Cash management is a critical aspect of any successful business, regardless of its size or industry. Understanding where your company stands financially in the short term is essential for making informed decisions about investments, expenses, and overall financial health. One of the most vital tools for this purpose is a cash position report template. This template provides a snapshot of your available cash and liquid assets, allowing you to anticipate potential shortfalls or identify opportunities for optimization. A well-designed Cash Position Report Template offers valuable insights into your company’s liquidity, which is its ability to meet its short-term obligations. This article will delve into the components of a cash position report, its importance, different types of templates, how to create one, and best practices for using it effectively.

The ability to accurately track and forecast cash flow is paramount for business survival and growth. Without a clear understanding of your cash position, you risk facing difficulties in paying suppliers, employees, and other crucial obligations. A cash position report provides a clear and concise overview, enabling proactive financial planning and informed decision-making. Whether you’re a startup navigating early growth, a small business managing day-to-day operations, or a large corporation monitoring financial performance, a reliable cash position report is an indispensable tool. Ignoring your cash position can lead to missed opportunities for investment, increased borrowing costs, and even financial distress.

The benefits of regularly using a cash position report template extend far beyond simply knowing how much money you have in the bank. Here’s a breakdown of why this report is so crucial:

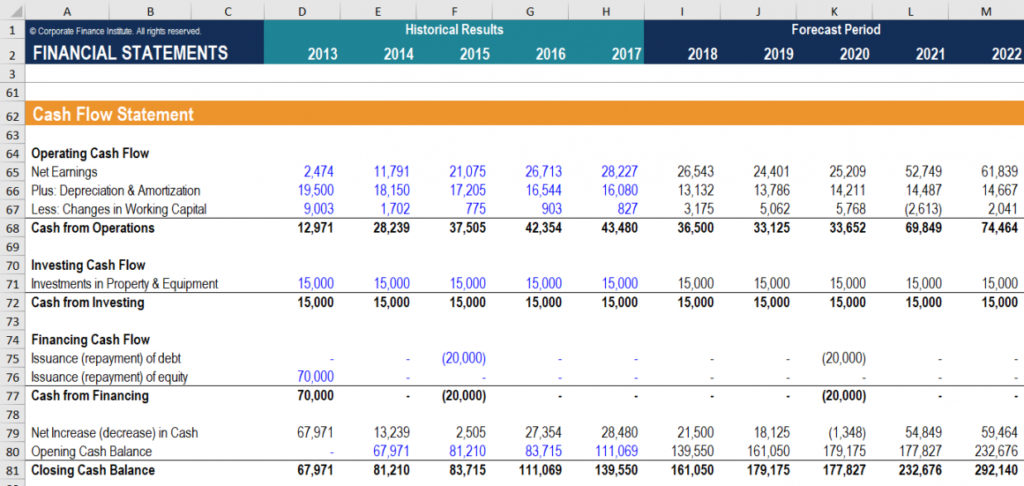

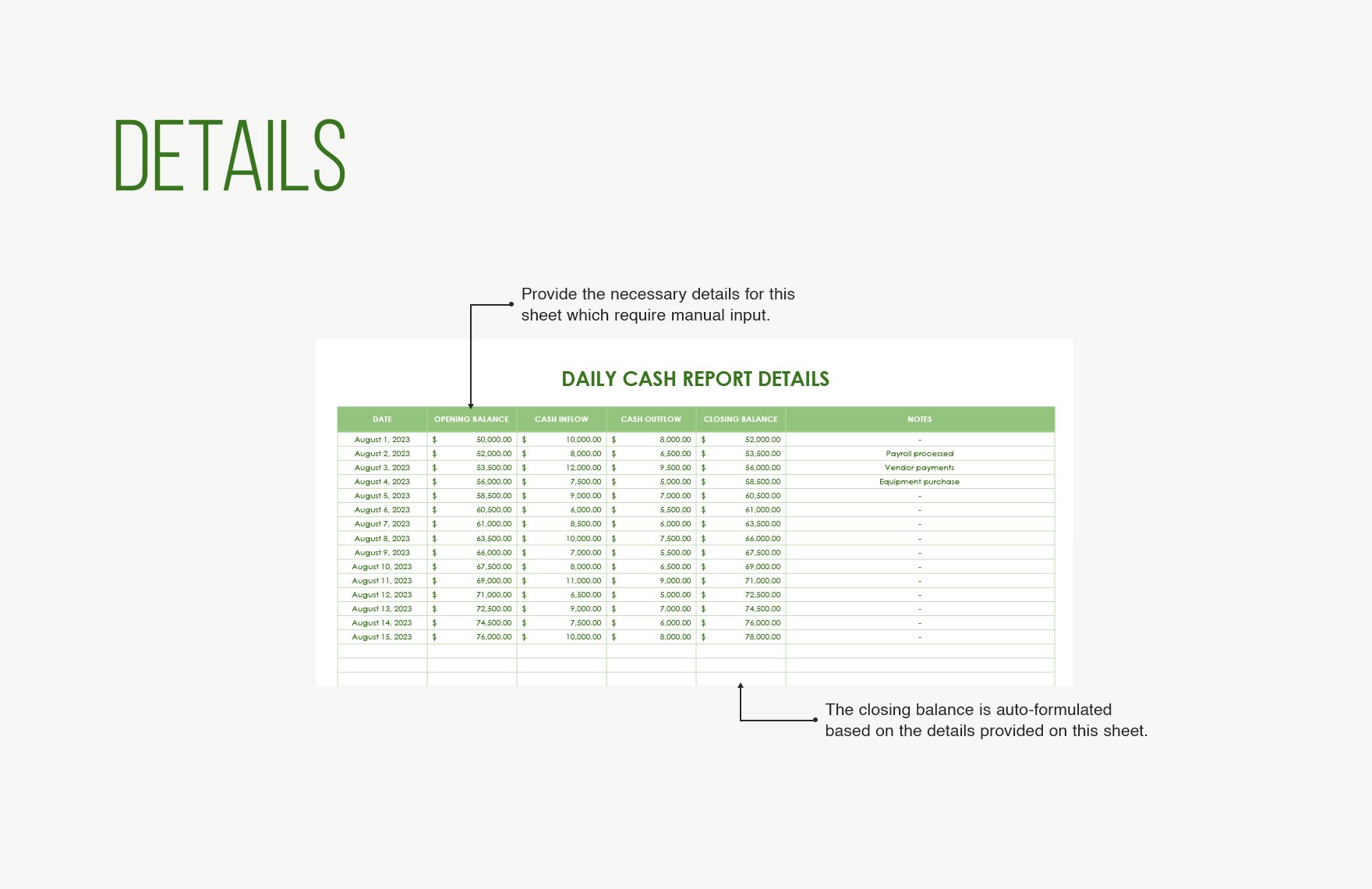

A comprehensive cash position report typically includes the following key components:

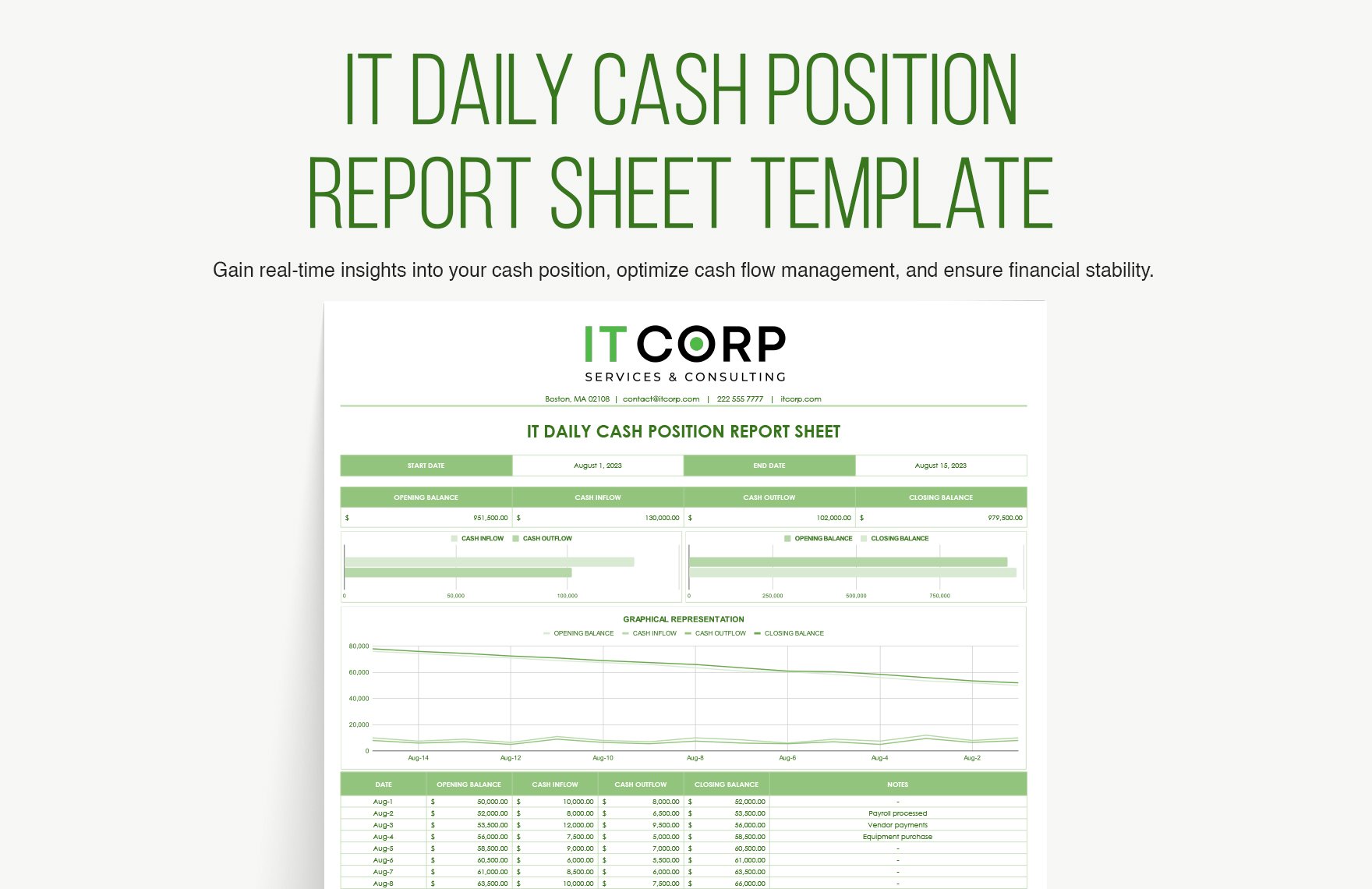

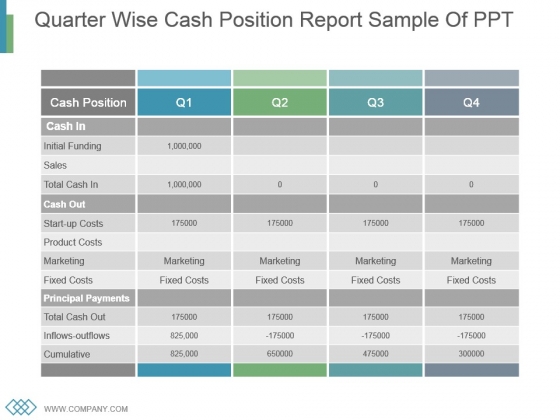

Several different types of cash position report templates are available, each suited to different business needs and reporting frequencies. Here are some common types:

While numerous pre-designed templates are available online, creating your own cash position report template can be beneficial, allowing you to tailor it to your specific business needs. Here’s a step-by-step guide:

Several tools and software solutions can streamline the process of creating and managing your cash position report template.

To maximize the value of your cash position report template, follow these best practices:

A cash position report template is an invaluable tool for any business striving for financial stability and growth. By regularly tracking and analyzing your cash inflows and outflows, you gain a clear understanding of your liquidity, enabling proactive financial planning, risk mitigation, and informed decision-making. Whether you opt for a simple spreadsheet-based template or a more sophisticated software solution, the key is to consistently monitor your cash position and use the insights gained to optimize your financial performance. Implementing best practices and utilizing available tools will allow you to effectively manage your cash flow and position your business for long-term success.

In summary, mastering the use of a cash position report template is a cornerstone of sound financial management. Regularly updating and analyzing this report provides invaluable insights into your company’s short-term financial health. From identifying potential cash shortages to recognizing investment opportunities, a well-utilized cash position report empowers businesses to navigate financial challenges and capitalize on growth prospects. By understanding the components of the report, choosing the appropriate template for your needs, and implementing best practices, you can ensure that your business is well-positioned for sustained financial success. The ability to proactively manage your cash flow, facilitated by a robust cash position report template, directly contributes to long-term stability and profitability.