The creation and execution of a robust collateral warranty agreement is a critical step in many business relationships, particularly those involving significant financial commitments or long-term partnerships. A well-drafted agreement protects both parties, outlining expectations, responsibilities, and potential liabilities. This article provides a comprehensive guide to creating and understanding collateral warranty agreements, equipping you with the knowledge to protect your interests and foster trust. Collateral Warranty Agreement Template – understanding its nuances is paramount for minimizing risk and ensuring a smooth transaction. This guide will cover essential elements, best practices, and potential pitfalls, offering a practical resource for businesses of all sizes.

A collateral warranty agreement is a legally binding contract that secures a financial obligation, typically a loan or investment, from a third party. It’s designed to mitigate risk for both the lender and the borrower. Without a clear agreement, disputes can arise, leading to financial losses and damaged relationships. The agreement establishes a framework for resolving disagreements, outlining specific terms and conditions that are enforced by a court of law if necessary. It’s not simply a formality; it’s a proactive measure to safeguard your investment and maintain a stable business relationship. The benefits extend beyond simple financial protection; they foster confidence and transparency, crucial for long-term success. A thoughtfully crafted agreement demonstrates professionalism and a commitment to responsible business practices.

A comprehensive collateral warranty agreement typically includes the following key elements:

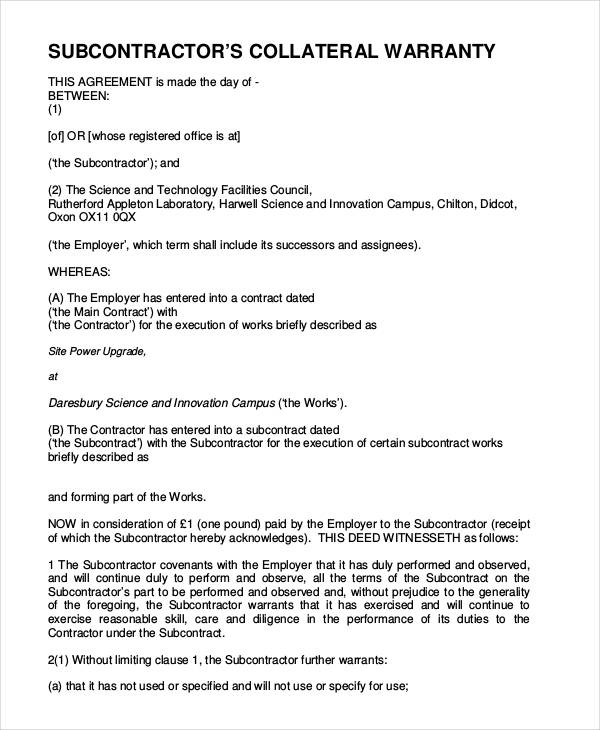

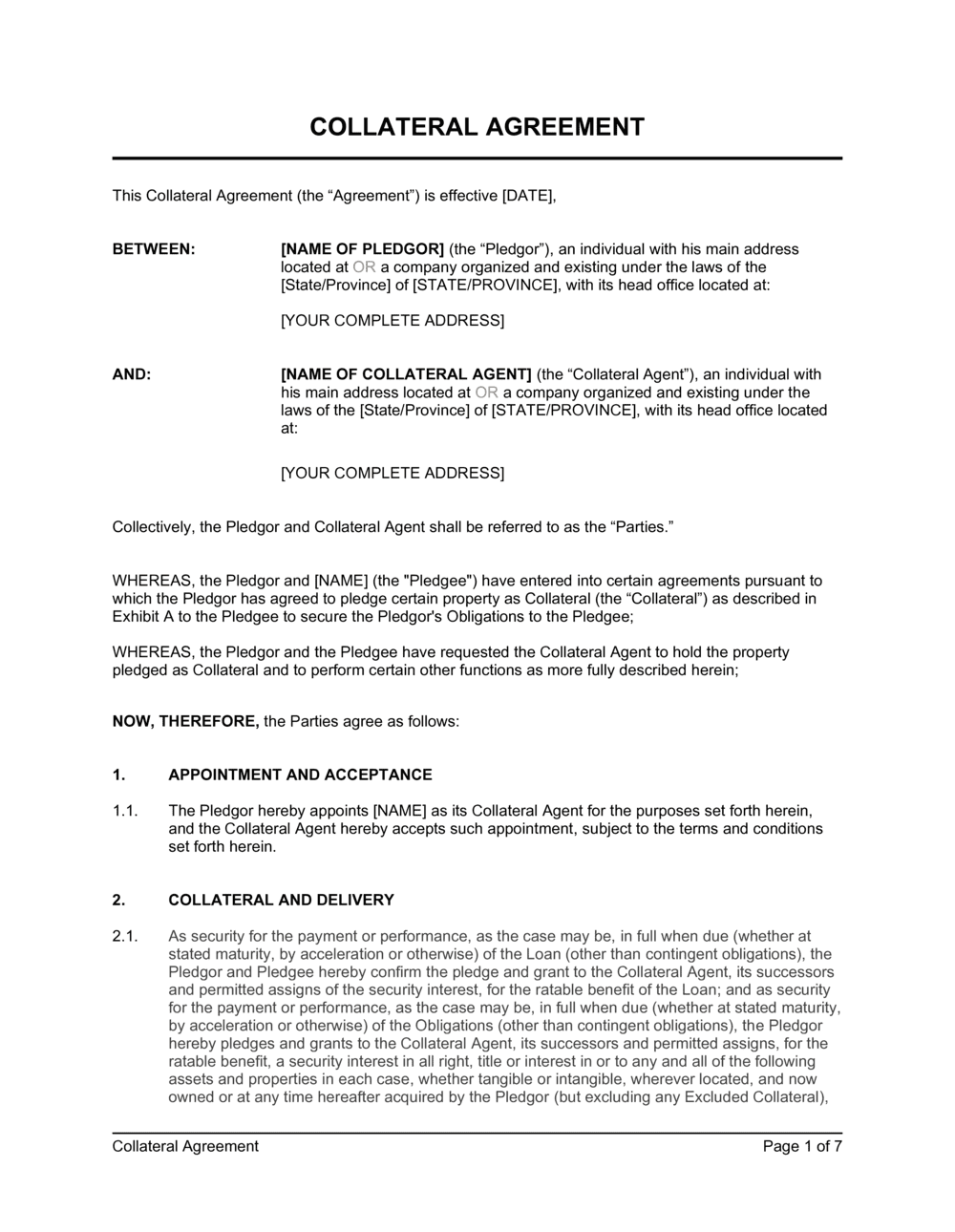

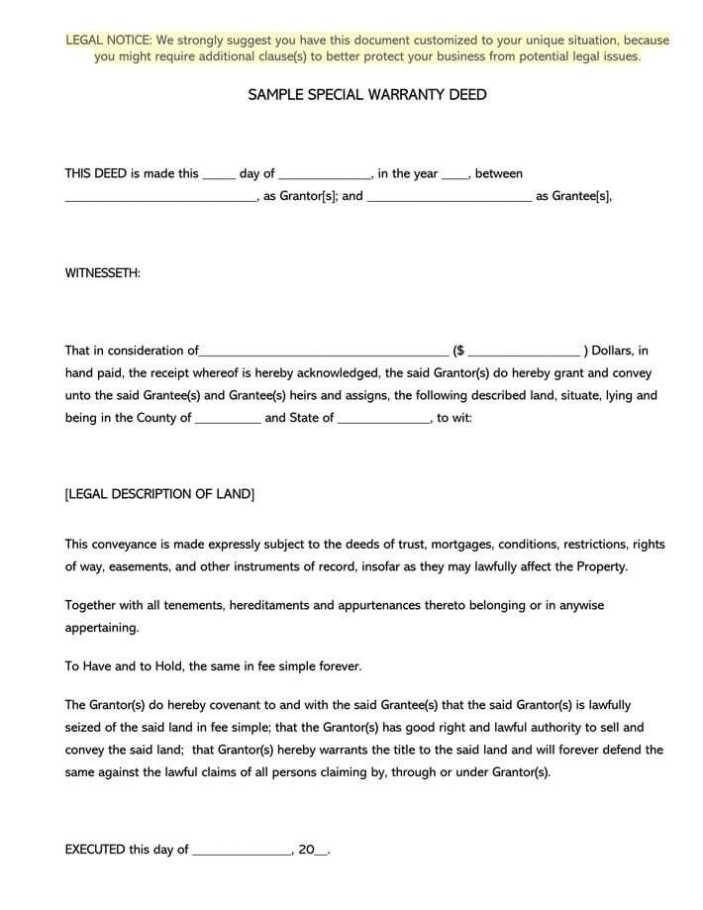

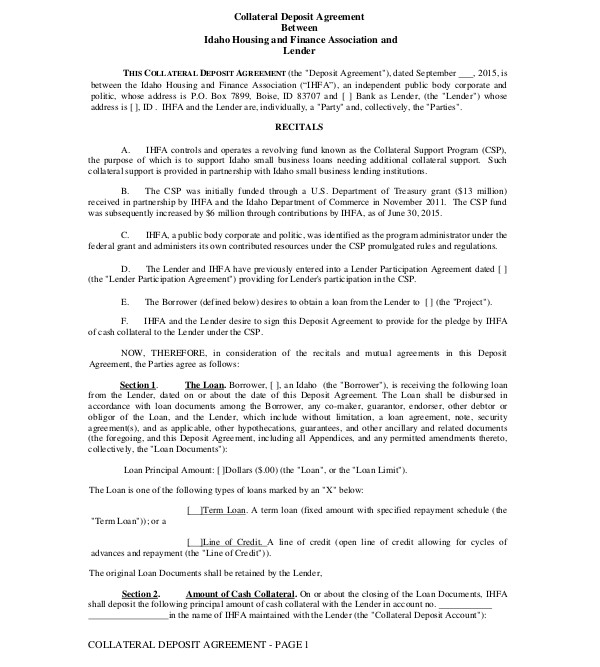

The structure of a collateral warranty agreement is crucial for clarity and enforceability. Here’s a breakdown of the typical sections:

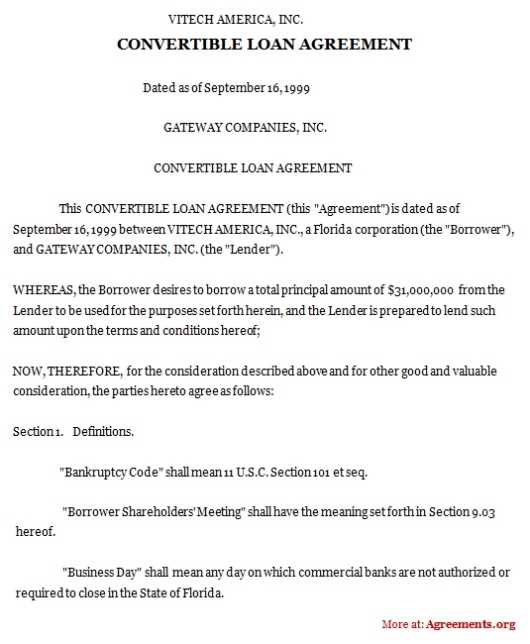

This section formally introduces the agreement and defines key terms used throughout the document. It clarifies the scope of the agreement and sets the stage for understanding the obligations of each party. It’s important to use precise language to avoid ambiguity.

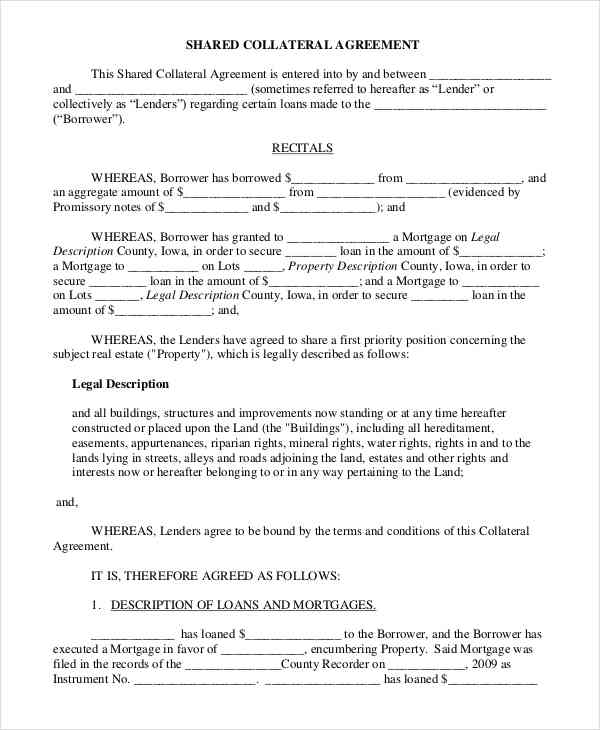

This section clearly identifies the lender and borrower, including their full legal names and addresses. It’s vital to accurately represent the parties involved to avoid future disputes.

A thorough description of the collateral is essential. This should include:

This section details the specific terms of the loan or investment, including:

This section outlines the consequences of default, including:

This section outlines the process for resolving disputes, often including mediation or arbitration. It specifies the jurisdiction where disputes will be resolved.

This section specifies the governing law and jurisdiction for the interpretation and enforcement of the agreement.

This section details the conditions under which the agreement can be terminated, either by mutual consent or by the lender’s actions.

Creating a robust collateral warranty agreement requires careful consideration of potential risks. Here are some key strategies for mitigating those risks:

A well-crafted collateral warranty agreement is a vital tool for protecting your financial interests. By understanding the key elements, structuring the agreement effectively, and implementing risk mitigation strategies, you can significantly reduce the likelihood of disputes and foster a stable and trustworthy business relationship. Remember that this agreement is a starting point; it should be tailored to the specific circumstances of your transaction. Collateral Warranty Agreement Template – adapting this template to your unique situation is key to success. Consulting with legal counsel is always recommended to ensure compliance with applicable laws and regulations.