Here’s the Markdown formatted article:

The path to securing funding for your business often involves navigating the complex process of applying for a bank loan. A well-crafted Business Proposal Template For Bank Loan is absolutely essential to presenting a compelling case to lenders. It’s more than just a document; it’s a strategic tool that communicates your business vision, financial projections, and repayment capabilities. Without a strong proposal, even a solid business idea can be overlooked. This article will guide you through creating a comprehensive and persuasive business proposal, specifically tailored for securing a bank loan. We’ll cover the essential sections, offer practical tips, and provide insights into what banks are looking for. Understanding the components of a successful proposal can significantly increase your chances of obtaining the capital you need to grow and thrive.

A Business Proposal Template For Bank Loan serves as your primary tool for communicating your business plan to potential lenders. It goes beyond simply asking for money; it demonstrates that you have a clear understanding of your business, its market, and its financial needs. A professional and well-structured proposal instills confidence in the lender, showing them that you’ve done your homework and have a realistic plan for success.

Here’s a breakdown of why a strong proposal is critical:

Many businesses underestimate the importance of a thorough proposal and fall into common pitfalls. Here are some mistakes to avoid:

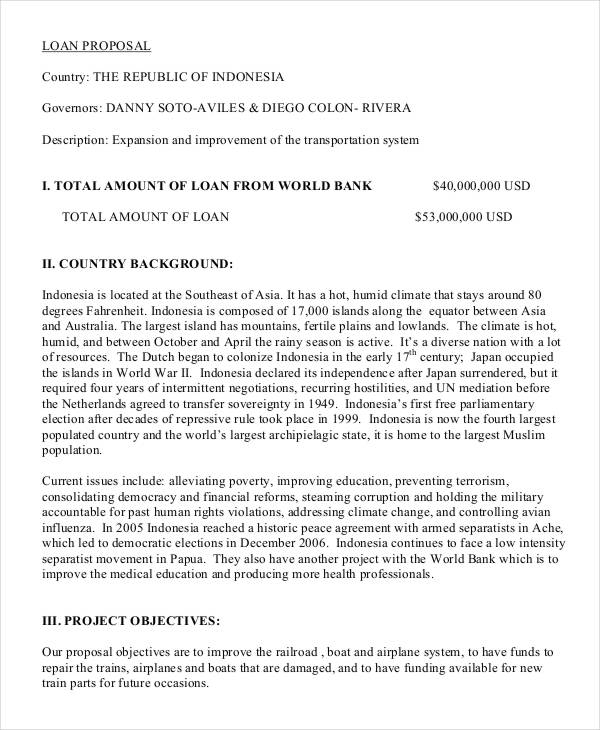

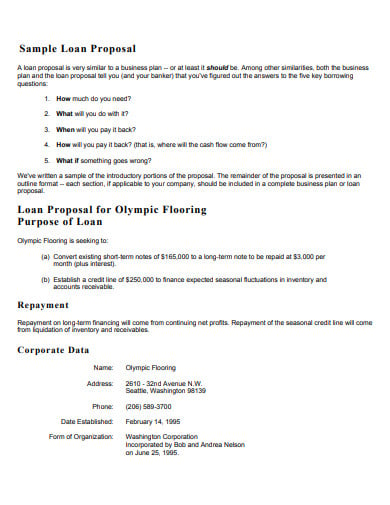

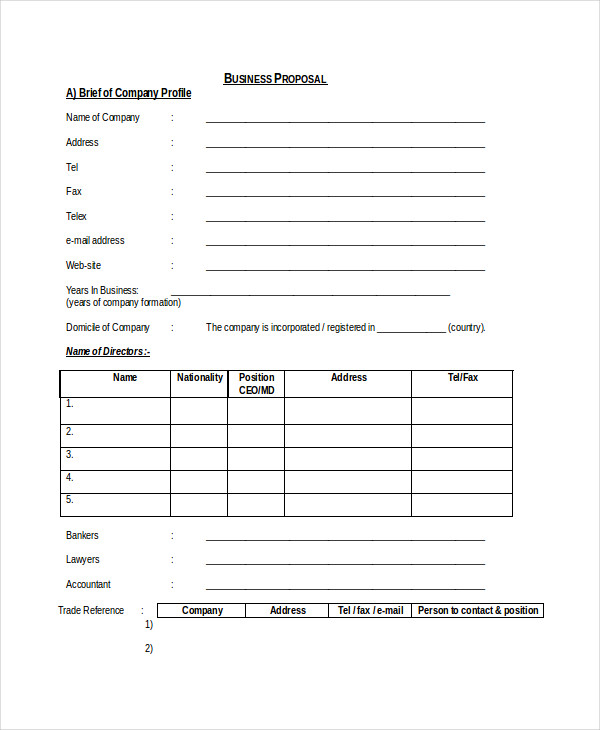

A robust Business Proposal Template For Bank Loan generally includes the following sections. Each section needs to be well-researched and clearly presented.

This is arguably the most important section, even though it’s typically written last. The executive summary provides a concise overview of your entire business proposal. It should be no more than one to two pages long and should highlight the key elements: your business concept, your target market, your competitive advantage, your financial projections, and the amount of funding you’re seeking. Think of it as an elevator pitch for your business. It’s your chance to grab the lender’s attention and convince them to read further.

This section provides a detailed overview of your business. Include information such as:

This section demonstrates that you understand your target market and the competitive landscape. It should include:

Lenders want to know who is running the business and whether they have the skills and experience to succeed. This section should include:

This is a critical section that demonstrates the financial viability of your business. It should include:

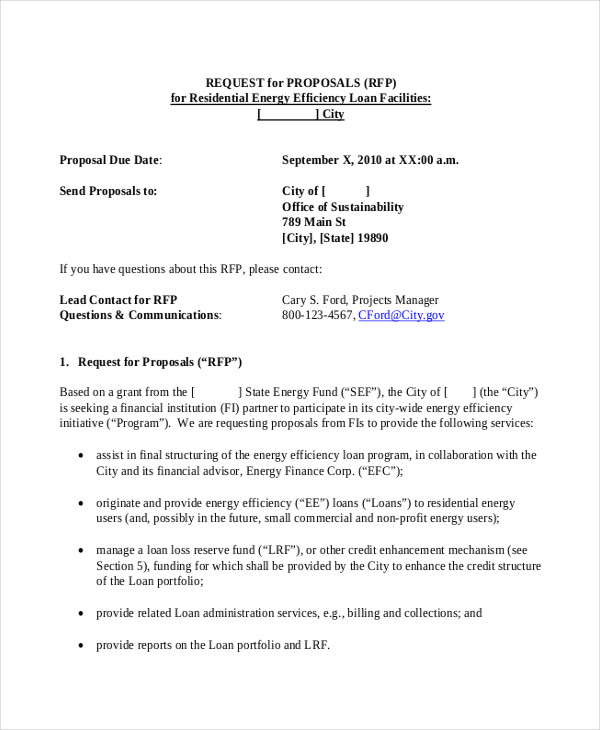

This section explicitly states the amount of funding you’re requesting and how you plan to use it. Be specific and provide a detailed breakdown of how the funds will be allocated. For example:

To create an effective business proposal, consider these tips:

Several online tools and resources can help you create a business proposal:

Securing a Business Proposal Template For Bank Loan is a vital step for businesses seeking funding. By following the structure and guidelines outlined in this article, you can create a compelling proposal that demonstrates the viability of your business and increases your chances of obtaining a loan. Remember to thoroughly research your target lender, tailor your proposal to their specific requirements, and present your information in a clear, concise, and professional manner. A well-crafted business proposal is not just a document; it’s an investment in your business’s future. By taking the time to develop a strong proposal, you can empower yourself to achieve your business goals and build a thriving enterprise. Consistent review and updating of your proposal as your business evolves will also ensure it remains a powerful tool for future funding needs.