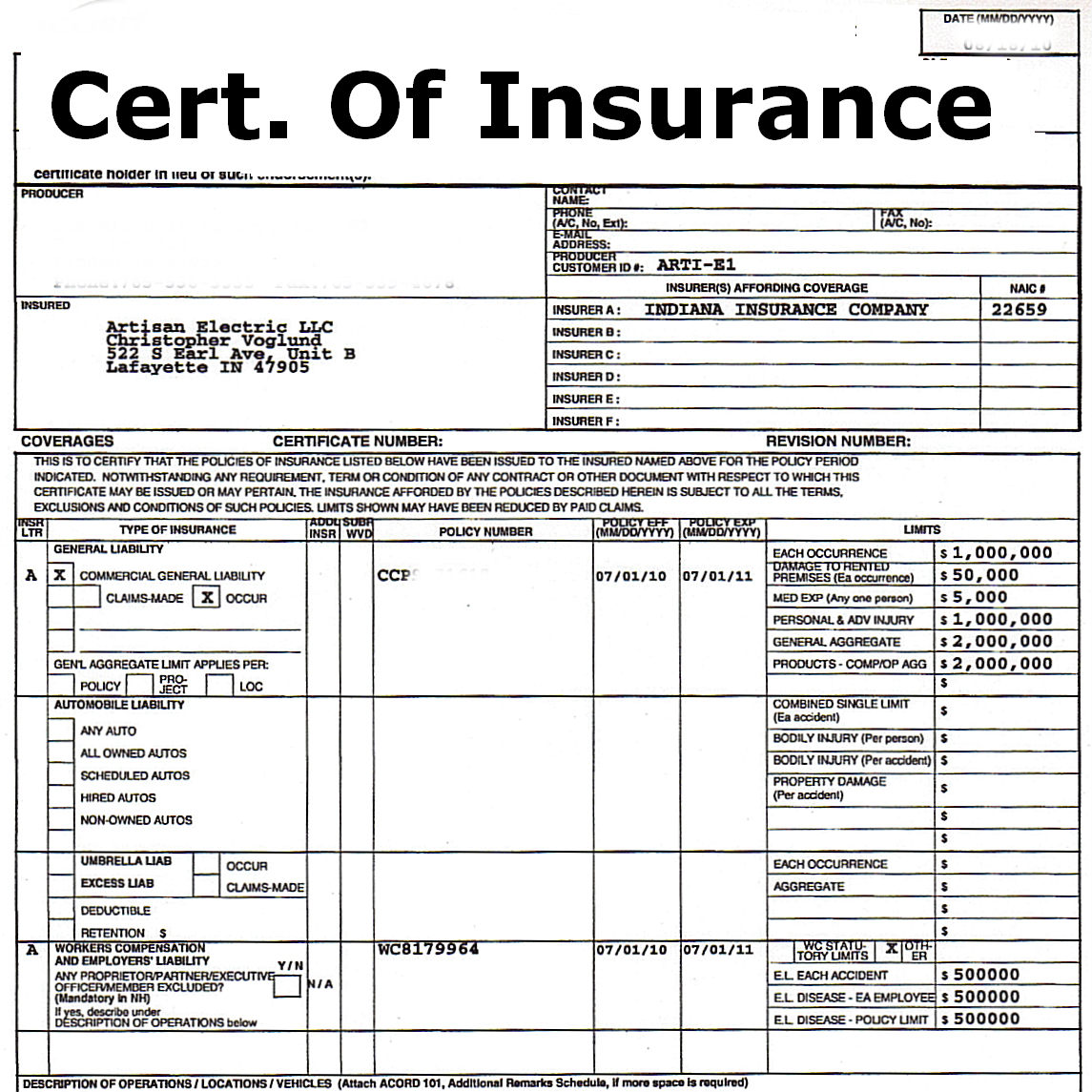

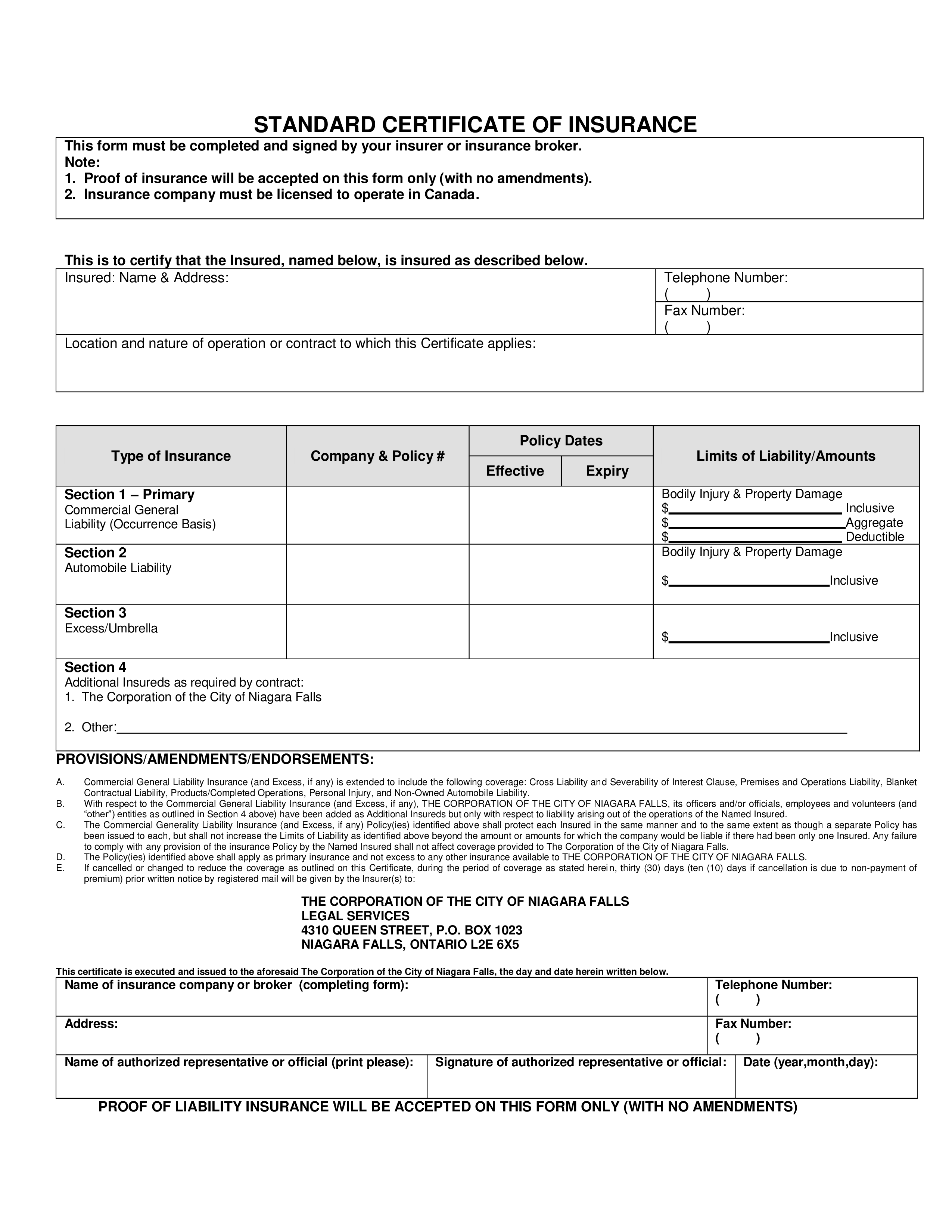

Navigating the complexities of insurance can be daunting, especially when dealing with subcontractors, vendors, or clients who require proof of your coverage. Ensuring you have the correct documentation readily available is crucial for maintaining professional relationships and mitigating potential liabilities. A well-structured document that clearly outlines your insurance coverage details is essential, and that’s where a Certificate Of Insurance Template becomes an invaluable tool. It’s a standardized document that summarizes your insurance policies, providing key information to third parties without revealing sensitive policy details.

The process of creating a Certificate of Insurance (COI) can seem overwhelming, but it doesn’t have to be. Understanding the purpose of the document, the information it contains, and the various templates available can streamline the process significantly. Many businesses, particularly those in construction, real estate, and event planning, routinely exchange COIs to verify that all parties involved have adequate insurance protection. Failing to provide a COI when requested can lead to project delays, contract breaches, or even legal disputes.

Beyond simply fulfilling a requirement, a COI serves as a vital risk management tool. It allows you to quickly verify that your contractors or vendors have the necessary liability, workers’ compensation, and other relevant insurance coverages. This proactive approach can help protect your business from potential financial losses resulting from accidents, injuries, or property damage caused by third parties. Properly utilizing a Certificate Of Insurance Template demonstrates professionalism and a commitment to responsible business practices.

The digital age has brought about numerous online resources and templates designed to simplify the COI creation process. While many free options are available, it’s important to choose a template that is compliant with industry standards and customizable to your specific needs. Consider factors like ease of use, compatibility with your existing systems, and the ability to generate professional-looking documents quickly and efficiently.

Ultimately, a Certificate of Insurance is more than just a piece of paper; it’s a symbol of trust and a safeguard against potential risks. Investing the time to understand the document and utilize a reliable Certificate Of Insurance Template is a worthwhile investment in the long-term health and stability of your business.

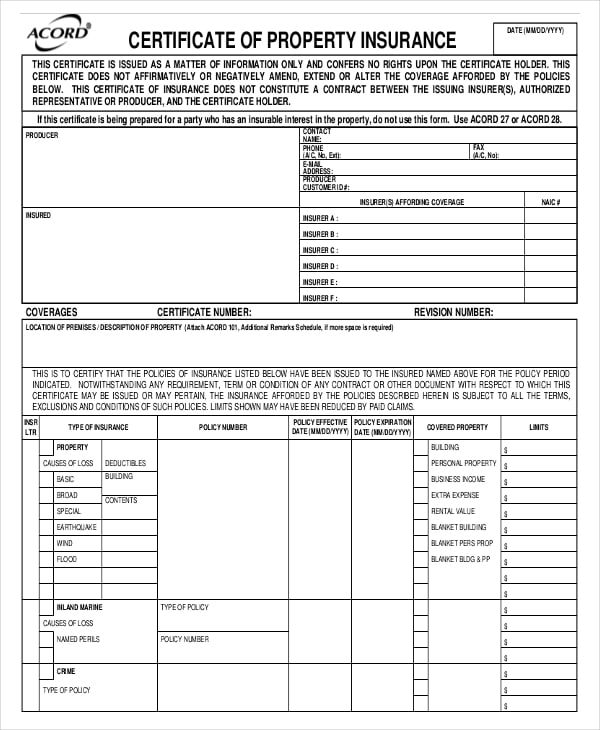

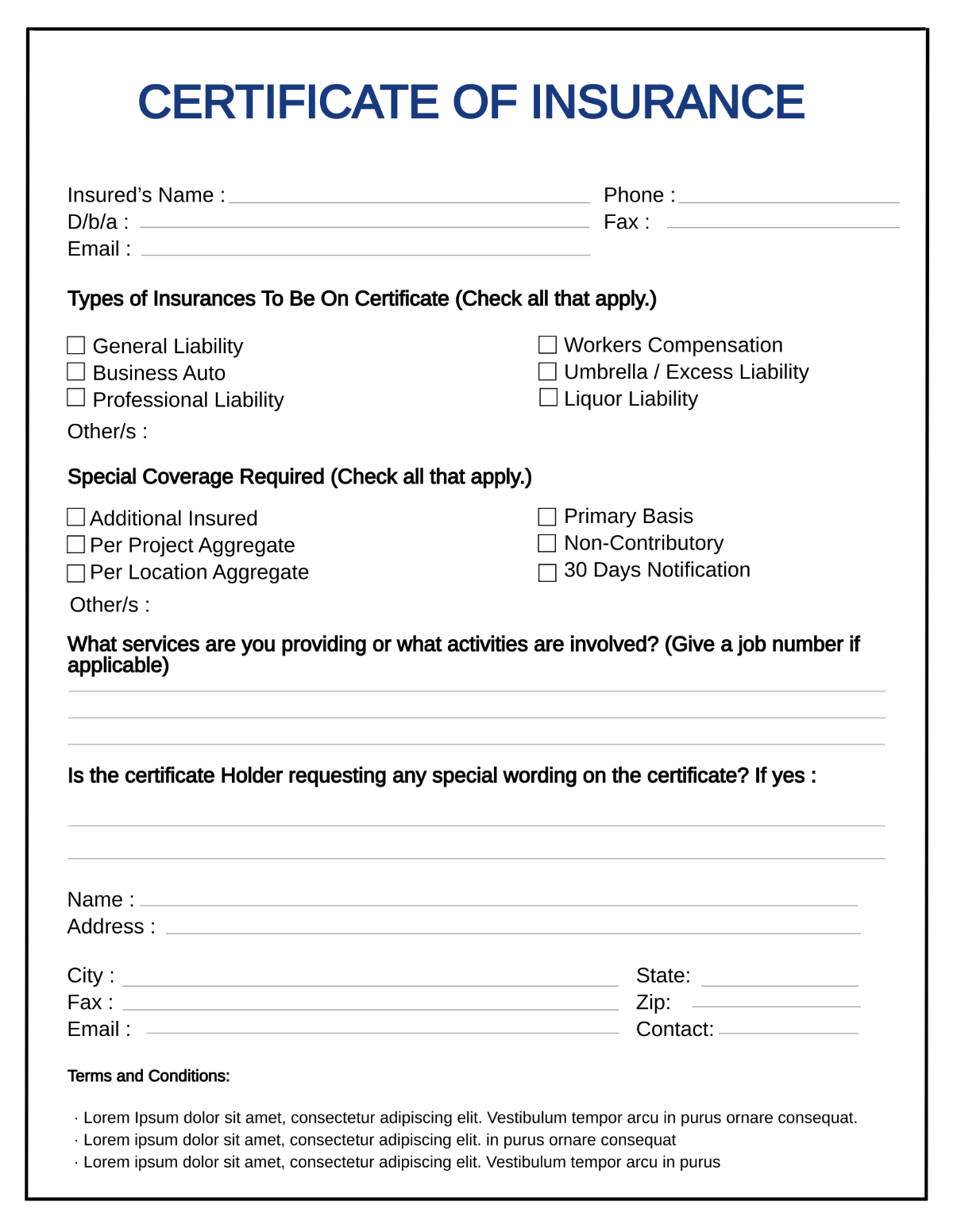

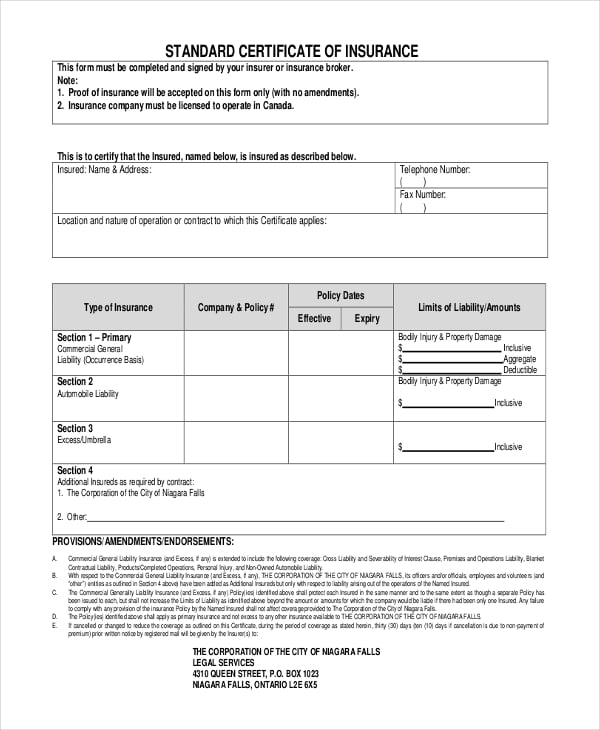

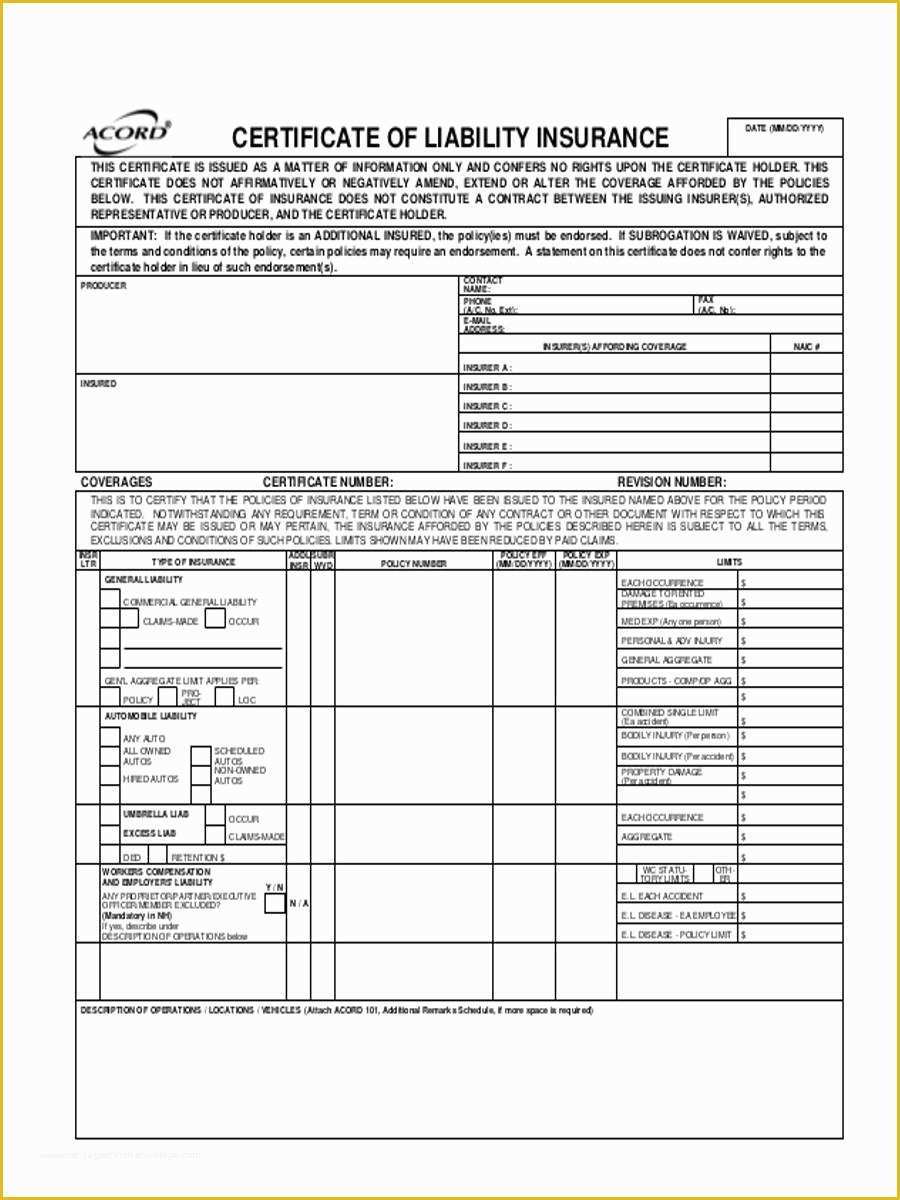

A Certificate of Insurance (COI) is a summary of your insurance policies, not a copy of the policy itself. It provides essential information to third parties, such as clients, contractors, or landlords, verifying that you have the required insurance coverage. It’s a standardized document, typically following a specific format, ensuring clarity and consistency. The COI doesn’t grant coverage; it simply confirms that a policy exists and outlines its key details.

Several standard sections are included in most COIs. These typically include:

Choosing the right template is crucial for creating a professional and compliant COI. Several options are available, ranging from free online templates to paid software solutions.

Free templates can be a good starting point, but they often lack customization options and may not be fully compliant with industry standards. Paid templates, typically offered as part of insurance management software, provide more features, such as:

Once you’ve selected a template, it’s essential to customize it to accurately reflect your insurance policies and meet the specific requirements of the certificate holder.

Even with a good template, mistakes can happen. Being aware of common pitfalls can help you avoid errors and ensure your COI is accurate and compliant.

The rise of technology has led to the development of digital COI solutions that offer significant advantages over traditional paper-based processes.

Several platforms offer digital COI solutions, including:

While a COI is a summary document, it’s important to understand the legal implications associated with its use.

A COI does not create insurance coverage. It simply confirms that a policy exists. The certificate holder is not a party to the insurance contract and has no direct claim against the insurance company. However, the additional insured endorsement, if included, can provide certain legal protections to the certificate holder.

Providing a false or misleading COI can have serious legal consequences. It’s crucial to ensure that all information on the COI is accurate and up-to-date. Misrepresenting your insurance coverage can lead to claims of fraud and potential liability.

A Certificate Of Insurance Template is an essential tool for businesses of all sizes. It simplifies the process of providing proof of insurance coverage to third parties, mitigates potential risks, and demonstrates professionalism. Whether you choose a free online template or a paid software solution, it’s crucial to customize the template accurately, avoid common mistakes, and consider the benefits of digital COI solutions. By understanding the purpose, components, and legal considerations associated with COIs, you can ensure that your business is adequately protected and maintains strong relationships with clients, contractors, and vendors. Remember to regularly review and update your COIs to reflect any changes in your insurance policies.