.

Understanding how to effectively utilize a Business Plan Balance Sheet Template is paramount for securing funding, attracting investors, and managing your business operations efficiently. A well-prepared balance sheet demonstrates financial responsibility and provides a clear picture of your company’s solvency. This, in turn, builds confidence and trust among stakeholders. Let’s delve into the specifics of creating and interpreting this crucial financial document.

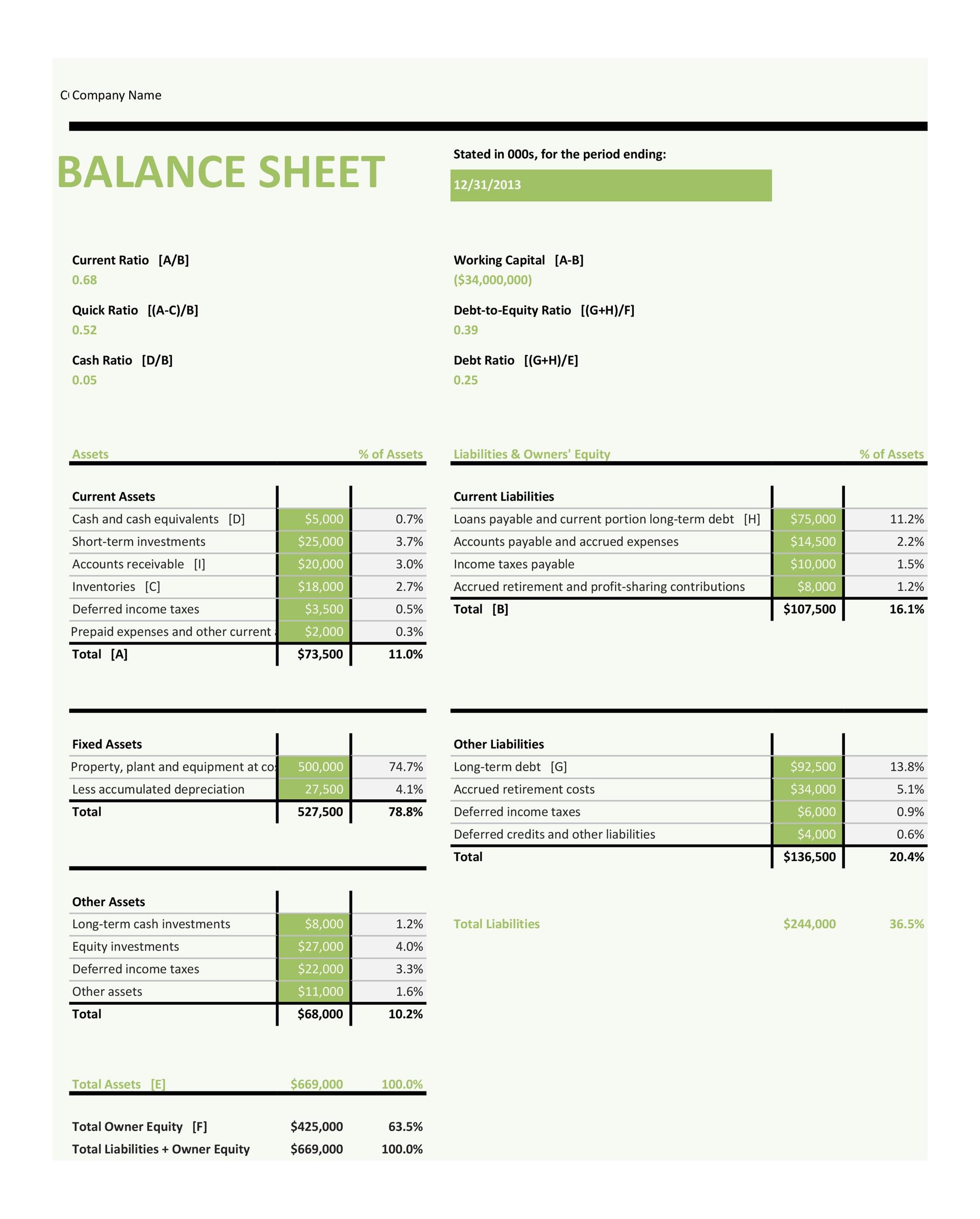

The balance sheet operates on a fundamental accounting equation: Assets = Liabilities + Equity. This equation highlights the relationship between what a company owns (assets), what it owes (liabilities), and the owners’ stake in the company (equity). A balanced equation signifies that all assets are financed by either debt or equity.

Assets represent the resources owned and controlled by the company that have future economic value. These are generally categorized into current assets and non-current (or fixed) assets.

Liabilities represent the obligations of the company to external parties. These are also categorized into current and non-current liabilities.

Equity represents the residual interest in the assets of the company after deducting liabilities. It is the owners’ stake in the company.

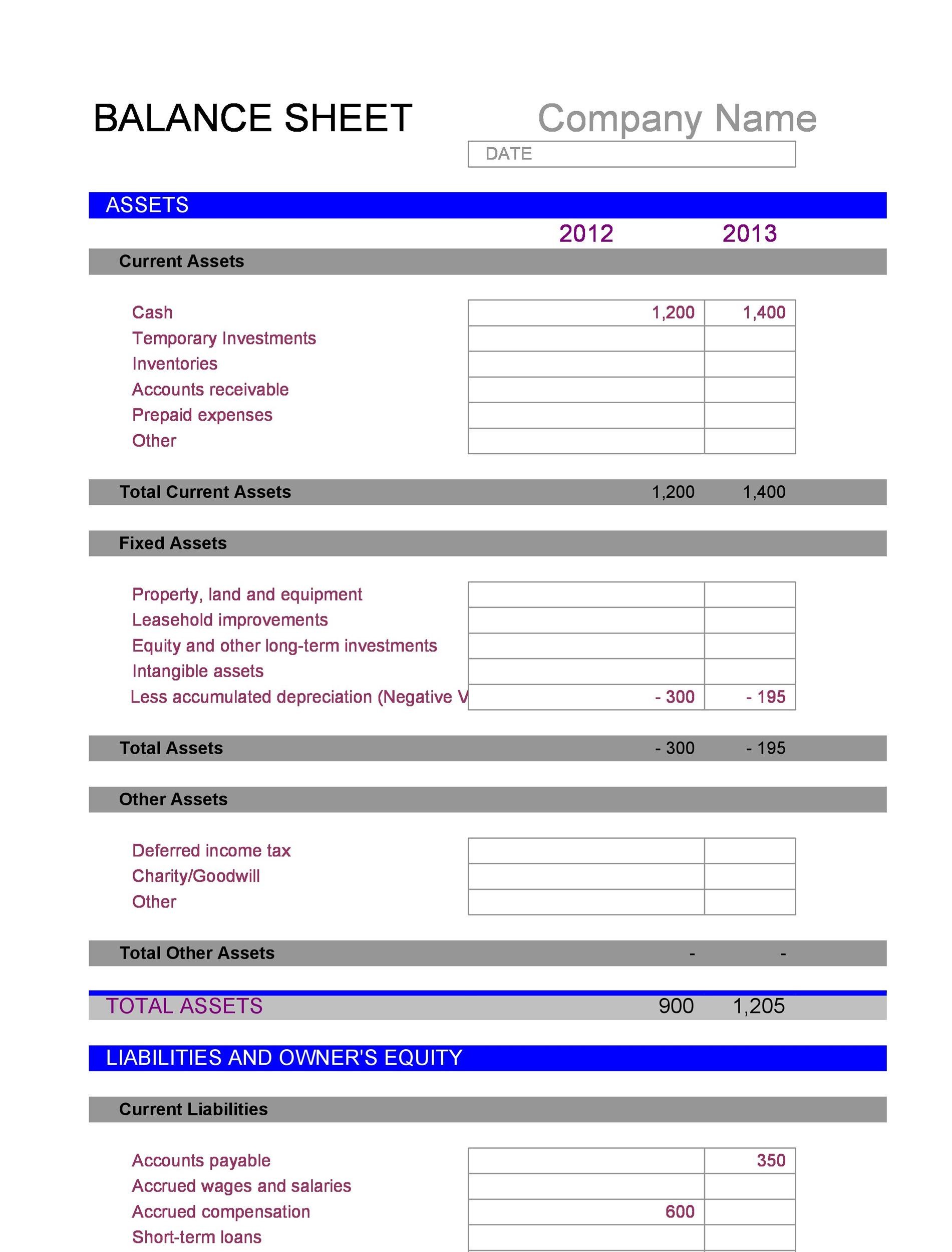

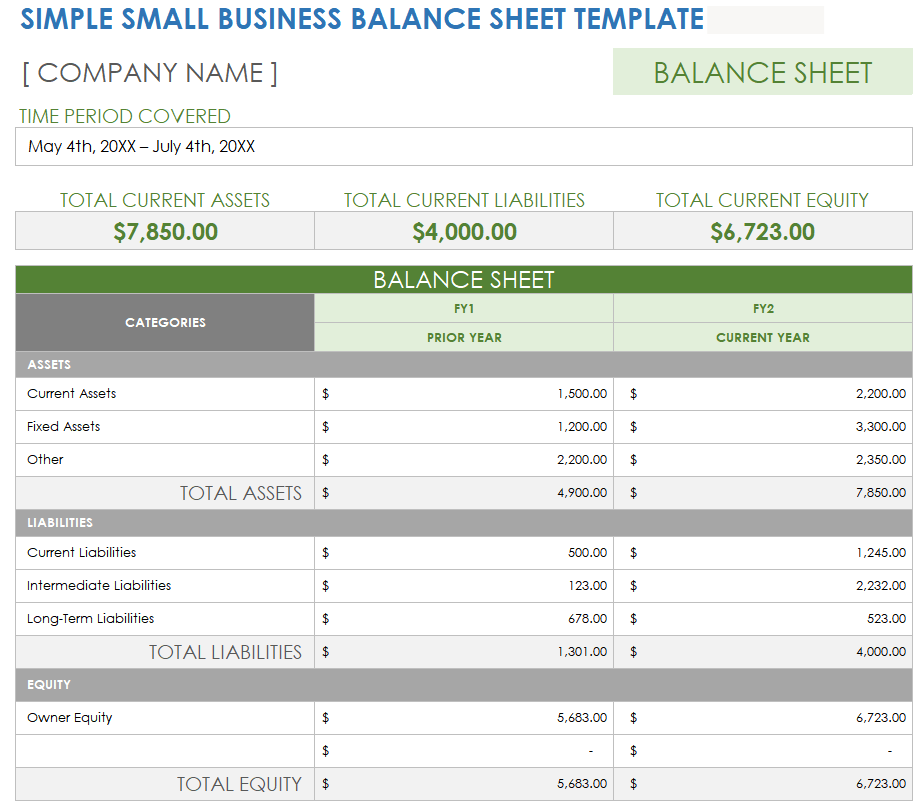

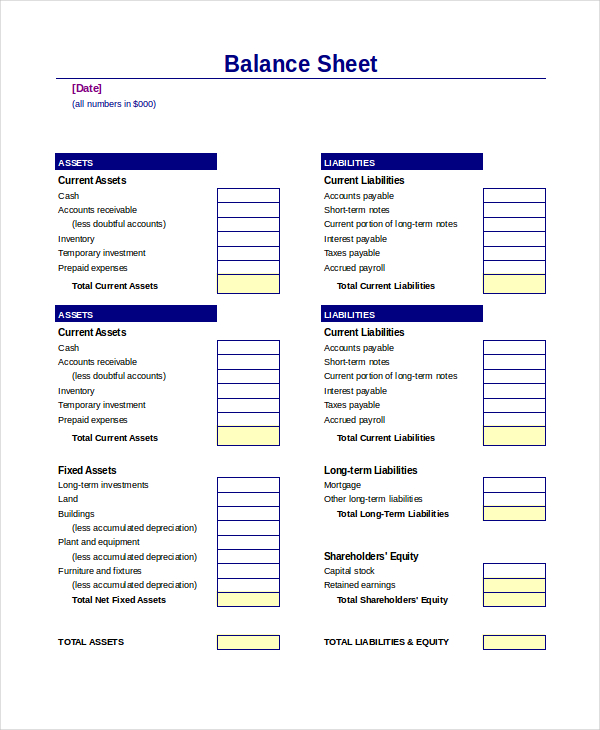

Developing your own Business Plan Balance Sheet Template involves a structured approach to ensure accuracy and clarity. Several options are available: using spreadsheet software like Microsoft Excel or Google Sheets, utilizing accounting software, or finding pre-designed templates online.

Consider which format best suits your needs. Spreadsheet software offers flexibility and customization, while accounting software automates many calculations. Online templates provide a starting point but may require adaptation. Ensure the template clearly displays the asset, liability, and equity sections.

Begin by listing all your current assets, starting with cash and accounts receivable. Assign estimated values to each asset. Then, list your non-current assets, including any property, equipment, or intangible assets. Estimate their depreciated value or fair market value.

List your current liabilities, such as accounts payable and short-term loans, along with their respective amounts. Next, list your non-current liabilities, such as long-term loans and deferred tax liabilities.

Calculate the equity section by adding common stock, retained earnings, and additional paid-in capital. If your business is a sole proprietorship or partnership, the equity section will represent the owner’s capital account.

Finally, verify that your balance sheet is indeed “balanced.” Sum up your total assets, then sum up your total liabilities and equity. Ensure that the two totals are equal. If they are not, revisit your calculations and asset valuations to identify and correct any errors.

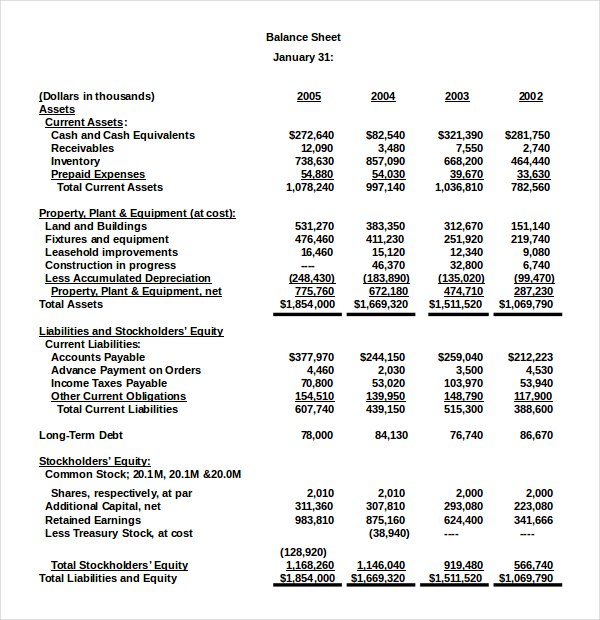

The Business Plan Balance Sheet Template isn’t just a static document; it’s a valuable source of data for calculating financial ratios that provide insights into your company’s financial health. These ratios can be used to assess liquidity, solvency, and efficiency.

Liquidity ratios measure a company’s ability to meet its short-term obligations.

Solvency ratios measure a company’s ability to meet its long-term obligations.

Efficiency ratios measure how efficiently a company uses its assets to generate revenue.

Your Business Plan Balance Sheet Template isn’t just for reflecting your current financial position; it’s also crucial for projecting your future financial standing within your business plan. Future projections are essential for attracting investors and securing loans. Projecting forward involves making assumptions about revenue growth, expenses, and investment in assets.

Forecast future asset growth based on your sales projections and operational plans. For example, if you anticipate increased sales, you may need to invest in additional inventory or equipment. Consider depreciation for fixed assets and account for potential asset disposals.

Forecast changes in liabilities based on your financing plans. If you plan to take out a loan, include the projected debt in your liability section. Account for repayment schedules and any anticipated increases in accounts payable.

Forecast changes in equity based on projected profits and dividends. Retained earnings will increase with net income and decrease with dividends paid out to shareholders. Consider any planned equity financing rounds or stock repurchases.

Conduct sensitivity analysis by creating multiple scenarios (e.g., optimistic, pessimistic, and most likely) to assess how changes in key assumptions impact your projected balance sheet. This will demonstrate the robustness of your financial projections and your understanding of potential risks and opportunities.

Creating an accurate and reliable Business Plan Balance Sheet Template requires careful attention to detail. Several common mistakes can undermine the integrity of your financial projections.

Overstating or understating the value of assets can distort the true picture of your financial health. Ensure that asset valuations are based on reasonable market values or depreciated costs. Obtain professional appraisals if necessary for significant assets like real estate or equipment.

Misclassifying liabilities as either current or non-current can skew liquidity ratios and mislead investors. Be sure to correctly classify each liability based on its due date. Short-term obligations due within one year should be categorized as current liabilities, while those due beyond one year should be classified as non-current.

Failing to account for depreciation of fixed assets can overstate the value of your assets over time. Use a consistent depreciation method and regularly update depreciation schedules to reflect the declining value of your assets.

Failing to regularly reconcile your balance sheet with your other financial statements (income statement and cash flow statement) can lead to inconsistencies and errors. Ensure that the data across all three statements align and that any discrepancies are investigated and resolved.

Many businesses overlook intangible assets like patents, trademarks, and goodwill. These assets can be valuable and should be included in the balance sheet if they meet the recognition criteria. Failing to include them can understate the true value of your business.

A well-crafted Business Plan Balance Sheet Template is an indispensable tool for managing and growing your business. By understanding the fundamental accounting equation, accurately categorizing assets and liabilities, and projecting future financial performance, you can gain valuable insights into your company’s financial health. Using the balance sheet to calculate key financial ratios allows you to assess liquidity, solvency, and efficiency, enabling you to make informed decisions and attract investors. Avoiding common mistakes like inaccurate asset valuations and incorrect liability classifications will ensure the reliability and integrity of your financial projections, ultimately contributing to the success of your business venture.